Abstract

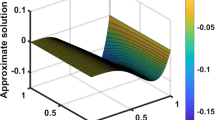

In the financial market, the change in price of underlying stock following fractal transmission system is modeled by time-fractional Black-Scholes partial differential equations (PDEs). In this paper, we propose a numerical scheme on uniform mesh for solving time-fractional Black-Scholes PDEs governing European options. The fractional time derivative defined in the Caputo sense is discretized by using the classical L1-scheme and the spatial derivatives are discretized by the cubic spline method. The stability and convergence of the proposed method are analyzed and shown to be second order accurate in space with \((2-\alpha )\) order accuracy in time. Two numerical examples with exact solutions are presented to verify the efficiency and accuracy of the method validating the theoretical results. Finally, three different types of European options governed by time-fractional Black-Scholes PDE are priced using our proposed method as an application. Further, the impact of the order of time-fractional derivative on the option price is shown.

Similar content being viewed by others

Data availability

As no datasets were created or examined during the current study, data sharing is not applicable to this paper.

References

Ahmad, J., Shakeel, M., Hassan, Q.M.U., Mohyud-Din, S.: Analytical solution of Black-Scholes model using fractional variational iteration method. Int. J. Mod. Math. Sci. 5, 133–142 (2013)

Akram, T., Abbas, M., Ismail, A.I., Sabri, S.R.M., Noor, N.M.: Numerical solution of the time fractional Black-Scholes equation using b-spline technique. In: AIP Conference Proceedings, AIP Publishing LLC, vol. 2423, p. 020002. (2021)

Black, F., Scholes, M.: The pricing of options and corporate liabilities. J. Polit. Econ. 81, 637–654 (1973)

Blanco-Cocom, L., Estrella, A.G., Avila-Vales, E.: Solution of the Black-Scholes equation via the Adomian decomposition method. Int. J. Appl. Math. Res. 2(4), 486 (2013)

Chen, W., Xu, X., Zhu, S.-P.: Analytically pricing double barrier options based on a time-fractional Black-Scholes equation. Comput. Math. Appl. 69, 1407–1419 (2015)

De Staelen, R.H., Hendy, A.S.: Numerically pricing double barrier options in a time-fractional Black-Scholes model. Comput. Math. Appl. 74, 1166–1175 (2017)

Diethelm, K.: The Analysis of Fractional Differential Equations: An Application-Oriented Exposition Using Differential Operators of Caputo Type. Springer Science & Business Media, Germany (2010)

Fadugba, S.E.: Homotopy analysis method and its applications in the valuation of European call options with time-fractional Black-Scholes equation. Chaos, Solitons Fractals. 141,110351 (2020)

Fall, A.N., Ndiaye, S.N., Sene, N.: Black-Scholes option pricing equations described by the Caputo generalized fractional derivative. Chaos, Solitons Fractals. 125, 108–118 (2019)

Golbabai, A., Nikan, O.: A computational method based on the moving least-squares approach for pricing double barrier options in a time-fractional Black-Scholes model. Comput. Econ. 55(1), 119–141 (2020)

Huang, J., Cen, Z.: Cubic spline method for a generalized Black-Scholes equation. Math. Probl. Eng. 7(3), 229–235 (2014)

Khader, M., Kumar, S., Abbasbandy, S.: Fractional homotopy analysis transforms method for solving a fractional heat-like physical model. Walailak J. Sci. Technol. (WJST) 13, 337–353 (2016)

Klibanov, M.V.: Stability Estimates for Some Parabolic Inverse Problems With the Final Overdetermination via a New Carleman Estimate. (2023). arXiv:2301.09735

Klibanov, M.V., Shananin, A.A., Golubnichiy, K.V., Kravchenko, S.M.: Forecasting stock options prices via the solution of an ill-posed problem for the Black-Scholes equation. Inverse Probl. 38(11), 115008 (2022)

Klibanov, M.V., Kuzhuget, A.V., Golubnichiy, K.V.: An ill-posed problem for the Black-Scholes equation for a profitable forecast of prices of stock options on real market data. Inverse Probl. 32(1), 015010 (2015)

Klibanov, M.V., Golubnichiy, K.V., Nikitin, A.V.: Application of Neural Network Machine Learning to Solution of Black-Scholes Equation. (2021). arXiv:2111.06642

Liu, F., Zhuang, P., Liu, Q.: Numerical Methods of Fractional Partial Differential Equations and Applications. Science Press, Beijing (2015)

Merton, R.C.: Theory of rational option pricing. Bell J. Econ. Manag. Sci. 4(1), 141–183 (1973)

Podlubny, I.: Fractional Differential Equations. Academic Press, San Diego (1999)

Rihan, F.A.: Numerical modeling of fractional-order biological systems. Abstr. Appl. Anal. 2013,1–11 (2013). Article ID:816803

Rogers, L.C.G.: Arbitrage with fractional Brownian motion. Math. Financ. 7(1), 95–105 (1997)

Roul, P.: A high accuracy numerical method and its convergence for time-fractional Black-Scholes equation governing european options. Appl. Numer. Math. 151, 472–493 (2020)

Sene, N., Fall, A.N.: Homotopy perturbation \(\rho \)-Laplace transform method and its application to the fractional diffusion equation and the fractional diffusion-reaction equation. Fractal Fractional. 3(2), 14 (2019)

Song, L., Wang, W.: Solution of the fractional Black-Scholes option pricing model by finite difference method. Abstr. Appl. Anal. 2013, 1–10 (2013)

Stynes, M., O’Riordan, E., Gracia, J.L.: Error analysis of a finite difference method on graded meshes for a time-fractional diffusion equation. SIAM J. Numer. Anal. 55, 1057–1079 (2017)

Tian, Z., Zhai, S., Ji, H., Weng, Z.: A compact quadratic spline collocation method for the time-fractional Black-Scholes model. J. Appl. Math. Comput. 66, 327–350 (2021)

Tien, D.N.: Fractional stochastic differential equations with applications to finance. J. Math. Anal. Appl. 397, 334–348 (2013)

Wilmott, P., Dewynne, J., Howison, S.: Option Pricing: Mathematical Models and Computation. Oxford Financial Press, Oxford (1993)

Wyss, W.: The fractional Black-Scholes equation. Fract. Calc. Appl. Anal. 3, 51–61 (2000)

Xiaozhong, Y., Lifei, W., Shuzhen, S., Xue, Z.: A universal difference method for time-space fractional Black-Scholes equation. Adv Differ. Equ. 71, 1–14 (2016)

Li, C., Zeng, F.: Numerical Methods for Fractional Calculus. CRC Press, Taylor & Francis Group (2015)

Zhang, J., Fu, X., Morris, H.: Construction of indicator system of regional economic system impact factors based on fractional differential equations. Chaos, Solitons Fractals. 128, 25–33 (2019)

Zhang, H., Liu, F., Turner, I., Yang, Q.: Numerical solution of the time fractional Black-Scholes model governing European options. Comput. Math. Appl. 71, 1772–1783 (2016)

Zhang, X., Sun, S., Wu, L.: \(\theta \)-difference numerical method for solving time-fractional Black-Scholes equation. Chin. Acad. Sci. Technol. Pap. 7, 1287–1295 (2014)

Acknowledgements

The authors wish to acknowledge the referees for their valuable comments and suggestions, which helped to improve the presentation.

Further, the first author would like to thank the Department of Science and Technology (DST) for providing the financial assistance under the scheme of INSPIRE Fellowship (IF190836), New Delhi, India.

Funding

Under the scheme of INSPIRE Fellowship (IF190836) by Department of Science and Technology (DST), India.

Author information

Authors and Affiliations

Contributions

JK implemented the method and obtained the theoretical estimates, and prepared the first version of the paper

SN proposed the numerical scheme and re-edited the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Kaur, J., Natesan, S. A novel numerical scheme for time-fractional Black-Scholes PDE governing European options in mathematical finance. Numer Algor 94, 1519–1549 (2023). https://doi.org/10.1007/s11075-023-01545-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11075-023-01545-6

Keywords

- Time-fractional Black-Scholes PDE

- Cubic spline method

- \( L 1\)-scheme

- European options

- Stability

- Convergence