Abstract

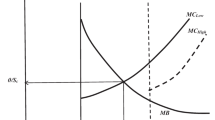

US mortgage markets have evolved radically in recent years. An important part of the change has been the rise of the “subprime” market, characterized by loans with high default rates, dominance by specialized subprime lenders rather than full-service lenders, and little coverage by the secondary mortgage market. In this paper, we examine these and other “stylized facts” with standard tools used by financial economists to describe market structure in other contexts. We use three models to examine market structure: an option-based approach to mortgage pricing in which we argue that subprime options are different from prime options, causing different contracts and prices; and two models based on asymmetric information–one with asymmetry between borrowers and lenders, and one with the asymmetry between lenders and the secondary market. In both of the asymmetric-information models, investors set up incentives for borrowers or loan sellers to reveal information, primarily through costs of rejection.

Similar content being viewed by others

References

Akerlof, G. A. (1970). “The Market for ‘Lemons’: Quality Uncertainty and the Market Mechanism,” Quarterly Journal of Economics 84, 488–500.

Ambrose, B., and M. LaCour-Little. (2001). “Prepayment Risk in Adjustable Rate Mortgages Subject to Initial Year Discounts: Some New Evidence,” Real Estate Economics 29(2), 305–328.

Archer, W. R., P. J. Elmer, D. M. Harrison, and D. C. Ling. (2002). “Determinants of Multifamily Mortgage Default,” Real Estate Economics 30(3), 445–474.

Bennett, P., R. Peach, and S. Peristiani. (2000). “Implied Mortgage Refinancing Thresholds,” Real Estate Economics 28(3), 405–434.

Ben-Shahar, D., and D. Feldman. (2003). “Signaling-Screening Equilibrium in the Mortgage Market,” Journal of Real Estate Finance and Economics 26(2).

Bester, H. (1985). “Screening vs. Rationing in Credit Markets with Imperfect Information,” American Economic Review 75(4), 850–855.

Black, F., and M. Scholes. (1973). “The Pricing of Options and Corporate Liabilities,” Journal of Political Economy 81(3), 637–654.

Brueckner, J. (2000). “Mortgage Default with Asymmetric Information,” Journal of Real Estate Finance and Economics 20(3), 251–274.

Chan, Y., and H. Leland. (1982). “Prices and Qualities in Markets with Costly Information,” Review of Economic Studies 49(4), 499–516.

Clapp, J. M., G. M. Goldberg, J. P. Harding, and M. LaCour-Little. (2001). “Movers and Shuckers: Interdependent Prepayment Decisions,” Real Estate Economics 29(3), 411–450.

Courchane, M., B. Surette, and P. Zorn. (2004). “Subprime Borrowers: Mortgage Transitions and Outcomes,” Journal of Real Estate Finance and Economics 29(4).

Deng, Y. H., J. Quigley, and R. Van Order. (2000). “Mortgage Terminations, Heterogeneity and the Exercise of Mortgage Options.” Econometrica 68(2), 275–307.

Fair Isaac and Co. (2000). Understanding your Credit Score, San Rafael, CA: Fair Isaac and Co.

Freddie Mac. (2002a). Investor Analyst Report: August 2002. Accessed September 6, 2002 at <http://www.freddiemac.com/shareholders/reports.html>.

Freddie Mac. (2002b). “Freddie Mac Will No Longer Invest in Subprime Mortgages with Prepayment Penalty Terms Greater Than Three Years,” March 1, 2002 Press Release. Accessed October 21, 2002 at <http://www.freddiemac.com/news/archives2002/subprime_030102.htm>.

Freixas, X., and J. C. Rochet. (1997). Microeconomics of Banking, Cambridge: MIT Press.

Gale, D., and M. Hellwig. (1985). “Incentive-Compatible Debt Contracts: The One-Period Problem,” Review of Economic Studies 52(4), 647–663.

Harrison, D. M., T. G. Noordewier, and A. Yavas. (2001). “Do Riskier Borrowers Borrow More?” Working Paper.

Hart, O. (1995). Firms, Contracts, and Financial Structure, New York: Oxford University Press.

Hendershott, P., and R. Van Order. (1987). “Pricing Mortgages: An Interpretation of Models and Results,” Journal of Financial Services Research 1(1), 19–55.

Kau, J. B., and D. C. Keenan. (1995). “An Overview of Option-Theoretic Pricing of Mortgages,” Journal of Housing Research 6(2), 217–244.

Krasa, S., and A. P. Villamil. (2000). “Optimal Contracts When Enforcement Is a Decision Variable,” Econometrica 68(1), 119–134.

Lax, H., M. Manti, P. Raca, and P. Zorn. (2000). “Subprime Lending: An Investigation of Economic Efficiency,” Freddie Mac Working Paper.

Leland, H. E. (1979). “Quacks, Lemons, and Licensing: A Theory of Minimum Quality Standards,” Journal of Political Economy 87(6), 1328–1346.

LoanPerformance. (2002). The Market Pulse 8(2).

Nichols, J., A. Pennington-Cross, and A. Yezer. (2002). “Borrower Self-Selection, Underwriting Costs, and Subprime Mortgage Credit Supply,” Working Paper.

Option One Mortgage Corporation (OOMC). (2002a). Loan Performance: June 2002. Accessed September 6, 2002 at <http://www.oomc.com/corp/corp_investor.html>.

Option One Mortgage Corporation (OOMC). (2002b). LTV and Pricing Matrix for Legacy Platinum Plus: Rates Effective September 3, 2002. Accessed September 6, 2002 at <http://www.oomc.com/broker/rate_sheets/Legacy_Plus_Platinum_Pricing_Matrix.pdf>.

Option One Mortgage Corporation (OOMC). (2002c). Wholesale Rate Sheets (various states): Rates Effective September 3, 2002. Accessed September 6, 2002 at <http://www.oomc.com/broker/broker_prodprice.html>.

Option One Mortgage Corporation (OOMC). (2002d). Best Practices. Accessed October 9, 2002 at <http://www.oomc.com/corp/corp_bestpract.html>.

Richardson, C. (2002). “Predatory Lending and Housing Disinvestment,” Paper presented at the AREUEA Mid-Year Meetings Washington, D.C., May 28–29.

Rothschild, M., and J. E. Stiglitz. (1976). “Equilibrium in Competitive Insurance Markets: An Essay on the Economics of Imperfect Information,” Quarterly Journal of Economics 90(4), 630–649.

Spence, A. M. (1973). “Job Market Signaling,” Quarterly Journal of Economics 87, 355–374.

Staten, M., O. Gilley, and J. Umbeck. (1990). “Information Costs and the Organization of Credit Markets: A Theory of Indirect Lending,” Economic Inquiry 28(3), 508–529.

Stiglitz, J. E., and A. Weiss. (1981). “Credit Rationing in Markets with Imperfect Information,” American Economic Review 71(3), 393–410.

Straka, J. W. (2000). “A Shift in the Mortgage Landscape: The 1990s Move to Automated Credit Evaluations,” Journal of Housing Research 11(2), 207–231.

Townsend, R. M. (1979). “Optimal Contracts and Competitive Markets with Costly State Verification,” Journal of Economic Theory 21(2), 265–293.

US Department of Housing and Urban Development. (2000). Unequal Burden: Income and Racial Disparities in Subprime Lending in America. Washington, D.C. Accessed at <http://www.huduser.org/publications/fairhsg/unequal.html>.

US Department of Housing and Urban Development, Office of Housing. (2002). FHA Portfolio Analysis: Data as of June 2002. Accessed October 15, 2002 at <http://www.hud.gov/offices/hsg/comp/rpts/com/commenu.cfm>.

Van Order, R. (2003). “A Model of Financial Structure and Financial Fragility,” Freddie Mac Working Paper.

Van Order, R., and P. M. Zorn. (2000). “Income, Location and Default: Some Implications for Community Lending,” Real Estate Economics 28(3), 385–404.

Weicher, J. C. (2002). Statement of John C. Weicher before the United States House of Representatives Committee on Financial Services Subcommittee on Housing and Community Opportunity, April 24, 2002. Accessed September 2, 2002 at <http://financialservices.house.gov/media/pdf/042402jw.pdf>.

Yezer, A., R. F. Phillips, and R. P. Trost. (1994). “Bias in Estimates of Discrimination and Default in Mortgage Lending: The Effects of Simultaneity and Self Selection,” Journal of Real Estate Economics 9(3), 197–215.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Cutts, A.C., Van Order, R.A. On the Economics of Subprime Lending. J Real Estate Finan Econ 30, 167–196 (2005). https://doi.org/10.1007/s11146-004-4878-9

Issue Date:

DOI: https://doi.org/10.1007/s11146-004-4878-9