Abstract

Historical cost accounting deals with uncertainty by deferring the recognition of earnings until the uncertainty has largely been resolved. Such accounting affects both earnings and book value and produces expected earnings growth deemed to be at risk. This paper shows that the earnings-to-price and book-to-price ratios that are the product of this accounting forecast both earnings growth and the risk to that growth. The paper also shows that the market pricing of earnings and book values in these ratios aligns with the risk imbedded in the accounting: the returns to buying stocks on the basis of their earnings yield and book-to-price are explained as a rational pricing of the risk of expected earnings growth not being realized. Accordingly, the paper provides a rationalization of the well-documented book-to-price effect in stock returns: book-to-price indicates the risk in buying earnings growth. However, growth identified by a high book-to-price as yielding a higher return in this paper is quite different from “growth” typically attributed to a low book-to-price as yielding a lower return. Accordingly, the notion of “growth” versus “value” requires modification.

Similar content being viewed by others

Notes

Relative to R-squares observed in regressions of realized annual returns on realized annual earnings, R-squares increase significantly when earnings and returns are observed over longer periods (in Easton et al. 1992; Ohlson and Penman 1992, for example): long-horizon returns are strongly correlated with long-run earnings outcomes.

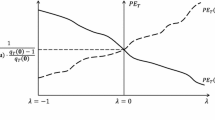

The common Gordon formula, forward P/E = 1/(r − g), where r is the required return and g is the earnings growth rate, exhibits the property, although this formula holds only for full payout. The formula also shows that, in the case of no growth, E/P = r. Ohlson and Juettner-Nauroth (2005) provide a formula for P/E with the same properties but payout insensitive.

A constant discount rate is, of course, not entirely palatable. The formulation here suffices to introduce the empirical analysis, which is concerned with documenting the yield (in returns) to buying stocks in the cross-section (at a point in time) based on accounting characteristics. However, the attribution of observed yields to reward for risk is made with some hesitancy; market efficiency issues aside, a constant discount rate is inconsistent with no-arbitrage if discount rates are stochastic, and observed returns include the effect of changes in discount rates with which accounting characteristics could be correlated. See Hughes et al. (2009). Rubinstein (1976) and Breeden and Litzenberger (1978) provide dividend discount models with varying discount rates and Feltham and Ohlson (1999), Ang and Liu (2001), and Christensen and Feltham (2009) lay out residual earnings valuation models with stochastic discount rates.

This residual earnings growth rate is the earnings growth rate, adjusted for retention and capital contributions. One infers earnings growth from residual earnings growth by reverse engineering residual earnings to infer earnings. The assumption of a constant growth rate is not necessary for our purposes: let g represent additional long-term earnings (after the forward year).

The expressions require ROCE t+1 > g, a restriction that will be addressed in the empirical work. Rather than starting from the residual earnings valuation, one could start from an abnormal earnings growth valuation (in Ohlson and Juettner-Nauroth 2005) where price is based on expected forward earnings capitalized at the required return plus value from abnormal earnings growth. This model is more general (and removes the restriction) but does not involve book value. See Ohlson and Gao (2006).

For example, an R&D firm (a pharmaceutical company) can have a low B/P (because the R&D asset is missing from the balance sheet) and a high ROCE t+1 (because of the missing book value) but no growth. Stated differently, a firm can be priced with a low B/P but a normal P/E = 1/r.

The practice of expensing R&D expenditures, considered to have risky payoffs, is an example. The practice reduces book value, deferring earnings to the future. But repeated expensing with growth in R&D expenditures reduces forward earnings (for a given price and book value), deferring earnings from t + 1 to the long term. And so with LIFO accounting, brand-building expenditures, conservative revenue recognition, and accelerated depreciation policies (to mention a few).

Equations (2a) and (2b) cannot strictly be applied in the scenario where growth informs about r, for g is the residual earnings growth rate rather than the earnings growth rate, and the residual earnings growth rate is a function of r as well as growth in earnings. However, one can show via examples that, for B/P < 1, reducing forward earnings with price held constant, g increases with increases in r. From model (1a),

\( g = r - \frac{{Earnings_{t + 1} - rB_{t} }}{{P_{t} - B_{t} }}. \)

With P t and B t held constant, a decrease in Earnings t+1 and an increase in r implies an increase in g. The empirical construction in the paper finesses the issue.

As Earnings t+1 = OI t+1 − Net Interest t+1, where OI t+1 is operating income (earnings before net interest), it is easily shown that

\( g_{t + 1}^{E} = g_{t + 1}^{OI} + ELEV_{t} \left[ {g_{t + 1}^{OI} - g_{t + 1}^{Int} } \right], \) where g E, g OI, and g Int are expected growth rates in earnings, operating income, and net interest expense, respectively, and \( ELEV_{t} = Net\;Interest_{t} /Earnings_{t} \) measures leverage in the income statement. So provided leverage is favorable such that \( \left[ {g_{t + 1}^{OI} - g_{t + 1}^{Int} } \right] > 0 \), leverage levers up the expected earnings growth.

See Penman et al. (2007) for an examination of the relationship between book-to-price, leverage, and return.

It is said that accountants practice conservatism as a defense against lawsuits, and the political process under which accounting standard setting operates forces too-conservative accounting. LIFO accounting for inventories depresses earnings and produces earnings growth (with growing inventories) but is presumably related to tax issues rather than risk.

Simply, E/P = E/B × B/P.

Fama and French (2006) have the flavor of what’s going on here, but their setup is quite different. In a model that involves clean surplus accounting, as in Eq. (1b), they express the expected return in terms of B/P, profitability (earnings relative to book value, ROCE), and growth in book value (which they call “investment”). They investigate the relationship between returns and each one of these, holding the other two constant. But their comparative statics do not accord with the way that accounting works: one cannot vary an accounting component of Eq. (2b) while holding the other components constant. To produce more growth (for a given r and price), for example, the accountant has to change either book value or short-term earnings or both. In contrast to our results, growth (as they define it) is negatively related to expected returns in the cross section (holding their other accounting attributes constant). These points aside, the results of our paper indicate the rational pricing of risk that the stream of Fama and French papers emphasize.

The risk free rate, a constant in the cross section, merely scales E/P and book value in the calculation of STE and so is not particularly important.

As LTE is the complement of the earnings yield relative to the risk-free rate (Eq. 8), it is also scaled by the risk-free rate. The scaling leads to higher LTE for firms with low E/P and lower LTE for firms with high E/P. As the risk-free rate is a constant in the cross section at a point in time, the relative ranking of LTE across firms at a point in time is preserved however.

Portfolio betas do not average to 1.0 here and in later tables because they are arithmetic means of security betas in each portfolio, with the security betas estimated using a value-weighted market index.

Buy-and-hold returns are calculated from CRSP monthly returns. For firms that are delisted during the 12 months, we calculate the return for the remaining months by first applying the CRSP delisting return and then reinvesting any remaining proceeds at the risk-free rate. This mitigates concerns with potential survivorship biases. Firms that are delisted for poor performance (delisting codes 500 and 520–584) frequently have missing delisting returns (see Shumway 1997). We control for this potential bias by applying delisting returns of −100 % in such cases. Our results are qualitatively similar if we make no such adjustment.

One cannot rule out other explanations, of course. The highest LTE portfolio in Table 4 is also the lowest earnings yield portfolio, and Panel E indicates that these are loss firms, on average. High B/P for these firms might indicate distress, higher transactions costs, or lower liquidity that warrants higher returns. However, many loss firms have high long-term growth prospects (a technology firm expensing R&D in excess of short-term revenues being an example), and these growth prospects are often viewed as risky (as are payoffs to R&D). And the B/P effect in returns is evident in Table 4 across the whole range of earnings yields.

The finding corresponds to the observation that earnings realizations explain much of long-run returns. See footnote 2.

The ex post growth rates are calculated only for firms that survived 2 years ahead. While survivorship rates differ somewhat over LTE portfolios (83.8 % for the low LTE portfolios versus 71.7 % for the high LTE portfolios), the rate varied little over B/P portfolios, except for the high LTE portfolio where the survivorship rate for the low B/P group was 75.7 versus 70.4 % for the high B/P group.

The mean rank correlation between B/P and E/P in Table 2 is 0.312 and is 0.477 for firms with positive E/P.

References

Anderson, C., & Garcia-Feijóo, L. (2006). Empirical evidence on capital investment, growth options, and security returns. Journal of Finance, 61, 171–194.

Ang, A., & Liu, J. (2001). A general affine earnings valuation model. Review of Accounting Studies, 6, 397–425.

Ball, R. (1978). Anomalies in relationships between securities’ yields and yield-surrogates. Journal of Financial Economics, 6, 103–126.

Ball, R., & Brown, P. (1968). An empirical evaluation of accounting income numbers. Journal of Accounting Research, 6, 159–177.

Bansal, R., Dittmar, R., & Lundblad, C. (2005). Consumption, dividends, and the cross-section of equity returns. Journal of Finance, 60, 1639–1672.

Bansal, R., & Yaron, A. (2004). Risks for the long run: A potential resolution of asset pricing puzzles. Journal of Finance, 59, 1481–1509.

Basu, S. (1977). Investment performance of common stocks in relation to their price-earnings ratios: A test of the efficient market hypothesis. The Journal of Finance, 32, 663–682.

Basu, S. (1983). The relationship between earnings yield, market value, and return for NYSE stocks: Further evidence. Journal of Financial Economics, 12, 129–156.

Beaver, W. (1968). The information content of annual earnings announcements. Journal of Accounting Research, 6, 67–92.

Beaver, W., & Morse, D. (1978). What determines price-earnings ratios? Financial Analysts Journal, 34, 65–76.

Berk, J., Green, R., & Naik, V. (1999). Optimal investment, growth options and security returns. Journal of Finance, 54, 1153–1607.

Breeden, D., & Litzenberger, R. (1978). Prices of state-contingent claims implicit in option prices. Journal of Business, 51, 621–651.

Brief, R., & Lawson, R. (1992). The role of the accounting rate of return in financial statement analysis. The Accounting Review, 67, 411–426.

Campbell, J., & Shiller, R. (1988). Stock prices, earnings, and expected dividends. Journal of Finance, 43, 661–676.

Campbell, J., & Shiller, R. (1998). Valuation ratios and the long-run stock market outlook. Journal of Portfolio Management, 24, 11–26.

Campbell, J., & Thomson, S. (2008). Predicting the equity premium out of sample: Can anything beat the historical average? Review of Financial Studies, 21, 1509–1531.

Christensen, P., & Feltham, G. (2009). Equity valuation. Foundations and trends in accounting, 4, 1–112.

Cochrane, J. (1996). A cross-sectional test of an investment-based asset pricing model. Journal of Political Economy, 104, 572–621.

Cohen, R., Polk, C., & Vuolteenaho, T. (2009). The price is (almost) right. Journal of Finance, 64, 2739–2782.

Croce, M., Lettau, M., & Ludvigson, S. (2010). Investor information, long-run risk, and the duration of risky cash flows. NBER working paper 12912.

Danielson, M., & Press, E. (2003). Accounting returns revisited: Evidence of their usefulness in estimating economic returns. Review of Accounting Studies, 8, 493–530.

Dechow, P., Sloan, R., & Soliman, M. (2004). Implied equity duration: A new measure of equity risk. Review of Accounting Studies, 9, 197–228.

Dubinsky, A., & Johannes, M. (2006). Earnings announcements and equity options. Unpublished paper, Columbia Business School.

Easton, P., Harris, T., & Ohlson, J. (1992). Accounting earnings can explain most of security returns: The case of long event windows. Journal of Accounting and Economics, 15, 119–142.

Fairfield, P. (1994). P/E, P/B and the present value of future dividends. Financial Analysts Journal, 50, 23–31.

Fama, E., & French, K. (1988). Dividend yields and expected stock returns. Journal of Financial Economics, 22, 3–25.

Fama, E., & French, K. (1992). The cross-section of expected stock returns. Journal of Finance, 47, 427–465.

Fama, E., & French, K. (1993). Common risk factors in the returns of stocks and bonds. Journal of Financial Economics, 33, 3–56.

Fama, E., & French, K. (1996). Multifactor explanations of asset pricing anomalies. Journal of Finance, 51, 55–84.

Fama, E., & French, K. (2006). Profitability, investment, and average returns. Journal of Financial Economics, 82, 491–518.

Feltham, G., & Ohlson, J. (1995). Valuation and clean surplus accounting for operating and financial activities. Contemporary Accounting Research, 12, 689–731.

Feltham, G., & Ohlson, J. (1999). Residual income valuation with risk and stochastic interest rates. The Accounting Review, 74, 165–183.

Fuller, R., Huberts, L., & Levinson, M. (1992). It’s not higgledy-piggledy growth! Journal of Portfolio Management, 18, 38–45.

Gode, D., & Mohanram, P. (2013). Evaluating implied cost of capital estimates after removing analyst forecasts errors. Review of Accounting Studies (forthcoming).

Gomes, J., Kogan, L., & Zhang, L. (2003). Equilibrium cross-section of returns. Journal of Political Economy, 111, 693–732.

Hughes, J., Liu, J., & Liu, J. (2009). On the relation between expected returns and implied cost of capital. Review of Accounting Studies, 14, 246–259.

Hughes, J., Liu, J., & Su, W. (2008). On the relation between predictable market returns and predictable analysts’ forecast errors. Review of Accounting Studies, 13, 266–291.

Jaffe, J., Keim, D., & Westerfield, R. (1989). Earnings yields, market values, and stock returns. Journal of Finance, 44, 135–148.

Lettau, M., & Ludvigson, S. (2001). Resurrecting the (C)CAPM: A cross-sectional test when risk premia are time-varying. Journal of Political Economy, 109, 1238–1286.

Lettau, M., & Ludvigson, S. (2005). Expected returns and expected dividend growth. Journal of Financial Economics, 76, 583–626.

Lettau, M., & Wachter, J. (2007). Why is long-horizon equity less risky? A duration-based explanation of the value premium. Journal of Finance, 62, 55–92.

Lewellen, J., & Nagel, S. (2006). The conditional CAPM does not explain asset-pricing anomalies. Journal of Financial Economics, 82, 289–314.

Malloy, C., Moskowitz, T., & Vissing-Jorgensen, A. (2009). Long-run stockholder consumption risk and asset returns. Journal of Finance, 64, 2427–2479.

Menzly, L., Santos, T., & Veronesi, P. (2004). Understanding predictability. Journal of Political Economy, 112, 1–47.

Ohlson, J. (2008). Risk, growth, and permanent earnings. Unpublished paper, New York University Stern School of Business.

Ohlson, J., & Gao, Z. (2006). Earnings, earnings growth and value. Foundations and Trends in Accounting, 1, 1–70.

Ohlson, J., & Juettner-Nauroth, B. (2005). Expected EPS and EPS growth as determinants of value. Review of Accounting Studies, 10, 349–365.

Ohlson, J., & Penman, S. (1992). Disaggregated accounting data as explanatory variables for returns. Journal of Accounting, Auditing and Finance,, 7, 553–573.

Penman, S. (1996). The articulation of price-earnings ratios and market-to-book ratios and the evaluation of growth. Journal of Accounting Research, 34, 235–259.

Penman, S. (2013). Financial statement analysis and security valuation (5th ed.). New York: McGraw-Hill.

Penman, S., Richardson, S., & Tuna, İ. (2007). The book-to-price effect in stock returns: Accounting for leverage. Journal of Accounting Research, 45, 427–467.

Petkova, R., & Zhang, L. (2005). Is value riskier than growth? Journal of Financial Economics, 78, 187–202.

Rajan, M., Reichelstein, S., & Soliman, M. (2007). Conservatism, growth, and return on investment. Review of Accounting Studies, 12, 325–370.

Rubinstein, M. (1976). The valuation of uncertain income streams and the pricing of options. Bell Journal of Economics, 7, 407–425.

Shumway, T. (1997). The delisting bias in CRSP data. Journal of Finance, 52, 327–340.

Wahlen, J., & Wieland, M. (2011). Can financial statement analysis beat consensus analysts’ recommendations? Review of Accounting Studies, 16, 89–115.

Xing, Y. (2008). Interpreting the value effect through the Q-theory: An empirical investigation. Review of Accounting Studies, 21, 1767–1795.

Zhang, X. (2000). Conservative accounting and equity valuation. Journal of Accounting and Economics, 29, 125–149.

Zhang, L., & Chen, L. (2008). Neoclassical factors. Unpublished paper, University of Michigan and Washington University, St. Louis.

Acknowledgments

We thank Jeff Abarbanell, Andrew Ang, Sanjeev Bhojraj, Ilia Dichev, Takashi Obinata, Keywan Rasekhschaffe, and Scott Richardson for comments. Stephen Penman thanks Bocconi University, the Swedish Institute for Financial Research, and the Guanghua School of Management at Peking University for providing facilities during a sabbatical when this paper was written. Francesco Reggiani thanks the Center for Research on Corporate Administration, Finance and Regulation at Bocconi University for research support.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Penman, S., Reggiani, F. Returns to buying earnings and book value: accounting for growth and risk. Rev Account Stud 18, 1021–1049 (2013). https://doi.org/10.1007/s11142-013-9226-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-013-9226-y