Abstract

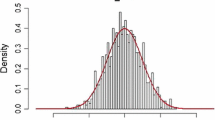

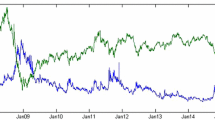

The daily asset (log) return is considered to consist of two parts, the positive and negative jump. These jumps are determined by the arrival of positive and negative news in the market, are not observable and their differences define the asset returns. In order to estimate the jumps, the basic discrete time-homogeneous linear Kalman filter is applied, in which all the noises are assumed to be normally distributed. Then, under the assumption that the estimated jumps have to be non-negative, the method of their pdfs’ truncation, according to the non-negativity constraints, is used, and it is accompanied by appropriate scaling. The fitting of the model is justified by examining the fitting of the estimated returns to the empirical ones. For that purpose, the daily Nasdaq returns during the three year period 2006-2008 are used.

Similar content being viewed by others

References

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Political Economy 81(3):637–659

Barbu VS, Limnios N (2008) Semi-Markov Chains and Hidden Semi-Markov Models toward Applications. Springer, New York

Carr P, Geman H, Madan DB, Yor M (2002) The fine structure of asset returns: An empirical investigation. J Business 75(2):305–332

Durbin J, Koopman SJ (2012) Time Series Analysis by State Space Methods, Second Edition. Oxford University Press, Oxford (UK)

Harvey AC (1989) Forecasting Structural Time Series Models and the Kalman Filter. Cambridge University Press, Cambridge (UK)

Kalman R (1960) A new approach to linear filtering and prediction problems. J Basic Engineering (Transactions of the ASME Series D) 82:35–45

Koopman SJ, Mallee M, Wel M (2010) Analyzing the Term Structure of Interest Rates using the Dynamic Nelson-Siegel Model with Time-Varying Parameters. J of Business and Economic Statistics 28(3):329–343

Mamon RS, Elliott RG (2007) Hidden Markov Models in Finance. Springer, New York

Merton RC (1973) Theory of rational option pricing. Bell Journal of Economics and Management Science 4(1):141–183

Polimenis V (2012) Information arrival as price jumps. Optimization: A Journal of Mathematical Programming and Operations Research 61(10):1179–1190

Racicot FE, Théoret R (2010) Forecasting stochastic volatility using the Kalman filter. An application to Canadian interest rates and Price-earnings Ratio. The IEB International Journal of Finance 1:28–47

Simon D (2006) Optimal State Estimation. Wiley, New York

Simon D, Simon DL (2010) Constraint Kalman filtering via density function truncation for turbofan engine health estimation. Int J of Systems Science 41(2):159–171

Theodosiadou O, Polimenis V, Tsaklidis G (2016) Sensitivity analysis of market and stock returns by considering positive and negative jumps. J of Risk Finance 17(4):456–472

Wells C (1996) The Kalman Filter in Finance. Springer, Dordrecht.

Wilhelm S, Manjunath BG (2010) tmvtnorm: A Package for the Truncated Multivariate Normal Distribution. The R Journal 2(1):25–29

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Theodosiadou, O., Tsaklidis, G. Estimating the Positive and Negative Jumps of Asset Returns Via Kalman Filtering. The Case of Nasdaq Index. Methodol Comput Appl Probab 19, 1123–1134 (2017). https://doi.org/10.1007/s11009-016-9532-5

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11009-016-9532-5