Abstract

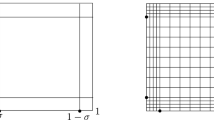

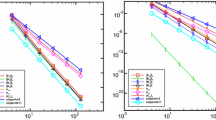

In this paper we present a convergence analysis of a positivity-preserving fitted finite volume element method (FVEM) for a generalized Black-Scholes equation transformed on finite interval, degenerating on both boundary points. We first formulate the FVEM as a Petrov-Galerkin finite element method using a spatial discretization, previously proposed by the author. The Gärding coercivity of the corresponding discrete bilinear form is established. We obtain stability and error bounds for the solution of the fully-discrete system. Analysis of the impact of the finite domain transformation on the numerical solution of the original problem is given.

Similar content being viewed by others

References

Achdou, Y., Pironneau, O.: Computational Methods for Option Pricing. SIAM Frontiers in Applied Mathematics (2005)

Angermann, L.: Discretization of the Black-Scholes operator with a natural left-hand side boundary condition. Far East J. Appl. Math. 30(1), 1–41 (2008)

Angermann, L., Wang, S.: Convergence of a fitted finite volume method for the penalized Black-Scholes equation governing European and American option pricing. Numer. Math. 106, 1–40 (2007)

Chernogorova, T., Valkov, R.: Finite volume difference scheme for a degenerate parabolic equation in the zero-coupon bond pricing. Math. Comp. Model. 54, 2659–2671 (2011)

Duffy, D.: Finite Difference Methods in Financial Engineering: A Partial Differential Approach. Wiley (2006)

Ehrhardt, M., Mickens, R.: A fast, stable and accurate numerical method for the Black-Scholes equation of American options. Int. J. Theor. Appl. Finance 11(5), 471–501 (2008)

Grosch, C.E., Orszag, S.A.: Numerical solution of problems in unbounded regions: coordinate transforms. J. Comput. Phys. 25, 273–296 (1977)

in’t Hout, K.J., Volders, K.: Stability and convergence analysis of discretizations of the Black-Scholes PDE with the linear boundary condition. IMA J. Numer. Anal. (2013). doi:10.1093/imanum/drs050

Gyulov, T., Valkov, R.: Classical and weak solutions for two models in mathematical finance. AIP Conf. Proc. 1410, 195–202 (2011)

Han, H., Wu, X.: A fast numerical method for the Black-Scholes equations of American options. SIAM J. Numer. Anal. 41, 2081–2095 (2003)

Mikula, K., Ševčovič, D., Stehlíková, B.: Analytical and Numerical Methods for Pricing Financial Derivatives. Nova Science Publishers Inc, Hauppauge (2011)

Kangro, R., Nicolaides, R.: Far field boundary condition for Black-Scholes equations. SIAM J. Numer. Anal. 38(4), 1357–1368 (2000)

Tavella, D., Randall, C.: Pricing Financial Instruments. Wiley, New York (2000)

Valkov, R.: Fitted finite volume method for a generalized Black-Scholes equation transformed on finite interval. Numer. Algor. (2013). doi:10.1007/s11075-013-9701-3

Windcliff, H., Forsyth, P.A., Vetzal, K.R.: Analysis of the stability of the linear boundary condition for the Black-Scholes equation. J. Comput. Finance 8, 65–92 (2004)

Wilmott, P., Howison, S., Dewynne, J.: The Mathematics of Financial Derivatives. Cambridge University Press, Cambridge (1995)

Wang, S.: A novel fitted volume method for the Black-Scholes equation governing option pricing. IMA J. Numer. Anal. 24, 699–720 (2004)

Zhu, Y.-l., Wu, X., Chern, I.-l.: Derivative Securities and Difference Methods. Springer, Berlin (2004)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Valkov, R. Convergence of a finite volume element method for a generalized Black-Scholes equation transformed on finite interval. Numer Algor 68, 61–80 (2015). https://doi.org/10.1007/s11075-014-9838-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11075-014-9838-8