Abstract

This study utilizes bibliometric analyses to map and visualize the development, conceptual structure, and thematic evolution of the Islamic Banking and Finance (IB&F) scholarly research. It analyses 464 WoS IB&F research publications of 921 authors comprising 58 countries published over three decades from 1990 to 2019. The results reveal that (i) collaboration among countries is limited and institutional collaboration can be described as a “locally concentrated and globally isolated,“ (ii) the IB&F research is a type of “small-world-network” where few authors and journals dominate the networks and play a central role in the diffusion of knowledge and the “homophily impact” is present among the leading authors of the IB&F research, (iii) the networks in IB&F research reflects the “Matthew Effect,“ implying that few authors have a more significant number of networks compared to the rest of authors. The study has also identified the conceptual structure and thematic trends in the IB&F research and provides avenues for future research.

Similar content being viewed by others

1 Introduction

The Islamic Banking and Finance (hereafter, IB&F) system is established on the concept of abolishing interest and unfair facets of the economy to comply with the principles of Islamic Shariah (Islamic jurisprudence). Besides, it is escorted by Islamic doctrine principles supporting risk sharing. Thus, lending, borrowing, and investment functions are likely to be conducted based on risk-sharing. In addition, IB&F is accompanied by social activities, including distributing social dividends. Hence, it can be seen as a value-based system aiming to ensure the substantial well-being of people and sustainable economic growth (Aydin 2020; Musa et al. 2020). The IB&F covers different sectors, including Islamic banks, financial markets, and financial intermediation. The principles of IB&F have been applied since the 1970s in the Middle East, leading to the establishment of Islamic banksFootnote 1. At a later stage, the Western banks (e.g., Citibank & HSBC) have begun establishing their Islamic windows, which provide Islamic banking services to attract deposits from Muslims in Middle Eastern countries.

The IB&F system grows through seeking innovation and diversity of services, customers, and markets. The Islamic services cover many areas such as Islamic Bonds (i.e., Sukuk), Islamic Insurance (i.e., Takaful), investments funds, and Islamic Stock Exchange (e.g., Dow Jones Islamic Index). The Banker’s report in 2015 declares that the Islamic assets have increased rapidly with a growth rate of 12.7% annually. The European Union countries were in the top 20 major countries that complied with Islamic Shariah in providing their Islamic services. Furthermore, the Islamic Financial Services Board report published in 2019 indicated that the IB&F industry worth is $2.19 trillion as of the second quarter of 2018, compared to the $2.05 trillion recorded at the end of 2017. Islamic banking represents 71.7% of the IB&F industry, while the Islamic capital market represents 27% of the global IF&B asset. The Takaful (Islamic Insurance) services represent 1.3% of the IB&F services, with an annual growth rate of 4.3%.

IB&F research has received significant attention in recent years. Nevertheless, Narayan and Phan (2017) argue that research in this area is still evolving. Prior research on IB&F has focused mainly on investigating the performance of Islamic banks (e.g., Mobarek and Kalonov 2014; Saraç and Zeren 2015; Kabir et al. 2015; Mollah et al. 2017; Grira et al. 2016). Another stream of research has examined the corporate governance system of Islamic banks (Hayat and Hassan 2017; Elnahas et al. 2017; Jan et al. 2021). Previous studies have also explored the features of Islamic bond markets (Naifar and Hammoudeh 2016) and the Islamic Insurance system (Raza et al. 2019). Furthermore, research has explored some ethical issues related to IB&F. For instance, Al-Suhaibani and Naifar (2014) explore the ethical framework of Islamic financial institutions (IFIs) and Platonova et al. (2018) examine the social responsibility roles of IFIs.

The evolution of research in a field of study induces scholars to quantitatively review its scientific production to understand its “intellectual structure” (Rivera and Pizam 2015). This helps develop a knowledge base for this field, identify its research trends, understand its theories and methodologies, determine the contributions and suggest potential avenues for future research (Ferreira et al. 2014). The bibliometric analysis is an innovative methodology aiming to reveal the development and structure and visualize the scientific production in a field of study (Mostafa 2020; Qi et al. 2018). It is applied to explore the knowledge structure in different fields of research, such as Halal food (Mostafa 2020), circular economy (Alnajem et al. 2021), operational research (Argoubi et al. 2020), innovation (Yahaya et al. 2020), and corporate governance (Zheng and Kouwenberg 2019). Nonetheless, there is a lack of research analyzing the intellectual structure of IB&F research. Therefore, the current study fills this gap and uses bibliometric networks to investigate IB&F scholarly publications. This technique helps identify the development, conceptual structure, and thematic evolution of the IB&F.

The current study aims to answer the following research questions. First, how the research on IB&F has been evolved since its emergence? Second, what are the influential authors, journals, and countries in the IB&F field? Third, what are the collaborative networks among authors, institutions, and countries in the IB&F research? Fourth, what are the intellectual structure and thematic trends of IB&F research? Finally, what are the key hotspots in the IB&F research? The study analyses 464 World of Science (WoS) IB&F research publications of 921 comprising 58 countries published over three decades from 1990 to 2019. This helps to understand the development, intellectual structure, and contribution of the IB&F research and identify challenges and areas for future research in this field of study.

The study contributes to the extent of literature in several ways. First, it is the first to employ the bibliometric analysis to review IB&F knowledge structure which adds an innovative way to show the thematic evolution of the key research themes in IB&F. Bibliometric networks methodology objectively, rather than subjectively, produces findings that show a joint view expressed by actual data (Linnenluecke et al. 2020). This helps to build knowledge, gain an understanding, and show the future direction in this research area. Second, the study also adds to the theoretical development of IB&F research as it helps scholars discover potential opportunities and define the significant intellectual structure and research themes in the field of IB&F. Third, the study focuses solely on examining Islamic rather than conventional banking and finance, which enriches the body of knowledge of this underrepresented field of study.

The paper is structured as follows. Section 2 provides a review of IB&F literature. Section 3 describes the research design. Section 4 presents the descriptive statistics pertaining to the IB&F scientific production. Section 5 reports the network analyses. Section 6 presents the intellectual structure maps. Finally, the concluding remarks and directions for future research are provided in Sect. 7.

2 IB&F literature: an overview

The research on IB&F is fast growing due to innovative Islamic products, including Islamic bonds, insurance, and stock exchange (Zaher and Hassan, 2001). However, limited research has attempted to review the research about IB&F. For instance, Narayana and Phan (2019) surveyed the academic research on IB&F. They focused on 112 research papers from 1983 to 2017. The results suggest that examining bank performance is the most popular topic in IB&F, representing 44% of the research papers, followed by research on the equity market (24%) and market interactions (16%). Nonetheless, the research on Islamic bonds has received less attention from academics. The analysis of prior studies also reveals that they focus on several aspects of IB&F, including the performance of IFIs, their governance system, and ethical issues in IB&F.

Substantial research has focused on the performances of Islamic compared to conventional (non-Islamic) banks. For instance, some studies (e.g., Olson and Zoubi 2011 & Beck et al. 2010) have explored how Islamic banks are cost-efficient compared to conventional banks. They find that conventional banks utilize their costs less efficiently than Islamic banks. However, Kabir et al. (2015) find that the credit risk is higher in conventional banks than in Islamic banks. Besides, Baele et al. (2014) and Pappas et al. (2017) suggest that the rate of loan default in conventional banks is higher than that of the Islamic banks. Mobarek and Kalonov (2014) confirm that Islamic banks are more likely to be financially secure than conventional banks. A group of prior studies reports mixed findings regarding the efficiency of Islamic relative to conventional banks. Some research reports the same efficiency level in conventional and Islamic banks (Johnes et al. 2014). However, other research reports that the efficiency of Islamic banks is either higher (Wanke et al. 2016) or lower (Belanès et al. 2015) relative to conventional banks’ efficiency. Research also has found that drivers of Islamic banking performance are the degree of capital adequacy, quality of management, and diversification of Islamic products (Sun et al. 2017).

There is growing research on the performance of Islamic equity markets, though it reports mixed findings. It finds that the profitability of Islamic markets is better than conventional markets (Narayan et al. 2017; Dewandaru et al. 2015). Nevertheless, research suggests that Islamic stocks are less successful than conventional stocks (Rahim and Masih 2016; Narayan and Bannigidadmath 2017) examine how Islamic stocks respond to market news. They find that positive news has more substantial effects than negative news in Islamic and conventional banks. Azmat et al. (2014) examine the Islamic bonds and find differences in the characteristics of Islamic compared to conventional banks. Besides, Naifar and Hammoudeh (2016) find that spillover effects of Islamic bonds and stocks and the yields of Islamic bonds are more significantly associated with the conventional than Islamic stock markets. In support, Alexakis et al. (2016) and Alaoui et al. (2015) provide evidence that Islamic markets are co-moving with conventional markets.

Research also explores the Shariah compliance issue and the corporate governance system of IFIs. Notably, the corporate governance system in IFIs is different from conventional counterparts in that it must be undertaken based on Islamic Shariah. Hence, non-compliance with Islamic Shariah can lead to financial turmoil (Grassa and Matoussi 2014). Besides, Shariah’s supervisory board is a crucial element in the governance system of IFIs. Grassa and Matoussi (2014) report significant variations in the structure of governance systems among Islamic banks, requiring more improvements and standardizations. Empirically, Mollah and Zaman (2015) find that Islamic banks’ performance is positively affected by the presence of the Shariah supervisory board. However, it is negatively associated with board structure and CEO duality. Mollah et al. (2017) confirm that Islamic banks’ governance structure facilitates risk-taking achievement of better performance. Apart from governance structure, Mallin et al. (2014) indicate that Islamic banks are aware of the mandatory disclosure requirements of the Accounting and Auditing Organization of Islamic Financial Institution (AAOIFI)Footnote 2. However, they give less consideration to voluntary disclosure.

The research area investigating the ethical issues in IB&F is still evolving. Limited research has investigated the effect of ethics and religion on either performance or reporting of Islamic banks. Ashraf (2016) examines whether the Islamic Shariah screening criteria influence the performance of the Islamic equity funds (IEFs). The findings reveal no significant variations between the performance of IEFs and conventional funds. Baele et al. (2014) examine whether religion affects the default rate of bank loans. Their results reveal that the rate of loan default in Islamic banks is less than that of the Islamic banks, suggesting that the religion from either individual piousness or network significantly influences the loan default. Likewise, Belal et al. (2015) examine the ethical reporting of Islamic banks. They find an increase in ethical information disseminated by Islamic banks. Besides, Islamic banks are likely to provide more clarity and community-related disclosures. Prior studies also explore the corporate social responsibility role of IB&F. Hassan et al. (2010) find that Islamic banks respond to society’s welfare needs and comply with the Islamic business ethics framework. Furthermore, Platonova et al. (2018) find that Islamic banks’ corporate social responsibility activities positively affect the current and future performance of Islamic banks.

Finally, few studies also examine the nexus between IB&F and small-medium enterprises (SMEs). These studies suggest that Islamic banks are likely to provide different kinds of finance to SMEs (Aysan et al. 2016). Limited research focuses on the IB&F from a macro-economic perspective. It finds that IB&F leads to development in the banking sector (Gheeraert 2014) and contributes significantly to economic growth and welfare (Abedifar et al. 2016). Despite the significant research on IB&F, there is a lack of comprehensive evaluation of the scientific publication in this area. Hence, this study aims to fill this gap by comprehensively evaluating the research of IB&F.

3 Research design

3.1 Method

The current study employs the “Scientometrics” method to analyze the IB&F research. It analyses various aspects of the field of study, including journals and their impacts, influential authors, countries, institutions, and thematic groups in the field of study. It involves developing “bibliometric network analyses” to examine all publications to identify the various networks, productivity, quality, and citations in a particular research field and evaluate its intellectual development. It has more advantages than the traditional state-of-the-art review in that it can investigate more relevant themes and provides an extra point of reference (Argoubi et al. 2020; Ronda-Pupo 2017) suggests that outputs of a specific field of study help understand its development and structure. Nonetheless, Block et al. (2020) indicate that research restricted to analyzing parameters such as influential authors, journals, and countries is not qualified to be bibliographic analysis. Besides, they argue that bibliometric analyses should aim to evaluate the development and thematic structure of the research field. In response, this study has followed Mostafa (2020) to conduct a thorough bibliometric analysis that evaluates the evolution, structure, and thematic of the IB&F scholarly research. This helps understand the development, intellectual formation, and contribution of the IB&F research and identify challenges and areas for future research in this field of study (Shi and Li 2019).

We have used the VoSviewer software and the R statistical computing version 4.1 to develop citation and co-citation analyses. The influential authors are identified based on the number of articles and total citations. Lotka’s law is used to measure the authorship concentration. The citation analysis identifies the most cited articles in the IB&F research. The VoSviewer software and the R statistical computing also develop visualized network maps for chronological IB&F citations (i.e., historiographic network), keyword co-occurrence, conceptual structure, and thematic contents. These methods ensure concluding a comprehensive evaluation of the IB&F research. The VoSviewer and R statistical computing are dominant software instruments for building visualized maps for objects of interest. It is common in bibliometric studies such as Halal food (Mostafa 2020), operational research (Argoubi et al. 2020), innovation (Yahaya et al. 2020), and circular economy (Alnajem et al. 2021).

3.2 Data

The data was collected based on the WoS database. The WoS is a leading database covering high-quality information on multidisciplinary subjects (Argoubi et al. 2020), and it is a substantial source for research abstracts and citations (Amrutha and Geetha 2020). In addition, it permits scholars to download a database including the bibliographic information of a particular research area, such as journals, citations, and affiliations. In this study, we have reviewed IB&F publications, definitions, and categories of IB&F to develop a central theme search string. We have searched all articles, books, and editorial reviews that include the following terms, “Islamic Banking, “Islamic Banks,“ and “Islamic Finance,“ in the research papers’ titles, keywords, and abstracts. We limited our search to include only research papers written in the English language. The year 1990 is considered the date of reference as there are virtually no significant studies regarding IB&F studies published earlier.

Table (1) shows that the search has produced 464 documents published from 1990 to 2019 in the WoS database comprising journal articles, book reviews, editorial materials, and proceeding papers. It also reveals that 921 authors wrote these documents. The average number of documents per author is 0.504, and on average, there are approximately1.98 authors per document. The average citation per document is 7.524 times. The collaboration index was 2.33, suggesting the non-dominance of single-authored papers, as per prior research (e.g., Alnajem et al. 2021).

4 Scientific production

To answer the first research question, we traced the evolution of the scientific production of IB&F literature. Figure (1) presents the development and trend of IB&F research production. The graph shows that the IB&F research has witnessed exponential growth at an average rate of 5.6% annually. Nevertheless, this rate of growth is not equally dispersed over the years. The first decade of IB&F research starts from 1990 to 2000. During this decade, the IB&F literature seems to be relatively rare, representing a maximum of four annual research documents. This decade can be seen as the early application of IB&F principles as different nations began to develop their Islamic financial institutions. The second decade of the IB&F research starts from 2001 to 2010. This period has witnessed substantial interest in research in IB&F, as evidenced by the significant growth in IB&F publications, with a peak of 12 documents published per year. Therefore, the second decade can be called the “initial growth stage” in Islamic financial institutions. The third decade of IB&F research starts from 2011 to 2015, and it has a significant boost by scholars in the IB&F field of study, representing on average 30 annual research publications. Thus, it can be called the “swift growth stage” in the IB&F. The last decade of the IB&F research is from 2016 to 2019. It is observable that IB&F research has reached maturity during this decade, evidenced by the publication, on average, of 60 annual research documents. Hence, this decade can be called the “maturity stage” in the IB&F. Eventually, there has been an exponential increase in IB&F research since 2008.

The large number of countries involved in IB&F research provides shreds of evidence for the significant growth of the IB&F research outputs. Table (2) shows the total citations, % of citations, and average article citations of the top 20 active countries in the IB&F research. It reveals that the USA led the publication in IB&F, with approximately 674 citations representing 20% of the total citations in this field. The United Kingdom contributes approximately 561 citations (17%), followed by Netherland (10%). There is no substantial contribution from other countries, including Egypt (0.74), South Africa (0.74), and Brazil (0.68).

Nonetheless, in Table (3), we have calculated the single-country publications (SCP) and the multiple country publications (MCP). The Table indicates that Malaysia ranks first in both SCP and MCP, followed by Indonesia and the United Kingdom. Malaysia has produced 82 single publications and 23 joint publications with other nations. The SCP and MCP of Indonesia are 50 and 6, respectively. The United Kingdom has produced 26 (14) SCP (MCP). In addition, there are a limited contribution of other countries such as Egypt (SCP = 2, MCP = 2) and the Netherland (SCP = 1, MCP = 3).

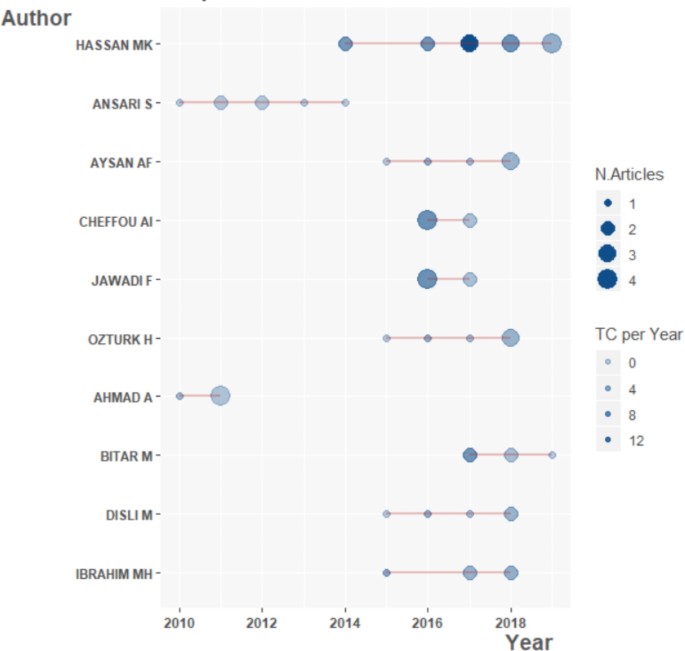

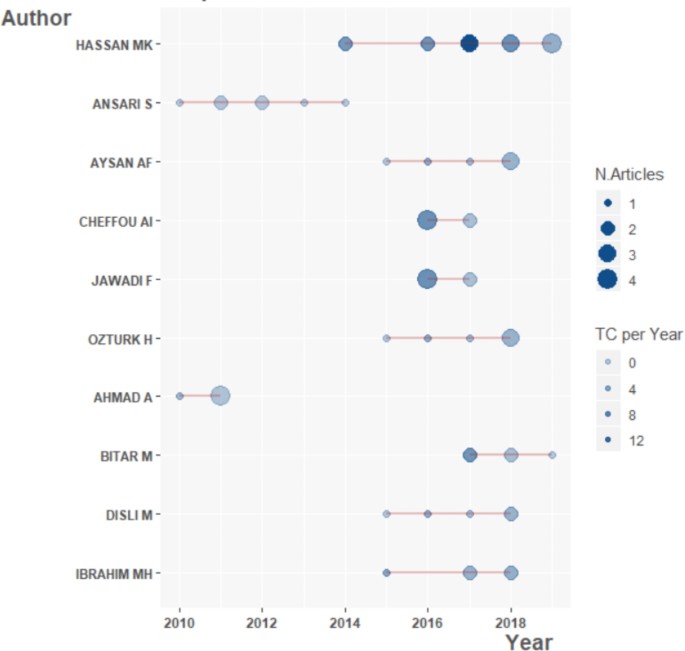

The substantial growth in the IB&F research is evident in the significant number of authors involved in this field of study. The top 20 influential authors in the IB&F research are shown in Table (4). The Table shows that the leading author in this field is Kabir Hassan [Hassan, M. K], with 14 research publications, followed by Sanaullah Ansari [Ansari, S], with seven publications. Besides, Ahmet Faruk Aysan [Aysan, A. F], Abdoulkarim Idi Cheffou [Cheffou, A. I], Fredj Jawadi [Jawadi, F], and Huseyin Ozturk [Ozturk, H] contribute by six publication each. Other IB&F leading authors include Ahmad Baehaqi [Ahmad, A], Mohammad Bitar [Bitar, M], Mustafa Disli [ Disli, M], Mansor H Ibrahim [Ibrahim, M. H], Nabila Jawadi [Jawadi, N], Kashif-Ur-Rehman [Kashif-Ur-Rehman, K. R], Ismah Osman [Osman, I], and Amine Tarazi [Tarazi, A] who provides five research publication each in the IB&F field. Other influential authors provide four IB&F research publications, including Khaliq Ahmad [Ahmad, K], Faisal Alqahtani [Alqahtani, F], Kym Brown [Brown, K], Sri Rahayu Hijrah Hati [Hati, S. R], Marwan Izzeldin [Izzeldin, M], and Abul Mansur M. Masih [Masih, M].

The dominance of the IB&F influential authors varied over time. Figure (2) presents the dominance of the top ten IB&F influential authors from 1990 to 2019. The varying sizes of circles and their colours in the Figure suggest the authors’ dominance in terms of the number of articles and total citations, respectively, during a particular time. The Figure reveals that Sanaullah Ansari [Ansari, S] had the highest number of publications and total citations from 2010 to 2014, suggesting that this author was the most influential author from 2010 to 2014. Then, Kabir Hassan [Hassan, M. K] took the lead and became the most influential author from 2014 till now. It is also observable that Ahmet Faruk Aysan [Aysan, A. F], Huseyin Ozturk [Ozturk, H], Mustafa Disli [ Disli, M], and Mansor H Ibrahim [Ibrahim, M. H] were influential from 2015 to 2018. Other authors had also dominated for shorter periods, including Abdoulkarim Idi Cheffou [Cheffou, A. I] and Fredj Jawadi [Jawadi, F] for the period of 2016–2017, and Mohammad Bitar [Bitar, M] for the period of 2017–2019.

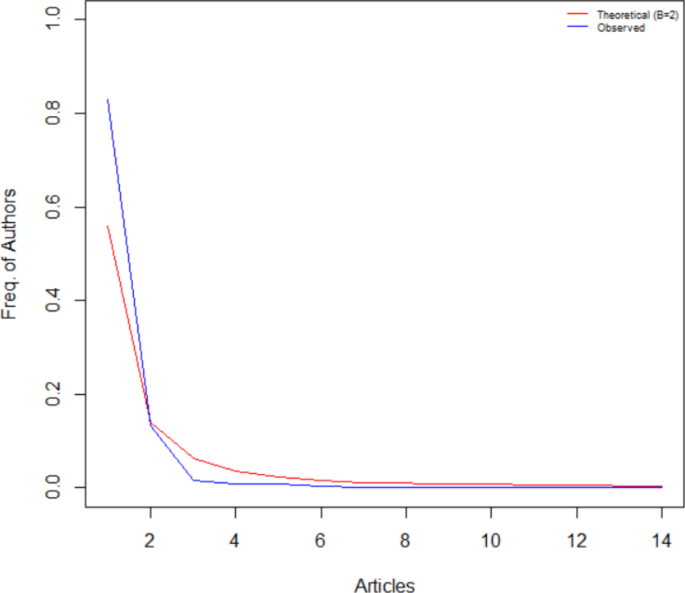

It is argued that the consistency and concentration of the contributions of the authors in a field of study is an essential feature in bibliometric studies (Merediz-Solà and Bariviera 2019). Literature suggests that Lotka’s law, developed by Lotka (1926), is a widely used measure in bibliometric studies to measure the authorship concentration in a particular field of study (Corbet et al. 2019). To the best of our knowledge, this study provides the first application of Lotka’s law in the field of IB&F. Figure (3) presents the distributions of the observed and the fitted Lotka’s. The results of the Kolmogorov-Smirnov two-sample test show a β coefficient of 2.7 with a p-value of 0.27 and a goodness of fit of 0.92. These statistics imply no significant differences between the theoretical and the empirical distributions of the IB&F research, suggesting that authors contribute to both theoretical and practical aspects. Besides, Lotka’s law holds in the IB&F research at a 5% significance level.

The citation analysis is utilized to determine the most popular articles in the IB&F research. It counts the frequency of citations that other research articles have cited a particular research paper for recognizing the impact of a research article in a specific field of study (Kumar et al. 2019). Table (5) presents the ten most cited research articles in IB&F. The first top-cited article was conducted by Thorsten Beck, Asli Demirguc-Kunt, and Ouarda Merrouche in 2013. It has 325 citations and was published in the “Journal of Banking and Finance.“ This article investigated how Islamic banks are different from conventional banking regarding business models, bank efficiency, and stability. Beng Chong and Ming-Hua Liu conducted the second most widely cited article in 2009. It was published in the “Pacific-Basin Finance Journal” with 200 citations. It focuses on the paradigm of distributing profit/ loss in the Islamic banking sector. The third most cited article was performed by Martin Cihak and Heiko Hesse in 2010, published in the “Journal of Finance Service Research,“ and has 170 citations. It aims to investigate the financial stability issue in Islamic banks. Feisal Khan did the fourth most cited article in 2010, published in the “Journal of Economic Behavior & Organization,“ and has 150 citations. It explores the practices that differentiate Islamic banks from conventional ones. The fifth most cited research paper was performed by Pejman Abedifar, Philip Molyneux, and Amine Tarazi in 2013. It was published in the “Review of Finance” with 121 citations. It examines the risk issue in Islamic banks. Finally, other research articles are considered influential in the field of IB&F, including Aggarwal and Yousef (2000), Maali et al. (2006), Haniffa and Hudaib (2007), Pollard and Samers (2007), and Johnes et al. (2014).

5 Network analyses

5.1 Historiographic and co-citation networks

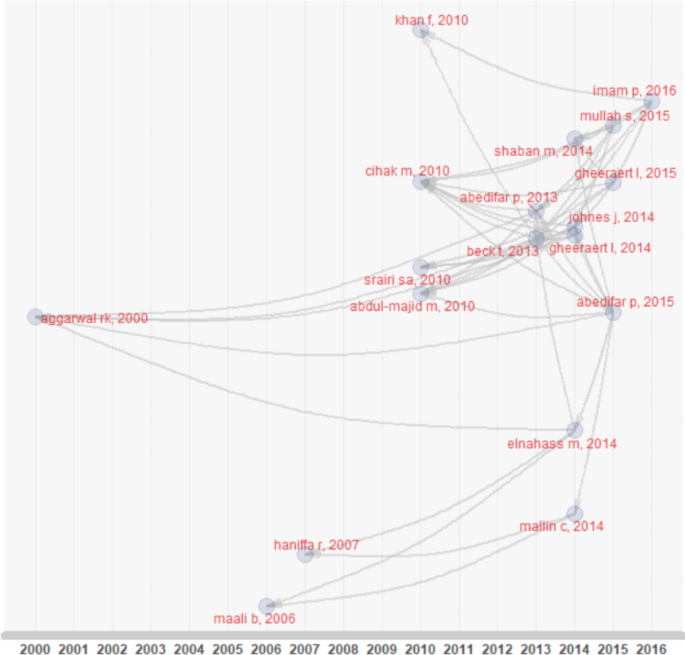

The historiographic network is utilized to identify the temporal direct citation flow of highly cited research papers to trace the intellectual history of the IB&F field. It has been employed in myriad fields of studies, including the circular economy (Alnajem et al. 2021), Halal food (Mostafa 2020), and service networks (da Silva et al. 2017). The Historiographic network of the IB&F research is shown in Fig. (4). The Figure indicates a presence of various distinct IB&F research with, to some extent, joint clusters. The primary subnetwork was initiated in 2000 through a research paper conducted by Aggarwal and Yousef (2000). This paper was published in the “Journal of Money Credit and Banking” and investigated Islamic banks’ financial instruments. It has remained influential in the IB&F field until 2016. Besides, it has gained a substantial impact over time because Abdul-Majid first cited it in 2010, which was cited by Beck et al. (2010). Subsequently, several authors have cited this article leading to a complicated citation network of this research paper. Considerably, it becomes a central research paper in IB&F after several years. A research paper by Maali B. (2006) developed another cluster of citations, which was cited by Mallin c. (2014) and Elnahass M. (2014), followed by a large number of citations.

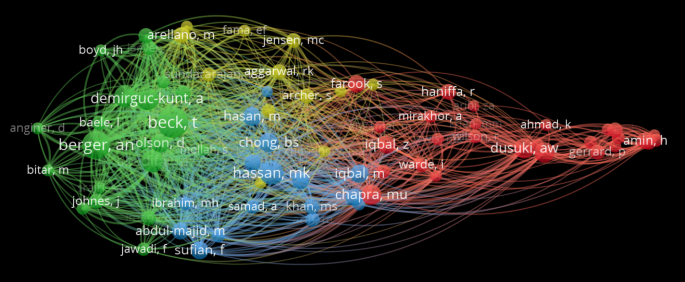

The influential authors can distribute the knowledge through their networks because they are in a good position to initiate interactions and seek comments on a particular research area. Hence, they are more likely to stimulate the flow of ideas and information in a field of study. The co-citation network of authors helps identify the leading authors in an area of research (Alnajem et al. 2021). The IB&F co-citation network of authors is shown in Fig. (5). Several meaningful insights are observable from examining the Figure. For instance, the nodes’ sizes suggest that Kabir Hassan (Hassan MK) dominates a key node spot in the network, suggesting his central role in the diffusion of knowledge in the IB&F research (i.e., a leading author in the IB&F author co-citation network). It is also observable that several spots of nodes are relatively close. This suggests a presence of a “homophily impact” among authors of the IB&F research. In IB&F, authors have common research interests, leading to a high level of coordination among authors. The “homophily impact” can be identified in the co-citations networks through the authors’ thematic similarity of the research agenda (Jiang et al. 2019). The Figure also shows that the node spot representing Thorsten Beck (Beck, T) is close to the node spot representing Allen N. Berger (Berger, A. N), suggesting that they share common research interests (i.e., homophily impact). Furthermore, the red-coloured nodes on the right side of the Figure represent, to some extent, virtually separate nodes. This suggests a presence of structural holes (Mostafa 2020), meaning that some authors develop research articles that may act as bridges to link between different separate nodes and are subsequently cited by authors in different clusters.

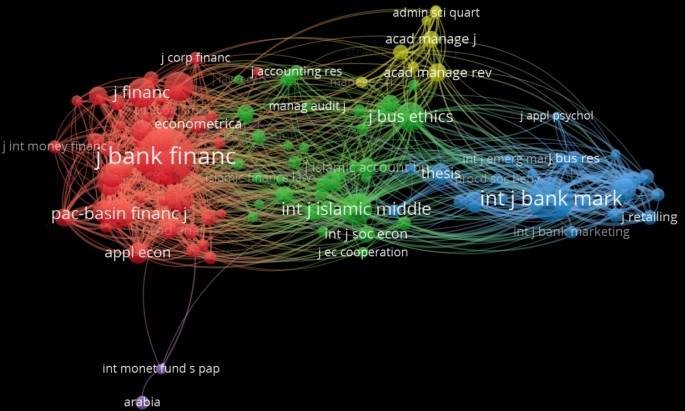

Likewise, Fig. (6) presents the IB&F co-citation network of academic Journals. It reveals four distinct Journal co-citation nodes presented in four different colours. Each coloured node combines journals that publish a particular theme of IB&F research. The Figure also depicts a low connection among the four coloured nodes. The Journals within each coloured node can be described as a core-periphery pattern (Dobusch and Kapeller 2012). The core journals are shown in the central spot within each node, which are considered the primary academic Journals of a particular thematic area of the IB&F research. The periphery journals are presented around the core journals of each node. It is observable that few core journals dominate the publication of IB&F research on a specific theme of research.

The red nodes present academic Journals that focus on the financial performance and instruments of Islamic financial institutions. The “Journal of Banking and Finance” is considered the core journal in this thematic area. While the periphery journals include the “Journal of Finance,“ “Pacific-Basin Finance Journal,“ and “Journal of Corporate Finance.“ The green nodes deal with Shariah-compliance issues, ethical values, and social responsibility duties of Islamic financial institutions. It includes the “Journal of Business Ethics” and the “International Journal of Islamic and Middle Eastern Finance and Management” as core journals. However, this node’s periphery journals include the “Managerial Auditing Journal” and the “International Journal of Social Economics.“ The blue cluster focuses on journals dealing with marketing aspects and customer preferences in IB&F. It includes the “International Journal of Bank Marketing” as a core journal and the “Journal of Applied Psychology” and “Emerging Market Business Research” as periphery journals. Finally, the yellow cluster focuses on managerial and administrative issues of Islamic financial institutions. It includes the “Academy Management Journal” and the “Academy Management Review.“

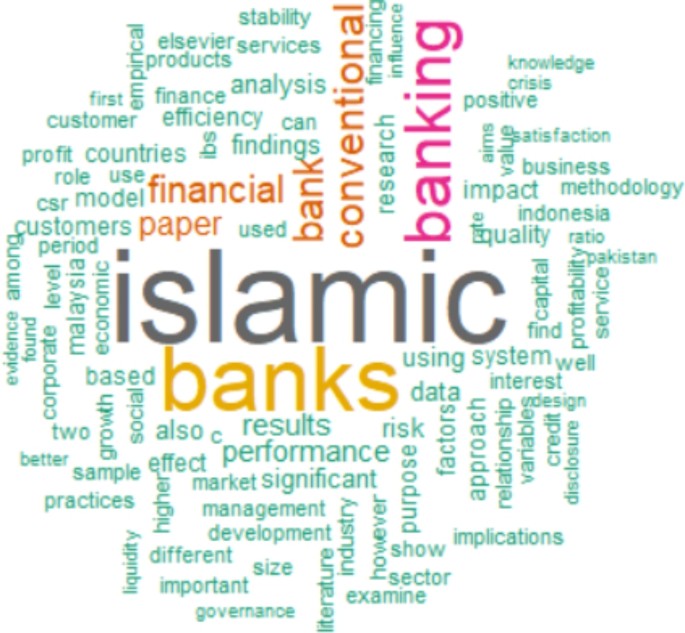

5.2 Keyword, Sankey diagram, and co-occurrence network analyses

Analyzing keywords of a field of study is essential in bibliometric analysis (Mostafa 2020). The keyword co-occurrence analysis identifies the main topics, domains, contents, and thematic structure in a particular field of study (Su and Lee 2010). The tag cloud is a visual figure depicting a specific word’s frequency of occurrence in a research article. Words with higher (lower) frequency are more (less) likely to be present in the tag could. The tag cloud of the keywords in the abstracts of the IB&F research is presented in Fig. (7). It is observable that the most repetitive keywords were “Islamic,“ “banks,“ “banking,“ “conventional,“ “performance,“ and “financial.“ This suggests that IB&F research mainly focuses on examining the financial performance of Islamic relative to conventional banks. This is consistent with the significant research that examines this issue (e.g., Narayan et al. 2017; Dewandaru et al. 2015; Wanke et al. 2016; Belanès et al. 2015; Baele et al. 2014; Pappas et al., 2016; Mobarek and Kalonov 2014).

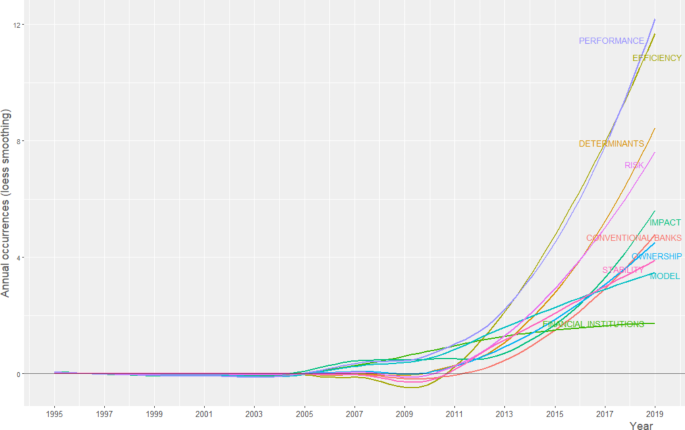

Moreover, Colicchia et al. (2019) argue that knowledge of a field of study includes topics and themes that are more likely to be investigated and attain particular research interest from scholars but then become less attractive to scholars and disappear eventually. Therefore, Fig. (8) presents the temporal occurrence of keywords with a sharp rise in frequency over time in the IB&F research. It reveals that keywords such as “performance,“ “efficiency,“ “risk,“ and “stability” have received more attention in IB&F research in recent years and may be seen as essential research fronts or hotspots in the future studies. It is also worth mentioning that methodological advancement was introduced recently, evidenced by the keyword “model.“ Thus, it is expected to see advanced models such as structural equation modelling and the generalized method of moments (GMM) model in the future research of IB&F.

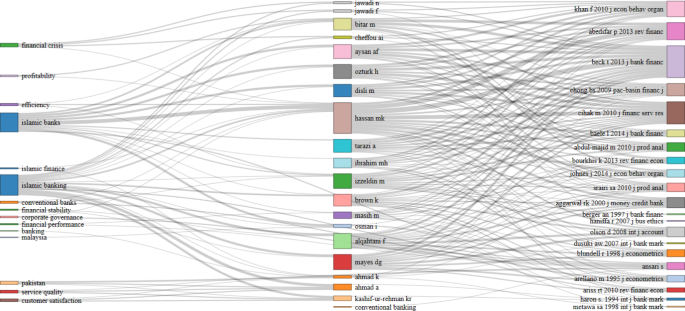

The Sankey diagram presents the flow of parameters among two or more groups (Sankey 1898). For example, the Sankey diagram is presented in three field plots in bibliometric analysis. The left side represents the keywords in the field of study, the middle side represents the authors, and the right side reflects the cited publications in this field. Figure (9) presents the Sankey diagram, which illustrates the flow among keywords, authors, and research publications in the field of IB&F. It is observable that “Islamic banks” and “Islamic banking” keywords have the most significant edge widths. That is, these keywords are dominant and highly searched by scholars in the field of IB&F. Also, authors including Kabir Hassan [Hassan, M.K], Marwan Izzeldin [Izzeldin, M.], David Geoffrey Mayes [Mayes G. D], Ahmet Faruk Aysan [Aysan, A. F], Amine Tarazi [Tarazi, A], Huseyin Ozturk [Ozturk, H], Faisal Alqahtani [Alqahtani, F], Kym Brown [Brown, K], and Mohammad Bitar [Bitar, M.] have used relatively more keywords relative to other authors. This implies that their research publications covered numerous themes and topics in the field of IB&F, which is evidenced by their publications in diversifiable academic journals such as “Journal of Banking and Finance,“ “Journal of Finance Service Research,“ “Journal of Economic Behavior & Organization,“ “Review of Finance,“ and “Pacific-Basin Finance Journal.“

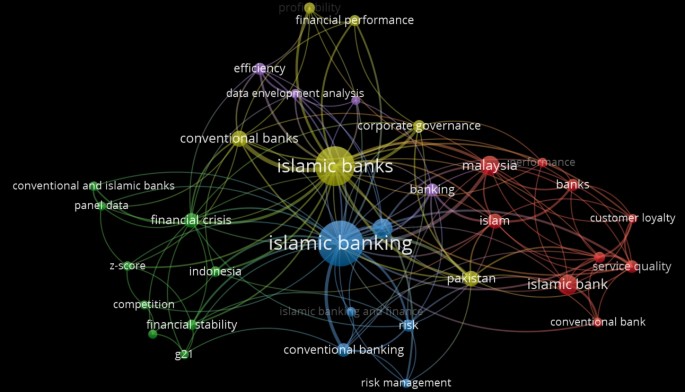

The keywords provided by authors in the abstracts of their research papers are used to develop the “keyword co-occurrence network.“ This network helps further probe the frequency that keywords appear in the research articles. Figure (10) presents the IB&F keyword co-occurrence network. The node’s size represents the frequency of each keyword, and the link thickness is the number of times a pair of keywords appears together in a research article. The large nodes close to the center of the network present research “hotspots” in the study field (Van Eck and Waltman 2014). The Figure reveals that IB&F deals mainly with five main clusters of topics, including “Islamic and conventional banking,“ “performance and corporate governance system,“ “risks and competition in Islamic and conventional banks,“ “efficiency of Islamic banking,“ and “service quality and consumer loyalty in Islamic and conventional banks.“ These topics can be considered core trends for current and future research in IB&F.

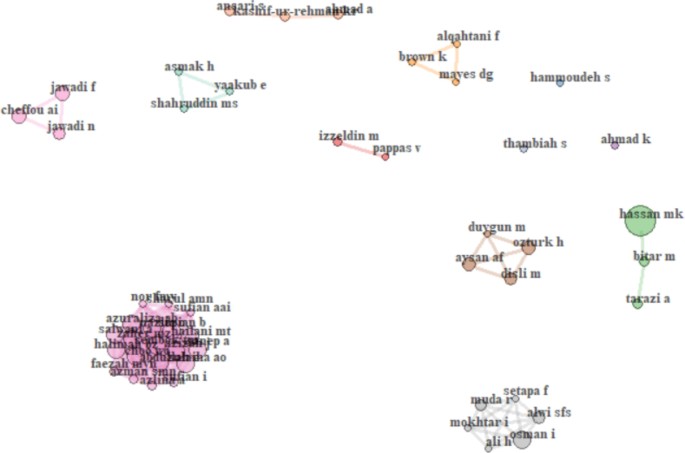

5.3 Collaboration networks

The authors’ collaboration network identifies the frequency of their joint research publications in a particular area. Figure (11) presents the author’s collaboration network in the IB&F field. The node’s size represents each author’s research, and the link thickness is to the frequency of joint research articles. The coloured nodes in the Figure represent 12 research groups of authors, suggesting a limited collaboration between authors in the IB&F research field. There is also a limited and dispersed collaboration network, such as the network of Marwan Izzeldin [Izzelldin, M.] and Vasileios Pappas [Pappas, V.]. The Figure also suggests that most of the networks are somewhat disjointed. This indicates rare cooperation among authors in the IB&F research field. This phenomenon could be explained on the basis that leading authors in IB&F are more likely to develop collaboration with authors from different research fields.

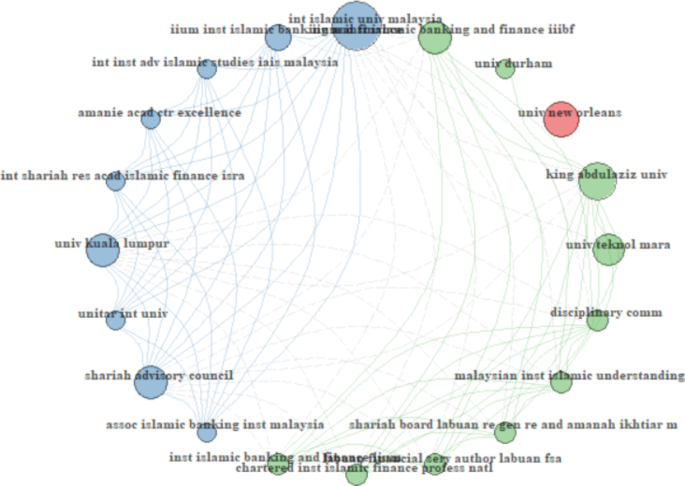

Likewise, Fig. (12) presents the IB&F research institutions’ collaboration network. It shows that the institutions are categorized into three groups based on the colour used. The first group is shown in green and represents the largest institutions’ collaboration group. It consists of ten institutions located in different countries, such as the International Islamic University Malaysia [Malaysia], the King Abdulaziz University [Saudi Arabia], and the Universiti Teknologi Malaysia [Malaysia]. These institutions develop collaborations with other institutions such as the University of Durham [UK] and the Shariah Advisory Council [Malaysia]. The second cluster is blue and includes nine institutions, such as the Institute of Islamic Banking and Finance and Kuala Lumpur University in Malaysia. They initiate collaboration with the association of Islamic banking and financial institution of Malaysia. The final cluster shows isolated and limited collaboration and includes only one institution: the University of New Orleans in the USA.

The IB&F research institutions’ collaboration network is a “locally concentrated and globally isolated” collaboration. This is observable from the high level of collaboration among universities and research institutions in Malaysia and the limited collaboration between Malaysian and international institutions. Furthermore, there is limited collaboration among institutions in developed and developing countries. For example, the University of New Orleans has not developed collaboration with other institutions in developed countries. Henceforth, the institution’s collaboration network in the IB&F field denotes its scattered nature, leading to limited knowledge sharing among scholars and institutions.

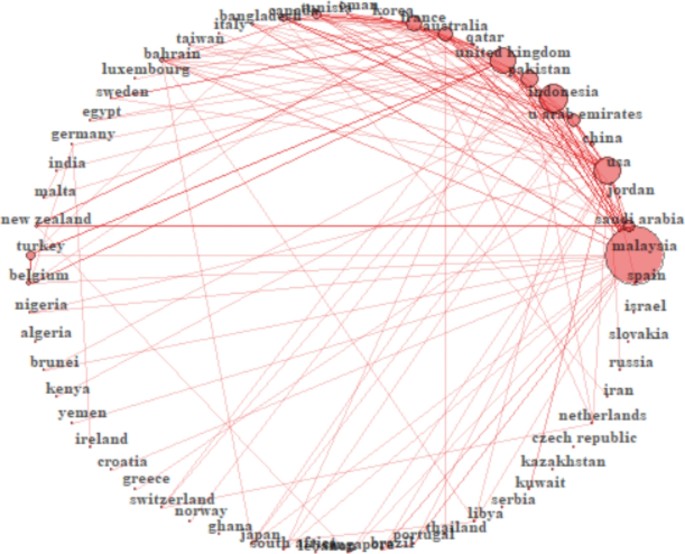

Furthermore, Fig. (13) shows the IB&F research countries’ collaboration. It reveals that Malaysia is the most productive in IB&F research, and it is highly collaborating with some other countries such as New Zealand, Indonesia, the USA, and the UK. Besides, it has some bit collaborations with Turkey, Nigeria, Belgium, and Egypt. The countries’ collaboration network is denser than the collaboration networks of authors (Fig. 11) and institutions (Fig. 12). However, this represents only 5% of countries’ collaboration with a few isolated countries such as Israel and Slovakia. Besides, the countries’ collaboration is more likely to be attributable to collaboration among authors from different countries rather than direct official collaboration between institutions from the countries. Overall, the collaborations of institutions and countries are driven by their Islamic culture, geographical area, and degree of economic development.

6 Intellectual structure maps

6.1 Conceptual structure map

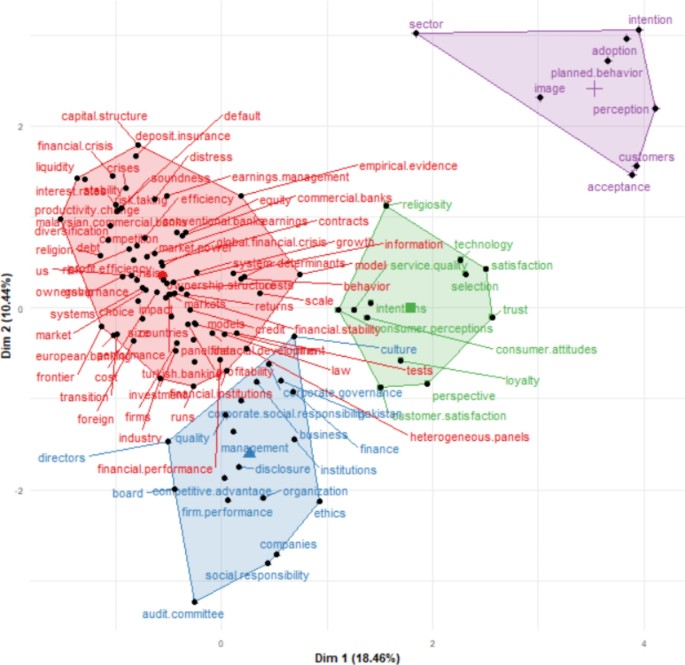

The current study utilizes the multiple correspondence analysis (MCA) to detect the conceptual structure and different dimensions of research in the IB&F field. The MCA has extensively been employed in prior studies (e.g., Mostafa 2020; Alnajem et al. 2021). Figure (14) is a mapping of the conceptual structure of the keywords that appeared in the IB&F research during the last 30-years. It categorizes the conceptual structure of IB&F research into four mutually interrelated clusters. It is observable that the core cluster is shown in red and incorporates keywords that are concerned with the performance of Islamic banks, such as “performance,“ “efficiency,“ “productivity,“ “liquidity,“ “stability,“ “diversification,“ “return” and “equity.“ This cluster may include, but is not limited to, research articles that explore the performance of Islamic compared to conventional banks concerning profitability (Narayan et al. 2017; Dewandaru et al. 2015), bank efficiency (Johnes et al. 2014; Wanke et al. 2016; Belanès et al. 2015), cost efficiency (Beck et al., 2013; Olson and Zoubi 2011), a default rate of loans (Baele et al. 2014; Pappas et al. 2017), and financial stability (Mobarek and Kalonov 2014).

The second cluster is blue and deals with Islamic banks’ ethics, corporate governance system, and social responsibility. It includes keywords such as “ethics’, “management”, “quality”, “disclosure”, “corporate social responsibility” and “audit committee”. The authors within this cluster examine the efficiency of Islamic banks’ corporate governance system and how social responsibility affects the performance of Islamic financial institutions. Representative research articles include Mollah and Zaman (2015), who examine whether Shariah’s supervisory board and corporate governance system influence Islamic banks’ performance. Also, they include Mollah et al. (2016), who explore the impact of governance structures on risk-taking and financial performance of Islamic relative to conventional banks, and Baele et al. (2014), who investigate religion’s effect on the default rate of bank loans. Other representative articles of this cluster include Belal et al. (2015), who analyze the ethical reporting of Islamic banks, Hassan et al. (2010), and Platonova et al. (2016), who investigate the social responsibility behaviour of Islamic banks and its consequences on the future performance of bank banks.

The third cluster is green and seems to deal with service quality and consumer perceptions of Islamic banks. It includes keywords such as “service quality”, “behavior”, “consumer perception”, “satisfaction”, and “culture”. Representative research includes Taap et al. (2011), who investigate the quality of services in Islamic banks relative to conventional ones, and Haron et al. (2020), who examine the customers’ satisfaction, loyalty, and trust in Islamic banks. The last cluster is shown in purple, and it seems to deal with behavioural and social finance in Islamic banking. It includes keywords such as “adoption,“ planned behaviour,“ perceptions,“ and “image.“ Representative research includes Hoque et al. (2019), who explores the drivers of customers’ intention to follow a variety of products and services of Islamic banks.

6.2 Thematic map

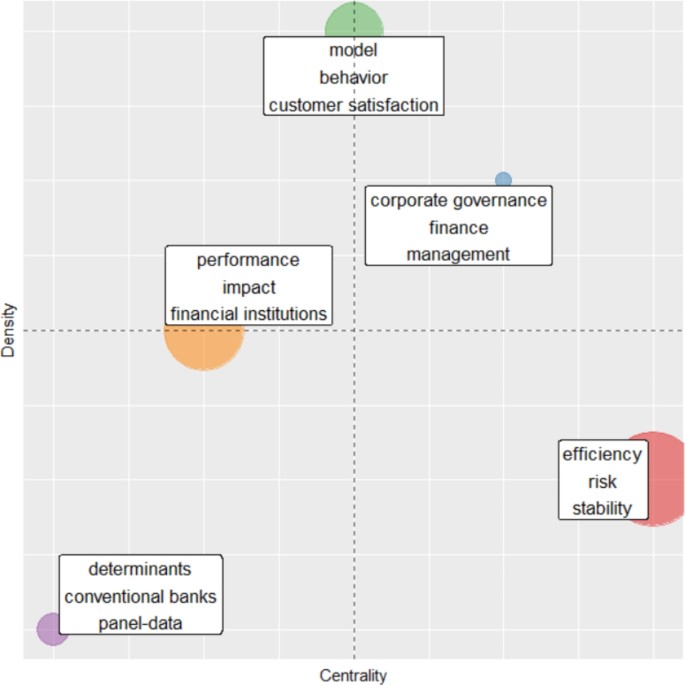

The thematic map is a clustering algorithm used to identify the concentration of different themes related to a specific field of study. It is divided into four quadrants based on the levels of density and centrality. The first one is the “well-developed” theme with high density and centrality. The second one is the “highly-developed-and-isolated” theme which can be identified by a high density and a low centrality. The third one is the “emerging-or-declining” theme with low density and centrality. The final them is termed “basic-and-transversal” and is described by low density and high centrality. The size of the theme bubble is prorated to the frequency of research publications that include particular keywords.

Figure (15) presents the thematic map of IB&F research. It shows that the well-developed theme includes “corporate governance,“ “finance,“ and ‘management,‘ while the highly developed and isolated theme includes “performance,“ “impact’ and “financial institutions.“ The emerging or declining theme in IB&F research includes the “determinants,“ “conventional banks” and “panel data.“ However, the primary and transversal theme includes “efficiency,“ “risk” and “stability.“ The Figure also shows some issues that occupy a hybrid positions (present in two quadrants) including “model,“ ‘behaviour” and “customer satisfaction.“ These can be seen as highly total citations implying impactful themes in the IB&F field (Mostafa 2020).

7 Concluding remarks and future research directions

The IB&F is a value-based system aiming to ensure the substantial well-being of people and sustainable economic growth of a country. The research on IB&F has witnessed exponential growth at an average rate of 5.6% annually during the last three decades. Besides, scholars are interested in examining the roles of Islamic financial institutions in the COVID-19 pandemic (Hassan et al. 2021), suggesting future research in this area. This study is motivated by a research interest in mapping IB&F scholarly research. It adds to the literature by utilizing bibliometric analyses–an innovative way to map and visualize the development, conceptual structure, and thematic evolution of the IB&F field. The study analyses 464 WoS IB&F research publications of 921 authors comprising 58 countries published over three decades from 1990 to 2019. It presents a “big picture” of IB&F research that identifies the temporal chronological IB&F citations to trace the intellectual history of the IB&F. It also builds different networks between authors, research publications, academic journals, institutions, and countries to understand the sources and flow of knowledge in IB&F filed. In addition, it utilizes the MCA to detect the conceptual structure and different dimensions of research in the IB&F field. Furthermore, it develops a thematic clustering algorithm map to identify the concentration of different themes in IB&F research.

The results suggest the following insights and implications for scholars. First, there has been an exponential increase in IB&F research since 2008, evidenced by a significant number of authors and countries involved alongside total citations in this field of study. Malaysia is the most productive in IB&F research, and it is ranked first in both SCP and MCP, followed by Indonesia and the United Kingdom. The collaboration among countries is limited and influenced by the culture (Islamic vs. non-Islamic countries), economic development (developed vs. developing countries), and geographical area. Besides, the countries’ collaboration is more likely to be attributable to collaboration among authors from different countries rather than direct official collaboration between institutions from these countries. The results also suggest that the collaboration among institutions can be described as a “locally concentrated and globally isolated” collaboration. This is evidenced by the high collaboration among universities and research institutions in Malaysia and their limited global collaboration. This scattered nature of institutions and countries’ collaborations is likely to lead to limited knowledge sharing among scholars and institutions.

Second, the co-citations networks of authors and academic journals reveal that the IB&F research can be seen as a type of “small-world network.“ Few authors and journals dominate the networks and play a central role in the diffusion of knowledge in the IB&F research. Besides, there is a “homophily impact” among the leading authors of the IB&F research, meaning that they have common research interests, leading to a high level of coordination. Furthermore, there are structural holes in IB&F research, meaning that some authors develop research articles that may act as bridges to link different research themes. Thus, the networks in IB&F research reflect the “Matthew Effect” (described in sociology), meaning that few authors have a more significant number of networks than the rest of the authors.

Third, the conceptual structure of IB&F research can be classified into four mutually interrelated clusters, including (i) performance of Islamic banks, (ii) Islamic banks’ ethics, corporate governance system, and social responsibility, (iii) service quality and consumer perceptions of Islamic banks, and (iv) behavioural and social finance in Islamic banking. This conceptual structure is essential in developing agenda for future research in the IB&F field. Finally, thematic development suggests a promising research trend in this field of study, especially in analyzing the performance of Islamic and conventional banks using longitudinal panel data techniques.

The study has some limitations that can be suggested as avenues for future research. First, data is collected from only the WoS database, covering high-quality peer-reviewed research publications. Thus, the results of our search may not cover all publications of the IB&F research. Future research can use multiple data sources. Besides, we focus on English IB&F research publications, limiting the scope of research coverage. Future research can consider different languages (e.g., Arabic and Malay) alongside the English language to be able to generalize the results. Second, the current study follows prior research and uses the co-citations networks (Mostafa 2020; Argoubi et al. 2020; Yahaya et al. 2020; Alnajem et al. 2021). However, other methods, including self-organization- maps and continuous space (Skupin 2004), can be used for future research. Finally, based on our keyword network analyses, future research can employ methodological advancements such as structural equation modelling and the generalized method of moments (GMM) model. Besides, future research can explore several research aspects of Islamic institutions which are ignored in IB&F research, including Islamic banks’ level of cash holdings (Hassanein and Kokel 2022), voluntary disclosure (Alm El-Din et al. 2022), social responsibility (Alazzani et al. 2017), market reaction (Hassanein et al. 2021), earning management (Zalata et al. 2019), and future-oriented information (Hassanein and Hussainey 2015; Hassanein et al. 2019; Benameur et al. 2022).

Change history

11 August 2022

A Correction to this paper has been published: https://doi.org/10.1007/s11135-022-01491-w

Notes

In 1970s, many Islamic banks have been established such as Nasser Social Bank Cairo (1972, Egypt), Islamic Development Bank (1975, Saudi Arabia), Dubai Islamic Bank (1975, United Arab Emirates), Kuwait Finance House (1977, Kuwait), Faisal Islamic Bank of Sudan (1977, Sudan).

AAOIFI was created in 1990 to ensure that IFIs are complying with the Islamic jurisprudence. It develops standards for IFIs throughout the world and its standards focus on different areas including Shariah, accounting, auditing, governance, and codes of ethics.

References

Abedifar, P., Hasan, I., Tarazi, A.: Finance-growth nexus and dual-banking systems: Relative importance of Islamic banks. J. Econ. Behav. Organ. 132, 198–215 (2016)

Aggarwal, R.K., Yousef, T.: Islamic banks and investment financing.Journal of money, credit and banking,93–120. (2000)

Alaoui, A., Dewandaru, G., Rosly, S., Masih, M.: Linkages and co-movement between international stock market returns: case of Dow Jones Islamic Dubai Financial Market index. J. Int. Financ. Mark. Inst. Money. 36, 53–70 (2015)

Alazzani, A., Hassanein, A., Aljanadi, Y.: Impact of gender diversity on social and environmental performance: evidence from Malaysia. Corp. Gov. 17(2), 266–283 (2017)

Alexakis, C., Pappas, V., Tsikouras, A.: Hidden cointegration reveals hidden values in Islamic investments.Journal of International Financial Markets, Institutions and Money,70–83(2016)

Alm El-Din, M.M., El-Awam, A.M., Ibrahim, F.M., Hassanein, A.: Voluntary disclosure and complexity of reporting in Egypt: the roles of profitability and earnings management. J. Appl. Acc. Res. 23(2), 480–508 (2022)

Alnajem, M., Mostafa, M., ElMelegy, A.: Mapping the first decade of circular economy research: a bibliometric network analysis. J. Industrial Prod. Eng. 38(1), 29–50 (2021)

Al-Suhaibani, M., Naifar, N.: Islamic corporate governance: risk-sharing and Islamic preferred shares. J. Bus. Ethics. 124(4), 623–632 (2014)

Amrutha, V.N., Geetha, S.N.: A systematic review on green human resource management: Implications for social sustainability. J. Clean. Prod. 247, 119131 (2020)

Argoubi, M., Ammari, E., Masri, H.: A scientometric analysis of Operations Research and Management Science research in Africa.Operational Research,1–17. (2020)

Ashraf, D.: Does Shari’ah screening cause abnormal returns? Empirical evidence from Islamic equity indices. J. Bus. Ethics. 134(2), 209–228 (2016)

Aydin, N.: Paradigmatic foundation and moral axioms of ihsan ethics in Islamic economics and business. J. Islamic Acc. Bus. Res. 11(2), 288–308 (2020)

Aysan, A.F., Disli, M., Ng, A., Ozturk, H.: Is small the new big? Islamic banking for SMEs in Turkey. Econ. Model. 54, 187–194 (2016)

Azmat, S., Skully, M., Brown, K.: Issuer’s choice of Islamic bond type. Pac.-Basin Financ. J. 28, 122–135 (2014)

Baele, L., Farooq, M., Ongena, S.: Of religion and redemption: Evidence from default on Islamic loans. J. Banking Finance. 44, 141–159 (2014)

Beck, T., Demirgüç-Kunt, A., Merrouche, O.: Islamic vs. conventional banking: Business model, efficiency and stability. J. Banking Finance. 37, 433–447 (2010)

Belal, A.R., Abdelsalam, O., Nizamee, S.S.: Ethical reporting in Islami bank Bangladesh limited (1983–2010). J. Bus. Ethics. 129(4), 769–784 (2015)

Belanès, A., Ftiti, Z., Regaïeg, R.: What can we learn about Islamic banks efficiency under the subprime crisis? Evidence from GCC Region. Pac.-Basin Financ. J. 33, 81–92 (2015)

Benameur, K., Hassanein, A., Azzam, M.E.A.Y., Elzahar, H.: Future-oriented disclosure and corporate value: the role of an emerging economy corporate governance. J. Appl. Acc. Res. (2022). https://doi.org/10.1108/JAAR-01-2021-0002

Block, J., Fisch, C., Rehan, F.: Religion and entrepreneurship: a map of the field and a bibliometric analysis. Manage. Rev. Q. 70(4), 591–627 (2020)

Colicchia, C., Creazza, A., Noè, C., Strozzi, F.: Information sharing in supply chains: a review of risks and opportunities using the systematic literature network analysis (SLNA). Supply Chain Management: An International Journal. 24, 5–21 (2019)

Corbet, S., Dowling, M., Gao, X., Huang, S., Lucey, B., Vigne, S.A.: An analysis of the intellectual structure of research on the financial economics of precious metals. Resour. Policy. 63, 101416 (2019)

da Silva, S.V., Antonio, N., de Carvalho, J.C.: Analysis of the service dominant logic network, authors, and articles. Serv. Ind. J. 37(2), 125–152 (2017)

Dewandaru, G., Masih, R., Bacha, O.I., Masih, A.M.M.: Combining momentum, value, and quality for the Islamic equity portfolio: Multi-style rotation strategies using augmented Black Litterman factor model. Pac.-Basin Financ. J. 34, 205–232 (2015)

Dobusch, L., Kapeller, J.: A guide to paradigmatic self-marginalization: Lessons for post-Keynesian economists. Rev. Political Econ. 24, 469–487 (2012)

Elnahas, A.M., Hassan, M.K., Ismail, G.M.: Religion and ratio analysis: Towards an Islamic corporate liquidity measure. Emerg. Markets Rev. 30, 42–65 (2017)

Ferreira, M.P., Pinto, C.F., Serra, F.R.: The transaction costs theory in international business research: a bibliometric study over three decades. Scientometrics. 98(3), 1899–1922 (2014)

Gheeraert, L.: Does Islamic finance spur banking sector development? J. Econ. Behav. Organ. 103, S4–S20 (2014)

Grassa, R., Matoussi, H.: Corporate governance of Islamic banks. Int. J. Islamic Middle East. Finance Manage. 7(3), 346–362 (2014)

Grira, J., Hassan, M.K., Soumaré, I.: Pricing beliefs: Empirical evidence from the implied cost of deposit insurance for Islamic banks. Econ. Model. 55, 152–168 (2016)

Haniffa, R., Hudaib, M.: Exploring the ethical identity of Islamic banks via communication in annual reports. Journal of business Ethics, 76(1), 97–116. (2007)

Haron, R., Subar, N.A., Ibrahim, K.: Service quality of Islamic banks: satisfaction, loyalty and the mediating role of trust. Islamic Economic Studies. 28(1), 3–23 (2020)

Hassan, M.K., Khan, A.N.F., Ngow, T.: Is faith-based investing rewarding? The case for Malaysian Islamic unit trust funds. J. Islamic Acc. Bus. Res. 1(2), 148–171 (2010)

Hassan, M.K., Muneeza, A., Sarea, A.M.: COVID-19 and Islamic Social Finance. Routledge. (2021)

Hassanein, A., Hussainey, K.: Is forward-looking financial disclosure really informative? Evidence from UK narrative statements. Int. Rev. Financial Anal. 41, 52–61 (2015)

Hassanein, A., Kokel, A.: Corporate cash hoarding and corporate governance mechanisms: evidence from Borsa Istanbul. Asia-Pacific J. Acc. Econ. 29(3), 831–848 (2022)

Hassanein, A., Mostafa, M., Benameur, K., Al- Khasawneh, J.: How do big markets react to investors’ sentiments on firm tweets? J. Sustainable Finance Invest. (2021). https://doi.org/10.1080/20430795.2021.1949198

Hassanein, A., Zalata, A., Hussainey, K.: Do forward-looking narratives affect investors’ valuation of UK FTSE all-shares firms? Rev. Quant. Financ. Acc. 52(2), 493–519 (2019)

Hayat, R., Hassan, M.K.: Does an Islamic label indicate good corporate governance? J. Corp. Finance. 43, 159–174 (2017)

Hoque, M.E., Hassan, M.K., Hashim, N.M.H.N., Zaher, T.: Factors affecting Islamic banking behavioral intention: the moderating effects of customer marketing practices and financial considerations. J. Financial Serv. Mark. 24(1), 44–58 (2019)

Jan, A.A., Lai, F.W., Draz, M.U., Tahir, M., Ali, S.E.A., Zahid, M., Shad, M.K.: Integrating sustainability practices into islamic corporate governance for sustainable firm performance: from the lens of agency and stakeholder theories.Quality & Quantity,1–24. (2021)

Jiang, Y., Ritchie, B., Benckendorff, P.: Bibliometric visualization: An application to tourism crisis and disaster research. Curr. Issues Tourism. 22, 1925–1957 (2019)

Johnes, J., Izzeldin, M., Pappas, V.: A comparison of performance of Islamic and conventional banks 2004–2009. J. Econ. Behav. Organ. 103, S93–S107 (2014)

Kabir, M.N., Worthington, A., Gupta, R.: Comparative credit risk in Islamic and conventional bank. Pac.-Basin Financ. J. 34, 327–353 (2015)

Kumar, S., Sureka, R., Colombage, S.: Capital structure of SMEs: a systematic literature review and bibliometric analysis.Management Review Quarterly,1–31. (2019)

Linnenluecke, M.K., Marrone, M., Singh, A.K.: Conducting systematic literature reviews and bibliometric analyses. Aust. J. Manage. 45(2), 175–194 (2020)

Lotka, A.J.: The frequency distribution of scientific productivity. J. Wash. Acad. Sci. 16(12), 317–323 (1926)

Maali, B., Casson, P., Napier, C.: Social reporting by Islamic banks. Abacus. 42(2), 266–289 (2006)

Mallin, C., Farag, H., Ow-Yong, K.: Corporate social responsibility and financial performance in Islamic banks. J. Econ. Behav. Organ. 103, S21–S38 (2014)

Merediz-Solà, I., Bariviera, A.F.: A bibliometric analysis of bitcoin scientific production. Res. Int. Bus. Finance. 50, 294–305 (2019)

Mobarek, A., Kalonov, A.: Comparative performance analysis between conventional and Islamic banks: empirical evidence from OIC countries. Appl. Econ. 46(3), 253–270 (2014)

Mollah, S., Zaman, M.: Shari’ah supervision, corporate governance and performance: Conventional vs. Islamic banks. J. Banking Finance. 58, 418–435 (2015)

Mollah, S., Hassan, M.K., Farooque, A., Mobarek, A.: The governance, risk-taking, and performance of Islamic banks. J. Financial Serv. Res. 51(2), 195–219 (2017)

Mostafa, M.M.: A knowledge domain visualization review of thirty years of halal food research: themes, trends and knowledge structure. Trends Food Sci. Technol. 99, 660–677 (2020)

Musa, M.A., Abd Sukor, M.E., Ismail, M.N., Elias, M.R.F.: Islamic business ethics and practices of Islamic banks: Perceptions of Islamic bank employees in Gulf cooperation countries and Malaysia. J. Islamic Acc. Bus. Res. 11(5), 1009–1031 (2020)

Naifar, N., Hammoudeh, S.: Dependence structure between sukuk (Islamic bonds) and stock market conditions: An empirical analysis with Archimedean copulas. J. Int. Financ. Mark. Inst. Money. 44, 148–165 (2016)

Narayan, P.K., Bannigidadmath, D.: Does financial news predict stock returns? New evidence from Islamic and non-Islamic stocks. Pac.-Basin Financ. J. 42, 24–45 (2017)

Narayan, P.K., Phan, D.H.B.: Momentum strategies for Islamic stocks. Pac.-Basin Financ. J. 42, 96–112 (2017)

Narayan, P.K., Narayan, S., Phan, D.H.B., Thuraisamy, K.S., Tran, V.T.: Credit quality implied momentum profits for Islamic stocks. Pac.-Basin Financ. J. 42, 11–23 (2017)

Olson, D., Zoubi, T.A.: Efficiency and bank profitability in MENA countries. Emerg. markets Rev. 12(2), 94–110 (2011)

Pappas, V., Ongena, S., Izzeldin, M., Fuertes, A.M.: A survival analysis of Islamic and conventional banks. J. Financial Serv. Res. 51(2), 221–256 (2017)

Platonova, E., Asutay, M., Dixon, R., Mohammad, S.: The impact of corporate social responsibility disclosure on financial performance: Evidence from the GCC Islamic banking sector. J. Bus. Ethics. 151(2), 451–471 (2018)

Pollard, J., Samers, M.: Islamic banking and finance: postcolonial political economy and the decentring of economic geography. Trans. Inst. Br. Geogr. 32(3), 313–330 (2007)

Qi, T., Wang, T., Ma, Y., Zhang, W., Zhu, Y.: A scientometric analysis of e-participation research. Int. J. Crowd Sci. 2, 136–148 (2018)

Rahim, A.M., Masih, M.: Portfolio diversification benefits of Islamic investors with their major trading partners: Evidence from Malaysia based on MGARCH-DCC and wavelet approaches. Econ. Model. 54, 425–438 (2016)

Raza, S.A., Ahmed, R., Ali, M., Qureshi, M.A.: Influential factors of Islamic insurance adoption: an extension of theory of planned behavior. J. Islamic Mark. 11(6), 1497–1515 (2019)

Rivera, M.A., Pizam, A.: Advances in hospitality research: from Rodney Dangerfield to Aretha Franklin. Int. J. Contemp. Hospitality Manage. 27, 362–378 (2015)

Ronda-Pupo, G.A.: The effect of document types and sizes on the scaling relationship between citations and co-authorship patterns in management journals. Scientometrics. 110(3), 1191–1207 (2017)

Sankey, M.H.P.R.: Introductory note on the thermal efficiency of steam-engines. In Minutes of Proceedings of the Institution of Civil Engineers,134, 1897-98. (1898)

Saraç, M., Zeren, F.: The dependency of Islamic bank rates on conventional bank interest rates: further evidence from Turkey. Appl. Econ. 47(7), 669–679 (2015)

Shi, Y., Li, X.: A bibliometric study on intelligent techniques of bankruptcy prediction for corporate firms.Heliyon, 5(12), e02997. (2019)

Skupin, A.: The world of geography: Visualizing a knowledge domain with cartographic means. Proceedings of the National Academy of Sciences, 101(suppl 1), 5274–5278. (2004)

Su, H.N., Lee, P.C.: Mapping knowledge structure by keyword co-occurrence: a first look at journal papers in Technology Foresight. Scientometrics. 85(1), 65–79 (2010)

Sun, P.H., Mohamad, S., Ariff, M.: Determinants driving bank performance: A comparison of two types of banks in the OIC. Pac.-Basin Financ. J. 42, 193–203 (2017)

Taap, M.A., Chong, S.C., Kumar, M., Fong, T.K.: Measuring service quality of conventional and Islamic banks: a comparative analysis. Int. J. Qual. Reliab. Manage. 28(8), 822–840 (2011)

Van Eck, N.J., Waltman, L.: Visualizing bibliometric networks. In: Measuring scholarly impact. Springer, Cham (2014)

Wanke, P., Azad, M.A.K., Barros, C.P., Hassan, M.K.: Predicting efficiency in Islamic banks: An integrated multicriteria decision making (MCDM) approach. J. Int. Financ. Mark. Inst. Money. 45, 126–141 (2016)

Yahaya, I.S., Amat, A., Maryam, S., Khatib, S.F.A., Sabo, A.U.: Bibliometric analysis trend on business model innovation. J. Crit. Rev. 7(09), 2391–2407 (2020)

Zaher, T.S., Kabir Hassan, M.: A comparative literature survey of Islamic finance and banking. Financial Markets, Institutions & Instruments. 10(4), 155–199 (2001)

Zalata, A.M., Ntim, C.G., Choudhry, T., Hassanein, A., Elzahar, H.: Female directors and managerial opportunism: Monitoring versus advisory female directors. Leadersh. Q. 30(5), 101309 (2019)

Zheng, C., Kouwenberg, R.: A bibliometric review of global research on corporate governance and board attributes. Sustainability. 11(12), 3428 (2019)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Hassanein, A., Mostafa, M.M. Bibliometric network analysis of thirty years of islamic banking and finance scholarly research. Qual Quant 57, 1961–1989 (2023). https://doi.org/10.1007/s11135-022-01453-2

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-022-01453-2