Abstract

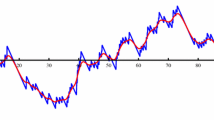

For a Borel-function \(f:\mathbb{R} \to \mathbb{R}\), we consider the approximation of a random variable f(W 1) with \(\mathbb{E}f^{2}(W_{1})<\infty\) by stochastic integrals with respect to the Brownian motion \(W = (W_{t})_{t \in[0, 1]}\) and the geometric Brownian motion, where the integrands are piecewise constant within certain deterministic time intervals. In earlier papers it has been shown that under certain regularity conditions the optimal approximation rate is 1/ \(\sqrt{n}\), if one optimizes over deterministic time-nets of cardinality n. We will show the existence of random variables f(W 1) such that the approximation error tends as slowly to zero as one wishes.

Similar content being viewed by others

References

Geiss, S. (1999). On quantitative approximation of stochastic integrals with respect to the geometric Brownian motion. Report Series: SFB Adaptive Information Systems and Modelling in Economics and Management Science, Vienna University, Vol. 43.

Geiss S. (2002). Quantitative approximation of certain stochastic integrals. Stoch. Stoch. Rep. 73(3–4): 241–270

Geiss, S., and Hujo, M. (2004). Interpolation and approximation in L 2(γ). Preprint 290, University of Jyväskylä, http://www.math.jyu.fi/tutkimus/julkaisut.html

Gobet E., Temam E. (2001). Discrete time hedging errors for options with irregular payoffs. Finance Stoch. 5(3): 357–367

Karatzas I., Shreve S. (1988) Brownian Motion and Stochastic Calculus. Springer, Berlin

Zhang, R. (1998) Couverture approchée des options Européennes, PhD thesis, Ecole Nationale des Ponts et Chaussées, Paris.

Handbook of Mathematical Functions (Abramowitz, M., Stegun, I. A. eds.). (1970). Dover Publications, New York.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hujo, M. Is the Approximation Rate for European Pay-offs in the Black–Scholes Model Always 1/ \(\sqrt{n}\) . J Theor Probab 19, 190–203 (2006). https://doi.org/10.1007/s10959-006-0008-3

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10959-006-0008-3