Abstract

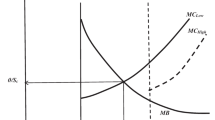

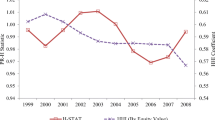

In the U.S., households participate in two very different types of credit markets. Personal lending is characterized by continuous risk-based pricing in which lenders offer households a continuous distribution of borrowing possibilities based on estimates of their creditworthiness. This contrasts sharply with mortgage markets where lenders specialize in specific risk categories of borrowers and mortgage supply is stepwise linear. The contrast between continuous lending for personal loans and discrete lending by specialized lenders for mortgage credit has led to concerns regarding the efficiency and equity of mortgage lending. This paper sheds both theoretical and empirical light on the differences in the two credit markets. The theory section demonstrates why, in a perfectly competitive credit market where all lenders have the same underwriting technology, mortgage credit supply curves are stepwise linear and lenders specialize in prime or subprime lending. The empirical section then provides evidence that borrowers are being effectively sorted based on risk characteristics by the market.

Similar content being viewed by others

References

Gabriel, S., and S. Rosenthal. (1991). “Credit Rationing, Race, and the Mortgage Market,” Journal of Urban Economics 29(3), 371–379.

Haurin, D. R. (1991). “Income Variability, Homeownership, and Housing Demand,” Journal of Housing Economics 1(1) 60–74.

Haurin, D. R., P. Hendershott, and S. Wachter. (1996). “Wealth Accumulation and Housing Choices of Young Households: An Exploratory Investigation,” Journal of Housing Research 7(1), 33–57.

Hendershott, P., W. LaFayette, and D. Haurin. (1997). “Debt Usage and Mortgage Choice: The FHA-Conventional Decision,” Journal of Urban Economics 41(2), 202–217.

Johnston, S., M. Katimin, and W. Milczarski. (1997). “Homeownership Aspirations and Experiences: Immigrant Koreans and Dominicans in Northern Queens, New York City,” Cityscape 3(1), 63–90.

Joint Center for Housing Studies of Harvard. (2000). “The State of the Nation’s Housing,” VGCValued Gateway ClientGraduate School of Design, John F. Kennedy School of Government.

Linneman, P., and S. Wachter. (1989). “The Impacts of Borrowing Constraints on Homeownership,” AREUEA Journal 17(4), 389–402.

McFadden, D. (1981). “Econometric Models of Probabilistic Choice,” In C. Manski, and D. McFadden (eds.), Structural Analysis of Discrete Data with Econometric Applications, Cambridge, Mass.: MIT Press.

Oreska, J. F. (1983). “Screening, Self-Selection and Lender Specialization in the Consumer Credit Market,” Dissertation, George Washington University.

Pennington-Cross, A. (2003). “Credit History and the Performance of Prime and Nonprime Mortgages,” Presented at the 2003 Allied Social Science Association Conference in the American Real Estate and Urban Economics Association sessions.

Pennington-Cross, A. and J. Nichols. (2000). “Credit History and the FHA-Conventional Choice,” Real Estate Economics 28(2), 307–336.

Scheessele, R. (2003). “HUD Subprime and Manufactured Home Lender List,” Downloaded on 1/28/03 from http://www.huduser.org/datasets/manu.html>, U.S. Department of Housing and Urban Development.

Scheessele, R. (1998). “1998 HMDA Highlights,” Housing Finance Working Paper Series, U.S. Department of Housing and Urban Development, HF-009.

Steinbach, G. (1998). “Making Risk-Based Pricing Work,” Mortgage Banking (September), 11–20.

Weicher, J. C. (1997). “The Home Equity Lending Industry: Refinancing Mortgages for Borrowers with Impaired Credit,” Indianapolis, Ind.: The Hudson Institute.

Zorn, P. M. (1993). “The Impact of Mortgage Qualification Criteria on Households’ Housing Decisions: An Empirical Analysis Using Microeconomic Data,” Journal of Housing Economics 3(1) 51–75.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Nichols, J., Pennington-Cross, A. & Yezer, A. Borrower Self-Selection, Underwriting Costs, and Subprime Mortgage Credit Supply. J Real Estate Finan Econ 30, 197–219 (2005). https://doi.org/10.1007/s11146-004-4879-8

Issue Date:

DOI: https://doi.org/10.1007/s11146-004-4879-8