Abstract

This paper aims to determine if significant associations exist between audit quality and earnings management in less developed economies, providing their various shortcomings and differences. Five different measures of audit quality (auditor size, auditor industry specialization, auditor opinion, auditor change and timeliness of auditor report) were examined based on a sample of 337 non-financial Saudi listed firms from 2006 to 2009. The absolute value of discretionary accruals is used as a proxy for earnings management by using a cross-sectional variation of the Kothari model. The results of this research indicate that only auditor opinion indicates earnings management practice. The results support the argument that auditors are powerless in front of managerial opportunistic activities. Issues that may impair audit quality in Saudi Arabia are discussed.

Similar content being viewed by others

References

Abbott, L. J., Parker, S., & Peters, G. F. (2004). Audit committee characteristics and restatements. Auditing: A Journal of Practice & Theory, 23(1), 69–87.

Abdul Rahman, R., & Ali, F. H. M. (2006). Board, audit committee, culture and earnings management: Malaysian evidence. Managerial Auditing Journal, 21(7), 783–804.

Al-Abbas, M. (2009). Corporate governance and earnings management: An empirical study of the Saudi market. The Journal of American Academy of Business, Cambridge, 15(1), 45–74.

Albassam, W. M. (2014). Corporate governance, voluntary disclosure and financial performance: An empirical analysis of Saudi listed firms using mixed-methods of research design. Ph.D Thesis. University of Glasgow, United Kingdom. Available at: http://theses.gla.ac.uk/5280/

Alghamdi, S., & Alangari, H. (2005). The impacts of implementing quality review program on audit firms in the Kingdom of Saudi Arabia: An empirical study. Journal of King Abdul-Aziz: Economics and Administration., 19(2), 48–77.

Asehaly, M. (2006). Earnings management in Saudi Firms. Journal of Public Management, 46(3), 513–545.

Balsam, S., Krishnan, J., & Yang, J. S. (2003). Auditor industry specialization and earnings quality. Auditing: A Journal of Practice & Theory, 22(2), 71–97.

Bartov, E., Gul, F. A., & Tsui, J. S. L. (2001). Discretionary accruals models and audit qualifications. Journal of Accounting and Economics, 30(3), 421–452.

Becker, C., DeFond, M., Jiambalvo, J., & Subramanyam, K. R. (1998). The effect of audit quality on earnings management. Contemporary Accounting Research, 15(1), 22–39.

Bradshaw, M., Richardson, S., & Sloan, R. (2001). Do analysts and auditors use information in accruals? Journal of Accounting Research, 39, 45–74.

Butler, M., Leone, A. J., & Willenborg, M. (2004). An empirical analysis of auditor reporting and its association with abnormal accruals. Journal of Accounting and Economics, 37, 139–165.

Carcello, J., & Nagy, A. L. (2004). Client size, auditor specialization and fraudulent financial reporting. Managerial Auditing Journal, 19(5), 651–668.

Chang, J., & Lian Sun, H. (2009). Crossed-listed foreign firms’ earnings informativeness, earnings management and disclosures of corporate governance information under SOX. The International Journal of Accounting, 44, 1–32.

Charles, J., Stanley, C., & Charlotte, H. (2010). The imp act of audit quality on earnings management to achieve user reference points in EPS. Journal of Applied Business Research, 26(1), 19–30.

Che-Ahmad, A., & Abidin, S. (2008). Audit delay of listed companies a case of Malaysia. International Business Research., 1(4), 32–39.

Chen, H., Chen, J., Lobo, G., & Wang, Y. (2011). Effects of audit quality on earnings management and cost of equity capital: Evidence from China. Contemporary Accounting Research, 28(3), 892–920.

Chen, C. J. P., Chen, S., & Su, X. (2001). Profitability regulation, earnings management, and modified audit opinions: Evidences from China. Auditing: A Journal of Practice & Theory, 20(2), 9–30.

Chen, K. Y., Lin, K. L., & Zhou, J. (2005). Audit quality and earnings management for Taiwan. Managerial Auditing Journal, 20(1), 86–103.

Chi, C., Lisic, L., & Pevzner, M. (2011). Is enhanced audit quality associated with greater real earnings management? Accounting Horizons, 25(2), 315–335.

Colbert, G., & Murray, D. (1999). The association between auditor quality and auditor size: An analysis of small CPA firms. Journal of Accounting & Auditing & Finance-Control, 13(2), 976–983.

Davidson, W., Jiraporn, P., & DaDalt, P. (2006). Causes and consequences of audit shopping: An analysis of auditor opinions, earnings management, and auditor changes. Quarterly Journal of Business & Economics, 45(1 and 2), 70–87.

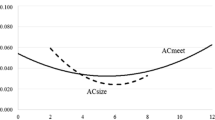

DeAngelo, L. E. (1981). Auditor size and audit quality. Journal of Accounting and Economics, 3(3), 183–199.

Dechow, P., Sloan, R., & Sweeney, A. (1995). Detecting earnings management. The Accounting Review, 70(2), 193–225.

DeFond, M. L., & Jiambalvo, J. (1993). Factors related to auditor-client disagreements over income increasing accounting methods. Contemporary Accounting Research, 9, 415–431.

DeFond, M., & Subramanyam, K. R. (1998). Auditor change and discretionary accruals. Journal of Accounting and Economics, 25, 35–67.

Dye, R. (1993). Auditing standards, legal liability and auditor wealth. Journal of Political Economy, 101, 887–914.

Ebrahim, A. (2007). Earnings management and board activity: An additional evidence. Review of Accounting and Finance, 6(1), 42–58.

Emmanuel, G. (2012). Audit quality in common-law and code-law emerging markets: Evidence on earnings conservatism: agency costs and cost of equity. Emerging Markets Review, 13(2), 101–117.

Falgi, I. K. (2009). Corporate governance in Saudi Arabia: A stakeholder perspective. Unpublished Thesis, UK. University of Dundee.

Francis, J. R. (2004). What do we know about audit quality? The British Accounting Review, 36, 15–36.

Francis, J., & Wilson, E. (1988) Auditor changes: A joint of theories relating to agency cost and auditor differentiation. The Accounting Review, LXIII, 4, 663–682.

Garcia, J., Argiles, J., & Martinez, M. (2013) Earnings management and audit qualifications: A non-matched sample approach. Research in Finance, 29, 29–62, 34.

Givoly, D., & Palmon, D. (1982). Timeliness of annual earnings announcements: Some empirical evidence. The Accounting Review, 57(3), 486–508.

Gujarati, D. (2003). Basic econometrics (4th ed.). New York: McGraw Hill.

Gul, F. A., Yu Kit Fung, S., & Bikki, J. (2009). Earnings quality: Some Evidence on the role of auditor tenure and auditors’ industry expertise. Journal of Accounting and Economics, 47, 265–287.

Habbash, M. (2012). Corporate governance mechanisms and earnings management: Evidence from Saudi Arabia. Accounting Research Journal, 11(1), 49–84.

Habbash, M., & Alghamdi, S. (2012). How do Saudi managers manipulate earning? A perception of earnings management techniques in Saudi Public firms. Accounting Research Journal, 2(12), 95–117.

Habbash, M., & Alghamdi, S. (2015). The perception of earnings management motivations in Saudi public firms. Journal of Accounting in Emerging Economies, 5(1), 122–147.

Habib, A., & Bhuiyan, M. (2011). Audit firm industry specialization and the audit report lag. Journal of International Accounting, Auditing and Taxation., 20, 32–44.

Healy, P., & Lys, P. (1986). Auditor changes following big eight merger with non-big eight audit firms. Journal of Accounting and Public Policy, 5, 251–265.

Herbohn, K., & Ragunathan, V. (2008). Auditor reporting and earnings management: Some additional evidence. Accounting and Finance., 48(2008), 575–601.

Hoitash, R., Markelevich, A., & Barragato, (2007). Auditor fees and audit quality. Managerial Auditing, Journal, 22(8), 761–786.

Jad Alha, H. (1993). The development of Saudi accounting profession. Institute of Public administration Journal, Riyadh, 14, 49–67.

Jaggi, B., Leung, S., & Gul, F. (2009). Family control, board independence and earnings management: Evidence based on Hong Kong firms. Journal of Accounting and Public Policy, 28, 281–300.

Jones, J. (1991). Earnings management during import relief investigations. Journal of Accounting Research, 29(2), 193–223.

Kanagaretnam, A. (2010). Auditor reputation and earnings management: International evidence from banking industry. Journal of Banking & Finance, 34(10), 2318–2337.

Kao, L., & Chen, A. (2004). The effects of board characteristics on earnings management. Corporate Ownership & Control, 1(3), 96–107.

Klein, A. (2002). Audit committee, board of director characteristics, and earnings management. Journal of Accounting and Economics, 33(3), 375–401.

Kluger, B., & Shields, D. (1991). Management moral hazard and auditor change. Critical Perspectives on Accounting, 2, 255–272.

Knechel, W. R., & Payne, J. L. (2001). Research notes. Additional evidence on audit report lag. Auditing: A Journal of Practice & Theory, 20(1), 137–146.

Kothari, S. P., Lcone, A. J., & Wasley, C. E. (2005). Performance-matched discretionary accruals. Journal of Accounting and Economics, 39(1), 163–197.

Krishnan, G. (2003). Does big 6 auditor industry expertise constrain earnings management? Accounting Horizons, 17 (Suppl.), 1–16.

Lennox, C. (1990). Audit quality and auditor size: An evaluation of reputation and deep pockets hypotheses. Journal of Business finance & Accounting, 26, 797–805.

Lim, C. Y., & Tan, H. T. (2008). Non-audit service fees and audit quality: The impact of auditor specialization. Journal of Accounting Research, 46(1), 199–246.

Lin, J., & Hwang, M. (2010). Audit quality, corporate governance, and earnings management: A meta-analysis. International Journal of Auditing, 10, 1099–1123.

Lin, J., Li, J., & Yang, J. (2006). The effect of audit committee performance on earnings quality. Managerial Auditing Journal, 21(9), 921–933.

Lowensohn, S., Johnson, L., Elder, R., & Davies, S. (2007). Auditor specialization, perceived audit quality, and audit fees in the local government audit market. Journal of Accounting, 26(6), 705–732.

Maijoor, S., & Vanstraelen, A. (2006). Earnings management within Europe: The effects of member state audit environment, audit firm quality and international capital markets. Accounting and Business Research, 36(1), 33–52.

Mayhew, B. W., & Wilkins, M. S. (2003). Audit firm industry specialization as a differentiation strategy: Evidence from fees charged to firms going public. Journal of Practice & Theory, 22(2), 33–52.

Mohamad Naimi, N., Shafie, R., & Wan-Hussin, W. (2010). Corporate governance and audit report lag in Malaysia. Asian Academy of Management Journal of Accounting and Finance, 6(2), 57–84.

Neal, T., & Riley, J. (2004). Auditor industry specialist research design. Auditing: A Journal of Practice & Theory, 23(2), 169–177.

Othman, H. B., & Zeghal, D. (2006). A study of earnings-management motives in the Anglo-American and Euro-Continental Accounting Models: The Canadian and French cases. The International Journal of Accounting, 41, 406–435.

Peasnell, K. V., Pope, P. F., & Young, S. (2000). Detecting Earnings management using cross-section a abnormal accruals models. Accounting and Business Research, 30, 313–326.

Pincus, M., & Rajgopal, S. (2002). The interaction between accrual management and hedging: evidence from oil and gas firms. The Accounting Review, 77(1), 127–160.

Piot, C., & Janin, R. (2007). External auditors, audit committees and earnings management in France. European Accounting Review, 16(2), 429–454.

Porter, B., Simon, J., & Hatherly, D. (2003). Principles of external auditing (2nd ed.). UK: Wiley.

Romanus, N., Maher, J., & Fleming, D. (2008). The effect of auditor change on audit fees, audit hours, and audit quality. Journal of Accounting and Public Policy, 15, 55–76.

Sun, N., Salama, A., Hussainey, & Habbash, M. (2010). Corporate enviromental disclosure, corporate governance and earnings management. Managerial Auditing Journal, 25(7), 679–700.

Tanyi, P., Raghunandan, K., & Barua, A. (2010). Audit report lags after voluntary and involuntary auditor changes. Accounting Horizons, 24(4), 671–688.

Tendeloo, B., & Vanstraelen, V. (2008). Earnings management and audit quality in Europe: Evidence from the private client segment market. European Accounting Review, 17(3), 20–38.

Velury, U. (2005). The association between an auditor industry specialization and earnings management. Research in Accounting Regulation, 16, 107–184.

Xie, B., Davidson, W., & DaDalt, P. (2003). Earnings management and corporate governance: The roles of the board and the audit committee. Journal of Corporate Finance, 9(3), 295–317.

Yang, J., & Krishnan, J. (2005). Audit committees and quarterly earnings management. International Journal of Auditing, 9, 201–219.

Acknowledgments

We are grateful for the kind support of Professor Robert Dixon and Dr Ann wood from Durham University Business School, UK. We are also grateful to Dr Yusuf Karbhari, from Cardiff Business School, UK for his useful comments. We also appreciate the useful comments of participants at the annual PhD seminars, held at Durham Business School, Durham University, UK, 2011.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Habbash, M., Alghamdi, S. Audit quality and earnings management in less developed economies: the case of Saudi Arabia. J Manag Gov 21, 351–373 (2017). https://doi.org/10.1007/s10997-016-9347-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10997-016-9347-3