Abstract

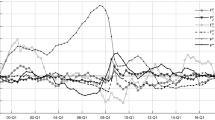

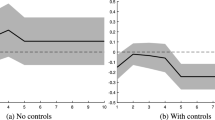

We estimate exchange rate pass-through (PT) into import, producer and consumer price indexes for nine OECD countries, using a method proposed by Uhlig (2005). In a Vector Autoregression (VAR) model, we identify the exchange rate shock by imposing restrictions on the signs of impulse responses for a small subset of variables. These restrictions are consistent with a large class of theoretical models and previous empirical findings. We find that exchange rate PT is less than one at both short and long horizons. Among three price indexes, exchange rate PT is greatest for import price index and smallest for consumer price index. In addition, greater exchange rate PT is found in an economy which has a smaller size, higher import share, more persistent exchange rate, more volatile monetary policy, higher inflation rate, and less volatile aggregate demand.

Similar content being viewed by others

Notes

According to Obstfeld (2002), two conditions are required for a strong expenditure-switching effect: high exchange rate PT to import prices, but low exchange rate PT to consumer prices.

The cost includes re-tagging goods, revising and reprinting catalogues, and advertising.

Exchange rate changes are usually perceived as cost shocks for an exporter (see Yang 1997).

Industrial production is used because GDP is not available at a monthly frequency.

The nominal effective exchange rate of country j is constructed as the trade-weighted average of bilateral exchange rates between country j and its trading partners:

$$ NE{R_j} = \Pi_{{i = 1}}^qER_{{i,j}}^{{{\omega_i}}}, $$Where ER i,j is the index of bilateral nominal exchange rate between country i and j, expressed as units of currency j per unit of currency i. The weight, ω i , is the average share of imports of country j from country i during our sample period. For each country, q largest trading partners are included such that at least 80% of that country’s imports are covered in our calculation. The foreign export price index is calculated similarly.

Detailed description of the methodology is available in Uhlig (2005).

The posterior distribution is derived under the assumption of a diffuse Jeffries prior over the parameters of the VAR.

Drawing from flat prior on the unit sphere will make the results independent of the chosen decomposition of ∑. Thus, reordering the variables and choosing different Choleski decompositions in order to parameterize the impulse vectors will not yield different results.

We set n 1 = n 2 = 500, so there are 250,000 draws in total.

The impulse responses of output gaps and interest rates are not presented in the paper, but available upon request.

Our results do not change qualitatively in the simple correlation coefficients. Results of the simple correlation coefficients are available upon request.

We follow McCarthy (2007) in measuring the exchange rate volatility and persistence.

We thank the referee for suggesting we add more countries into our sample to alleviate this problem.

References

Bache IW (2005) Assessing the structural VAR approach to exchange rate pass-through, Norges Bank Working Paper, No. 31

Burstein A, Eichenbaum M, Rebelo S (2005) Large devaluations and the real exchange rate. J Polit Econ 113:742–784

Burstein A, Eichenbaum M, Rebelo S (2007) Modeling exchange rate passthrough after large devaluations. J Monetary Econ 54:346–368

Campa JM, Goldberg L (2005) Exchange rate pass-through into import prices. Rev Econ Stat 87:660–679

Canova F, Pina J (1999) Monetary policy misspecification in VAR models, CEPR Discussion Paper, No.2333

Choudhri EU, Hakura D (2006) Exchange rate pass-through to domestic prices: does the inflationary environment matter? J Int Money Finance 25:614–639

Choudhri EU, Faruqee H, Hakura D (2005) Explaining the exchange rate pass-through in different prices. J Int Econ 65:349–374

Clarida R, Gali J, Gertler M (1998) Monetary policy rules in practice: some international evidence. Eur Econ Rev 42:1033–1067

Clark T (1999) The responses of prices at different stages of production to monetary policy shocks. Rev Econ Stat 81:420–433

Devereux M, Genberg H (2010) Currency appreciation and current account adjustment. J Int Money Finance 26(4):570–586

Devereux MB, Engel C, Storgarrd P (2003) Endogenous exchange rate pass-through when nominal prices are set in advance. J Int Econ 63:263–291

Engel C, West KD (2010) Global interest rates, currency returns, and the real value of the dollar. Am Econ Rev Pap Proc 100(2):562–67

Feinberg R (1986) The interaction of foreign exchange and market power effects on German domestic prices. J Ind Econ 35:61–70

Feinberg R (1989) The effects of foreign exchange movements on U.S. domestic prices. Rev Econ Stat 71:505–11

Hahn E (2003) Pass-through of external shocks to Euro area inflation, European Central Bank Working Papers, No. 243

Ito T, Sasaki Y, Sato K (2005) Pass-through of exchange rate changes and macroeconomic shocks to domestic inflation in East Asian Countries, RIETI Discussion Paper Series, No. 05-E-020

Kim Y (1990) Exchange rates and import prices in the United States: a varying-parameter estimation of exchange-rate pass-through. J Bus Econ Stat 8:305–315

Levchenko A, Lewis L, Tesar L (2009) The collapse of International Trade during the 2008–2009 crisis: In Search of the Smoking Gun, Research Seminar in International Economics Discussion Paper, No. 592

Mann CL (1986) Prices, profit margins and exchange rates. Fed Reserve Bull 72:366–79

McCarthy J (2007) Pass through of exchange rates and import prices to domestic inflation in some industrialized economies. East Econ J 33:511–537

Obstfeld M (2002) Exchange rates and adjustments: perspectives from the new open economy macroeconomics, monetary and economic studies (Special Edition)

Rudebusch GD (1998) Do measures of monetary policy in a VAR make sense? Int Econ Rev 39:907–931

Shambaugh J (2008) A new look at pass-through. J Int Money Finance 27:560–591

Sims C (1988) Bayesian skepticism on unit root econometrics. J Econ Dyn Control 12:463–474

Taylor JB (2000) Low inflation, pass-through, and the pricing power of firms. Eur Econ Rev 44:1389–1408

Uhlig H (2005) What are the effects of monetary policy on output? Results from an agnostic identification procedure. J Monetary Econ 52:381–419

Wang J (2010) Durable goods and the collapse of global trade. Economic Letter 5(2) Federal Reserve Bank of Dallas

Wei S, Parsley D (1995) Purchasing power disparity during the floating rate period: exchange rate volatility, trade barriers, and other culprits, NBER working paper, No.5032

Yang JW (1997) Exchange rate pass-through in U.S. manufacturing industries. Rev Econ Stat 79:95–104

Yang JW (1998) Pricing-to-market in U.S. imports and exports: a time series and cross-sectional study. Q Rev Econ Finance 38:843–861

All views are those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of Dallas or the Federal Reserve System. We thank Editor George Tavlas and an anonymous referee for many constructive comments and suggestions. We would also like to thank participants at various seminars and conferences for comments and Janet Koech for excellent research assistance.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

An, L., Wang, J. Exchange Rate Pass-Through: Evidence Based on Vector Autoregression with Sign Restrictions. Open Econ Rev 23, 359–380 (2012). https://doi.org/10.1007/s11079-010-9195-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-010-9195-8