Abstract

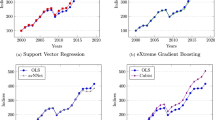

Constant-quality commercial indices generated by ordinary least squares may suffer an efficiency loss due to leptokurtosis caused by outliers in transactions data. When the subsequent nonnormality occurs, substantial improvement in index precision is obtained by estimating the hedonic model using a semiparametric adaptive estimator technique. When this method was applied to 1,846 office transactions that occurred in the Phoenix metropolitan area from January 1997 through June 2004, a substantial standard error reduction of approximately 9% was realized relative to ordinary least squares estimates. The difference in average returns between the semiparametric method and ordinary least squares was about 0.25% in each period, which represents a substantial increase in commercial property index precision.

Similar content being viewed by others

References

Bailey M, Muth R, Nourse H (1963) A regression method for real estate price index construction. J Am Stat Assoc 58:933–942

Bickel P (1982) On adaptive estimation. Ann Stat 10:647–671

Brown G, Matysiak G (2000) Sticky valuations, aggregation effects, and property indices. J Real Estate Finance Econ 20(1):49–66

Clapp J (2004) A semiparametric method for estimating local house price indices. Real Estate Econ 32(1):127–160

Clapp J, Giaccotto C (1998) Price indices based on the hedonic repeat-sales method: application to the housing market. J Real Estate Finance Econ 16(1):5–26

Corgel J, deRoos J (1999) Recovery of real estate returns for portfolio allocation. J Real Estate Finance Econ 18(3):279–296

Court A (1939) Hedonic price indexes with automotive examples. The Dynamics of Automobile Demand. The General Motors Corporation, New York, pp 99–117

Drost F, Klaassen C (1997) Efficient estimation in semiparametric GARCH models. J Econom 81:193–221

Fisher J, Geltner D, Webb B (1994) Value indices of commercial real estate: a comparison of index construction methods. J Real Estate Finance Econ 9(2):137–164

Fisher J, Gatzlaff D, Geltner D, Haurin D (2003) Controlling for the impact of variable liquidity in commercial real estate price indices. Real Estate Econ 31(2):269–303

Gatzlaff D, Haurin D (1997) Sample selection bias and repeat-sales index estimates. J Real Estate Finance Econ 14:33–50

Gatzlaff D, Haurin D (1998) Sample selection and biases in local house value indices. J Urban Econ 43:199–222

Geltner D (1997) The use of appraisals in portfolio valuation and index construction. J Prop Valuat Invest 15(5):423–447

Geltner D, Goetzmann W(2000) Two decades of commercial property returns: a repeated-measures regression-based version of the NCREIF Index. J Real Estate Finance Econ 21(1):5–21

Georgiev G, Gupta B, Kunkel T (2003) Benefits of real estate investment: some diversification benefit in particular allocations. J Port Manage (Special Issue) pp 28–34

Haas G (1922) Sales prices as a basis for farm land appraisal. The University of Minnesota Agricultural Experiment Station, St. Paul. Technical Bulletin 9

Hodgson D (1998a) Adaptive estimation of cointegrating regressions with ARMA errors. J Econom 85:231–267

Hodgson D (1998b) Adaptive estimation of error correction models. Econom Theory 14:44– 69

Hodgson D (1999) Adaptive estimation of cointegrated models: simulation evidence and an application to the forward exchange market. J Appl Econ 14:627–650

Hodgson D, Linton O, Vorkink K (2002) Testing the capital asset pricing model efficiently under elliptical symmetry: a semiparametric approach. J Appl Econ 17:617– 639.

Hodgson D, Vorkink K (2003) Efficient estimation of conditional asset pricing models. J Business Econ Stat 21:269–283

Hodgson D, Vorkink K (2004) Asset pricing theory and the valuation of canadian paintings. Can J Econ 37:629–655

Hsieh D, Manski C (1987) Monte carlo evidence on adaptive maximum likelihood estimation of a regression. Ann Stat 15:541–551

Hudson-Wilson S, Fabozzi F, Gordon J (2003) Why real estate? An expanding role for institutional investors. Port Manage (Special Issue) pp 12–27

Jarque C, Bera A (1980) Efficient tests for normality, homoskedasticity, and serial independence of regression residuals. Econ Lett 6:255–259

Jeganathan P (1995) Some aspects of asymptotic theory with applications to time series models. Econom Theory 11:818–887

Kreiss J-P (1987) On adaptive estimation in stationary ARMA processes. Ann Stat 15:112–133

Linton O (1993) Adaptive estimation in ARCH models. Econom Theory 9:539–569

Manski C (1984) Adaptive estimation of non-linear regression models. Econom Rev 3:145–194

McMillen D, Dombrow J (2001) A flexible fourier approach to repeat sales price indexes. Real Estate Econ 29(2):207–225

Meese R, Wallace N (1991) Nonparametric estimation of dynamic hedonic price models and the construction of residential housing price indices. AREUEA J 19(3):308–332

Meese R, Wallace N (1997) The construction of residential house price indices: a comparison of repeat-sales, hedonic-regression, and hybrid approaches. J Real Estate Finance Econ 14:51–74

Munneke H, Slade B (2000) An empirical study of sample-selection bias in indices of commercial real estate. J Real Estate Finance Econ 21(1):45–64

Munneke H, Slade B (2001) A metropolitan transaction-based commercial price index: a time varying parameter approach. Real Estate Econ 29(1):55–84

Newey W (1990) Efficient instrumental variables estimation of nonlinear models. Econometrica 58:809–837

Pace R (1993) Nonparametric methods with applications to hedonic models. J Real Estate Finance Econ 7:185–204

Pace R (1995) Parametric, semiparametric, and nonparametric estimation of characteristic values within mass assessment and hedonic pricing models. J Real Estate Finance Econ 11:195–217

Shiller R (1993) Measuring asset values in cash settlement in derivative markets: hedonic repeated measures indices and perpetual futures. J Finance 48:911–931

Silverman B (1986) Density estimation for statistics and data analysis. Chapman and Hill, London

Stone C (1975) Adaptive maximum likelihood estimation of a location parameter. Ann Stat 3: 267–284

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL Classification

C4 R0

Rights and permissions

About this article

Cite this article

Hodgson, D.J., Slade, B.A. & Vorkink, K.P. Constructing Commercial Indices: A Semiparametric Adaptive Estimator Approach. J Real Estate Finan Econ 32, 151–168 (2006). https://doi.org/10.1007/s11146-006-6012-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-006-6012-7