Abstract

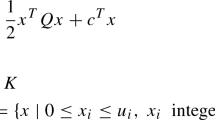

In this paper we investigate a class of cardinality-constrained portfolio selection problems. We construct convex relaxations for this class of optimization problems via a new Lagrangian decomposition scheme. We show that the dual problem can be reduced to a second-order cone program problem which is tighter than the continuous relaxation of the standard mixed integer quadratically constrained quadratic program (MIQCQP) reformulation. We then propose a new MIQCQP reformulation which is more efficient than the standard MIQCQP reformulation in terms of the tightness of the continuous relaxations. Computational results are reported to demonstrate the tightness of the SOCP relaxation and the effectiveness of the new MIQCQP reformulation.

Similar content being viewed by others

References

Alexander G.J., Baptista A.M.: A comparison of VaR and CVaR constraints on portfolio selection with the mean-variance model. Manag. Sci. 50, 1261–1273 (2004)

Angelelli R., Mansini R., Speranza M.G.: A comparison of MAD and CVaR models with real features. J. Banking Finance 32, 1188–1197 (2007)

Ben-Tal, A., Nemirovski, A.S.: Lectures on Modern Convex Optimization: Analysis, Algorithms, and Engineering Applications. MPS-SIAM Series on Optimization. Society for Industrial Mathematics, Philadelphia, PA (2001)

Bertsimas D., Shioda R.: Algorithm for cardinality-constrained quadratic optimization. Comput. Optim. Appl. 43, 1–22 (2009)

Bienstock D.: Computational study of a family of mixed-integer quadratic programming problems. Math. Program. 74, 121–140 (1996)

Boginski V., Butenko S., Pardalos P.M.: Statistical analysis of financial networks. Comput. Stat. Data Anal. 48, 431–443 (2005)

Boginski V., Butenko S., Pardalos P.M.: Mining market data: a network approach. Comput. Oper. Res. 33, 3171–3184 (2006)

Bonami P., Lejeune M.A.: An exact solution approach for portfolio optimization problems under stochastic and integer constraints. Oper. Res. 57, 650–670 (2009)

Burmeister, E., Roll, R., Ross, S.A.: Using macroeconomic factors to control portfolio risk. Tech. rep. (2003). Available at: http://www.birr.com/Using_Macroeconomic_Factors.pdf

Ceria S., Margot F., Renshaw A., Saxena A.: Novel approaches to portfolio construction: multiple risk models and multisolution generation. In: Satchell, S. (ed.) Optimizing Optimization: The Next Generation of Optimization Applications & Theory, pp. 23–52. Academic Press and Elsevier, Amsterdam (2010)

Connor G.: The three types of factor models: a comparison of their explanatory power. Financial Analysts J. 51, 42–46 (1995)

Duffie D., Pan J.: An overview of value at risk. J. Deriv. 4, 7–49 (1997)

Fama E.F., French K.R.: The cross-section of expected stock returns. J. Finance 47, 427–465 (1992)

Fama E.F., French K.R.: Size and book-to-market factors in earnings and returns. J. Finance 50, 131–155 (1995)

Frangioni A., Gentile C.: Perspective cuts for a class of convex 0–1 mixed integer programs. Math. Program. 106, 225–236 (2006)

Frangioni A., Gentile C.: SDP diagonalizations and perspective cuts for a class of nonseparable MIQP. Oper. Res. Lett. 35, 181–185 (2007)

Frangioni A., Gentile C.: A computational comparison of reformulations of the perspective relaxation: SOCP vs. cutting planes. Oper. Res. Lett. 37, 206–210 (2009)

Günlük O., Linderoth J.: Perspective reformulations of mixed integer nonlinear programs with indicator variables. Math. Program. 124, 183–205 (2010)

IBM ILOG CPLEX: IBM ILOG CPLEX 12.1 User’s Manual for CPLEX (2010)

Jorion P.: Value at Risk: The New Benchmark for Controlling Market Risk. McGraw-Hill, Chicago (1997)

Kolbert F., Wormald L.: Robust portfolio optimization using second-order cone programming. In: Satchell, S. (ed.) Optimizing Optimization: The Next Generation of Optimization Applications & Theory, pp. 3–22. Academic Press and Elsevier, Amsterdam (2010)

Konno H., Yamazaki H.: Mean-absolute deviation portfolio optimization model and its applications to Tokyo stock market. Manag. Sci. 37, 519–531 (1991)

Li D., Ng W.L.: Optimal dynamic portfolio selection: multiperiod mean-variance formulation. Math. Finance 10, 387–406 (2000)

Markowitz H.M.: Portfolio selection. J. Finance 7, 77–91 (1952)

Markowitz H.M.: Portfolio Selection: Efficient Diversification of Investments. Wiley, New York (1959)

Moazeni S.: A note on the dynamic liquidity trading problem with a mean-variance objective. Optim. Lett. 5, 113–124 (2011)

Pardalos P.M., Sandström M., Zopounidis C.: On the use of optimization models for portfolio selection: a review and some computational results. Comput. Econ. 7, 227–244 (1994)

Pardalos, P.M., Tsitsiringos, V. (eds.): Financial Engineering, Supply Chain and E-Commerce. Kluwer, Dordrecht (2002)

Pardalos, P.M., Wolkowicz, H. (eds.): Topics in Semidefinite and Interior-Point Methods. Fields Institute Communications Series: vol. 18. American Mathematical Society, Providence (1998)

Rockafellar R.T., Uryasev S.: Optimization of conditional Value-at-Risk. J. Risk 2, 21–42 (2000)

Rockafellar R.T., Uryasev S.: Conditional Value-at-Risk for general loss distributions. J. Banking Finance 26, 1443–1471 (2002)

Sharpe W.F.: A simplified model for portfolio analysis. Manag. Sci. 9, 277–293 (1963)

Shaw D., Liu S., Kopman L.: Lagrangian relaxation procedure for cardinality-constrained portfolio optimization. Optim. Methods Softw. 23, 411–420 (2008)

Vandenberghe L., Boyd S.: Semidefinite programming. SIAM Rev. 38, 49–95 (1996)

Young M.R.: A minimax portfolio selection rule with linear programming solution. Manag. Sci. 44, 673–683 (1998)

Zhou X.Y., Li D.: Continuous-time mean-variance portfolio selection: a stochastic LQ framework. Appl. Math. Optim. 42, 19–33 (2000)

Author information

Authors and Affiliations

Corresponding author

Additional information

This work was supported by National Natural Science Foundation of China under Grants 10971034, 11101092 and 71071036, and by the Joint NSFC/RGC grants under Grant 71061160506.

Rights and permissions

About this article

Cite this article

Cui, X.T., Zheng, X.J., Zhu, S.S. et al. Convex relaxations and MIQCQP reformulations for a class of cardinality-constrained portfolio selection problems. J Glob Optim 56, 1409–1423 (2013). https://doi.org/10.1007/s10898-012-9842-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10898-012-9842-2