Abstract

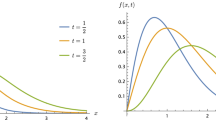

Since there is no analytic solution for arithmetic average options until present, developing an efficient numerical algorithm becomes a promising alternative. One of the most famous numerical algorithms is introduced by Hull and White (J Deriv 1:21–31, 1993). Motivated by the common idea of reducing the nonlinearity error in the adaptive mesh model in Figlewski and Gao (J Financ Econ 53:313–351, 1999) and the adaptive quadrature method, we propose an adaptive placement method to replace the logarithmically equally-spaced placement rule in the Hull and White’s model by placing more representative average prices in the highly nonlinear area of the option value as the function of the arithmetic average stock price. The basic idea of this method is to design a recursive algorithm to limit the error of the linear interpolation between each pair of adjacent representative average prices. Numerical experiments verify the superior performance of this method for reducing the interpolation error and hence improving the convergence rate. To show that the adaptive placement method can improve any numerical algorithm with the techniques of augmented state variables and the piece-wise linear interpolation approximation, we also demonstrate how to integrate the adaptive placement method into the GARCH option pricing algorithm in Ritchken and Trevor (J Finance 54:377–402, 1999). Similarly great improvement of the convergence rate suggests the potential applications of this novel method to a broad class of numerical pricing algorithms for exotic options and complex underlying processes.

Similar content being viewed by others

References

Aingworth, D., Motwani, R., & Oldham, J. D. (2000). Accurate approximations for Asian options. Proceedings of the 11th Annual ACM-SIAM Symposium on Discrete Algorithms.

Cakici N., Topyan K. (2000) The GARCH option pricing model: A lattice approach. Journal of Computational Finance 3: 71–85

Carverhill A.P., Clewlow L.J. (1990) Valuing average rate (Asian) options. Risk 3: 25–29

Chalasani P., Jha S., Egriboyun F., Varikooty A. (1999) A refined binomial lattice for pricing American Asian options. Review of Derivatives Research 3: 85–105

Chalasani P., Jha S., Varikooty A. (1998) Accurate approximations for European-style Asian options. Journal of Computational Finance 1: 11–29

Cho H.Y., Lee H.Y. (1997) A lattice model for pricing geometric and arithmetic average options. Journal of Financial Engineering 6: 179–191

Costabile M., Massabo I., Russo E. (2006) An adjusted binomial model for pricing asian options. Review of Quantitative Finance and Accounting 27: 285–296

Cox J.C., Ross S.A., Rubinstein M. (1979) Option pricing: A simplified approach. Journal of Financial Economics 7: 229–263

Dai, T.-S., Huang, G.-S., & Lyuu, Y.-D. (2002). Extremely accurate and efficient algorithms for Asian options with range bounds. Quantitative Methods in Finance 2002 Conference, Cairns, Australia.

Dai T.-S., Lyuu Y.-D. (2002) Efficient, exact algorithms for Asian options with multiresolution lattices. Review of Derivatives Researches 5: 181–203

Faires, J. D., & Burden, R. (2003). Numerical methods (3rd ed.). Brooks/Cole Press.

Figlewski S., Gao B. (1999) The adaptive Mesh Model: A new approach to efficient option pricing. Journal of Financial Economics 53: 313–351

Forsyth P.A., Vetzal K.R., Zvan R. (2002) Convergence of numerical methods for valuing path-dependent options using interpolation. Review of Derivatives Researches 5: 273–314

Geman H., Yor M. (1993) Bessel processes, Asian options, and perpetuities. Mathematical Finance 3: 349–375

Hull J.C., White A. (1993) Efficient procedures for valuing European and American path-dependent options. Journal of Derivatives 1: 21–31

Kemna A., Vorst T. (1990) A pricing method for option based on average asset values. Journal of Banking and Finance 14: 113–129

Klassen T.R. (2001) Simple, fast and flexible pricing of Asian options. Journal of Computational Finance 4: 89–124

Lin J., Ritchken P. (2006) On pricing derivatives in the presence of auxiliary state variables. Journal of Derivatives 14: 29–46

Milevsky M.A., Posner S.E. (1998) Asian option, the sum of lognormals and the reciprocal gamma distribution. Journal of Financial and Quantitative Analysis 33: 409–422

Neave E.H., Turnbull S.M. (1994) Quick solutions for arithmetic average options on a recombining random walk. Actuarial Approach for Financial Risks 2: 717–740

Ritchken P., Trevor R. (1999) Pricing options under generalized GARCH and stochastic volatility processes. Journal of Finance 54: 377–402

Turnbull S.M., Wakeman L.M. (1991) A quick algorithm for pricing European average option. Journal of Financial and Quantitative Analysis 26: 377–389

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Dai, TS., Wang, JY. & Wei, HS. Adaptive placement method on pricing arithmetic average options. Rev Deriv Res 11, 83–118 (2008). https://doi.org/10.1007/s11147-008-9025-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11147-008-9025-y