Abstract

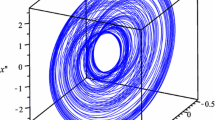

We have investigated the role of competitive mode for the generation of chaotic behavior in a financial dynamical system. Such type of events are very important in the light of stock market crush or volatile behavior. The competitive mode is a good approach other than the fixed point analysis. The character of mode frequencies and the attractor is analyzed numerically . Also, using an analytical method and Lagrange optimization, we were able to calculate the ultimate bound of the chaotic financial system. The method we have presented is simpler and more accurate than other methods that implicitly calculate the final boundary. The estimation of the ultimate bound can be used to study chaos synchronization. Numerical simulations illustrate the analytical results.

Similar content being viewed by others

References

Xu, E., Zhang, Y., Chen, Y.: Time-delayed local feedback control for a chaotic finance system. J Inequal Appl. 100 (2020). https://doi.org/10.1186/s13660-020-02364-2

Tacha, O.I., Volos, Ch.K., Kyprianidis, I.M., Stouboulos, I.N., Vaidyanathan, S., Pham, V.T.: Analysis, adaptive control and circuit simulation of a novel nonlinear finance system. Appl. Math. Comput. 276, 200–217 (2016)

Gao, Q., Ma, J.: Chaos and hopf bifurcation of a finance system. Nonlinear Dyn. 58, 209–216 (2009)

David, S.A., Machado, J.A.T., Quintino, D.D., Balthazar, J.M.: Partial chaos suppression in a fractional order macroeconomic model. Math. Comput. Simul. 122, 55–68 (2016)

Wang, Z., Huang, X., Shi, G.: Analysis of nonlinear dynamics and chaos in a fractional order financial system with time delay. Comput. Math. Appl. 62, 1531–1539 (2011)

Chen, W.C.: Nonlinear dynamics and chaos in a fractional-order financial system. Chaos Solitons Fractals 36–5, 1305–1314 (2008)

Bonyah, E.: Chaos in a 5-D hyperchaotic system with four wings in the light of non-local and non-singular fractional derivatives. Chaos Solitons Fractals 116, 316–331 (2018)

Van Gorder, R.A.: Shil’nikov chaos in the 4D Lorenz–Stenflo system modeling the time evolution of nonlinear acoustic-gravity waves in a rotating atmosphere. Nonlinear Dyn. 72, 837–851 (2013)

Yu, P.: Bifurcation, limit cycles and chaos of nonlinear dynamical systems, Bifurcation and Chaos in Complex Systems, pp. 92–120. Elsevier Science, Amsterdam (2006)

Ray, A., Saha, P., Chowdhury, A.R.: Competitive mode and topological properties of nonlinear systems with hidden attractor. Nonlinear Dyn. 88, 1989–2001 (2017). https://doi.org/10.1007/s11071-017-3357-9

Yu, P., Yao, W., Chen, G.: Analysis on topological properties of the Lorenz and the Chen attractors using GCM. Int. J. Bifur. Chaos 17, 2791–2796 (2007)

Choudhury, S.R., Van Gorder, R.A.: Competitive modes as reliable predictors of chaos versus hyperchaos and as geometric mappings accurately delimiting attractors. Nonlinear Dyn. 69, 2255–2267 (2012)

Van Gorder, R.A.: Emergence of chaotic regimes in the generalized Lorenz canonical form: a competitive modes analysis Nonlinear Dyn. 66(1–2), 153–160 (2011)

Saberi Nik, H., Van Gorder, R.A.: Competitive modes for the Baier–Sahle hyperchaotic flow in arbitrary dimensions. Nonlinear Dyn. 74, 581–590 (2013)

Rasoolzadeh, A., Tavazoei, M.S.: Prediction of chaos in non-salient permanent-magnet synchronous machines. Phys. Lett. A. 377, 73–79 (2012)

Choudhury, S.R., Mandragona, D.: A chaotic chemical reactor with and without delay: bifurcations, competitive modes, and amplitude death. Int. J. Bifurc. Chaos 29–2, 1950019 (2019)

Guhathakurta, K., Bhattacharya, B., Roy Chowdhury, A.: Testing non-linearity in emerging and developed markets. In: Roy, M., Sinha, Roy S. (eds.) International Trade and International Finance. Springer, New Delhi (2016). https://doi.org/10.1007/978-81-322-2797

Guhathakurta, K., Bhattacharya, B., Chowdhury, A.R.: Comparative analysis of asset pricing models based on log-normal distribution and tsallis distribution using recurrence plot in an emerging market. In: The Spread of Financial Sophistication through Emerging Markets Worldwide (Research in Finance, vol. 32, pp. 35–73. Emerald Group Publishing Limited, Bingley (2016). https://doi.org/10.1108/S0196-382120160000032003

Zbilut, J.P.: Use of recurrence quantification analysis in economic time series. In: Salzano, M., Kirman, A. (eds.) Economics: Complex Windows. New Economic Windows. Springer, Milano (2005). https://doi.org/10.1007/88-470-0

Leonov, G., Bunin, A., Koksch, N.: Attractor localization of the Lorenz system. Z. Angew. Math Mech. 67, 649–656 (1987)

Leonov, G.: Lyapunov dimension formulas for Henon and Lorenz attractors. St. Petersburg Math. J. 13, 1–12 (2001)

Leonov, G.: Lyapunov functions in the attractors dimension theory. J. Appl. Math. Mech. 76, 129–141 (2012)

Wang, P., Li, D., Wu, X., Lü, J., Yu, X.: Ultimate bound estimation of a class of high dimensional quadratic autonomous dynamical systems. Internat. J. Bifur Chaos. 21–9, 1–9 (2011)

Zhang, F., Liao, X., Zhang, G.: On the global boundedness of the Lu system. Appl. Math. Comput. 284, 332–339 (2016)

Kumar, D., Kumar, S.: In: Singh, V., Srivastava, H., Venturino, E., Resch, M., Gupta, V. (eds.) Ultimate numerical bound estimation of chaotic dynamical finance model, p. 171. Springer, Singapore (2016)

Wang, P., Zhang, Y., Tan, S., Wan, L.: Explicit ultimate bound sets of a new hyper-chaotic system and its application in estimating the Hausdorff dimension. Nonlinear Dyn. 74(1–2), 133–142 (2013)

Saberi Nik, H., Effati, S., Saberi-Nadjafi, J.: New ultimate bound sets and exponential finite-time synchronization for the complex Lorenz system. J. Complex. 31–5, 715–730 (2015)

Gao, W., Yan, L., Saeedi, M.H., Saberi-Nik, H.: Ultimate bound estimation set and chaos synchronization for a financial risk system. Math. Comput. Simul. 154, 19–33 (2018)

Zhang, F., Yang, G., Zhang, Y., Liao, X., Zhang, G.: Qualitative study of a 4D chaos financial system. Complexity 3789873 (2018). https://doi.org/10.1155/2018/3789873

Hu, X., Nie, L.: Exponential stability analysis of nonlinear systems with bounded gain error. J. Inequal. Appl. 296 (2019). https://doi.org/10.1186/s13660-019-2250-0

Acknowledgements

The authors express their sincere thanks to the anonymous referees for their rigorous comments and valuable suggestions helping to improve this paper.

Author information

Authors and Affiliations

Contributions

The authors declare that the study was realized in collaboration with equal responsibility. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interests

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Chien, F., Chowdhury, A.R. & Nik, H.S. Competitive modes and estimation of ultimate bound sets for a chaotic dynamical financial system. Nonlinear Dyn 106, 3601–3614 (2021). https://doi.org/10.1007/s11071-021-06945-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11071-021-06945-8