Abstract

A new method to retrieve the risk-neutral probability measure from observed option prices is developed and a closed form pricing formula for European options is obtained by employing a modified Gram–Charlier series expansion, known as the Gauss–Hermite expansion. This expansion converges for fat-tailed distributions commonly encountered in the study of financial returns. The expansion coefficients can be calibrated from observed option prices and can also be computed, for example, in models with the probability density function or the characteristic function known in closed form. We investigate the properties of the new option pricing model by calibrating it to both real-world and simulated option prices and find that the resulting implied volatility curves provide an accurate approximation for a wide range of strike prices. Based on an extensive empirical study, we conclude that the new approximation method outperforms other methods both in-sample and out-of-sample.

Similar content being viewed by others

Notes

Because the Gauss–Hermite expansion really converges for fat-tailed distributions, one, in principle, could truncate after a larger number of terms. The truncation after 20 terms proved sufficient and robust for our purpose. We also computed the approximation with truncation after 30 terms without running into numerical problems. However, from some point onwards the expansion coefficients are too small and the addition of new terms could cause numerical problems.

This is achieved by imposing that the polynomial (of degree 20) appearing in the expansion does not have real roots.

We thank the anonymous referee for pointing this to us.

The mean, the standard deviation and the Gauss-Hermite expansion coefficients depend, of course, on the time to maturity τ. However, the explicit dependence on τ is dropped from the notation in order to make the formula more readable.

We denote by the 1 week (1 W), 1 month (1 M) and 3 months (3 M) maturities those maturities that are closest to these times to maturity on the specific dates analyzed.

Meaning that the approximating probability density function is everywhere positive, its mass equals 1, and the martingale restriction is also satisfied.

We restrict the comparison to methods similar to the one developed in this paper, that are supposed to be calibrated day by day and maturity by maturity. Therefore, we exclude models with a parametric description of the dynamics of the underlying (e.g. Heston 1993; Andersen et al. 2015) since, in general, such models are calibrated to the whole sample of options.

The subsample contains approximately 20% of the whole sample.

These results are not included in the paper, but are available upon request.

We make the assumption that the shape of the implied volatility curves depends on the moneyness.

For the GH model we also applied a different methodology for computing out-of-sample performance, namely we employed the GH formula with the parameters obtained as a linear interpolation of the corresponding parameters from the previous day. The results obtained with this alternative methodology are similar to those reported in the tables.

For the GH model we also computed out-of-sample hedging performance by applying the same methodology as for the SVI and SI models. The results obtained with this alternative methodology are similar to those reported in the tables.

References

Abramowitz, M., & Stegun, I. A. (Eds.). (1964). Handbook of mathematical functions. Gaithersburg, MD: National Bureau of Standards.

Ait-Sahalia, Y., & Duarte, J. (2003). Nonparametric option pricing under shape restrictions. Journal of Econometrics, 116, 9–47.

Ait-Sahalia, Y., & Lo, A. W. (1998). Nonparametric estimation of state-price densities implicit in financial asset prices. Journal of Finance, 53, 499–548.

Andersen, T. G., Fusari, N., & Todorov, V. (2015). The risk premia embedded in index options. Journal of Financial Economics, 117, 558–584.

Bakshi, G., Cao, C., & Chen, Z. (1997). Empirical performance of alternative option pricing models. Journal of Finance, 52, 2003–2049.

Bakshi, G., Kapadia, N., & Madan, D. (2003). Stock return characteristics, skew laws, and the differential pricing of individual equity options. Review of Financial Studies, 16(1), 101–143.

Bakshi, G., & Madan, D. (2000). Spanning and derivative-security valuation. Journal of Financial Economics, 55, 205–238.

Bibby, B. M., & Sorensen, M. (1997). A hyperbolic diffusion model for stock prices. Finance and Stochastics, 1, 25–41.

Black, F., & Scholes, M. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81, 637–654.

Brown, C., & Robinson, D. (2002). Skewness and kurtosis implied by option prices: A correction. Journal Financial Research, 25, 279–281.

Corrado, C. J. (2007). The hidden martingale restriction in Gram–Charlier option prices. Journal of Futures Markets, 27(6), 517–534.

Corrado, C. J., & Su, T. (1996). S&P 500 index option tests of Jarrow and Rudd’s approximate option valuation formula. Journal of Futures Markets, 16, 611–629.

Corrado, C. J., & Su, T. (1997). Implied volatility skews and stock index skewness and kurtosis implied by S&P 500 index option prices. Journal of Derivatives, 4, 8–19.

Cramer, H. (1957). Mathematical methods of statistics. Princeton: Princeton University Press.

Cuchiero, C., Keller-Ressel, M., & Teichmann, J. (2012). Polynomial processes and their applications to mathematical finance. Finance and Stochastics, 16, 711–740.

Eriksson, A., Forsberg, L., & Ghysels, E. (2004). Approximating the probability distribution of functions of random variables: A new approach. Discussion paper, CIRANO.

Farkas, E. W., Necula, C., & Waelchli, B. (2015). Herding and stochastic volatility. Available at SSRN: http://ssrn.com/abstract=2685939.

Figlewski, S. (2010). Estimating the implied risk-neutral density for the US market Portfolio. In T. Bollerslev, J. Russell, & M. Watson (Eds.), Volatility and time series econometrics: Essays in honor of Robert Engle. Oxford: Oxford University Press.

Filipović, D., Mayerhofer, E., & Schneider, P. (2013). Density approximations for multivariate affine jump-diffusion processes. Journal of Econometrics, 176, 93–111.

Fringuellotti, F., & Necula, C. (2015). A generalized Bachelier formula for pricing basket and spread options. Available at SSRN: http://ssrn.com/abstract=2698307.

Gatheral, J., & Jacquier, A. (2014). Arbitrage-free SVI volatility surfaces. Quantitative Finance, 14(1), 59–71.

Gradshteyn, I. S., Ryzhik, I. M., Jeffrey, A., & Zwillinger, D. (2000). Table of integrals, series, and products (6th ed.). London: Academic Press.

Hardy, G. H. (1949). Divergent series. Oxford: Clarendon Press.

Heston, S. L. (1993). A closed-form solution for options with stochastic volatility with applications to bond and currency options. Review of Financial Studies, 6, 327–343.

Heston, S. L., & Rossi, A. G. (2017). A spanning series approach to options. The Review of Asset Pricing Studies, 7(1), 2–42.

Jarrow, R., & Rudd, A. (1982). Approximate option valuation for arbitrary stochastic processes. Journal of Financial Economics, 10, 347–369.

Jondeau, E., & Rockinger, M. (2001). Gram–Charlier densities. Journal of Economic Dynamics and Control, 25, 1457–1483.

Jurczenko, E., Maillet, B., & Negrea, B. (2002). Revisited multi-moment approximate option pricing models: A general comparison (Discussion paper of the LSE-FMG, No. 430).

Jurczenko, E., Maillet, B., & Negrea, B. (2004). A note on skewness and kurtosis adjusted option pricing models under the martingale restriction. Quantitative Finance, 4, 479–488.

Kou, S. G. (2002). A jump-diffusion model for option pricing. Management Science, 48(8), 1086–1101.

Longstaff, F. A. (1995). Option pricing and the martingale restriction. Review of Financial Studies, 8, 1091–1124.

Merton, R. (1973). Rational theory of option pricing. Bell Journal of Economics and Management Science, 4, 141–183.

Merton, R. C. (1976). Option pricing when underlying stock returns are discontinuous. Journal of Financial Economics, 3, 125–144.

Myller-Lebedeff, W. (1907). Die Theorie der Integralgleichungen in Anwendung auf einige Reihenentwicklungen. Mathematische Annalen, 64, 388–416.

Rompolis, L. S., & Tzavalis, E. (2007). Retrieving risk neutral densities based on risk neutral moments through a Gram–Charlier series expansion. Mathematical and Computer Modelling, 46, 225–234.

Rompolis, L. S., & Tzavalis, E. (2008). Recovering risk neutral densities from option prices: A new approach. Journal of Financial and Quantitative Analysis, 43(4), 1037–1054.

van der Marel, R. P., & Franx, M. (1993). A new method for the identification of non-Gaussian line profiles in elliptical galaxies. Astrophysical Journal, 407, 525–539.

Acknowledgements

We thank an anonymous referee as well as the participants at the conferences Global Derivatives 2016, 9th World Congress of the Bachelier Finance Society 2016, Challenges in Derivatives Markets 2015, Stochastics and Computational Finance 2015, International Conference on Operations Research 2015, and Quantitative Methods in Finance 2015 for helpful comments.

Funding

The research leading to these results has received funding from the SCIEX Project 11.159 and from the European Union Seventh Framework Programme (FP7/2007-2013) under the MC-IEF Grant Agreement No. 627701.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Lemma 1

If one denotes by \( \tilde{p}\left( {\tilde{x}} \right) \) the standardized density, one has that \( p\left( x \right) = \frac{1}{\sigma }\tilde{p}\left( {\frac{x - \mu }{\sigma }} \right) \). Using a well-known property of the “physicists” Hermite polynomials, namely

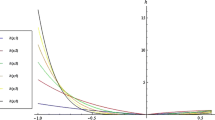

the Gauss–Hermite expansion of \( \tilde{p}\left( {\tilde{x}} \right) \) can be written as

Therefore, the Fourier transform of \( \tilde{p} \) is

The Fourier transform of p follows immediately. □

Proof of Proposition 1

If one denotes by pt+τ(St+τ) the terminal underlying asset price risk-neutral density and by p(x) the standardized log-return risk-neutral density then we have that:

with

and \( \Pi _{2} = \int_{{ - d_{2} }}^{\infty } {p\left( x \right)dx} . \) Taking into account the Gauss–Hermite expansion of the log-return risk-neutral density, one has that

with

and Π2 = ∑ ∞ n=0 anJn with \( J_{n} = \int_{{ - d_{2} }}^{\infty } {H_{n} \left( x \right)z\left( x \right)dx} \). Using the properties of Gauss–Hermite polynomials namely \( H_{n + 1} \left( x \right) = 2x H_{n} \left( x \right) - 2n H_{n - 1} \left( x \right) \), \( H_{n}^{'} \left( x \right) = 2n H_{n - 1} (x) \) and integration by parts, one can obtain the recursion equations for In and Jn as follows:

where we have used \( z^{\prime}\left( x \right) = - x z\left( x \right) \).

Finally, we have \( I_{0} = \int_{{ - d_{1} }}^{\infty } z \left( x \right)dx = N\left( {d_{1} } \right) \) and similarly \( J_{0} = \int_{{ - d_{2} }}^{\infty } z \left( x \right)dx = N\left( {d_{2} } \right) \). □

1.1 Discussion about the convergence of the series from the pricing formulas

We assume that the standardized density of log-returns for horizon τ, under the risk-neutral measure, is described by a continuous, smooth and positive function p(x) such that \( \mathop \int\nolimits \nolimits_{ - \infty }^{\infty } p\left( x \right)dx\, = \,1 \). Denote \( \hat{p}_{N}^{{}} \left( x \right): = \sum\nolimits_{k = 0}^{N} {a_{k}^{{}} } H_{k}^{{}} \left( x \right)z\left( x \right) \) the Gauss–Hermite expansion truncated after N terms. It is known that \( \hat{p}_{N}^{{}} \left( \cdot \right) \) converges pointwise (even uniformly on compact intervals) and in \( L^{2} \left( {\mathbf{\mathbb{R}}} \right) \) to p( · ).

Consider a constant b ≥ 0 such that \( \mathop \int\nolimits \nolimits_{ - \infty }^{\infty } e^{bx} p\left( x \right)dx\, < \,\infty \). For example, if \( b = \sigma \sqrt \tau \) this condition is due to the martingale restriction (i.e. E [STe−r(T−t)] = St).

For example consider the limit

This result cannot be proved using the Cauchy–Schwarz inequality because the function ebx is not in \( L^{2} \left( {\mathbf{\mathbb{R}}} \right) \). We present here an argument based on Abel-summability and Tauberian theorems (Hardy 1949).

Let

and

where \( \omega \left( x \right) = e^{{ - x^{2} }} = 2\pi z\left( x \right)^{2} \). We have that

and \( \overline{{a_{k}^{{}} }} = \int_{ - \infty }^{\infty } {\overline{{H_{k}^{{}} }} z\left( x \right)p\left( x \right)dx} . \) Therefore, it follows that

here \( \overline{{q_{k}^{{}} }} : = \int_{ - \infty }^{\infty } {e^{bx} \overline{{H_{k}^{{}} }} z\left( x \right)dx} \).

If we denote by \( \overline{{\psi_{k}^{{}} }} : = \overline{{H_{k}^{{}} }} z \) the normalized Hermite functions (a complete orthonormal basis of \( L^{2} \left( {\mathbf{\mathbb{R}}} \right) \)) one has that:

Denote by \( h\left( x \right) = e^{bx} \notin L^{2} \left( {\mathbf{\mathbb{R}}} \right) \) and

Let \( \overline{{q_{k,n}^{{}} }} : = \left\langle {h_{n} ,\overline{{\psi_{k}^{{}} }} } \right\rangle_{{L^{2} \left( {\mathbf{\mathbb{R}}} \right)}} \). It follows that

and

We have that (e.g. Gradshteyn et al. 2000, eq. 7.374.8, 7.376.1)

Since \( 0 < h_{n} < 2e^{{\frac{{b^{2} }}{2}}} \hbox{max} \left( {1,h} \right) \), \( \left\langle {p,\hbox{max} \left( {1,h} \right)} \right\rangle_{{L^{2} \left( {\mathbf{\mathbb{R}}} \right)}} < \infty \) and p > 0 it follows that

Therefore, the series \( \sum\nolimits_{k = 0}^{\infty } {\overline{{a_{k}^{{}} }} \overline{{q_{k}^{{}} }} } \) is Abel-summable to the limit \( \left\langle {p,h} \right\rangle_{{L^{2} \left( {\mathbf{\mathbb{R}}} \right)}} \). A series ∑ ∞ k=0 ck is called Abel-summable to the limit l if limz↗1 ∑ ∞ k=0 ckzk = l (e.g. Hardy 1949). If the Gauss–Hermite coefficients are such that one of the Tauberian conditions (Hardy 1949, p. 149) is satisfied, e.g. \( \overline{{a_{k}^{{}} }} \overline{{q_{k}^{{}} }} = O\left( {k^{ - 1} } \right) \), then it follows from the corresponding Tauberian theorem (Hardy 1949, ch. VII) that the series \( \sum\nolimits_{k = 0}^{\infty } {\overline{{a_{k}^{{}} }} \overline{{q_{k}^{{}} }} } \) converges (in the usual sense) and \( \sum\nolimits_{k = 0}^{\infty } {\overline{{a_{k}^{{}} }} \overline{{q_{k}^{{}} }} } = \left\langle {p,h} \right\rangle_{{L^{2} \left( {\mathbb{R}} \right)}} \). It is worth pointing out that, even if the Tauberian conditions cannot be verified, one can Abel-sum the series \( \sum\nolimits_{k = 0}^{\infty } {\overline{{a_{k}^{{}} }} \overline{{q_{k}^{{}} }} } \) to get the desired result \( \left\langle {p,h} \right\rangle_{{L^{2} \left( {\mathbf{\mathbb{R}}} \right)}} \).

1.2 Additional tables

Tables 6, 7 and 8 provide a more in-depth picture of the in-sample pricing performance of the methods under analysis. Table 9 deals with the comparison regarding the out-of-sample implied volatility root mean squared errors. Tables 10 and 11 present the in-sample and the out-of-sample mean relative absolute hedging errors.

Rights and permissions

About this article

Cite this article

Necula, C., Drimus, G. & Farkas, W. A general closed form option pricing formula. Rev Deriv Res 22, 1–40 (2019). https://doi.org/10.1007/s11147-018-9144-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11147-018-9144-z

Keywords

- European options

- Expansion based approximation of risk-neutral density

- Gauss–Hermite series expansion

- Calibration