Abstract

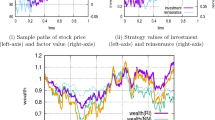

In this paper, we investigate the optimal investment-reinsurance strategy for an insurer with two dependent classes of insurance business, where the claim number processes are correlated through a common shock. It is assumed that the insurer can invest her wealth into one risk-free asset and multiple risky assets, and meanwhile, the instantaneous rates of investment return are stochastic and follow mean-reverting processes. Based on the theory of linear-quadratic control, we adopt a backward stochastic differential equation (BSDE) approach to solve the mean-variance optimization problem. Explicit expressions for both the efficient strategy and efficient frontier are derived. Finally, numerical examples are presented to illustrate our results.

Similar content being viewed by others

References

Abou-Kandil H, Freiling G, Ionescu V, Jank G (2003) Matrix Riccati equations in control and systems theory. Birkhäuser, Basel

Bäuerle N (2005) Benchmark and mean-variance problems for insurers. Math Methods Oper Res 62:159–165

Bai L, Cai J, Zhou M (2013) Optimal reinsurance policies for an insurer with a bivariate reserve risk process in a dynamic setting. Insurance Math Econom 53:664–670

Bai L, Zhang H (2008) Dynamic mean-variance problem with constraint risk control for the insurers. Math Methods Oper Res 68:181–205

Bender C, Kohlmann M (2000) BSDEs with stochastic Lipschitz condition. Universität Konstanz, Fakultät für Mathematik and Informatik

Bi J, Guo J (2013) Optimal mean-variance problem with constrained controls in a jump-diffusion financial market for an insurer. J Optim Theory Appl 157:252–275

Bi J, Liang Z, Xu F (2016) Optimal mean-variance investment and reinsurance problems for the risk model with common shock dependence. Insurance Math Econom 70:245–258

Bi J, Liang Z, Yuen KC (2019) Optimal mean-variance investment/reinsurance with common shock in a regime-switching market. Math Methods Oper Res 90:109–135

Chiu MC, Wong HY (2013) Mean-variance principle of managing cointegrated risky assets and random liabilities. Oper Res Lett 41:98–106

Fleming WH, Soner HM (2006) Controled Markov processes and viscosity solutions. Springer, New York

Kobylanski M (2000) Backward stochastic differential equations and partial differential equations with quadratic growth. Ann Probab 28:558–602

Liang Z, Bi J, Yuen KC, Zhang C (2016) Optimal mean-variance reinsurance and investment in a jump-diffusion financial market with common shock dependence. Math Methods Oper Res 84:155–181

Markowitz H (1952) Portfolio selection. J Finance 7:77–91

Rishel R (1999) Optimal portfolio management with partial observation and power utility function. Stochastic Analysis, Control, Optimization and Applications: a Volume in Honor of Fleming, Birkhäuser, pp 605-620

Shen Y (2015) Mean-variance portfolio selection in a complete market with unbounded random coefficients. Automatica 55:165–175

Shen Y, Zeng Y (2015) Optimal investment-reinsurance strategy for mean-variance insurers with square-root factor process. Insurance Math Econom 62:118–137

Shen Y, Zhang X, Siu TK (2014) Mean-variance portfolio selection under a constant elasticity of variance model. Oper Res Lett 42:337–342

Sun Z, Guo J (2018) Optimal mean-variance investment and reinsurance problem for an insurer with stochastic volatility. Math Methods Oper Res 88:59–79

Sun Z, Yuen KC, Guo J (2020) A BSDE approach to a class of dependent risk model of mean-variance insurers with stochastic volatility and no-short selling. J Comput Appl Math 366, 112413

Sun Z, Zhang X, Yuen KC (2020) Mean-variance asset-liability management with affine diffusion factor process and a reinsurance option. Scand Actuar J 3:218–244

Tian Y, Guo J, Sun Z (2021) Optimal mean-variance reinsurance in a financial market with stochastic rate of return. J Ind Manag Optim 17:1887–1912

Yuen KC, Liang Z, Zhou M (2015) Optimal proportional reinsurance with common shock dependence. Insurance Math Econom 64:1–13

Zhou J, Yang X, Guo J (2017) Portfolio selection and risk control for an insurer in the Lévy market under mean-variance criterion. Statist Probab Lett 126:139–149

Acknowledgements

This research was supported by the National Natural Science Foundation of China (Grant Nos. 11901344, 11931018, 12101602), the Fundamental Research Funds for the Central Universities (Grant No. 3122019139, 3122019156), the Shandong Provincial Natural Science Foundation, China (Grant No. ZR2019QA013), and Scientific Research Foundation for Introduced Scholars of Civil Aviation University of China (Grant No. 2020KYQD104).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Tian, Y., Sun, Z. & Guo, J. Optimal Mean-Variance Investment-Reinsurance Strategy for a Dependent Risk Model with Ornstein-Uhlenbeck Process. Methodol Comput Appl Probab 24, 1169–1191 (2022). https://doi.org/10.1007/s11009-021-09902-5

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11009-021-09902-5

Keywords

- Optimal investment-reinsurance strategy

- Common shock

- Mean-reverting processes

- Backward stochastic differential equation

- Efficient frontier