Abstract

Seminal work by Grenadier (J. Financ. Econ. 38:297–331, 1995) derived a set of hypotheses about the pricing of different lease lengths in different market conditions. Whilst there is a compelling theoretical case for and a strong intuitive expectation of differential pricing of different lease maturities, to date the empirical evidence is inconclusive. Drawing upon a substantial database of commercial lettings in central London (West End and City of London) over the last decade, we investigate the relationship between rent and lease maturity. In particular, we test whether building quality, credit risk and micro-location variables omitted in previous studies provide empirical results that are more consistent with the theoretical and intuitive a priori expectations. It is found that initial leases rates are upward sloping with the lease term and that this relationship is constant over time.

Similar content being viewed by others

Introduction

In the UK the dramatic changes to leasing patterns in the 1990s and the increase in the political salience of the subject has produced growing interest in lease pricing from real estate researchers. Researchers have proposed a range of models drawn from economic theory, most substantially from real options, to analyse lease pricing problems and offer optimal pricing solutions. However, despite the controversy surrounding the topic, there has been little empirical investigation of whether variation in lease terms produces variation in rents. In this paper, we use a sample of 935 London office leases granted between 1994 and 2004 to investigate the relationship between lease length and initial lease rates. Previous research (Gunnelin and Soderberg 2003, Englund et al. 2004) has found some evidence of a term structure in lease payments that varies over time.

For many UK property investors, government intervention in the commercial property leasing market has been perceived as a threat. Average lease lengths have been falling steadily throughout the last decade to produce a shift in ‘the risk pendulum’ from tenants to landlords (ODPMFootnote 1 2004). We expect that leases which produce increased risks for investors should provide an increased return (higher rent). However, it is clear that at a given point in time expected risk will vary with systematic (expectations of future market conditions) and specific factors (quality of building/location, tenant quality). Indeed it is possible to envision circumstances where a landlord would accept a reduced rent for shorter leases. For instance, where the landlord expects a market recovery in future or has a tenant with a weak credit rating occupying high quality space.

Previous Research

The most influential recent work on lease pricing is Grenadier’s (1995) analysis of a range of lease options. Grenadier explores the analogy of different lease lengths being comparable to bonds with different maturities. He produces an equilibrium rent for any length of lease and a term structure of lease rates analogous to a term structure of interest rates. Grenadier offers a set of hypotheses about the pattern of lease lengths in different market conditions. In the vein of the term structure of interest rates, he describes three possible term structure shapes—downward-sloping, upward-sloping and single-humped—driven by the expectations of landlords. Although the model does not take into account transaction costs, vacancies/non-renewals and taxes, there is an important point that short lease terms should not automatically produce higher rents. For fixed rent leases and for short leases, landlords will require different rents depending on their expectations of future market conditions. If they expect market conditions to improve in the future, they should regard short leases more favourably compared to an expectation of deteriorating market conditions. Grenadier’s work revealed the optionality inherent in real estate interests and the key role of rental volatility and the model of behaviour in rents. However, it is based upon a hypothesis of landlord behaviour—the expectations hypothesis—that is commonly applied in explaining the term structure of interest rates. It is questionable, to say the least, whether this is an accurate representation of landlord behaviour.

Following Grenadier (1995), a number of researchers (Ambrose et al. 2002, Booth and Walsh 2002a, b; Hendershott and Ward 2003, Stanton and Wallace 2004) utilize the concepts of market equilibrium relationships in the development of a model for pricing lease cash flows. The assumption of market equilibrium is important since

“The equilibrium context implies that in an efficient market, all leases with the same maturity should provide the same present value to the lessor, irrespective of whether the rental rate is fixed, fully variable or partially variable” (Ambrose et al. 2002, 35)

Typically drawing upon standard option pricing theory, they make a number of assumptions about risk free rates, drift coefficients (growth in rents), volatility and rental behaviour to devise hypothetical optimal pricing solutions. However, Clapham and Gunnelin (2003) draw upon the limitations of the expectations hypothesis to demonstrate that, even when the rent expectation is held constant, different assumptions about interest rate stochastics and risk aversion can generate widely different term structures. As a result, they caution against making inferences about market expectations from term structure observations.

Whilst the work cited above has tended to focus on asset values to the investor, McCann and Ward (2003) examine the optimal lease length from the tenants’ perspectives and question the applicability of a term structure. The premise is that from the tenant’s point of view, the cost of space varies with the lease length quite independently from the term structure of rental rates, so that the value of a lease to a tenant is not exogenously given. In other words, the standard assumption that landlords will extract the same value from the property regardless of lease structure is disputed. The occupancy value will therefore be a function of tenant-specific and market variables—legal and search costs, relocation probability and costs, rent and repairing costs, opportunity costs and ability to assign. They develop a model which, given certain assumptions, prices the range of lease lengths for individual tenants. Their key conclusion is that there is a clientele effect that overlays the financial equivalence of different lease lengths and that in some circumstances, business reasons will dominate the term structure of rents.

Following Grenadier’s (1995) suggestion that hypothetical pricing solutions should be compared with actual market rents, there has been work that has attempted to identify a term structure of lease rates. At the aggregate level, there are significant methodological issues in isolating the effects of lease terms on rents as researchers are faced with problems of trying to disentangle the effects on rents of tenant and building quality and market conditions from lease provisions. Typically this work has modelled observed rent as a function of a range of lease, market and property-specific factors. Empirical findings have been inconclusive.

In the USA much of the work on rent determination has focused on exploring the relationship between base and percentage rents in shopping malls (see Wheaton 2000; Miceli and Sirmans 1995; Ambrose et al. 2002; Hendershott and Ward 2003). However, Mooradian and Yang (2000) explicitly focused on the lease pricing effects of ability to exit. They find that the only variable that has significant effect on rent is the right to downsize.

Overcoming the problems of potential sample bias inherent in studies based upon a single landlord or tenant, Stanton and Wallace (2004) compare and contrast models of spot leases rates with observed rents for 711 lease originated between 1987 and 1996. They derived the implied structure of forward rents for a range of metropolitan areas as of September 1997. Whilst acknowledging a lack of precision for some of the model inputs they find term structures that are broadly consistent with the prior expectations. However, the ‘predicted’ rents are not consistent with observed rents implying mispricing in the market. With particular relevance to this study, they find that the length of the lease has a statistically positive effect on realised rent whilst credit worthy tenants and increased size of letting lead to significant reductions in rent.

Similarly two Swedish studies argued that previous studies fail to allow for possible variation in the term structure of lease length. Gunnelin and Soderberg (2003) report that differences in lease terms have statistically significant effects on commercial rents in the Stockholm CBD for 7 out of 15 years between 1977 and 1991. Partially confirming the term structure of lease rates, they identify an upward sloping curve in the bullish 1980s and a downward sloping curve in the bearish 1990s. Englund et al. (2004) find much more mixed results for more recent trends in three Swedish centres. In only half the cases is the null hypothesis that lease length has no effect rejected and there is typically an upward slope in the term structure of lease rates. This was counterintuitive given the market conditions and it suggests that the research, hampered by a lack of variations in the lease structures, has struggled to cope with the problems of isolating the effects of lease terms on rents from the other variables.

This is the case with ODPM (2004) who, using UK data, report similar mixed results. In some markets, they find that short lease terms are associated with low rents, whilst in others they are associated with high rents. However, it is difficult to assess whether this is due to genuine term structure effects. ODPM (2004) suggest two other possible explanations for the findings. First, the model is failing to account sufficiently for the effects of tenant quality and building/location characteristics relative to lease terms—an argument that would be consistent with the McCann and Ward paper. Second, and more interesting, is an implied behavioural explanation for the lack of an impact of lease terms on rent. Their interview survey of market participants found that in the process of rent negotiation, agreement on rent usually preceded agreement on detailed lease terms. This could be explained either by both parties have common views on the characteristics of the leases even before the terms were settled or that the bargaining structure was inefficient within the current institutional environment.

In summary, there are grounds to expect that observed rents will be conditioned by the terms of occupation. Ceteris paribus, we should expect that variations in lease terms should produce variations in observed rents. Lease length, in particular, is regarded as an important determinant of the risk in the cash flows delivered by leased real estate assets. However, in addition to differences in risks among different assets and sectors, expectations about risks of future cash flows will vary over time. Analogous to bond markets, a priori, we should not expect to observe a static rental premium or discount across different sectors and over time.

Estimating a Term Structure of Office Rents

The empirical studies that are most relevant to this study are the papers of Gunnelin and Soderberg (2003) and Englund et al. (2004). In the first paper the model used both linear and quadratic function forms to estimate the term structure relationship. The quadratic model used was specified as

where lease i is the rental payment for lease i, Fact i are characteristics of lease contract i such as size, age of building, whether the lease is a renewal of a previous contract and the institutional owner of the property occupied in lease i. D j represents a dummy variable for the year in which the lease was originated and Term i is the length of the contractual obligation for lease i. The Parameters \(\alpha _0 ,\;\beta _i ,\;\gamma _i ,\;\lambda _i \) are estimated using OLS.

Englund et al. (2004) present a similar model, except no parametric form is placed on the relationship between lease rental and term. While this may have advantages in allowing a flexible functional relationship between rental and term to be estimated, it comes at the expense of an increased number of parameters requiring estimation. This is a particular issue in this study as the term of the leases often reaches 25 years or more.

A major methodological issue not encountered in the studies just mentioned, but of high relevance to the present paper, is the treatment of option clauses, such as lease break and upward-only rent reviews. Stanton and Wallace (2004) provide an extensive discussion of these issues and recommend using options-based valuation of each lease clause. They construct a net present value for the cash flows from each lease and use this measure in estimating the term structure of lease paymentsFootnote 2. In the present paper we adopt an empirical approach to this issue. Firstly, as the 5 year upward-only rent review is a common institutional feature of the London office market, it is assumed that any adjustment that would be made to the value of each lease would be common to all leases. Hence the relative lease payments are unlikely to be affected. Secondly, with regard to lease breaks, we consider alternative functional forms that take into consideration the possible impact of the break provision on the rental payment. These alternative functional forms are discussed in the next section.

Where information is provided on rent-free periods we calculate an effective lease cost which spreads the savings from the rent-free period over the term of the lease.

Data

The primary dataset used in this study is based on information collected by CB Richard Ellis. This database consisted of 726 leases for the City of London office market and 394 leases for the West End market. A possible limitation of the data available from CB Richard Ellis is that it consists of leases where the underlying occupied space is almost always greater than 10,000 ft2 (929 m2) in size. At first this may seem a limitation however, it may provide a simple way to control for tenant quality. As we do not have information on tenant credit worthiness for all sample observations it is assumed that larger tenants are likely to be more credit worthy than occupiers with smaller space requirementsFootnote 3.

To supplement the analysis and check that the results obtained are not biased due to the restricted nature of the leases in the database, we compared the results obtained from the models, with estimates obtained from using data from the Estates Gazette service. This dataset is larger than the CB Richard Ellis data and covers lease transactions of varying sizes and from more locations in London. However, information on lease breaks and rent-free periods is not as detailed as widely available and the quality of the information, which is input from a wide variety of sources, is more difficult to ascertainFootnote 4.

After sorting the CBRE data and removing outlying observations or information from years in which there were few observations, the number of leases that remained in the data set was 935. These leases covered the period from 1994 to 2004. A summary of the characteristics of these leases is shown in Table 1.

The information in Table 1 provides a breakdown on the sample leases by area as well as reporting the aggregate totals. From the table it can be seen that the sample is dominated by lease contracts for office space in the City of London (595 as opposed to 340 from the West End). The initial rents are higher in the City, £345.09 per m2, compared to £323.77 per m2 in the West End. The average space covered by the lease contracts is also higher in the City (3,506.95 m2) than the West End (2,355.17 m2).

In the UK it is common to indicate building quality using a simple scale of A, B or C, with A being the highest quality property and C being the lowest. The higher rents on leases for City properties may reflect the higher portion of grade A properties in the sample (67% for City and 46% for West End). In the current sample 24% of all leases in the City had break clauses reported (10% for the West End) and the average length of time before the break could be exercised was 9.06 years (8.71 years for the West End). Average lease lengths were slightly shorter in the West End (13.28 years) compared to the City (14.47 years).

The fact that the sample only considers leases where the occupied area is greater than 10,000 ft2 may explain the characteristics observed in the sample. Typically the stock of office space in the West End is older with smaller floor plates compared to office space in the City. Properties in the City tend to be more modern with larger capacity floor plates designed to appeal to large corporate occupiers from the financial services sector.

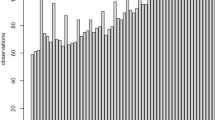

Table 2 shows the distribution of leases by lease length and year of origination. There are distinct peaks in the lease terms centred around the periods of 10, 15, 20 and 25 years. There are few leases in the sample less than 5 years in maturity. This stands in contrast to the data presented in Gunnelin and Soderberg (2003) where most of the leases had maturities of less than 5 years with very few observations above 7 yearsFootnote 5. From the data presented in this table there is little evidence to suggest that lease lengths are falling in the London office market. However, this should be interpreted in light of the nature of the sample, which is limited to large office space requirements. In these instance occupiers are likely to prefer longer lease terms due to the high frictional costs of relocating large numbers of employees and fitting out the premises.

Results

To estimate the term structure model we use a variation of model (1) based on the Gunnelin and Soderberg (2003) study. The first specification assumes a linear relationship between term length and initial rent.

where lease i is the initial real rental payment for lease i, Size i is the amount of space occupied, bk i is the length of the lease break provision if one is included in the lease, GrB i is a dummy variable for leases where the occupied space is in grade B properties and similarly GrC i is a dummy variable to denote the occupied space is in a grade C property. Loc i is a location dummy variable which takes the value 1 for lease in the West End market. D j represents a dummy variable for the year in which the lease was originated and covers the years from 1995 to 2004. Term i is the length of the contractual obligation for lease i. The multiplicative dummy variables D j cover the period from 1994 to 2004.

Note that in all cases the real rent is used as the dependent variable in the model. The real rental value is obtained by deflating the nominal rent value of each lease by the corresponding value of the implicit price deflator of domestic final demand in the same yearFootnote 6.

An alternative specification suggested in Gunnelin and Soderberg (2003) is to allow a quadratic specification for the term structure relationship. Adding a term to Eq. 2 that is quadratic in the term structure provides a model of the form

where \({\text{Term}}_i^2 \) is the square of the length of lease i.

The outcome from applying OLS to Eqs. 2 and 3 are shown in Tables 3 and 4 respectively. All standard errors are calculated using White’s heteroscedasticity consistent covariance estimates.

Table 3 reveals a number of interesting results. There appears to be a strong linear association between the term structure variable and initial lease rates. The interactive lease maturity variable is significant and position in each year except for 1996. This result is much stronger than that found in Gunnelin and Soderberg. The positive sign on this variable is counter to our prior expectations as it suggests that occupiers pay a higher initial rent to have a longer lease term. Such a result appears to go against anecdotal evidence from market participants which suggest that lower initial lease rates may be obtained by taking a longer lease term.

The individual year dummy variables provide some indication of the changing market conditions in London. Incremental lease rates increased from 1996 to 2002 before falling sharply in 2003 and 2004. This does appear to be consistent with market evidence that the late 1990s and early part of this decade saw strong increases in rent due to the expansion in financial service and technology related employment. However, following the downturn in these sectors in 2001 the leasing market has been considerably weaker.

The coefficient for size is negatively signed as expected, indicating that occupiers taking larger amounts of space receive a lower initial rent that those with smaller space requirements. The signs of the dummy variables for grade of building and location are also as expected with occupiers in lower grade buildings paying lower initial rents than those in grade A space. Also occupiers in the West End pay higher rates per square meter than those in the City, when all other factors are held constant.

Finally the coefficient on the break variable is significant and negative. This finding also seems unusual as it is usually perceived that break clauses provide advantages for tenants and negotiated as part of a rental agreement it is likely that a premium would be paid for this option. However, there is an expectation that the value of this option would fall as the time to expiry increases. We will return to this issue at a later point.

The overall fit of the equation is satisfactory with an R 2 of 45%, which implies that just under half of the variation in initial lease rates is explained by Eq. 2. To assess whether the nature of the term structure variable is changing we test the hypothesis that the coefficients from TM94 to TM04 are all equal. The resulting F-test statistic is 0.773, which implies the hypothesis cannot be rejectedFootnote 7. That is, there does not appear to be a changing pattern to the relationship between lease length and initial rent in the London office market.

Table 4 shows the results of estimating Eq. 3. The difference between this table and the previous is the inclusion of the square of the interactive lease term variables (shown as TM94_2 to TM04_2 in Table 4). Only two of the quadratic terms are significant in Table 4 (in 1999 and 2001). Interestingly, the sign of the squared terms from 2001 onwards are all negative whereas previously the squared terms were positive (though with little significance). The remaining variables are essentially unchanged with the exception of the year dummy variables. In this case the dummy variables now suggest that initial rental rates peaked in 1999 with large falls occurring in 2003 and 2004. However, as only the dummy variable for 1999 is significant this finding needs to be treated with caution.

The relationship between term and initial lease rates is explored further by considering the test of a null hypothesis of the equality of the interactive term structure variables in Eq. 3. The joint null hypothesis that

is evaluated. It is found that this null is not rejectedFootnote 8. Again this is evidence that the term structure of initial lease rates does not appear to be changing. As a final test we examine the hypothesis that the coefficients of the squared interactive lease term variables are jointly equal to 0. The F statistic of 1.65 is rejected at the significance level of 10% but is not rejected at the 5% levelFootnote 9.

In light of these hypothesis test findings we reparameterise the model to remove the interactive dummy variables for year of origination and term. These are replaced by variables for the lease term and lease term squared. The resulting model is shown in Table 5.

All parameters in this model are statistically significant at the 10% level with the exception of the dummy variables for origination years 1995 and 2004. The pattern of the dummy variable coefficients once again shows the increases in rent up to 2003 before falling quite sharply. The lease term and lease term squared variable are both statistically significant and confirm a quadratic relationship between (log) rents and lease length. The location and grade variables are all strongly significant and the lease break term is significant and negative.

Finally the limitation of the data set with regard to lease size if further considered. As there are few leases in the sample below 5 years we re-estimate the previous model after removing all leases below 5 years from the data set. The results for this new regression are not reported as the overall magnitude of the parameter estimates is broadly similar to Table 5. A notable difference is that the coefficient of the squared term variable is no longer significant.

The information in Table 5 and the supplemental equation with the short leases removed can be used to plot the term structure of (real) initial lease rates in the London office market. To draw the curve it is assumed that the current year is 2004, the representative office is taken to be in the City of London and has a floor area equal to the average size shown in Table 1 (3,506.95 m2). The resulting curves are shown in Fig. 1. In both cases an upward sloping curve linking initial lease rates to the term of the lease is observed.

We provide a further discussion of the empirical treatment of lease breaks in the contacts. Two additional models were considered, one that removes all lease contracts with a break in the sample and another that treats lease break as being equal to the terminal maturityFootnote 10.

It was found that when all leases with a break clause were removed from the sample and the model estimated using the remaining observations (615 remained), the parameter estimate were very similar to those obtained in Table 5 (results not reported). The sign of the lease length variable remained positive.

When the lease maturity was taken to be the minimum of either the lease break term or the lease term it was found that the term structure of initial lease rates was still upward sloping (results not reported). The signs of the term and term squared variable were reversed but this simply meant that the initial lease rates grew rapidly once lease terms reached above 20 years. The explanatory power of this model was also lower than the other equations estimated.

As a final check on the robustness of the results we applied the Eqs. 2 and 3 to an alternative lease data set obtained from the Estates Gazette. This contained a larger number of leases than the CBRE data and covered more regions within London. However, there were concerns about the reliability of the data which is why this dataset did not form the core data used in this study. When the models were estimated it was found that a similar upward sloping term structure in initial lease rates appeared. This confirms that the findings of this study are unlikely to be due to restricted nature of the lease data setFootnote 11.

Credit Rating, Occupier Type and Microlocation

As a further check on the robustness of the model, for a subset of the original sample, it was possible to obtain data from a credit rating agency (Dun and Bradstreet) on the credit quality of some tenants in the sample. Two measures of credit worthiness were obtained; a risk indictor variable, which takes integer values (in our sample the values range from 1 to 4), and a detrimental score variable, which takes values in the range from 1 to 100. The indicator variable, provides an indication of the risk of business failure, with smaller numbers representing a lower the risk of failure (for example 2 represents a lower than average risk of failure). The detrimental score is a percentile measure that indicates how many UK businesses have a lower risk of paying significantly late. Hence a value of 70 indicates than only 30% of UK businesses would have a lower risk of paying late. A larger score in this case indicates higher creditworthiness. As expected the two measures of credit worthiness are highly correlated (correlation coefficient −0.84). In total a sample of 480 leases were available for this further analysis.

For the subset of observations with credit quality information available, we developed two additional categories of explanatory variables. Firstly we provide a measure of microlocation. These variables attempt to hold constant for locational information at a finer level of detail than provided by the broad geography area of City or the West End used above. For data observations in the West End market, the market is divided into 14 sub-areas commonly used by agents in that market (e.g. Knightsbridge, Covent Garden, St James, etc). For properties located in the other areas, we use a postcode four digit postcode classification (e.g. EC1A, EC2N, etc). Secondly, we use information on the tenant to develop a dummy variable for occupier-sector type. We divide the type of tenants into broad categories to reflect the industry sector (e.g Government, Commercial Bank, Property Company, etc)Footnote 12. A total of 12 sector types were identified. This is to help hold constant for a possible cliental effect as discussed by McCann and Ward (2003).

The regression results for the complete model containing the additional variables are shown in Table 6. Even though the results presented in Table 6 relate to a different sample used for Table 5 (obviously with a large degree of overlap), the results are broadly consistent which provides additional support for the general results of the model. Approximately 74% of the variation in initial lease rates in the sample is explained by the model. The time variation of the dummy variable for year of origination provides a similar pattern to that obtained in the previous regression. Rents in the London office market are seen to peak in 2002 before falling sharply in 2003 and 2004. Surprisingly the size of the leased space is not significant in Table 6. It may be that in this case size was acting as a proxy variable for one of the dimensions not included in previous models but now included in this model. The length of the lease and the squared length of lease are both significant and broadly consistent in magnitude to the previous results. Once again providing support for an upward sloping term structure. The time to the first lease break has the same negative sign as in the earlier models but is not statistically significant in the current model. The influence of building quality is the same as in previous tables (B and C grade properties have respectively lower rents than A grade properties). Of the 44 microlocation variables included in the model, 19 are statistically different from zero. For readers familiar with the board game “Monopoly®”, it will not be surprising that Mayfair is the most expensive area for initial office rents (along with The Strand and St James). The postcode area EC1V has the lowest relative rental rate. Note that due to space constraints the coefficients for the 44 micro-location variables are not included in the table. For the sector classifications of tenants used in the model, Hedge Funds, Fund Managers, and Industrial companies paid the largest initial rents respectively in the sample (all statistically significant). This seems to accord with market information with suggests that hedge fund managers require high quality office space (even controlling for the effect of location). Government tenants had the smallest coefficient for initial rents but it was not statistically significant from zero. Property-related service companies had the next smallest coefficient (paid the second lowest rents, all else held constant), however, the coefficient was not statistically different from zero, so there is no evidence to suggest that property companies were unfairly using their market information to extract lower rents from landlords. Finally, the credit worthiness variable (detriment score) is found to be statistically significant and negative, implying that high credit quality tenants are able to secure lower initial rentsFootnote 13.

Test of Endogeneity of Lease Term

All the above econometric models were estimated using the ordinary least squares technique. This ignores the potential problem of endogeneity of the lease term variable which may be jointly determined with the initial lease rent. To test for the potential endogeneity of the lease term we use a Hausman test following the approach of Davidson and MacKinnon (1993). This test is specified as a two-step procedure which involves running an auxiliary regression of the lease term on all exogenous variables in the model. The residuals from this regression are then retained and included in the full model specification for the initial lease rent. A hypothesis test of the coefficient of the residual term is then carried out. A significant coefficient would imply that OLS estimates of the full equation would not be consistent. However, in this instance, the residual term for the auxiliary equation is not significantly different from zeroFootnote 14.

As a final check for endegeneity we specified a system of equations that may plausibly capture the joint determination of the key variables of interest in this study. It is noted that to some extent the equations listed below are ad hoc. A complete empirical model based on a theoretically derived lease pricing model is the subject of further research. In the meanwhile the system of equations below specifies the relationship between initial lease rates and lease term. The model estimated is:

Where the key variables are as identified in the section above, with the addition of the following variables: Loc q is a micro-location variable for lease q, Occ s is the occupier classification for lease s, Credit i is the credit worthiness score for lease i, coefficients are now subscripted with a variable identifier and an equation identifier. The terms e i and w i represent random error terms.

The model is estimated using three stage least squares, with the exogenous variables covering year of origination, location, building grade, and credit worthiness used as instrumental variables. To save space the results are not reported but are available on request from the authors. The model confirms that initial lease rents are not significant in an equation for lease term. The determinants of lease term that are significant include year of origination, size and credit worthiness of the tenant. In the equation for initial lease rents, the term of lease remains significantly positive, consistent with the results reported previously.

Conclusion

In this paper we have investigated the relationship between lease length and initial lease rates in the London office market. This follows earlier work by Gunnelin and Soderberg (2003) and Englund et al. (2004). Data on 935 office leases, originated between 1994 and 2004, in the City of London and the West End were used to estimate models of initial lease rates holding constant for lease characteristics such as size, location, quality of building, year of origination, timing of lease breaks, and lease term. While a term structure of initial lease rates was found, unlike the previous studies, it did not appear to change over time. There was also mixed evidence on whether a linear or quadratic form for the term structure was most appropriate.

One of the main results was that the term structure of initial lease rates was upward sloping in lease term. This implies that occupiers requiring longer leases pay higher initial rates than those requiring shorter leases. As a robustness check we estimated the econometric models on an alternative data set and the finding of an upward sloping term structure to initial lease rates was still evident. Such a finding appears at odds with market evidence of lease transactions and even after controlling for factors relating to tenant credit rating, micro-location factors and occupier type the upward only term structure persisted. This finding also held constant when the few short leases in the sample were removed and when a systems estimation approach (3SLS) was adopted to allow for potential endogeniety in the model.

This work has provided further empirical evidence on the nature of the term structure of leases. A surprising result was the constant and robust finding of the upward sloping relationship between lease length and initial rent in the London office market. Such a result, while unexpected when considered in the framework of Grenadier (1995) is entirely consistent with the theoretical findings of Clapham and Gunnelin (2003).

Notes

Office for the Deputy Prime Minister

Though it is noted that their model has very low explanatory power.

Information on credit ratings for a tenant are available for a subset of the sample. More details on this are provided in the next section.

Of course, it is likely that many leases contained in the Estates Gazette data will be the same of those in the CBRE data set.

The data used by Gunnelin and Soderberg is highly representative of the Stockholm market and illustrates the interesting institutional differences that exist between office markets in Europe.

The implicit price deflator of final demand is one measure of economy wide inflation that more explicitly captures price changes for corporate entities than does a measure of consumer inflation (such as the CPI). It is sourced from the UK National Accounts data.

F(10,908) = 0.773, p-value = 0.66

F(20,897) = 1.037, p-value = 0.414.

F(11,897) = 1.651, p-value = 0.08. Note that a test that all term structure variables are jointly equal to zero is rejected with F(22,897) = 5.118, p-value = 0.00

That is, we assume lease breaks are always exercised or at least used to renegotiate a new contract.

Results not reported but are available on request from the authors.

Note, we do not use SIC classification codes as we found that this did not provide a sufficient level of distinction based on anecdotal discussions with leasing agents.

Both credit worthiness variables were evaluated, and found to convey essentially the same information. The model using the detriment score had a marginally higher adjusted R2 coefficient and is included in the preferred model presented in Table 6.

The t-statistic for the coefficient of the residual term was 0.3785, which is not significantly different from zero using the standard normal tables.

References

Ambrose, B., Hendershott, P., & Klosek, M. (2002). Pricing upward-only adjusting leases. Journal of Real Estate Finance and Economics, 25, 33–49.

Booth, P., & Walsh, D. (2001a). An option pricing approach to valuing upward only rent review properties with multiple reviews. Insurance: Mathematics and Economics, 28, 151–171.

Booth, P., & Walsh, D. (2001b). The application of financial theory to the pricing of upward-only rent reviews. Journal of Property Research, 18, 69–83.

Clapham, W., & Gunnelin, A. (2003). Rental expectations and the term structure of lease rates. Real Estate Economics, 33, 647–670.

Davidson, R., & MacKinnon, J. G. (1993). Estimation and inference in econometrics. New York: Oxford University Press.

Englund, P., Gunnelin, A., Hoesli, M., & Söderberg, B. (2004). Implicit forward rents as predictors of future rents. Real Estate Economics, 32, 183–215.

Grenadier, S. R. (1995). The valuation of leasing contracts: a real options approach. Journal of Financial Economics, 38, 297–331.

Gunnelin, Å., & Söderberg, B. (2003). Term structures in the office rental market in Stockholm. Journal of Real Estate Finance and Economics, 26, 241–265.

Hendershott, P., & Ward, C. (2003). Valuing and pricing retail leases with renewal and overage options. Journal of Real Estate Finance and Economics, 26, 223–240.

Miceli, T., & Sirmans, C. F. (1995). Contracting with spatial externalities and agency problems: the case of retail leases. Regional Science and Urban Economics, 25, 355–372.

McCann, P., & Ward, C. (2003). Real estate rental payments: application of stock-inventory modelling. The Journal of Real Estate Finance and Economics, 28, 273–292.

Mooradian, R., & Yang, S. (2000). Cancellation strategies in commercial real estate leasing. Real Estate Economics, 28, 65–88.

ODPM (2004). Monitoring the code of practice for commercial leases: interim report. The University of Reading, Reading and Office of the Deputy Prime Minister, London.

Stanton, W., & Wallace, N. (2004). An empirical test of a contingent claims lease valuation model. Working Paper, Haas School of Business U.C. Berkeley.

Wheaton, W. C. (2000). Percentage rent in retail leasing: the alignment of landlord–tenant interests. Real Estate Economics, 28, 185–204.

Acknowledgements

The authors would like to thank Peter Damesick, Richard Holberton and Ian Kissane for providing helpful comments in addition to the data used in this study, and participants at the 2005 European Real Estate Society Annual Meeting, the 2005 Asian Real Estate Society Annual Meeting, the 2006 Cambridge-Maastricht-MIT Real Esate Symposium and, in particular, our discussant David Ling and an anonymous referee.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bond, S.A., Loizou, P. & McAllister, P. Lease Maturity and Initial Rent: Is There a Term Structure for UK Commercial Property Leases?. J Real Estate Finan Econ 36, 451–469 (2008). https://doi.org/10.1007/s11146-007-9096-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-007-9096-9