Abstract

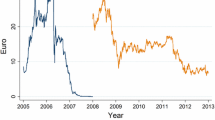

We find an asymmetric pass-through of European emission allowance (EUA) prices to wholesale electricity prices in Germany and show that this asymmetry disappeared in response to a report on investigations by the competition authority. The asymmetric pricing pattern, however, was not detected at the time of the report, nor had it been part of the investigations. Our results therefore provide evidence for the deterring effect of regulatory monitoring on firms which exhibit non-competitive pricing behavior. We do not find any asymmetric pass-through of EUA prices in recent years. Several robustness checks support our results.

Similar content being viewed by others

Notes

Personal interview from May 16, 2012, with Jörg Rothermel, division manager Energy, Climate Protection and Resources, Verband der Chemischen Industrie e.V., Frankfurt.

EEX price data for natural gas with delivery in Germany has only been available since 2008 and is thus not applicable to our research.

The test regression includes an intercept.

References

BKartA. (2006). Bundeskartellamt: Sachstandspapier zur Vorbereitung der mündlichen Verhandlung in Sachen Emissionshandel und Strompreisbildung.

Borenstein, S., Cameron, A., & Gilbert, R. (1997). Do gasoline prices respond asymmetrically to crude oil price changes? The Quarterly Journal of Economics, 112(1), 305–339.

Brown, S. P. A., & Yücel, M. K. (2000). Gasoline and crude oil prices: Why the asymmetry? Economic and Financial Review (Federal Reserve Bank of Dallas), Q3, 23–29.

Cabral, L., & Fishman, A. (2012). Business as usual: A consumer search theory of sticky prices and asymmetric price adjustment. International Journal of Industrial Organization, 30(4), 371–376.

Damania, R., & Yang, B. Z. (1998). Price rigidity and asymmetric price adjustment in a repeated oligopoly. Journal of Institutional and Theoretical Economics (JITE), 154(4), 659–679.

Dickey, D., & Fuller, W. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74(366), 427–431.

Ellerman, A., Convery, F., De Perthuis, C., & Alberola, E. (2010). Pricing carbon: The European Union emissions trading scheme. Cambridge: Cambridge University Press.

Fell, H. (2010). EU-ETS and nordic electricity: A CVAR analysis. The Energy Journal, 31(2), 1–26.

Fell, H., Vollebergh, H., & Hintermann, B. (2012). Estimation of carbon cost pass-through in electricity markets. Conference paper, CESifo Area Conference on Energy and Climate Economics.

Fezzi, C., & Bunn, D. (2009). Structural interactions of European carbon trading and energy prices. Journal of Energy Markets, 2(4), 53–69.

Härdle, W., & Simar, L. (2007). Applied multivariate statistical analysis (2nd ed.). Berlin: Springer.

Harrington, J. E. (2005). Optimal cartel pricing in the presence of an antitrust authority. International Economic Review, 46(1), 145–169.

Harrington, J. E, Jr. (2008). Detecting cartels. In P. Buccirossi (Ed.), Handbook of antitrust economics (pp. 213–258). Cambridge: MIT Press.

Harrington, J. E., & Skrzypacz, A. (2011). Private monitoring and communication in cartels: Explaining recent collusive practices. American Economic Review, 101(6), 2425–2449.

Kirat, D., & Ahamada, I. (2011). The impact of the European Union emission trading scheme on the electricity-generation sector. Energy Economics, 33(5), 995–1003.

Kirat, D., & Ahamada, I. (2012). The impact of phase II of the EU ETS on the electricity-generation sector. Université Paris1 Panthéon-Sorbonne (Post-Print and Working Papers) halshs-00673918, HAL.

Kolstad, J. T., & Wolak, F. A. (2008). Using environmental emissions permit prices to raise electricity prices: Evidence from the California electricity market. Available for download at:http://hc.wharton.upenn.edu/jkolstad/kolstad_wolak_aug08.pdf

Kovenock, D., & Widdows, K. (1998). Price leadership and asymmetric price rigidity. European Journal of Political Economy, 14(1), 167–187.

Kuran, T. (1983). Asymmetric price rigidity and inflationary bias. American Economic Review, 73(3), 373–82.

Lewis, M. S. (2011). Asymmetric price adjustment and consumer search: An examination of the retail gasoline market. Journal of Economics & Management Strategy, 20(2), 409–449.

Lo Prete, C., & Norman, C. S. (2013). Rockets and feathers in power futures markets? Evidence from the second phase of the EU ETS. Energy Economics, 36(C), 312–321.

Lütkepohl, H. (2005). New introduction to multiple time series analysis (1st ed.). Berlin: Springer.

Marcellino, M. (1999). Some consequences of temporal aggregation in empirical analysis. Journal of Business & Economic Statistics, 17(1), 129–136.

McCutcheon, B. (1997). Do meetings in smoke-filled rooms facilitate collusion? Journal of Political Economy, 105(2), 330–350.

Newey, W. K., & West, K. D. (1987). A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica, 55(3), 703–708.

OFT. (2011). The impact of competition interventions on compliance and deterrence. Technical Report oft1391, London Economics on behalf of the Office of Fair Trading.

Peltzman, S. (2000). Prices rise faster than they fall. Journal of Political Economy, 108(3), 466–502.

Reagan, P. B., & Weitzman, M. L. (1982). Asymmetries in price and quantity adjustments by the competitive firm. Journal of Economic Theory, 27(2), 410–420.

RWE. (2004). Recent developments in RWE trading and the global commodity markets—Presentation by Stefan Judisch, Managing Director of RWE Trading GmbH, held at a meeting with investors. Accessed online on August 1, 2012.

RWE. (2005). Carbon and the challenge to get the generation spread ‘to walk on three legs’—Presentation by Peter Kreuzberg, Managing Director of RWE Trading GmbH, at a meeting with investors. Accessed online on August 1, 2012.

Sijm, J., Chen, Y., & Hobbs, B. F. (2012). The impact of power market structure on \(\text{ CO }_2\) cost pass-through to electricity prices under quantity competition—A theoretical approach. Energy Economics, 34(4), 1143–1152.

Yang, H., & Ye, L. (2008). Search with learning: Understanding asymmetric price adjustments. The RAND Journal of Economics, 39(2), 547–564.

Zachmann, G., & von Hirschhausen, C. (2008). First evidence of asymmetric cost pass-through of EU emissions allowances: Examining wholesale electricity prices in Germany. Economics Letters, 99(3), 465–469.

Acknowledgments

We are grateful for valuable comments from Anna Créti, the participants of the EAERE annual conference 2013, the editor, and an anonymous referee. We thank Anna-Lena Huthmacher for valuable research assistance. Funding was provided from the project “CFI—Climate Change, Financial Markets and Innovation” chaired by Dr. Paschen von Flotow (Sustainable Business Institute—SBI) and supported by the German Ministry for Education and Research. The paper benefited from the discussion with Dr. Paschen von Flotow and Prof. Dr. Dirk Schiereck (Technical University Darmstadt). All remaining errors are those of the authors.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Mokinski, F., Wölfing, N.M. The effect of regulatory scrutiny: Asymmetric cost pass-through in power wholesale and its end. J Regul Econ 45, 175–193 (2014). https://doi.org/10.1007/s11149-013-9233-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-013-9233-8