Abstract

The sudden acquisition of a large sum of money, known as “wealth shock,” can have unanticipated negative consequences, and actually cause greater unhappiness in its so-called beneficiaries. There is extensive economic literature describing these negative consequences on a macro-economic level, but there is no coherent theoretical model that describes the various consequences of wealth shock on a micro-economic level. To explain both the short- and long-term effects of an exogenous monetary shock (for example, winning a lottery) on individual happiness, this paper offers a novel dynamic equilibrium model of human happiness. A dynamic equilibrium model is best suited for this purpose, because happiness is a dynamic process. The proposed model captures both short- and long-term effects, and describes an equilibrium in which a person’s experienced utility and happiness is improved after the sudden wealth shock, and why at the saddle point, life can become sadder and more miserable. The conditions detrimental to winners’ happiness include reducing the amount of time and effort they allocate to preserving their stock of hedonic capital.

Similar content being viewed by others

Notes

William “Bud” Post who won USD 16.2 million in the Pennsylvania lottery in 1988. http://www.businessinsider.com/lottery-winners-who-lost-everything-2013-12?op=1.

Evelyn Adams who won the New Jersey lottery twice, in 1985 and 1986, raking in USD 5.4 million (Doll 2012).

“Wild” Willie Seeley of Manahawkin, New Jersey who won USD 3.8 million. http://www.nbcnews.com/news/other/drama-nonstop-powerball-winner-wild-willie-wants-his-old-life-f8C11251444.

Jack Whittaker of West Virginia won USD 314.9 million in, 2002 http://www.thewire.com/national/2012/03/terribly-sad-true-stories-lotto-winners/50555/.

A winner of the Florida lottery, quoted in Ugel (2007).

By 2017 more than NKr 8bn ($1tn) had accumulated in Norway’s oil fund (Norges Bank Investment Management 2017). The purpose of this and similar “boom funds” is to invest the revenues outside of the local market, in order to minimize the appreciation of the currency and guarantee the economic prosperity of future generations.

Based on Frey and Stutzer (2014, p. 940) intrinsic needs reflect: (1) “a need for relatedness,” (2) “a need for competence” and (3) the “desire for autonomy.” The attributes related to extrinsic desires represent the desire for “material possessions, fame, status or prestige,” which are obtained using pecuniary resources. Frey and Stutzer (2104) explain that each activity and good has attributes related to both intrinsic and extrinsic needs, but some are more intrinsic by nature.

A more reasonable assumption would be that the relative productivity between working hours and productive leisure eventually decreases when \(T_{t}^{w}\) increases and when \(L_{t}^{\Pr o}\) decreases. However, this assumption is not required here in order to avoid a corner solution because \(T_{t}^{w}\) also expends the budget set, allowing increased consumption in which utility function is concave.

We note that without loss of generality, it could be assumed that \(\alpha ,\beta ,\) and \(\gamma\) equal unity. Nevertheless, it will be useful not to do so to allow for comparative static.

The only implication of a multiplicative utility function is that the marginal rate of substitution (MRS) between two utilities is independent of the third one (“weak separability”). This is a reasonable assumption; for example, the MRS between the pecuniary utility and the non-pecuniary utility is unlikely to depend on the level of passive utility. Note that the form in (5) need not imply that any one of the goods is vital for the agent; for example: let \(U_{t}^{P} (c_{t} + \gamma C_{t - 1} ) = e^{{c_{t} + \gamma C_{t - 1} }}\), \(U_{t}^{NP} (\delta H_{t - 1} + L_{t}^{\Pr o} + \zeta T_{t}^{W} ) = e^{{H_{t - 1} + L_{t}^{\Pr o} + \zeta T_{t}^{W} }}\), and \(U_{t}^{Pas} (L_{t}^{{\text{P} as}} ) = e^{{L_{t}^{{\text{P} as}} }}\), and \(\alpha = \beta = \varepsilon = 1\) then \(U_{t}\) = \(e^{{c_{t} + \gamma C_{t - 1} + H_{t - 1} + L_{t}^{\Pr o} + \zeta T_{t}^{W} + L_{t}^{{\text{P} as}} }}\). In this form, it is easy to see that any of the goods might be zero without zeroing the overall utility.

Concavity follows from the standard assumption of decreasing marginal utility.

The first part of Oblomov by Ivan Goncharov (1859) describes a man who desires only to spend all his day in bed or lying on a sofa, meaning his \(\beta \to 1.\)

The linear formalization of the utility function is achieved by taking the natural logarithm and defining \(u_{t}^{P} : = \ln U_{t}^{P} ,\;\;u_{t}^{NP} : = \ln U_{t}^{NP} ,\;\) and \(u_{t}^{Pas} : = \ln U_{t}^{Pas} .\) Note that taking an order-preserving transformation of the target function does not affect the location of which it attains its maximum (Varian 2010, p. 55).

In a steady state, capital goods are naturally proportionate to consumption, and hedonic capital is proportionate to active leisure (given by \(C_{t} = \frac{{\gamma c_{t} }}{1 - \gamma }\) and \(H_{t} = \frac{{\delta L_{t}^{\alpha } }}{1 - \delta }\), respectively). Thus, this conclusion follows directly from the concavity of the utility functions.

It emerges that equation (ii) depends only on the relative productivity of work and productive leisure for producing hedonic capital (see “Appendix 1” for details).

Research has revealed that more time devoted to internet use is positively associated with loneliness and negatively correlated to life satisfaction (Stepanikova et al. 2010). “Heavy” internet use in specific domains, such as gaming, is a predictor of lower levels of happiness and life satisfaction (Mitchell et al. 2011). The negative effect of consuming passive leisure may be due to lack of hedonic capital. These individuals do not invest time and creative effort in gaining productive capital, and therefore lack stimulating alternatives for leisure time.

We use this anecdotal evidence, and additional cases presented below, to support the predictions of our model. We emphasize that while our model is consistent with all of our anecdotal evidence, there are other plausible explanations that are not included in the model. Future research might propose an alternative model that could also explain this evidence coherently.

Naturally, there are other possible explanations for the “end of the party and back to reality.” One example is rising aspirations (Easterlin 2001). The winner might think that having more money would change dramatically his or her life for the better but increased aspirations can lead to disappointment. Other explanations might be the envy of friends or their inability to cope with the winner’s increased demands, or and winner’s economic inability to “make ends meet.” The wealth shock is not enough to satisfy all winner's material desires.

They demonstrate that winners of USD 50,000 to USD 150,000 are more likely to file for bankruptcy three to five years after winning than winners of smaller prizes.

Note that replacing, according equation (1) (which holds for every t), \(J_{t+1}(C_{t+1},H_{t+1},W_{t+1})\) with \(u_{t+1}^{p}(C_{t+1}+c_{t+1})+u_{t+1}^{PAS}(L_{t+1}^{Pas})+u_{t+1}^{NP}(H_{t+1}+\zeta _{1}L_{t+1}^{Pro}+\zeta _{2}(\bar{T}-L^{Pas}-L^{Pro})+\rho \cdot J_{t+2}(C_{t+2},H_{t+2},W_{t+2})\) and continue in this manner (i.e. replacing \(J_{t+2}\) in the last equation according to equation (1) with a formal containing \(J_{t+2}\) and so forth) infinitely many times, one obtains the original maximization problem \(\max \sum _{0}^{\infty }\rho ^{t}U_{t}(.)\).

For the necessary and sufficient conditions of an Hamiltonian problem see, for example, Acemoglu (2008, p. 324).

Note that the amount of wealth in the steady state path must also be constant for otherwise it will diverage. If, for example \(W_{t}>W_{t-1}\), then, \(W_{t+1}>W_{t}\) must also be the case due to higher interest rate gains (namely, because \(W_{t}\cdot r>W_{t-1}\cdot r\)).

Note that the amount of wealth in the steady state path must also be constant for otherwise it will diverage. If, for example \(W_{t}>W_{t-1}\), then, \(W_{t+1}>W_{t}\) must also be the case due to higher interest rate gains (namely, because \(W_{t}\cdot r>W_{t-1}\cdot r\)).

References

Acemoglu, D. (2008). Introduction to modern economic growth. Princeton University Press.

Apouey, B., & Clark, A. E. (2014). Winning big but feeling no better? The effect of lottery prizes on physical and mental health. Health Economics. https://doi.org/10.1002/hec.3035.

Argyle, M. (1987). The psychology of happiness. London: Routledge.

Arvey, R. D., Harpaz, I., & Liao, H. (2004). Work centrality and post-award work behavior of lottery winners. The Journal of Psychology,138(5), 404–420.

Becker, G. S. (1996). Accounting for tastes. Cambridge, MA: Harvard University Press.

Brickman, P., Coates, D., & Janoff-Bulman, R. (1978). Lottery winners and accident victims: Is happiness relative? Journal of Personality and Social Psychology,36(8), 917.

Carbone, N. (2012). The unlucky winners. Time. http://newsfeed.time.com/2012/11/28/500-million-powerball-jackpot-the-tragic-stories-of-the-lotterys-unluckiest-winners/slide/billie-bob-harrell-jr/.

Cesarini, D., Lindqvist, E., Notowidigdo, M. J., & Östling, R. (2015). The effect of wealth on individual and household labor supply: Evidence from Swedish lotteries (No. w21762). National Bureau of Economic Research.

Cesarini, D., Lindqvist, E., Östling, R., & Wallace, B. (2016). Wealth, health, and child development: Evidence from administrative data on Swedish lottery players. The Quarterly Journal of Economics,131(2), 687–738.

Clark, A. E., Frijters, P., & Shields, M. A. (2008). Relative income, happiness, and utility: An explanation for the Easterlin paradox and other puzzles. Journal of Economic Literature,46(1), 95–144.

Corden, W. M. (1984). Booming sector and Dutch disease economics: Survey and consolidation. Oxford Economic Papers,36(3), 359–380.

Corden, W. M., & Neary, J. P. (1982). Booming sector and de-industrialization in a small open economy. The Economic Journal,92(December), 825–848.

Csikszentmihalyi, M. (1990). Flow: The psychology of optimal experience. New York: HarperCollins. (e-book).

Daily Mail. (2013). “The drama is nonstop:” $4 million Powerball winner “Wild” Willie Steely wants his old life back. http://www.dailymail.co.uk/news/article-2431868/Powerball-jackpot-winner-Wild-Willie-Steely-wants-old-life-back.html#ixzz4gZ0jjvgg.

Debreu, G. (1959). Topological methods in cardinal utility theory (no. 76). Cowles Foundation for Research in Economics, Yale University.

Diener, E., & Biswas-Diener, R. (2008). Happiness: Unlocking the mysteries of psychological wealth. Malden, MA: Wiley.

Doll, J. A. (2012). Treasury of terribly sad stories of lotto winners. The Atlantic. http://www.theatlantic.com/national/archive/2012/03/terribly-sad-true-stories-lotto-winners/329903/.

Easterlin, R. A. (2001). Income and happiness: Towards a unified theory. The Economic Journal,111(473), 465–484.

Easterlin, R. A. (2003). Building a better theory of well-being. IZA discussion paper no. 742.

Eckblad, G. F., & von der Lippe, A. L. (1994). Norwegian lottery winners: Cautious realists. Journal of Gambling Studies,10(4), 305–322.

Frederick, S., & Loewenstein, G. F. (1999). Hedonic adaptation. In D. Kahneman, E. Diener, & N. Schwarz (Eds.), Well-being: The foundations of hedonic psychology (pp. 302–329). New York: Russell Sage Foundation.

Frederick, S., Loewenstein, G., & O'donoghue, T. (2002). Time discounting and time preference: A critical review. Journal of Economic Literature, 40(2), 351–401.

Frey, B. S., Benesch, C., & Stutzer, A. (2007). Does watching TV make us happy? Journal of Economic Psychology,28(3), 283–313.

Frey, B. S., & Stutzer, A. (2002). Happiness and economics: How the economy and institutions affect human well-being. Princeton: Princeton University Press.

Frey, B. S., & Stutzer, A. (2014). Economic consequences of mispredicting utility. Journal of Happiness Studies,15(4), 937–956.

Gardner, J., & Oswald, A. J. (2007). Money and mental wellbeing: A longitudinal study of medium-sized lottery wins. Journal of Health Economics,26(1), 49–60.

Goncharov, I. (1859) Oblomov. Translated by D. Magarshack (1954). London: Penguin Books.

Graham, L., & Oswald, A. J. (2010). Hedonic capital, adaptation and resilience. Journal of Economic Behavior and Organization,76(2), 372–384.

Grün, C., Hauser, W., & Rhein, T. (2010). Is any job better than no job? Life satisfaction and re-employment. Journal of Labor Research,32, 285–306.

Hankins, S., Hoekstra, M., & Skiba, P. M. (2011). The ticket to easy street? The financial consequences of winning the lottery. Review of Economics and Statistics,93(3), 961–969.

Henley, A. (2004). House price shocks, windfall gains and hours of work: British evidence. Oxford Bulletin of Economics and Statistics,66(4), 439–456.

Hsee, C. K., Rottenstreich, Y., & Stutzer, A. (2012). Suboptimal choices and the need for experienced individual well-being in economic analysis. International Journal of Happiness and Development,1(1), 63–85.

Imbens, G. W., Rubin, D. B., & Sacerdote, B. (2001). Estimating the effects of unearned income on labor supply, earnings, savings, and consumption: Evidence from a survey of lottery players. American Economic Review,91(4), 778–794.

Jahoda, M. (1981). Work, employment and unemployment: Values, theories and approaches in social research. American Psychologist,36, 184–191.

Kahneman, D., & Thaler, R. H. (2006). Anomalies: Utility maximization and experienced utility. The Journal of Economic Perspectives,20(1), 221–234.

Kahneman, D., Wakker, P. P., & Sarin, R. (1997). Back to Bentham? Explorations of experienced utility. The Quarterly Journal of Economics,112(2), 375–406.

Kaplan, H. R. (1987). Lottery winners: The myth and reality. Journal of Gambling Behavior,3(3), 168–178.

Kroll, C., & Pokutta, S. (2013). Just a perfect day? Developing a happiness optimised day schedule. Journal of Economic Psychology,34, 210–217.

Kuhn, P., Kooreman, P., Soetevent, A., & Kapteyn, A. (2011). The effects of lottery prizes on winners and their neighbors: Evidence from Dutch Postcode Lottery. American Economic Review,101(5), 2226–2247.

Kushnirovich, N., & Sherman, A. (2017). Dimensions of life satisfaction: Immigrant and ethnic minorities. International Migration. https://doi.org/10.1111/imig.12329.

Lane, R. E. (1992). Work as “disutility” and money as “happiness:” Cultural origins of a basic market error. Journal of Socio-Economics,21(1), 43–64.

Lau, C., & Kramer, L. (2005). Die Relativitätstheorie des Glücks: über das Leben von Lottomillionären [The relativity of happiness: On the life of Lotto millionaires] (Vol. 24). Herbolzheim: Centaurus.

Layard, R. (2004). Good jobs and bad jobs. CEP occasional paper no. 19.

Layard, R. (2005). Happiness: Lessons from a new science. London: Allen Lane.

Layous, K., Lee, H., Choi, I., & Lyubomirsky, S. (2013). Culture matters when designing a successful happiness-increasing activity: A comparison of the United States and South Korea. Journal of Cross-Cultural Psychology,44(8), 1294–1303.

Lindahl, M. (2005). Estimating the effect of income on health and mortality using lottery prizes as an exogenous source of variation in income. Journal of Human Resources,40(1), 144–168.

Lutter, M. (2007). Book Review: Winning a lottery brings no happiness! Journal of Happiness Studies,8(1), 155–160.

Luttmer, E. F. P. (2005). Neighbors as negatives: Relative earnings and well-being. Quarterly Journal of Economics,120(3), 963–1002.

Lyubomirsky, S., Dickerhoof, R., Boehm, J. K., & Sheldon, K. M. (2011). Becoming happier takes both a will and a proper way: An experimental longitudinal intervention to boost well-being. Emotion,11(2), 391–402.

Mitchell, M. E., Lebow, J. R., Uribe, R., Grathouse, H., & Shoger, W. (2011). Internet use, happiness, social support and introversion: A more fine grained analysis of person variables and internet activity. Computers in Human Behavior,27(5), 1857–1861.

Powdthavee, N., & Oswald, A. J. (2014). Does money make people rightwing and inegalitarian? A longitudinal study of lottery winners. IZA discussion paper no. 7934.

Samuelson, P. (1937). A note on measurement of utility. The Review of Economic Studies,4(2), 155–161.

Scitovsky, T. (1976). The joyless economy: An inquiry into human satisfaction and consumer dissatisfaction. Oxford: Oxford University Press.

Seligman, M. E. P. (2011). Flourish: A Visionary new understanding of happiness and well-being. New York: Free Press.

Seligman, M. E., Steen, T. A., Park, N., & Peterson, C. (2005). Positive psychology progress: Empirical validation of interventions. American Psychologist,60(5), 410–425.

Sherman, A., & Shavit, T. (2009). Welfare to work and work to welfare: The effect of the reference point: A theoretical and experimental study. Economics Letters,105(3), 290–292.

Sherman, A., & Shavit, T. (2012). How the lifecycle hypothesis explains volunteering during retirement. Ageing and Society,32(08), 1360–1381.

Sherman, A., & Shavit, T. (2013). The immaterial sustenance of work and leisure: A new look at the work-leisure model. The Journal of Socio-Economics,46, 10–16.

Sherman, A., & Shavit, T. (2017). The thrill of creative effort at work: An empirical study on work, creative effort and well-being. Journal of Happiness Studies. https://doi.org/10.1007/s10902-017-9910-x.

Skidelsky, R., & Skidelsky, E. (2012). How much is enough? Money and the good life. New York: Other Press.

Spencer, D. A. (2009). The political economy of work. London: Routledge.

Sprott, J. C. (2005). Dynamical models of happiness. Nonlinear Dynamics, Psychology, and Life Sciences,9(1), 23–36.

Stepanikova, I., Nie, N. H., & He, X. (2010). Time on the Internet at home, loneliness, and life satisfaction: Evidence from panel time-diary data. Computers in Human Behavior,26(3), 329–338.

Stutzer, A., & Frey, B. S. (2010). Recent advances in the economics of individual subjective well-being. Social Research,77(2), 679–714.

Sullivan, E. (2008). For Alex Toth, Lotto win was followed by trouble. Tampa Bay Times. http://www.tampabay. com/news/obituaries/for-alex-toth-lotto-win-was-followed-by-trouble/472080.

Ugel, E. (2007). Money for nothing: One man’s journey through the dark side of lottery millions. New York: HarperCollins.

van Praag, B., & Ferrer-i-Carbonell, A. (2002). Life satisfaction differences between workers and non-workers: The value of participation per se (no. 02-018/3). Tinbergen Institute discussion paper.

Varian, H. R. (2010). Intermediate microeconomics (8th ed.). New York: Norton.

Winkelmann, R., Oswald, A. J., & Powdthavee, N. (2011). What happens to people after winning the lottery. In Proceedings of European economic association & econometric society parallel meetings (pp. 25–29).

Woodruff, M., & Kelly, M. (2013). 20 lottery winners who blew it all. Business Insider. http://www.businessinsider.com.au/lottery-winners-who-lost-everything-2013-12#the-griffiths-bought-their-dream-home-then-life-fell-apart-1.

Zoroya, G. (2004). One wild ride for jackpot winner. USA Today. http://usatoday30.usatoday.com/news/nation/2004-02-12-lottery-winner_x.htm.

Acknowledgements

We would like to thank the research authority at the School of Business Administration in the Academic College of Management Academic Studies (Israel) for financial support.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Proof of Theorem 1

Let \(\zeta :=\zeta _{2}\) and define the productivity of productive leisure by \(\zeta _{1}\), then the Hamiltonian of the problem at any time t is given by:

- (1)

\(J_{t}=\alpha u_{t}^{p}(C_{t}+c_{t})+\beta u_{t}^{PAS}(L_{t}^{Pas})+(1-\alpha -\beta )u_{t}^{NP}(H_{t}+\zeta _{1}L_{t}^{Pro}\zeta _{2}(\bar{T}-L^{Pas}-L^{Pro}))+\rho \cdot J_{t+1}(C_{t+1},H_{t+1},W_{t+1})\)).

Subject to the laws of motion:

- (2)

\(W_{t}=W_{t-1}(1+r)+w(\bar{T}-L^{Pas}-L^{Pro})\)

- (3)

\(C_{t}= C_{t-1}+c_{t}\)

- (4)

\(H_{t}=H_{t-1}+L_{t}^{Pro}+\zeta T_{t}^{w}\).

where \(u_{t}^{p}+u_{t}^{PAS}+u_{t}^{NP}\) is, in terms of the Hamiltonian problem, the value function. W, C, and H are the state variables and \(L^{Pas}, L^{Pro}\), and c are the control variables, and \(J_{t+1}(C_{t+1},H_{t+1},W_{t+1}\)) is the Hamiltonian at time \(t+1\).Footnote 22 Replacing equations (2)–(4) into the Hamiltonian function, we obtain:

Differentiating with respect to the state variable, \(c_{t}\), \(L_{t}^{Pas}\), and \(L_{t}^{Pro}\), we obtain:Footnote 23

- (I)

\(\alpha \cdot \frac{\partial u_{t}^{p}}{\partial c_{t}}+\rho (\gamma \cdot \frac{dJ_{t+1}}{dC_{t+1}}-\frac{dJ_{t+1}}{dW_{t+1}})=0.\)

- (II)

\(\beta \cdot \frac{\partial u_{t}^{PAS}}{\partial L_{t}^{Pas}}+\rho (-\delta \zeta _{2}\cdot \frac{dJ_{t+1}}{dH_{t+1}}-\frac{dJ_{t+1}}{dW_{t+1}}\cdot w)=0.\)

- (III)

\((1-\alpha -\beta )\frac{\partial u_{t}^{NP}}{\partial L_{t}^{Pro}}+\rho (\delta (\zeta _{1}-\zeta _{2})\frac{dJ_{t+1}}{dH_{t+1}}-\frac{dJ_{t+1}}{dW_{t+1}}\cdot w)=0.\)

Differentiating with respect to the state variables, \(C_{t}\) and \(H_{t}\), we obtain:

- (IV)

\(\frac{\frac{dJ_{t}}{dC_{t}}=}{{\partial u_{t}^{p}}{\partial c_{t}}+\rho \gamma \cdot \frac{dJ_{t+1}}{dC_{t+1}}}\)

- (V)

\(\frac{dJ_{t}}{dH_{t}}=(1-\alpha -\beta )\frac{\frac{\partial u_{t}^{NP}}{\partial L_{t}^{Pro}}}{\zeta _{1}-\zeta _{2}}+\rho (\delta \cdot \frac{dJ_{t+1}}{dH_{t+1}}-\frac{dJ_{t+1}}{dW_{t+1}}\cdot w).\)

We now look for the steady state, that is, for a saddle point in which the state variables are constant overtime. First note that since in the steady state \(C_{t}=C_{t+1}\), \(c_{t}=c_{t+1}\) must also be the case, and hence \(\frac{\partial u_{t}^{p}}{\partial c_{t}}=\frac{\partial u_{t+1}^{p}}{\partial c_{t+1}}\) holds.

Now, iterating equation (IV) infinitely many times, we obtain: \(\frac{dJ_{t}}{dC_{t}}=\varSigma _{i=t}^{\infty }\rho ^{i-t}\cdot \frac{ \partial u_{t}^{p}}{\partial c_{t}}\), which is independent of t. This shows that in steady state \(\frac{dJ_{t}}{dC_{t}}=\frac{dJ_{t+1}}{dC_{t+1}}\) for every t. In the exact same way, it is possible to show that in steady state \(\frac{ dJ_{t}}{dH_{t}}=\frac{dJ_{t+1}}{dH_{t+1}}\) and \(\frac{dJ_{t}}{dW_{t}}=\frac{ dJ_{t+1}}{dW_{t+1}}\) for every t.

Replacing \(\frac{dJ_{t}}{dC_{t}}=\frac{dJ_{t+1}}{dC_{t+1}}\) and \(\frac{dJ_{t} }{dH_{t}}=\frac{dJ_{t+1}}{dH_{t+1}}\) in equations (IV) and (V), respectively, we obtain:

- (VI)

\(\frac{dJ_{t}}{dC_{t}}=\alpha \frac{\frac{\partial u_{t}^{p}}{\partial c_{t}}}{1-\rho \gamma }.\)

- (VII)

\(\frac{dJ_{t}}{dH_{t}}=(1-\alpha -\beta )\frac{\frac{\partial u_{t}^{NP}}{\partial L_{t}^{Pro}}}{(\zeta _{1}-\zeta _{2})(1-\rho \delta )}.\)

Replacing \(\frac{dJ_{t}}{dC_{t}}\) and \(\frac{dJ_{t}}{dH_{t}}\) from equation (VI) and (VII) into equations (I)-(III), we obtain:

- (VIII)

\(\frac{\alpha \cdot \frac{\partial u_{t}^{p}}{\partial c_{t}}}{1-\rho \gamma }=\rho \cdot \frac{dJ_{t+1}}{dW_{t+1}}\).

- (IX)

\(\frac{\beta \cdot \partial u_{t}^{PAS}}{\partial L_{t}^{Pas}}\cdot \frac{\zeta _{1}(1-\rho \delta )-\zeta _{2}}{(\zeta _{1}-\zeta _{2})((1-\rho \delta )}=\rho w\cdot \frac{dJ_{t+1}}{dW_{t+1}}\).

- (X)

\(\frac{(1-\alpha -\beta )\frac{\partial u_{t}^{NP}}{\partial L_{t}^{Pro}}}{1-\rho \delta }=\rho w\cdot \frac{dJ_{t+1}}{dW_{t+1}}\). Dividing (VIII) by (X) we obtain equation (i) in Theorem 1, and dividing (IX) by (X) equation (ii) is obtained, where \(\zeta :=\frac{\zeta _{2}}{\zeta _{1}}\). This completes the proof.

Appendix 2

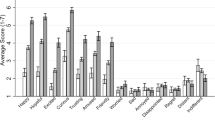

See Table 1.

Appendix 3: An numerical example

In this appendix, we provide a closed form solution to a special case of our model. First, we follow Graham and Oswald (2010) by assuming that the utility function is logarithmic. Merely for the sake of expositional simplicity, we also assume that \(\gamma =\delta\) (i.e. that the capital goods and the hedonic capital are depreciating in the same rate), \(\zeta =0\) (i.e. that there is no value from work per se), and, prior to wining, we assume that \(W_{0}=0\); further, we normalize \(w=1\) .

Replacing these parameters in equations (i) and (ii) in Theorem 1, we obtain the following amount of \(c_{t}\), \(L_{t}^{Pas}\), and \(L_{t}^{pro}\) in steady state:Footnote 24

The amount of capital goods and hedonic capital is then given by:

Finally, the overall utility is given by:

We first stimulate case 1 in which winning does not cause any change in the decision utility’s parameters. The exogenous shock in wealth (denoted by \(A>0\)) increases wealth from \(W_{t}=0\) to \(W_{t+1}=A\). The new steady state amounts are then given by:Footnote 25

and the utility level in the steady state is increased to:

We now proceed with what we find to be the most interesting scenario in which \(\varepsilon\) is reduced in the decision utility (to a level denoted by \(\varepsilon ^{\prime }\)) but experienced utility does not change (as well as the other parameters),

The overall utility is then given by:

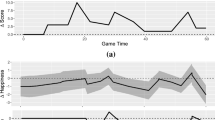

\(V_{t}=(\ln \frac{\bar{T}(1-\rho \delta (\alpha -\varepsilon ^{\prime }-\alpha \varepsilon ^{\prime })}{(1-(\alpha +\varepsilon ^{\prime })\rho \delta )(1-\delta )}+\ln (Ar))^{\alpha }\cdot (\ln \frac{\bar{T}\beta }{1-(\alpha +\varepsilon ^{\prime })\rho \delta }+\ln (Ar))^{\beta }+(\ln\)\(\frac{\bar{T}\alpha \varepsilon ^{\prime }\rho \delta }{1-(\alpha +\varepsilon ^{\prime })\rho \delta }+\ln (Ar))^{\varepsilon }\). Note that the power \(\varepsilon\) is used rather than \(\varepsilon ^{\prime }\) because there is no change in experienced utility’s parameters. The question of interest is for which set of parameters, the agent is experiencing a reduction in level of utility, after winning. To answer this question, we fix \(\bar{T}=1\), \(Ar=10\), \(\rho ,\delta =0.9\), \(\alpha =\frac{1}{3},\)\(\beta =1-\alpha -\varepsilon\), and we plot (see Fig. 1) \(U_{t}\) and \(V_{t}\) for different values of \(\varepsilon ^{\prime }<\varepsilon\):

The levels of experienced utility prior to winning (dashed line),and after winning (solid line) as a function of \(\varepsilon\) for different values of \(\varepsilon ^{\prime }\).

As one can observe from the figure, for large enough \(\varepsilon\), there is a small enough \(\varepsilon ^{\prime }\) such that \(V_{t}<U_{t}\), and as \(\varepsilon\) grows larger, a smaller reduction in \(\varepsilon ^{\prime }\) is sufficient for this. That is, as the hedonic capital becomes relatively more important prior to winning, a smaller change in the decision utility’s parameters is sufficient to create a reduction of experienced utility after winning.

Rights and permissions

About this article

Cite this article

Sherman, A., Shavit, T. & Barokas, G. A Dynamic Model on Happiness and Exogenous Wealth Shock: The Case of Lottery Winners. J Happiness Stud 21, 117–137 (2020). https://doi.org/10.1007/s10902-019-00079-w

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10902-019-00079-w