Abstract

Does advertising help consumers to find the products they need or push them to buy products they don’t need? In this paper we study the heterogeneous effects of advertising on consumer mistakes in the market for mortgage refinancing and quantify the resulting overall effect on the net present value of mortgage debt. Mortgage borrowers frequently make costly refinancing mistakes by either refinancing when they should wait, or by waiting when they should refinance. We assemble a novel data set that combines a borrower’s exposure to direct mail refinance advertising and their subsequent refinancing decisions. Even though borrowers would lose on average $1229 by refinancing, the average monthly exposure of 0.13 refinancing direct mail advertisements reduces the expected net present value of mortgage payments on average by $7 each month, because borrowers who should refinance are targeted by advertisers and more responsive to advertising. A counterfactual advertising policy that redirects all advertising to borrowers who should refinance would increase the gain in borrower welfare to $36.

Similar content being viewed by others

Notes

Ozga (1960), Stigler (1961), Telser (1964), Nelson (1970, 1974) and Grossman and Shapiro (1984) are references on informative advertising. Braithwaite (1928), Robinson (1933) or Kaldor (1950) are early references on persuasive advertising and Glaeser and Ujhelyi (2010) is a recent reference on deceptive advertising.

Following the terminology in the literature on “refinancing mistakes”, we refer to decisions as “mistakes” whenever an alternative decision yields a higher expected payoff, if we condition on all relevant information - whether this information was available to the decision maker or not. Such decisions are not always called mistakes. For example, such decisions can be optimal in models of rational inattention or models of costly reasoning (e.g. Andersen et al. 2017). However, we believe that such reinterpretations of “mistakes” do not need to change the interpretation of our results. A rationally inattentive borrower for example, who fails to take advantage of lower interest rates, would still benefit from advertising that draws her attention. A rationally inattentive borrower who should not refinance might be harmed by advertising that draws her attention even if she does not refinance, however.

For example Keys et al. (2016) estimate that the median loss among households who fail to refinance when the interest rate reaches the optimal trigger rate is $11,500.

Mass advertising data are available from Kantar Media.

CRISM combines credit bureau data from Equifax matched to the loan-level McDash loan servicing data (formerly Lender Processing Service).

Andersen et al. (2017) point out that studying refi mistakes with US data can be problematic because the borrower characteristics are typically only observed at the time of origination.

It is also worth noting that our estimates of the average effect of advertising are relatively small and in some specifications not statistically significant at conventional levels. This suggests that the endogeneity concern due to targeting based on unobservables might be limited.

As examples of targeted direct mailings, Figs. 1 and 2 in Appendix A are examples of targeted direct mail advertisements based on public records and credit bureau records, respectively.

A more detailed discussion of endogeneity can be found in Section 4.

Dubois et al. (2016) is an exception. They rely on a structural model and quantify the effect of advertising under alternative assumptions about the mechanism by which advertising affects decision making.

However, this is not necessarily the case as we discuss in Section 2.3.

Notice however that our framework rules out some mechanisms by which advertising affects decision making. For details see the discussion of the theoretical advertising literature at the end of Section 2.

See Heidhues (2016) for a theoretical contribution.

We only consider the direct effects of advertising on consumer welfare, not potential equilibrium effects (e.g. price changes).

As consumers who wait have the option to buy later uwait consists of an immediate payoff and a continuation value. If receiving advertising today is informative for consumers to predict the probability of receiving advertising in the future the continuation value would depend on a. By assuming that uwait does not depend on a, we also rule out this possibility.

To estimate ubuy (x) − uwait (x) we would typically follow a revealed preference approach and assume that consumers make no mistakes.

We introduce separate notation for the current mortgage rate because the optimal refinancing policy can be characterized by a trigger mortgage rate.

We provide details about the calculation of NPVj(r,x; σ) in Section 5.

Johnson et al. (2015) have survey measures of time preferences and risk aversion and find that they cannot explain the failure of households to refinance their mortgage. They also have survey measures of the future moving propensity, which helps to rationalize some of the apparent refinancing mistakes. In one of our robustness checks we allow for heterogeneous moving propensities and find similar estimates of differential responsiveness as in the baseline estimates with a uniform moving propensity.

We find that borrowers who should refinance are more responsive to advertising. This suggests that at least some of these borrowers make mistakes or are inattentive and their failure to refinance despite low interest rates cannot be rationalized by unobservables such as time preferences, risk aversion or future moving propensity.

Conceptually, there is a “model free” alternative to study refinancing mistakes by simply comparing the realized streams of mortgage payments of borrowers who refinanced and those who did not. In practice, however, this approach would require data over a very long time period to ensure that the realized path of mortgage rates approximates rational expectations. For example, the mortgage rates were decreasing over the first half of our sample period so the mistakes of borrowers who failed to refinance during this time appeared “right” ex post.

Akerlof and Shiller (2015) (“Advertising as Storytelling”) emphasize this aspect: “... It’s not just that we acquire new ’information’; we change our point of view and interpret information in new ways. Importantly, these evolutions of our thoughts mean that our opinions, and the decisions that are based on them, may be quite inconsistent. These descriptions of human thinking as narrative, or like narrative — so that it will not naturally, inevitably, be consistent—gives a role for advertising.” On the role of advertisers they write: “...advertisers are supposed to enhance the sales of the companies that hire them, even if those sales reduce consumers’ well being.”

See also Kaldor (1950): “As a means of supplying information it may be argued that advertising is largely biased and deficient. Quite apart from the making of deliberately faked claims about products which legislation and professional etiquette have never succeeded in suppressing, the information supplied in advertisements is generally biased, in that it concentrates on particular features to the exclusion of others; makes no mention of alternative sources of supply; and it attempts to influence the behavior of the consumer, not so much by enabling him to plan more intelligently through giving more information, but by forcing a small amount of information through its sheer prominence to the foreground of consciousness.”

Nelson (1974) who develops models a model informative advertising discusses deceptive advertising informally. Recently, formal models of deceptive advertising have been studied by Glaeser and Ujhelyi (2010), Hattori and Higashida (2012), Hattori (2014), Corts (2014), Piccolo et al. (2015a, 2015b) and Rhodes and Wilson (2015).

The FTC warns consumers specifically about deceptive mortgage advertising and explains “What the Ads Say” and “What the Ads Don’t Say” (http://www.consumer.ftc.gov/articles/0087-deceptive-mortgage-ads). Under the Consumer Financial Protection Act the Consumer Financial Protection Bureau (CFPB) is authorized to take action against deceptive lending acts.

Our version of the Mintel data set contains credit bureau data from TransUnion such as the outstanding mortgage loan balance.

We approximate a borrower’s updated house value using the house value at loan origination and a county-level house price index provided by CoreLogic.

We obtain data on r from Freddie Mac’s website (www.freddiemac.com/pmms/pmms30.html).

The fraction of all refi ads sent to those who should wait can be calculated as follows: \(0.85=\frac {0.12*25021}{0.12*25021 + 0.23*2337}\).

The data is available at https://fred.stlouisfed.org/series/MORTGAGE30US. In a robustness check, we allow different borrowers to have access to different interest rates to account for possible differences in default risk or mortgage shopping costs.

This is the case for 8.5% of all observations.

Later we show that our results are similar if we consider refinancing within one, two or four quarters instead.

In the baseline specification we assume that all borrowers have access to a uniform market mortgage rate. In Table 15 in Appendix D we allow interest rates to vary across borrowers.

The proportions for the five bins are 19%, 22%, 30%, 21% and 9%, respectively. The last bin is smaller than the other bins, because we want to make sure that there is a separate bin for borrowers who should refinance. We have also obtained estimates with quintile bins, which results in qualitatively similar results. In earlier drafts we have also obtained estimates where we interact a directly with dADL(x,r) instead of with bins for dADL(x,r). One disadvantage of such a less flexible specification is that for sufficiently negative values of dADL(x,r) the estimates imply that advertising has a negative effect on the purchase probability if the estimated coefficient on the interaction term is positive.

For a subsample of borrowers we also observe education and occupation but we found these not to be important for refinancing behavior.

The specification is fairly flexible with respect to dADL(x,r), but less so for Z. A more flexible parametric or even nonparametric specification for Z would be desirable but in light of our sample size we chose this less flexible functional form.

In more recent years the Mintel sample includes respondents who are panelists, whereas the sample was a repeated cross-section in earlier years. Therefore we also experimented with specifications with borrower fixed effects. However, we only have within borrower-variation for some borrowers. These estimates therefore rely heavily on the functional form of the linear probability model and should be interpreted with caution. We also estimated specifications with county-month fixed effects, which suffer from a similar problem. The estimates with these specifications are qualitatively similar to estimates we present.

As examples of targeted direct mailings, Figs. 1 and 2 in Appendix A are examples of targeted direct mail advertisements based on public records and credit bureau records, respectively.

Another reason why advertisers rely on credit bureau information for targeting, is that they are also concerned with targeting borrowers with good credit scores, whose loans can be securitized through Fannie Mae, Freddie Mac or Ginnie Mae.

For example, Experian provides a tool for mortgage advertisers to generate a mailing list: https://www.experian.com/small-business/marketinglist/mortgage-List.jsp

We are very grateful to Hank Korytkowski from Equifax for explaining how advertisers assemble their mailing lists in this market.

Mortgage servicers collect interest and principal payments from borrowers and advance them to the investors who hold mortgage backed securities.

In a targeting regression in Table 11 in Appendix C the R2 is about 10 percent. Notice that more than 75 percent of advertising recipients receive exactly one piece of advertising in that month. Hence the targeting regression is close to a linear probability model.

Our interpretation of this R2 is that a large fraction of the unexplained variation in advertising exposure is due to lender characteristics. Lender characteristics that vary the profitability of advertising but do not affect the borrower’s payoff from refinancing do not lead to an endogeneity problem in the responsiveness regressions. For example the cost of capital, cost of underwriting and cost of warehousing the loan before selling it on the secondary market can vary across lenders and time.

See for example Fig. 2 in Appendix A: “This ’prescreened’ offer of credit is based on information in your credit report indicating that you meet certain criteria.”

Notice that the IP address can generally not be used to infer the street address, but only the proximate area and the Internet Service Provider.

We also omit county and quarter fixed effects from the specification used for the future refi policy, because we have only few observations for most counties and some quarters and can therefore not consistently estimate the fixed effects. Notice however, that we use our baseline estimates to calculate Δσ (a,r,x) in Eq. 4, because the fixed effects cancel out in this difference and predicted refi probabilities outside of [0, 1] are not problematic.

Refi loans are likely to be similar to most advertised products for which E [Δu (x)] is presumably also negative, so the average consumer would make a mistake if she buys the product. Unlike for refi loans, we cannot measure E [Δu (x)] for most product. However, E [Δu (x)] is likely to be very negative for products such as prescription drugs. Moreover, E [Δu (x)] is likely somewhat negative for most products except for those that are purchased by the majority of consumers. Hence, to the extent that advertising affects only Δσ and not Δu (x), advertising for these products can only be beneficial if the effects of differential responsiveness dominate the effect of consumer composition.

Recall that “Should Wait” and “Should Refinance” are derived from the optimal refinancing policy by ADL. Therefore, ΔNPV (r,x; σ) is positive for some borrowers who “should wait”. This is because ΔNPV (r,x; σ) does not assume that borrowers refinance optimally in the future. Instead, we assume that they follow the estimated refinancing policy. As the borrowers will not be able to exploit low interest rates in the future optimally, some borrower who should wait according to the ADL model, would be better off by refinancing today.

Table 11 in Appendix C is a targeting regression which shows that the number of advertisements a increases substantially if dADL(x,r) increases.

Publicly available records on house transactions can only be used to estimate the remaining principal balance and the interest rate of a mortgage.

References

Ackerberg, D.A. (2001). Empirically distinguishing informative and prestige effects of advertising. RAND Journal of Economics, 316–333.

Ackerberg, D.A. (2003). Advertising, learning, and consumer choice in experience good markets: an empirical examination. International Economic Review, 44(3), 1007–1040.

Agarwal, S., Driscoll, J.C., Laibson, D.I. (2013). Optimal mortgage refinancing: a closed-form solution. Journal of Money, Credit and Banking, 45(4), 591–622.

Agarwal, S., Rosen, R.J., Yao, V. (2015). Why do borrowers make mortgage refinancing mistakes? Management Science, 62(12), 3494–3509.

Aizawa, N., & Kim, Y.S. (2015). Advertising and risk selection in health insurance markets.

Akerlof, G.A., & Shiller, R.J. (2015). Phishing for Phools: the economics of manipulation and deception. Princeton University Press.

Andersen, S., Campbell, J.Y., Nielsen, K.M., Ramadorai, T. (2017). Inattention and inertia in household finance: evidence from the danish mortgage market. Available at SSRN 2463575.

Bagwell, K. (2007). The economic analysis of advertising. Handbook of Industrial Organization, 3, 1701–1844.

Becker, G.S., & Murphy, K.M. (1993). A simple theory of advertising as a good or bad. The Quarterly Journal of Economics, 941–964.

Braithwaite, D. (1928). The economic effects of advertisement. The Economic Journal, 16–37.

Brown, J., Hossain, T., Morgan, J. (2010). Shrouded attributes and information suppression: evidence from the field. The Quarterly Journal of Economics, 125(2), 859–876.

Buchak, G., Matvos, G., Piskorski, T., Seru, A. (2017). FinTech, regulatory arbitrage and the rise of shadow banks. Discussion paper, National Bureau of Economic Research.

Butters, G.R. (1977). Equilibrium distributions of sales and advertising prices. The Review of Economic Studies, 465–491.

Campbell, J.Y. (2006). Household finance. The Journal of Finance, 61(4), 1553–1604.

Campbell, J.Y., & Cocco, J.F. (2015). A model of mortgage default. The Journal of Finance.

Chetty, R., Looney, A., Kroft, K. (2009). Salience and taxation: theory and evidence. The American Economic Review, 99(4), 1145–1177.

Ching, A.T., & Ishihara, M. (2012). Measuring the informative and persuasive roles of detailing on prescribing decisions. Management Science, 58(7), 1374–1387.

Corts, K.S. (2014). Finite optimal penalties for false advertising. The Journal of Industrial Economics, 62(4), 661–681.

Dubois, P., Griffith, R., O’Connell, M. (2016). The effects of banning advertising in junk food markets.

Gabaix, X., & Laibson, D. (2006). Shrouded attributes, consumer myopia, and information suppression in competitive markets*. The Quarterly Journal of Economics, 121(2), 505.

Glaeser, E.L., & Ujhelyi, G. (2010). Regulating misinformation. Journal of Public Economics, 94(3), 247–257.

Goldfarb, A., & Tucker, C.E. (2011). Privacy regulation and online advertising. Management Science, 57(1), 57–71.

Green, R.K., & LaCour-Little, M. (1999). Some truths about ostriches: who doesn’t prepay their mortgages and why they don’t. Journal of Housing Economics, 8, 233–248.

Grodzicki, D. (2015). Competition and customer acquisition in the US credit card market, discussion paper working paper. Department of Economics, The Pennsylvania State University.

Grossman, G.M., & Shapiro, C. (1984). Informative advertising with differentiated products. The Review of Economic Studies, 51(1), 63–81.

Gurun, U.G., Matvos, G., Seru, A. (2016). Advertising expensive mortgages. Journal of Finance.

Han, S. (2015). Information, contract design, and unsecured credit supply: evidence from credit card mailings.

Han, S., Keys, B.J., Li, G. (2013). Unsecured credit supply over the credit cycle: evidence from credit card mailings. Finance and Economics Discussion Paper Series Paper, (2011-29).

Hastings, J.S., Hortacsu, A., Syverson, C. (2013). Sales force and competition in financial product markets: the case of Mexico’s social security privatization. Discussion paper, National Bureau of Economic Research.

Hattori, K. (2014). Misleading advertising and minimum quality standards. Information Economics and Policy, 28, 1–14.

Hattori, K., & Higashida, K. (2012). Misleading advertising in duopoly. Canadian Journal of Economics/Revue canadienne d’économique, 45(3), 1154–1187.

Heidhues, P. (2016). Naivete-based discrimination. The Quarterly Journal of Economics, qjw042.

Heidhues, P., & Koszegi, B. (2010). Exploiting naivete about self-control in the credit market. American Economic Review, 100(5), 2279–2303.

Honka, E., Hortaċsu, A., Vitorino, M.A. (2016). Advertising consumer awareness and choice: evidence from the US banking industry. Forthcoming at The RAND Journal of Economics.

Johnson, J.P. (2013). Targeted advertising and advertising avoidance. The RAND Journal of Economics, 44(1), 128–144.

Johnson, E., Meier, S., Toubia, O. (2015). Money left on the kitchen table: exploring sluggish mortgage refinancing using administrative data, surveys, and field experiments. Columbia University Working Paper.

Kaldor, N. (1950). The economic aspects of advertising. The Review of Economic Studies, 18(1), 1–27.

Keys, B.J., Pope, D.G., Pope, J.C. (2016). Failure to refinance. Journal of Financial Economics, 122(3), 482–499.

Marshall, A. (1919). Industry and trade: a study of industrial technique and business organization. Macmillan.

Nelson, P. (1970). Information and consumer behavior. The Journal of Political Economy, 311–329.

Nelson, P. (1974). Advertising as information. Journal of Political Economy, 82(4), 729–754.

Nichols, L.M. (1985). Advertising and economic welfare. The American Economic Review, 75(1), 213–218.

Ozga, S.A. (1960). Imperfect markets through lack of knowledge. The Quarterly Journal of Economics, 29–52.

Piccolo, S., Tedeschi, P., Ursino, G. (2015a). How limiting deceptive practices harms consumers. The RAND Journal of Economics, 46(3), 611–624.

Piccolo, S., Tedeschi, P., Ursino, G., et al. (2015b). Deceptive advertising with rational buyers discussion paper. Università Cattolica del Sacro Cuore, Dipartimenti e Istituti di Scienze Economiche (DISCE).

Renault, R. (2015). Advertising in markets. Handbook of Media Economics, 1A, 121.

Rhodes, A., & Wilson, C.M. (2015). False advertising. Available at SSRN 2716692.

Robinson, J. (1933). Economics of imperfect competition. MacMillan and Co.

Ru, H., & Schoar, A. (2016). Do credit card companies screen for behavioral biases?, Working Paper 22360, National Bureau of Economic Research.

Sanderson, E., & Windmeijer, F. (2016). A weak instrument F-test in linear IV models with multiple endogenous variables. Journal of Econometrics, 190(2), 212–221.

Schwartz, A. (2006). Household refinancing behavior in fixed rate mortgages, unpublished paper. Harvard University.

Seim, K., Vitorino, M.A., Muir, D.M. (2016). Drip pricing when consumers have limited foresight: evidence from driving school fees.

Shapiro, B. (2016). Positive spillovers and free riding in advertising of prescription pharmaceuticals. The case of antidepressants. Browser download this paper.

Sinkinson, M., & Starc, A. (2015). Ask your doctor? Direct-to-consumer advertising of pharmaceuticals. Discussion paper, National Bureau of Economic Research.

Stigler, G.J. (1961). The economics of information, The Journal of Political Economy, 213–225.

Stigler, G.J., & Becker, G.S. (1977). De gustibus non est disputandum. The American Economic Review, 76–90.

Telser, L.G. (1964). Advertising and competition. Journal of Political Economy, 72(6), 537–562.

Tucker, C.E. (2012). The economics of advertising and privacy. International Journal of Industrial Organization, 30(3), 326–329.

Acknowledgments

We thank Sanjog Misra (discussant), Richard Rosen, John Driscoll and Naoki Aizawa for comments that helped to improve the paper. Pete Jacobsen and Meher Islam provided outstanding research assistance. We thank Hank Korytkowski from Equifax for explaining how refi advertisers assemble their mailing lists. The analysis and conclusions set forth are those of the authors and do not indicate concurrence by other members of the staff, by the Board of Governors, or by the Federal Reserve Banks.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Direct mail examples

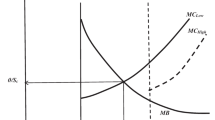

Appendix B: ADL trigger rate

The optimal trigger rate is given by

where W is the principal branch of the Lambert W −function and

Here, λ is the expected real rate of exogenous mortgage repayment and κ is the tax-adjusted refinancing cost. Table 9 summarizes the variables and parameters that enter the ADL threshold. The table also shows the parameter values suggested by ADL, which we use in our baseline estimates.

In robustness checks we explore the sensitivity of our findings to changes in the discount rate ρ and the standard deviation of the mortgage rate σ. The discount rate affects the trade-off between paying the upfront refinancing cost and future interest savings. For example consider a borrower with a remaining principal of M = $300, 000, a remaining term of Γ = 25 years and a mortgage rate of i0 = 0.06. Under the standard value for ρ = 0.05 we obtain an optimal trigger rate of 0.0467 for this borrower. The threshold increases to 0.0474 for ρ = 0.025 and decreases to 0.0461 for ρ = 0.075. The standard deviation of the mortgage rate that the borrowers expect affects the option value of waiting. For example, under the standard value σ = 0.0109 the optimal trigger rate is 0.0467, which increases to 0.0501 for σ = 0.0218 and decreases to 0.0419 for σ = 0.0054.

Appendix C: Additional tables

Appendix D: Differential responsiveness robustness checks

1.1 Alternative parameters for the optimal trigger rate

For our baseline estimates we use the parameters for the optimal trigger suggested by Agarwal et al. (2013) that are also used in Keys et al. (2016) and Agarwal et al. (2015). Tables 13 shows results for alternative parameter values. The discount rate ρ = 0.05 is either increased to ρ = 0.075, which leads to a lower trigger rate, or decreased to ρ = 0.025, which leads to a higher trigger rate. Similarly, the annualized interest rate of the mortgage rate σ = 0.01 is either increased to σ = 0.02, which reduces the optimal trigger rate, or decreased to σ = 0.005, which increases the optimal trigger rate. These changes have only a minor impact on the estimates. Estimates for the main coefficient of interest β1 range from 0.0142 to 0.0157.

1.2 Heterogeneous moving propensity

The optimal trigger rate suggested by ADL assumes that borrowers move with a probability of 10% per year. In reality, the moving propensity varies across borrowers. Importantly, if borrowers foresee that they will move in the near future this can rationalize some of the behavior that appears to be a refi mistake. Conversely, if the borrowers know that their moving probability is lower than 10% this can explain some behavior that appears to be premature refinancing. If the moving propensity is not only known to the borrower, but also to the advertisers, and the advertisers target borrowers who are more likely to refinance, i.e. borrowers with low moving propensity, our findings could be explained by reverse causality.

To investigate this issue we predict heterogeneous moving propensities using borrower and loan characteristics. We consider not only moving but also “windfall prepayments” because they reduce the incentive to refinance in the same fashion as moving if they are anticipated by the borrower. We regress a dummy variable that captures moving and windfall prepayments on borrower and loan characteristics to predict heterogeneous moving propensities. We normalize the estimated moving propensities such that the mean is 10% to isolate the effect of heterogeneity rather than a shift of the mean.

Table 14 shows estimates using the estimated heterogeneous moving propensities. The estimates are similar to our baseline estimates which suggests that our finding is not driven by unobservable heterogeneous moving propensities.

Rights and permissions

About this article

Cite this article

Grundl, S., Kim, Y.S. Consumer mistakes and advertising: The case of mortgage refinancing. Quant Mark Econ 17, 161–213 (2019). https://doi.org/10.1007/s11129-018-9207-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-018-9207-3