Abstract

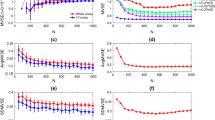

Complexity in time series is an intriguing feature of living dynamical systems such as financial systems, with potential use for identification of system state. Multiscale sample entropy (MSE) is a popular method of assessing the complexity in various fields. Inspired by Tsallis generalized entropy, we rewrite MSE as the function of q parameter called generalized multiscale sample entropy and surrogate data analysis (\(q\hbox {MSE}\)). qMSDiff curves are calculated with two parameters q and scale factor \(\tau \), which consist of differences between original and surrogate series \(q\hbox {MSE}\). However, the distance measure shows some limitation in detecting the complexity of stock markets. Further, we propose and discuss a modified method of generalized multiscale sample entropy and surrogate data analysis (\(q\hbox {MSE}_\mathrm{SS}\)) to measure the complexity in financial time series. The new method based on similarity and symbolic representation (\(q\hbox {MSDiff}_\mathrm{SS}\)) presents a different way of time series patterns match showing distinct behaviors of complexity and \(q\hbox {MSDiff}_\mathrm{SS}\) curves are also presented in two ways since there are two influence factors. Simulations are conducted over both synthetic and real-world data for providing a comparative study. The evaluations show that the modified method not only reduces the probability of inducing undefined entropies, but also performs more sensitive to series with different features and is confirmed to be robust to strong noise. Besides, it has smaller discrete degree for independent noise samples, indicating that the estimation accuracy may be better than the original method. Considering the validity and accuracy, the modified method is more reliable than the original one for time series mingled with much noise like financial time series. Also, we evaluate \(q\hbox {MSDiff}_\mathrm{SS}\) for different areas of financial markets. The curves versus q of Asia are greater than those of America and Europe. Moreover, American stock markets have the lowest \(q\hbox {MSDiff}_\mathrm{SS}\), indicating that they are of low complexity. While the curves versus \(\tau \) help to research their complexity from a different aspect, the modified method makes us have access to analyzing complexity of financial time series and distinguishing them.

Similar content being viewed by others

References

Darbellaya, G.A., Wuertzc, D.: The entropy as a tool for analysing statistical dependences in financial time series. Phys. A 287, 429–439 (2000)

Molgedey, L., Ebeling, W.: Local order, entropy and predictability of financial time series. EPJ B 15, 733–737 (2000)

Theiler, J., Eubank, S., Longtin, A., Galdrikian, B., Farmer, J.D.: Testing for nonlinearity in time series: the method of surrogate data. Phys. D 58, 77–94 (1992)

Baxter, M., King, R.G.: Measuring business cycles: approximate band-pass filters for economic time series. Rev. Econ. Stat. 81, 575–93 (1999)

Baldwin, R.A.: Use of maximum entropy modeling in wildlife research. Entropy 11, 854–866 (2009)

Machado, J.: Entropy analysis of systems exhibiting negative probabilities. Commun. Nonlinear Sci. Numer. Simul. 36, 58–64 (2016)

Sadeghpour, M., Salarieh, H., Vossoughi, G., Alasty, A.: Multi-variable control of chaos using PSO-based minimum entropy control. Commun. Nonlinear Sci. Numer. Simul. 16, 2397–2404 (2011)

Phillips, S.J., Anderson, R.P., Schapire, R.E.: Maximum entropy modeling of species geographic distributions. Ecol. Model. 190, 231–259 (2006)

Rényi, A.: On measures of entropy and information. In: Fourth Berkeley Symposium on Mathematical Statistics and Probability, vol. 1, pp. 547–561 (1961)

Fu, Z.T., Li, Q.L., Yuan, N.M., Yao, H.: Multi-scale entropy analysis of vertical wind variation series in atmospheric boundary-layer. Commun. Nonlinear Sci. Numer. Simul. 19, 83–91 (2014)

Yin, Y., Shang, P.: Modified cross sample entropy and surrogate data analysis method for financial time series. Phys. A 433, 17–25 (2015)

Tsallis, C.: Possible generalization of Boltzmann–Gibbs statistics. J. Stat. Phys. 52, 479–487 (1988)

Tsallis, C.: Some comments on Boltzmann–Gibbs statistical mechanics. Chaos Solitons Fractals 6, 539–559 (1995)

Schreiber, T.: Measuring information transfer. Phys. Rev. Lett. 85, 461–464 (2000)

Staniek, M., Lehnertz, K.: Symbolic transfer entropy. Phys. Rev. Lett. 100, 158101 (2008)

Pincus, S.M.: Approximate entropy as a measure of system complexity. Proc. Natl. Acad. Sci. USA 88, 2297–2301 (1991)

Yang, F.S., Hong, B., Tang, Q.Y.: Approximate entropy and its application to biosignal analysis. Nonlinear Biomed. Signal Proces. Dyn. Anal. Model. 2, 72–91 (2001)

Richman, J.S., Moorman, J.R.: Physiological time-series analysis using approximate entropy and sample entropy. Am. J. Physiol. Heart Circ. Physiol. 278, 2039–2049 (2000)

Yentes, J.M., Hunt, N.N., Schmid, K.K., et al.: The appropriate use of approximate entropy and sample entropy with short data sets. Ann. Biomed. Eng. 41, 349–365 (2013)

Costa, M., Goldberger, A.L., Peng, C.K.: Multiscale entropy analysis of biological signals. Phys. Rev. E 71, 021906 (2005)

Costa, M., Goldberger, A.L., Peng, C.K.: Multiscale entropy analysis of complex physiologic time series. Phys. Rev. Lett. 89, 068102 (2002)

Ahmed, M.U., Mandic, D.P.: Multivariate multiscale entropy: a tool for complexity analysis of multichannel data. Phys. Rev. E 84, 3067–76 (2011)

Lu, Y.F., Wang, J.: Multivariate multiscale entropy of financial markets. Commun. Nonlinear Sci. Numer. Simul. 52, 77–90 (2017)

Mao, X.G., Shang, P.J.: Transfer entropy between multivariate time series. Commun. Nonlinear Sci. Numer. Simul. 47, 338–347 (2017)

Silva, L., MurtaJr, L.: Evaluation of physiologic complexity in time series using generalized sample entropy and surrogate data analysis. Chaos 22, 043105 (2012)

Borges, E.P.: A possible deformed algebra and calculus inspired in nonextensive thermostatistics. Phys. A 340, 95–101 (2004)

Xia, J.N., Shang, P.J.: Multiscale entropy analysis of financial time series. Fluct. Noise Lett. 11, 1250033 (2012)

Xu, M.J., Shang, P.J., Huang, J.J.: Modified generalized sample entropy and surrogate data analysis for stock markets. Commun. Nonlinear Sci. Numer. Simul. 35, 17–24 (2016)

Tsallis, C.: Introduction to Nonextensive Statistical Mechanics. Springer, New York (2009)

Xu, M.J., Shang, P.J., Xia, J.N.: Traffic signals analysis using qSDiff and qHDiff with surrogate data. Commun. Nonlinear Sci. Numer. Simul. 28, 98–108 (2015)

Acknowledgements

The financial supports from the funds of the China National Science (61771035), the China National Science (61371130) and the Beijing National Science (4162047) are gratefully acknowledged. Our deepest gratitude goes to the editors and reviewers for their careful work and thoughtful suggestions that have helped improve this paper substantially.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Wu, Y., Shang, P. & Li, Y. Modified generalized multiscale sample entropy and surrogate data analysis for financial time series. Nonlinear Dyn 92, 1335–1350 (2018). https://doi.org/10.1007/s11071-018-4129-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11071-018-4129-x