Abstract

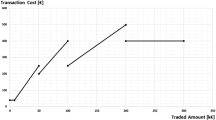

An essential element of any realistic investment portfolio selection is the consideration of transaction costs. Our purpose, in this paper, is to determine the maximum return and the corresponding number of securities to buy giving such return, whenever practical constraints features related to budget, buy-in thresholds, and transaction costs are taken into consideration. Dealing with the portfolio selection and optimization problem in the point of view of individual investors, we will arrive to get an analytic result, leading to a new and simple alternative solution to heuristic algorithms. Moreover, this result can be considered as another approach to integer optimization.

Similar content being viewed by others

References

Akian M., Menaldi J.L. and Sulem A. (1996). On an investment-consumption model with transaction costs. SIAM J. Control Optim. 34(1): 329–364

Chancelier, J.-P., Øksendal, B., Sulem, A.: Combined Stochastic Control and Optimal Stopping, and Application to Numerical Approximation of Combined Stochastic and Impulse Control. Department of Mathematics, University of Oslo (2000, Preprint)

Crama, Y., Schyns, M.: Simulated annealing for complex portfolio selection problems (2001, Preprint)

Davis M.H.A. and Norman A.R. (1990). Portfolio selection with transaction costs. Math. Oper. Res. 15(4): 676–713

Dumas B. and Luciano E. (1991). An exact solution to a dynamic portfolio choice problem under transaction costs. J. Finance XLVI(2): 577–595

Eastham J. and Hastings K. (1988). Optimal impulse control of portfolios. Math. Oper. Res. 13: 588–605

Gili, M., Kêllezi, E.: A Heuristic approach to portfolio optimization (2000, Preprint)

Øksendal, B., Sulem, A.: Optimal Consumption and Portfolio with Both Fixed and Proportional Transaction Costs. Department of Mathematics, University of Oslo (1999, Preprint)

Mansini M. and Speranza M: (1999). Heuristic algorithms for the portfolio selection problem with minimum transaction lots. Eur. J. Oper. Res. 114: 219–233

Schroder, M.: Optimal Portfolio Selection with Fixed Transaction Costs: Numerical Solutions. Working Paper, Michigan State University (1995).

Shreve S. and Soner H.M. (1994). Optimal investment and consumption with transaction costs. Ann. Appl. Probab. 4: 609–692

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Lajili-Jarjir, S., Rakotondratsimba, Y. The number of securities giving the maximum return in the presence of transaction costs. Qual Quant 42, 613–644 (2008). https://doi.org/10.1007/s11135-007-9126-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-007-9126-y