Abstract

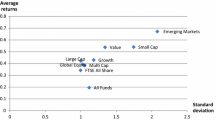

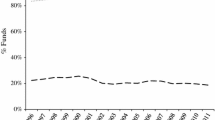

We investigate the net effect between diversification benefit and information cost of international real estate mutual funds from three dimensions: whether investors can benefit from investing in international real estate mutual funds, whether managers of international real estate mutual funds possess superior market knowledge and timing abilities, and whether investors are motivated by returns or diversification. Our findings are threefold. First, the results show that international real estate mutual funds perform better and are less risky than domestic real estate mutual funds before Jun 2007. That is, diversification benefits outweigh the information costs, and investors therefore gain from investing in international real estate mutual funds. However, the benefit is reduced because of the economic shock of sub-prime financial crisis. Second, on average, neither international mutual fund managers nor domestic mutual fund managers possess market timing abilities. Finally, we find that fund flows are driven by investors’ return-chasing behaviors and fund size, but not by diversification purpose.

Similar content being viewed by others

References

Barry, C. B., & Rodriguez, M. (2004). Risk and return characteristics of property indices in emerging markets. Emerging Markets Review, 5, 131–159.

Chang, E., Eun, C. S., & Kolodny, R. (1995). International diversification through closed-end country funds. Journal of Banking and Finance, 19, 1237–1263.

Cumby, R. E., & Glen, J. D. (1990). Evaluation the performance of international mutual funds. Journal of Finance, 45, 497–521.

Droms, W. G., & Walker, D. A. (1994). Investment performance of international mutual funds. Journal of Financial Research, 17, 1–14.

Edelen, R. M., & Warner, J. B. (2001). Aggregate price effects of institutional trading: a study of mutual fund flow and market returns. Journal of Financial Economics, 59, 195.

Elton, E. J., Gruber, M. J., & Rentzler, J. C. (1987). Professionally managed, publicly traded commodity funds. Journal of Business, 60, 175–199.

Engstrom, S. (2003). Costly information, diversification and international mutual fund performance. Pacific-Basin Journal, 11, 463–482.

Eun, C. S., Kolodny, R., & Resnick, B. G. (1991). U.S.-based international mutual funds: a performance evaluation. Journal of Portfolio Management, 17, 88–94.

Ferson, W. E., & Schadt, R. W. (1996). Measuring fund strategy and performance in changing economic conditions. Journal of Finance, 51, 425–461.

Henriksson, R. D. (1984). Market timing and mutual fund performance: an empirical investigation. Journal of Business, 57, 73–96.

Henriksson, R. D., & Merton, R. C. (1981). On market timing and investment performance. II. Statistical procedures for evaluating forecasting skills. Journal of Business, 54, 513–534.

Jagannathan, R., & Wang, Z. (1996). The conditional CAPM and the cross-section of expected returns. Journal of Finance, 23, 389–416.

Kallberg, J. G., Liu, C. L., & Trzcinka, C. (2000). The value added from investment managers: an examination of funds of REITs. Journal of Financial and Quantitative Analysis, 35, 387–408.

Kao, G. W., Cheng, L. T. W., & Chan, K. C. (1998). International mutual fund selectivity and market timing during up and down market conditions. Financial Review, 33, 127–144.

Karceski, J. (2002). Returns-chasing behavior, mutual funds, and beta’s death. Journal of Financial and Quantitative Analysis, 37, 559–594.

Lin, C. Y., & Yung, K. (2004). Real estate mutual funds: performance and persistence. Journal of Real Estate Research, 26, 69–93.

Ling, D. C., & Naranjo, A. (2006). Dedicated REIT mutual fund flows and REIT performance. Journal of Real Estate Finance and Economics, 32, 409–433.

O’Neal, E., & Page, D. (2000). Real estate mutual funds: abnormal performance and fund characteristics. Journal of Real Estate Portfolio Management, 6, 239–247.

Patro, D. K. (2006). International mutual fund flows. Working Paper.

Polwitoon, S., & Tawatnuntachai, O. (2006). Diversification benefits and persistence of US-based global bond funds. Journal of Banking and Finance, 30, 2767–2786.

Sirri, E. R., & Tufano, P. (1998). Costly search and mutual fund flows. Journal of Finance, 53, 1589–1622.

Treynor, J., & Mazuy, K. (1966). Can mutual funds outguess the market. Harvard Business Review, 44, 131–136.

Worzala, E., & Sirmans, C. F. (2003). Investing in international real estate stocks: a review of the literature. Urban Studies, 40, 1115–1149.

Author information

Authors and Affiliations

Corresponding author

Additional information

Lu acknowledges financial support from the National Science Council of Taiwan (NSC98-2410-H-002-219-MY2).

Rights and permissions

About this article

Cite this article

Shen, Yp., Lu, C. & Lin, ZH. International Real Estate Mutual Fund Performance: Diversification or Costly Information?. J Real Estate Finan Econ 44, 394–413 (2012). https://doi.org/10.1007/s11146-010-9257-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-010-9257-0

Keywords

- Domestic real estate mutual funds

- Fund performance

- International real estate mutual funds

- Market timing ability

- Mutual fund flows

- Stock selection ability