Abstract

In mortgage debt contracts, real property serves as collateral and the terms of mortgage financing are largely conditional on the certification of collateral value by appraisers. However, overstatement of collateral value is common in the appraisal industry, causing troubles in the mortgage market as observed in the recent crisis. In this paper, we examine whether competition in the appraisal industry affects appraisal bias. We model appraiser behavior given a loan officer’s preference for favorable appraisals (i.e. appraisal values at least as high as the transaction prices). As appraisers cater to loan officers to increase their probability of winning future business, our model predicts more inflated appraisals in more competitive markets. We confirm this prediction using a sample of purchase mortgages originated between 2003-2006 by a large subprime mortgage lender. Our results show that a one standard deviation increase in appraiser competition, measured at the MSA/year level, is associated with a 1.6–3.7 percentage point increase in the share of at-price appraisals. Furthermore, the effect is stronger in areas experiencing high house price growth.

Similar content being viewed by others

Notes

Total mortgage debt outstanding as reported by the Board of Governors of the Federal Reserve System.

The refinancing of mortgage loans is also dependent on the confirmation of the value of the real estate. In this paper, the discussion centers primarily on purchase mortgages since the empirical tests can only be conducted on those mortgages.

This is separate from bias stemming from the use of past transaction data that causes appraisals to lag real estate market cycles.

Introduced by the government-sponsored enterprises, the HVCC requires, among other things, the use of Appraisal Management Companies (AMCs) as a buffer between lenders and appraisers.

The loan officer can either be a mortgage broker or an employee of the lender. In the data used in our empirical analysis, 88% of the loans are arranged by mortgage brokers.

We are only concerned with positive tolerance levels.

This data reporting issue occurs because truthfully reported appraisals below the transaction price often do not make it to the lender for final approval. We provide more detail on this censoring issue in “Institutional Background”.

A competing view in the literature argues that agencies facing higher competition have to maintain their reputation by providing more credible reports. See, for example, Hong and Kacperczyk (2010) and Xia (2014). In addition, Doherty et al. (2012) and Bolton et al. (2007) also suggest that competition enhances information disclosure of financial service agencies.

The originating mortgage lender may temporarily fund a loan before selling the loan off in the secondary mortgage market to another lender (i.e., the ultimate lender). Appraisals improve mortgage liquidity in the secondary market.

This is meant to describe a “typical” transaction, however, significant variation in the process is possible. Also, the steps described here are more reflective of the process in the time period covered by our empirical analysis (2003 - 2006). The Home Valuation Code of Conduct (HVCC) was developed as a result of a settlement between the GSEs, the Federal Housing Finance Agency (FHFA), and the New York Attorney General in 2009 (Tzioumis 2017). A primary goal of the HVCC was to prevent parties with a vested interest in a closed transaction (e.g., real estate agents, loan officers) from attempting to influence appraisals. To help achieve this goal, loan officers were prevented from ordering appraisals directly from appraisers and from having substantive contact with appraisers. Instead, appraisals were typically ordered through another middleman, an appraisal management company (AMC), who then contracts with an appraiser. Interestingly, creating this “wall” (the AMC) between the loan officer and the appraiser may not prevent loan officer influence over the appraisal process. For example, if a loan officer consistently gets “low” appraisals from an AMC, then the officer can select a different AMC. Essentially the problem moves from loan officer influence over appraisers to loan officer influence over AMCs. The HVCC also inspired appraisal related provisions in the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Tzioumis 2017).

Prior to searching for homes, the loan officer gives the buyer an indication of the terms of credit that the borrower qualifies for.

Buyers also typically order a home inspection after receiving a satisfactory appraisal. The home inspection does not provide an estimate of the market value of the home. Rather, a home inspection evaluates the condition of the home’s major systems (e.g., roof, structure, HVAC, plumbing). A lender may require a home inspection in addition to the appraisal.

Conversations with loan officers that worked in the industry during the time of our study suggest that this practice was common. Intuitively, if the loan officer knows the below-price appraisal will kill the deal, there is no reason to send the appraisal (or the application) to the lender. This means that a large share of below-price appraisals are never reported to the lender, and thus will not show up in standard data sets like the one employed in this study. Ding and Nakamura (2016) discuss this selection issue, while Demiroglu and James (2016) provide evidence that this selection issue could incorrectly be interpreted as appraisal inflation. Our theoretical model and empirical strategy account for this selection issue.

Ironically, in the boom period some lenders allegedly used these “blacklists” to avoid appraisers that were unwilling to inflate values. See Harney (2008) for a description of one example of this alleged blacklisting.

Loan officers can refer to the employee of a lending institutions or mortgage brokers. Even though Dodd-Frank regulations create some distance between loan officers and appraisers by requiring loan officers to go through an appraisal management company (AMC), the incentive problem still remains. Our empirical test covers the pre-Dodd-Frank period. The source of pressure exerted on appraisers – whether from lenders, mortgage brokers, or real estate brokers – is immaterial to our model findings.

G is the distribution of appraisals around the transaction price, which could also be considered to be the market value of the property in an arm-length transaction. This distribution is not necessarily symmetrical around P.

In our model we assume that appraisers and loan officers do not consider the consequence of future losses from default due to appraisal inflation.

For example, Liaukonyte and Visockyte (2010) notes that HHI cannot directly capture many aspects of a market, such as market dynamics and market size. These other competition measures are not necessarily superior to HHI. Our objective is to show that our main result is robust to various, though maybe individually imperfect, competition measures.

We excluded unfunded loans with missing appraisal values.

In robustness checks, we also used the MSA share of appraisals that were at or just above price ([0,1%] and [0,5%]) as our dependent variable of interest. Results were qualitatively similar to those presented below.

All of our alternative measures of competition are based off the ability to identify individual appraisers in our data set. Thus, we drop all observations where the appraiser’s name is blank. Since appraisers are typically paid a fixed fee for an appraisal, we base HHI on the number of loan applications, rather than the dollar value of both refinance and purchase mortgage loan applications. However, as described above, we need a value (purchase price) to compare the appraisal to, so our dependent variable is based only on purchase loans.

Again, we calculate appraiser competition in each year for each MSA. Appraiser competition within an MSA is highly persistent over time.

Appraiser independence (or lack thereof) is commonly used in the literature to refer to other agents’ (e.g. borrower, broker, lender) ability to influence the appraiser’s valuation. Here, the term takes on a different meaning. We define an appraiser as independent if she does not work exclusively with a single broker or lender. The distinction is important. For our competition measure to be representative, we require that the appraisers do not work exclusively for a single broker, but we do not require that the appraiser’s valuation cannot be influenced by other agents.

Our study period ends in 2006 because NCEN filed for Chapter 11 bankruptcy in March 2007.

In unreported robustness checks we find that our results remain unchanged using other minimum MSA/year level loan application requirements (e.g., 20, 40, 50, 60).

In Table 1 we multiply the number of appraiser per resident by 100 to avoid showing zeros because of rounding. However, in our regression analysis we do not multiply this measure by 100.

The underwriting controls include (log) FICO Score, combined loan-to-value ratio, debt-to-income ratio, (log) loan amount, a binary indicator for an adjustable rate mortgage, a binary indicator for an investment property, and a binary indicator for a second home. In the interest of brevity, we do not report summary statistics or marginal effect estimates for the control variables used in the loan level regression of Eq. 11. These numbers are available from the authors upon request.

This is calculated as the coefficient estimate times the standard deviation of appraiser competition divided by the share of at price appraisals in Table 1 (4.684 x 0.008 = 0.037 / 0.443 = 0.085).

That is 0.443 x 0.035 / 0.443. To avoid confusion in this calculation, notice that the average share of at-price appraisals (0.443) is the same as the coefficient estimate of β (0.443).

These thresholds are based on MSA house price appreciations over the entire sample period.

Alternatively, we could create a boom indicator by looking at the distribution in house price changes over our sample period and arbitrarily assigning a cutoff value to define boom areas.

Full regression results are available from the authors upon request.

Downloaded November, 2018 from https://entp.hud.gov/idapp/html/apprlook.cfm.

References

Agarwal, S., Ambrose, B.W., Yao, V. (2014). The limits of regulation: Appraisal bias in the mortgage market. Available at SSRN 2487393.

Agarwal, S., Ben-David, I., Yao, V. (2015). Collateral valuation and borrower financial constraints: Evidence from the residential real estate market. Management Science, 61(9), 2220–2240.

Ambrose, B.W., Conklin, J., Yoshida, J. (2016). Credit rationing, income exaggeration, and adverse selection in the mortgage market. The Journal of Finance, 71(6), 2637–2686.

Bae, K.-H., Kang, J.-K., Wang, J. (2015). Does increased competition affect credit ratings? a reexamination of the effect of fitch’s market share on credit ratings in the corporate bond market. Journal of Financial and Quantitative Analysis, 50(5), 1011–1035.

Becker, B., & Milbourn, T. (2011). How did increased competition affect credit ratings? Journal of Financial Economics, 101(3), 493–514.

Ben-David, I. (2011). Financial constraints and inflated home prices during the real estate boom. American Economic Journal: Applied Economics, 3(2), 55–87.

Berger, A., Demirgüç-kunt, A., Levine, R., Haubrich, J. (2004). Bank concentration and competition: an evolution in the making. Journal of Money, Credit, and Banking, 36(3), 433–451.

Bikker, J., & Haaf, K. (2002). Measures of competition and concentration in the banking industry: a review of the literature. Economic & Financial Modeling, 9, 53–98.

Bitner, R. (2008). Confessions of a Subprime Lender: An Insider’s Tale of Greed, Fraud, and Ignorance. Hoboken: Wiley.

Bolton, P., Freixas, X., Shapiro, J. (2007). Conflicts of interest, information provision, and competition in the financial services industry. Journal of Financial Economics, 85(2), 297–330.

Bolton, P., Freixas, X., Shapiro, J. (2012). The credit ratings game. The Journal of Finance, 67(1), 85–111.

Calem, P.S., Lambie-Hanson, L., Nakamura, L.I. (2015). Information losses in home purchase appraisals. Federal Reserve Bank of Philadelphia Working Paper No. 15–11.

Calem, P.S., Lambie-Hanson, L., Nakamura, L.I. (2016). Appraising home purchase appraisals. Working Paper.

Campbell, J.Y. (2012). Mortgage market design. Review of Finance, 17(1), 1–33.

Chinloy, P., Cho, M., Megbolugbe, I.F. (1997). Appraisals, transaction incentives, and smoothing. The Journal of Real Estate Finance and Economics, 14 (1-2), 89–111.

Cho, M., & Megbolugbe, I.F. (1996). An empirical analysis of property appraisal and mortgage redlining. The Journal of Real Estate Finance and Economics, 13(1), 45–55.

Clayton, J., Geltner, D., Hamilton, S.W. (2001). Smoothing in commercial property valuations: Evidence from individual appraisals. Real Estate Economics, 29 (3), 337–360.

Cohen, A., & Manuszak, M.D. (2013). Ratings competition in the cmbs market. Journal of Money, Credit and Banking, 45(s1), 93–119.

Demiroglu, C., & James, C. (2016). Indicators of collateral misreporting, Management Science, (Forthcoming).

Ding, L., & Nakamura, L.I. (2016). The impact of the home valuation code of conduct on appraisal and mortgage outcomes. Real Estate Economics, 44(3), 658–690.

Doherty, N.A., Kartasheva, A.V., Phillips, R.D. (2012). Information effect of entry into credit ratings market: The case of insurers’ ratings. Journal of Financial Economics, 106(2), 308–330.

Eriksen, M.D., Fout, H.B., Palim, M., Rosenblatt, E. (2016). Contract price confirmation bias: Evidence from repeat appraisals. Working Paper.

Flynn, S., & Ghent, A. (2015). Competition and credit ratings after the fall. Working Paper.

Fout, H., & Yao, V. (2016). Housing market effects of appraising below contract. Working Paper.

Griffin, J.M., & Maturana, G. (2016). Who facilitated misreporting in securitized loans? Journal of Finance, 29(2), 384–419.

Hansz, J.A., & Diaz, J. III. (2001). Valuation bias in commercial appraisal: A transaction price feedback experiment. Real Estate Economics, 29(4), 553–565.

Harney, K.R. (2008). Appraiser lawsuit puts lenders on notice. Washington Post. http://www.washingtonpost.com/wp-dyn/content/article/2008/01/25/AR2008012501650.html.

Hong, H., & Kacperczyk, M. (2010). Competition and bias. The Quarterly Journal of Economics, 125(4), 1683–1725.

Kruger, S., & Maturana, G. (2017). Collateral misreporting in the RMBS market. Working Paper.

LaCour-Little, M., & Green, R.K. (1998). Are minorities or minority neighborhoods more likely to get low appraisals? The Journal of Real Estate Finance and Economics, 16(3), 301–315.

LaCour-Little, M., & Malpezzi, S. (2003). Appraisal quality and residential mortgage default: Evidence from Alaska. The Journal of Real Estate Finance and Economics, 27(2), 211–233.

Lang, W.W., & Nakamura, L.I. (1993). A model of redlining. Journal of Urban Economics, 33(2), 223–234.

Liaukonyte, J., & Visockyte, L. (2010). A history of mergers: Theory and regulations. Technical Report.

Nakamura, L.I., & et al. (2010). How much is that home really worth? Appraisal bias and house-price uncertainty. Business Review, (Q1): 11–22.

National Appraisal Congress. (2015). Removing barriers to entry into the residential valuations profession: Solutions for educating, training and regulating the next generation of appraisers. White Paper.

Petrongolo, B., & Pissarides, C.A. (2001). Looking into the black box: a survey of the matching function. Journal of Economic Literature, 39(2), 390–431.

Pissarides, C.A. (1994). Search unemployment with on-the-job search. The Review of Economic Studies, 61(3), 457–475.

Pissarides, C.A. (2000). Equilibrium Unemployment Theory. Cambridge: MIT Press.

Quan, D.C., & Quigley, J.M. (1991). Price formation and the appraisal function in real estate markets. The Journal of Real Estate Finance and Economics, 4(2), 127–146.

Shi, L., & Zhang, Y.J. (2015). Appraisal inflation: Evidence from 2009 GSE HVCC intervention. Journal of Housing Economics, 27, 71–90.

Skreta, V., & Veldkamp, L. (2009). Ratings shopping and asset complexity: a theory of ratings inflation. Journal of Monetary Economics, 56(5), 678–695.

Sorohan, M. (2016). MBA urges elimination of barriers to appraiser entry. MBANEWSLINK.

Tzioumis, K. (2017). Appraisers and valuation bias: an empirical analysis. Real Estate Economics, 45(3), 679–712.

Xia, H. (2014). Can investor-paid credit rating agencies improve the information quality of issuer-paid rating agencies? Journal of Financial Economics, 111(2), 450–468.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix: A

The two Bellman Eqs. (6) and (7) give the following functional forms of J(V ) and J(U).

The first-order conditions (FOCs) of Eqs. 12 and 13 with respect to a, respectively (14) and (15), give the following implicit functions for the optimal amount of “shading” by V appraisers, a(V ), and by U appraisers, a(U), respectively.

where

We assume that G follows a uniform distribution with support [-Q/2,Q/2]. Therefore,

Next, we substitute B, Z(a), Z′(a), G(a), and G′(a) in Eqs. (14) and (15) using (16), (17), and (18) to derive the FOCs for V and U appraisers, respectively (19) and (20), used in the simulation.

After simulation of the endogenous variables, we calculate the number of at-price appraisals by the V group (ATP(V )) and U group (ATP(U)), the total number of at-price appraisals (ATP), and the number of above-price appraisals (ABP) by both groups.

Next, we compute the proportion of at-price appraisals, the main focus of our empirical analysis, as follows:

Appendix: B

For competition observed in the New Century data to serve as a reasonable proxy for true market competition, we require that appraisers rarely work exclusively for one mortgage broker or lender. Indeed, this is what we find in the New Century data. Ninety two percent of the appraisals in our sample are performed by an appraiser that does at least three appraisals. Of those appraisers, 96% work with multiple mortgage brokerage firms. We believe that this is fairly convincing evidence that appraisers generally do not work for a single broker or lender, but because this is based on data from New Century alone, the possibility remains that this fact does not generalize.

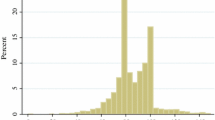

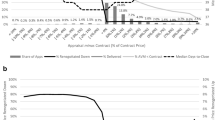

To provide further evidence that residential appraisers generally do not work exclusively for a single broker or lender, we downloaded all current FHA licensed appraisers from the U.S. Department of Housing and Urban Development’s website.Footnote 35 The list includes 47,126 individual appraisers, as well as the name and address of their employer. There are 41,907 unique company/address combinations in the database, with the distribution of the number of FHA licensed appraisers working within offices shown in Fig. 8. As the distribution clearly shows, the majority of these appraisal companies are small, consisting of only one appraiser. This provides evidence that appraisers generally work independent of one another. We also took a random sample of 100 appraisers from this list and further investigated the company name and address. Using company websites and other internet sources (LinkedIn, Facebook, local business directories, Google Street View), we flagged a company as ”independent” if it is not affiliated with a lender, a mortgage broker, or a real estate brokerage firm. Ninety-eight percent of this random sample was classified as ”independent.” Of the non-independent firms, one was affiliated with a lender and one was affiliated with a real estate broker. Most of the independent companies appear to be firms with only one employee, providing further evidence that appraisers operate independently.

Rights and permissions

About this article

Cite this article

Conklin, J., Coulson, N.E., Diop, M. et al. Competition and Appraisal Inflation. J Real Estate Finan Econ 61, 1–38 (2020). https://doi.org/10.1007/s11146-019-09697-w

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-019-09697-w