Abstract

We analyze the market impact of a partial vertical integration whereby a subset of retail firms acquire, through a private placement operation, a non-controlling stake in the capital of an upstream firm, which supplies an essential input. In addition, we assume that this upstream firm can price discriminate between the retail firms which (now) own a stake in its capital and all of their retail rivals. We find that price discrimination is optimal and, compared to a vertical separation scenario, there is input foreclosure, a higher retail price, and lower social welfare, which suggests that, from a competition policy viewpoint, such partial vertical integrations should be analyzed with particular concern. On the other hand, incentives are such that conducting a private placement operation of the upstream firm’s capital yields gains from trade, and we are able to identify the optimal characteristics of such an operation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In supply chains, the (backward) acquisition by a downstream firm of a share in the capital of an upstream firm is not very common: Fee et al. (2006) report relevant (5%) equity stakes in just over 3% of the trading relationships they look into, although this prevalence is higher for particular subsamples (upstream firms with high R &D intensity or who supply a large fraction of their sales to particular downstream firms).Footnote 1 Despite this, such partial acquisitions attracted a great deal of interest in the academic literature (which we discuss below), stirred debate in specific competition casesFootnote 2 and were mentioned explicitly in the FTC/DOJ Vertical Merger Guidelines released in 2020.Footnote 3

While falling short of full vertical integration, partial vertical integrations may (i) help “...align the interests of the target and acquirer, reducing transaction costs or encouraging non-contractible effort or specific investment” (Greenlee and Raskovich 2006, p. 1018), (ii) facilitate cooperation when contracts are incomplete (Allen and Phillips 2000; Fee et al. 2006), and (iii) contribute to a reduction in the double marginalization problem. The latter explanation is particularly relevant for competition policy: vertical mergers of firms with market power typically attract scrutiny from competition authorities because of the potential for input foreclosure, whereby the (now) vertically integrated firm constrains access to an input it produces to its (non-integrated) rivals in a downstream segment.Footnote 4 However, as it is well known in the literature (e.g., Motta 2004), the efficiency features of vertical mergers, namely the potential to reduce the double marginalization problem, typically make them less worrisome than their horizontal counterparts.

Our underlying supply chain setup shares features of Greenlee and Raskovich (2006)—a single upstream supplier and competition in the downstream segment—and of Hunold and Stahl (2016)—who allow for upstream price discrimination. In particular, we assume that downstream firms compete on quantity (Cournot) and the upstream monopolist chooses (possibly discriminatory) linear wholesale prices which differ across two groups of retail firms: one which contains the retail firms with a non-controlling stake in the upstream firm’s capital and another which contains its rivals in the downstream segment.

Under this setup, we then analyze the potential profitability of a backward partial integration through a private placement operation, with the help of a financial intermediary.Footnote 5\(^{,}\)Footnote 6 We are particularly interested in understanding the rationale for the financial intermediary’s choice of the number of retail firms to approach in the operation, and we explore two different motivations underlying the private placement: a “benevolent” motivation, which seeks to maximize gains from trade, and a “self-interest” motivation, which aims to maximize the upstream firm’s post-integration profits. To the best of our knowledge, this is one of the first papers to look at the optimal characteristics of private placements. In fact, a private placement operation strikes us as a plausible mechanism for the upstream firm, through a financial intermediary, to select and approach a group of downstream firms to acquire a part of its capital (under two different motivations). Section 2 provides a more detailed discussion of the related literature as well as the research gap this paper tries to contribute to.

Under backward partial vertical integration, we find that it is profit-maximizing for the upstream firm to price discriminate between retail firms, charging a higher wholesale price to the retail firms which own a non-controlling stake in its capital. This result appears, at first glance, counterintuitive. The capital stake held by a subset of retail firms, which entitles them to a share of profits, works as a rebate to the wholesale price they face. This, in turn, induces them to expand production (“output expansion effect”) and, thus, their demand for the upstream input. The upstream firm takes advantage of this increased demand and finds that its downstream shareholders become less sensitive to changes in the wholesale price they face. This induces the upstream firm to charge those firms a higher “gross” wholesale price than that which it charges their rivals, but in “net” terms (i.e., once the share of the upstream firm’s profits is considered), the wholesale price is effectively lower, as one would expect.Footnote 7

Compared to a scenario of vertical separation (where the partial integration does not occur), there is input foreclosure, and the final retail price is higher, with a detrimental effect on welfare.Footnote 8 This result—similar to Hunold and Stahl (2016)—is clearly different from Greenlee and Raskovich (2006) and from Hoffler and Kranz (2011).Footnote 9\(^{,}\)Footnote 10 Therefore, a policy implication of our results is that competition authorities should analyze such partial vertical integrations with particular concern and, if possible, constrain the upstream firm’s ability (post-acquisition) to price discriminate.

We find that partial vertical integration is profitable.Footnote 11 Such profitability justifies the role of a financial intermediary in a private placement operation, as there are gains from trade in the acquisition. In addition, it is consistent with Allen and Phillips’s (2000) results for private placements with strategic partners, which typically attract a premium.Footnote 12

We also find that private placement operations “benevolently” motivated involve more retail firms than those motivated by self-interest. For a given non-controlling share of the upstream firm’s capital to be sold, if self-interest is the primary motivation of the private placement, it is optimal to restrict it to a single investor; by contrast, if the objective is to maximize gains from trade, a financial intermediary finds it optimal not to be that restrictive. In particular, depending on the retail market size and the magnitude of the non-controlling share in the upstream firm, the optimal number of retail firms involved is at least one, but it is never optimal to approach all retail firms.Footnote 13

The paper has the following structure: Section 2 describes the related literature and discusses the paper’s contribution; Section 3 describes the model; Section 4 contains the main results and Section 5 concludes. Four appendices contain the proofs, complementary results, and two model extensions.

2 Related Literature

The recent literature on partial vertical integrations yields results which differ somewhat from full vertical mergers, as initially suggested by Baumol and Ordover (1994). This literature can be divided into two categories: one in which the partial acquisition gives the acquiring firm a controlling stake in its target, effectively allowing it to define prices (e.g., Brito et al. 2016; Levy et al. 2018), and another (to which this paper belongs) where the partial acquisition gives the acquirer a non-controlling stake in the target’s capital, which, thus, does not allow it to influence the target’s decisions (e.g., Greenlee and Raskovich 2006; Fiocco 2016;Footnote 14 Hunold and Stahl 2016; Hunold and Schlutter 2019; Alipranti et al. 2022).

Moreover, the effects of partial acquisitions are not consensual and depend on the underlying modelling assumptions. Flath (1989) (for pure passive backward partial integrations only), Greenlee and Raskovich (2006) and Brito et al. (2016, Proposition 1) obtain an invariance result, whereby passive partial acquisitions do not affect total output and welfare.Footnote 15 More concretely, Brito et al. (2016) obtain this result when ownership shares are not too different and all downstream firms are active, that is, when there is no full foreclosure; also, their welfare finding is that partial acquisitions do not affect consumer surplus. By contrast, Hunold and Stahl (2016) show that it may lead to anticompetitive effects, as does Hunold (2020) due to an entry deterrence effect. Brito et al. (2016, Proposition 1) also find an anticompetitive effect when ownership shares are too different, as this leads to full foreclosure. On the other hand, Alipranti et al. (2022) highlight possible procompetitive effects.

Closer to our paper, Brito et al. (2016, Section 5) consider and briefly discuss discriminatory wholesale pricing as an extension to their basic framework. In a setting where one downstream firm holds a non-controlling shareholding in the upstream firm, but the other does not, they find that total quantity is decreasing with the downstream firm’s ownership share. This finding is aligned with our main results, which we obtained in a more general setting where a group of firms owns symmetric shares in the upstream firm’s capital, while the remaining firms in the market do not.

Such partial acquisitions may materialize through competitive bid offerings or private placements (Smith 1986).Footnote 16 Empirical results show that competitive bid offerings yield lower flotation costs than private placements, and yet most firms which are not obliged to proceed otherwise prefer the latter (Smith 1986; Cronqvist and Nilsson 2005). As Wu (2004) notes, (i) high information asymmetries (Chemmanur and Fulghieri 1999) and (ii) the need to enhance the monitoring of managers typically work in favor of private placements, although the latter appears to lack empirical support (Hertzel and Smith 1993; Wu 2004).Footnote 17

This paper weds these two strands of the literature by analyzing a backward partial vertical integration—whereby downstream firms acquire a non-controlling share in the capital of an upstream firm—through a private placement operation. This is both a frequent and interesting phenomenon. Wu (2004) finds that 15% of private placement investors are “strategic alliance partners,” including suppliers, customers, and strategic partners. This means that such investors are typically present in the same supply chain. Allen and Phillips (2000) find that private placements involving firms with a strategic product market relationship attract a premium (and lead to increased operating cash flows), in stark contrast with the discount generally associated with private placements (see Finnerty 2013). This suggests that the “vertical linkages” between the firms involved in the private placement may explain such differences, and this paper contributes to this discussion.

3 The Model

We assume a supply chain with an upstream segment, where only one firm—firm U—is assumed to operate, producing an essential input for all firms in the downstream or retail segment, where N firms compete to produce a (homogeneous) final good for consumers. The underlying production process we assume is relatively simple and consists of a one-to-one fixed proportions technology. Firm U, which we assume not to have any production costs, produces an input which retail firms acquire and somehow “transform” or “convert” into a retail product (which, thus, also implies a retail cost on top of the input purchase costs).Footnote 18

Therefore, each downstream firm \(i\in \left\{ 1,...,N\right\} \) is assumed to have two elements in its cost function: first, the cost associated with the purchase of the essential input from firm U; second, a constant marginal cost of c. Inverse consumer demand is assumed to be linear and given by \(p=a-\sum \limits _{i=1}^{N}q_{i},\) with \(a>c.\)

The scenario we explore in this paper is one where \(K\le N\) retail firms acquire a symmetric non-controlling share \(\alpha \in \left( 0,1\right) \) in firm U’s capital. We are particularly interested in symmetric share ownerships and thus assume that \(\alpha =\Omega /K,\) where \(\Omega \) is the total share of firm U’s capital acquired by K retail firms. Of critical importance to our analysis is the assumption that the share \(\alpha \) in firm U’s capital does not give any retail firm control over firm U—particularly, it does not give them control over wholesale prices. Therefore, this capital acquisition by K retail firms can be seen as a passive ownership which involves pure cash flow rights—the expectation to receive a share of firm U’s profits. This setup is similar to that of Greenlee and Raskovich (2006), but differs from it in two important aspects. First, Greenlee and Raskovich (2006) only consider the acquisition of a share in firm U’s capital by all retail firms, while we allow only a subset of K firms to do so; second, we allow firm U to price discriminate (in linear prices) between two groups of retail firms: its K non-controlling shareholders and their \(\left( N-K\right) \) retail rivals.Footnote 19

Therefore, we assume that firm U sets a linear and observable wholesale price \(w_{K}\) applicable to each of K retail firms and a (possibly different) linear and observable wholesale price \(\bar{w}\) for all other retail firms.Footnote 20\(^{,}\)Footnote 21 Observability is a standard assumption in the partial vertical integration literature, and we do not consider the possibility of there being secret contracts. Appendix D relaxes the assumption of observable linear wholesale prices and considers the possibility of (possibly discriminatory) observable two-part tariffs.

Decisions are assumed to be sequential in a three-stage game: in the second stage, firm U sets the wholesale price for the essential input, and in the third stage, retail firms observe it and choose the quantity they provide to final consumers (Cournot competition). In the first stage, a financial intermediary assesses the potential profitability of a backward partial vertical integration and, conditional on the capital share \(\Omega \) that the upstream firm is willing to sell, decides how many K firms to approach in a private placement.

4 Equilibrium Results

4.1 Price and Quantity Choices (Second and Third Stages)

The subgame-perfect equilibrium is obtained by backward induction. In the third stage of the game, each retail firm \(j\in \left\{ K+1,...,N\right\} \) chooses a quantity \(q_{j}\) which maximizes its profits, \(\pi _{j}=\left( a-\sum \limits _{k=1}^{K}q_{k}-\sum \limits _{i=K+1}^{N}q_{i}\right) q_{j}- \bar{w}q_{j}-cq_{j}\), where \(\bar{w}\) is the wholesale price they face. Symmetry ensures that \(q_{K+1}=...=q_{N},\) so each firm j has the following reaction function:

Each retail firm \(k\in \left\{ 1,...,K\right\} \) (denoted kI to highlight that its profits are now those of a backward partially integrated firm) also chooses a quantity \(q_{k}\) which maximizes its profits \(\pi _{kI}=\left( a-\sum \limits _{i=1}^{K}q_{i}-\sum \limits _{j=K+1}^{N}q_{j}\right) q_{k}-w_{K}q_{k}-cq_{k}+\alpha \left( w_{K}\sum \limits _{i=1}^{K}q_{i}+\bar{w }\sum \limits _{j=K+1}^{N}q_{j}\right) ,\) where the latter term represents the share of firm U’s profits received by each firm k. Symmetry ensures that \(q_{1}=...=q_{K,}\) so each firm k has the following reaction function:

As it is standard in Cournot settings, we have strategic substitutability. In a Cournot-Nash equilibrium, we have

In the second stage of the game, firm U in the upstream segment chooses wholesale prices \(w_{K}\) and \(\bar{w}\) to maximize \(\pi _{U}=\left( 1-\alpha K\right) \left( w_{K}\sum \limits _{k=1}^{K}q_{k}+\bar{w}\sum \limits _{j=K+1}^{N}q_{j}\right) .\) In equilibrium, we obtain

Faced with these equilibrium wholesale prices, downstream firms will produce

Total quantity produced is given by \(Q^{*}\!=\!\sum \limits _{k=1}^{K}q_{k}^{*}+\sum \limits _{j=K+1}^{N}q_{j}^{*}\!=\! \frac{\left( \alpha ^{2}K^{2}-2\alpha N-\alpha ^{2}NK+2N\right) \left( a-c\right) }{4N-4\alpha N+4-4\alpha -\alpha ^{2}NK+\alpha ^{2}K^{2}}\) and the equilibrium retail price is \(p^{*}=a-Q^{*}.\)

In order to ensure that all retail quantities are strictly positive and that all downstream firms are active, we make the following assumption throughout the paper:

Assumption 1

The symmetric non-controlling share \(\alpha \in \left( 0,1\right) \) in firm U’s capital of each of K downstream firms satisfies \(\alpha <\frac{2}{2+K}\) (or, equivalently, \(\Omega <\frac{2K}{2+K}\)).Footnote 22\(^{,}\)Footnote 23

With this setup, we obtain the following results:

Proposition 1

It is profit-maximizing for firm U to price discriminate between retail firms: \(\bar{w}^{*}<w_{K}^{*}\).

Proof

See Appendix A.\(\square \)

Under vertical separation (“VS”), \(\alpha =0\) and no downstream firm holds a capital stake in U. In this case, U sets a uniform wholesale price \(w^{VS}\) and N firms compete on quantities in the downstream segment.Footnote 24

Proposition 2

In comparison to a vertical separation scenario, backward partial vertical integration with price discrimination leads to input foreclosure and higher retail prices: \(w^{VS}<\bar{w}^{*}<w_{K}^{*},\) \(q_{j}^{*}<q_{i}^{VS}<q_{k}^{*},\) \(\forall k\in \left\{ 1,...,K\right\} ,\) \(\forall j\in \left\{ K+1,...,N\right\} ,\) \(\forall i\in \left\{ 1,...,N\right\} \), \(Q^{VS}>Q^{*}\) and, consequently, \(p^{VS}<p^{*}.\)

Proof

See Appendix A.\(\square \)

By acquiring a share \(\alpha \) of firm U’s capital, the profit function of each firm \(k\in \left\{ 1,...,K\right\} \) becomes different from that of firms \(j\in \left\{ K+1,...,N\right\} .\) In particular, each firm k effectively receives a “rebate” or “discount” in the wholesale price it pays firm U. This is equivalent to saying that each firm k’s marginal cost becomes, in effect, lower than that of firms \(j\in \left\{ K+1,...,N\right\} .\) As is standard in a Cournot setting with asymmetric costs, this induces K firms to expand their production (“output expansion effect”) and their \(\left( N-K\right) \) competitors, because of strategic substitutability, to lower their production (given wholesale prices). When choosing wholesale prices to maximize its profits, firm U is faced with the fact that changes in \(w_{K}^{{}}\) are a somewhat “weak” instrument: indeed, looking at Eqs. 3 and 4, we can see that changes in \(w_{K}^{{}}\) (i) will affect \(q_{k}\) and \(q_{j},\) (ii) but that this impact is “moderated” by \(\alpha .\) This induces firm U to increase \(w_{K}^{{}},\) as it finds the downstream firms’ demand function to be less sensitive to changes in \(w_{K}^{{}}\).Footnote 25 This increase in \(w_{K}^{{}}\) contributes to an increase in \(q_{j}\) (see Eq. 4) which induces U to increase \(\bar{w}.\) Therefore, both wholesale prices are higher than under vertical separation.

At a first glance, it appears almost counterintuitive that firm U discriminates against its new shareholders—the K retail firms. But although \(\bar{w}^{*}<w_{K}^{*}\) in equilibrium, the “net” or “effective” input price paid by each firm \(k\in \left\{ 1,...,K\right\} \) (because of their \(\alpha \)-share in firm U’s capital) is \(\left( 1-\alpha \right) w_{K}^{*}<\bar{w}^{*}\).Footnote 26

Therefore, we find that both wholesale prices under partial vertical integration are higher than the wholesale price charged under vertical separation, thus leading to input foreclosure. In equilibrium, the output expansion effect of the K firms is insufficient to compensate the input foreclosure effect for their \(\left( N-K\right) \) rivals, and therefore, partial vertical integration reduces the overall quantity produced and leads to higher retail prices. Hunold and Stahl (2016) obtain a similar result to this one: backward partial vertical integrations clearly appear to have anti-competitive effects.

Not surprisingly, from a social welfare viewpoint, we find that

Proposition 3

Backward partial integration is detrimental to social welfare (compared to vertical separation).

Proof

See Appendix A.\(\square \)

Intuitively, this result is straightforward: compared to vertical separation, Proposition 2 shows that \(Q^{VS}>Q^{*}\) and, consequently, \(p^{VS}<p^{*}.\) Note that this welfare effect is driven by the input foreclosure effect of \(\left( N-K\right) \) firms, which reduce their output; the output expansion of the K firms counteracts this, but it is insufficient to increase overall output—and, consequently, social welfare.

In order to understand the magnitude of these effects, we can use Eq. 16 to calculate social welfare under vertical separation (\(\alpha =0\) and \(K=0)\) and under partial vertical integration (\(\alpha >0\) and \(K>0). \) Consider a market with either \(N=4\) or \(N=10\) downstream firms, where one firm (\(K=1)\) acquires a 40% stake in the upstream firm’s capital. Assuming \((a-c)=1,\) we find that social welfare decreases by 4.8% in the first case and 5% in the second. By contrast, suppose instead that two firms (\(K=2)\) acquire a 20% stake each in the upstream firm’s capital; in this case, social welfare decreases by 1.1% in the first case and 1.6% in the second.Footnote 27 Note that the welfare effect is higher for a larger N : intuitively, for a given K, the larger is N, the larger is the number of retail firms that do not own a stake in the upstream firm’s capital. These firms will be particularly affected by the input foreclosure effect, and therefore, the impact on social welfare is larger.

4.2 Optimal Private Placement

In the first stage of the game, a financial intermediary must assess the potential profitability of a backward partial vertical integration and choose the optimal characteristics of a private placement operation for firm U’s capital. Note that we assume perfect information in our analysis, when indeed information asymmetries could be an underlying explanatory reason for private placement operations. In addition, we do not consider alternative selling mechanisms, such as competitive offerings, where (arguably) the role of information asymmetries would be crucial. Moreover, we focus mainly on the upstream firm and on the profitability of such an operation from its own viewpoint. However, we also discuss and explain that participating in such a private placement operation would be beneficial to downstream firms.

As a natural first step, we look at the potential gains from trade of such an operation. We follow Hunold and Stahl (2016) in assessing whether backward partial integrations increase the combined profits of the upstream and downstream (acquiring) firms. In effect, as they note, the key condition for such acquisitions to materialize is that there are gains from trading claims on the upstream firm’s profits.

First, take the combined profits of firm U and K retail firms, given by \(\pi _{U}^{*}+K\pi _{kI}^{*}\), which are obtained when we substitute \(w_{K}^{*},\) \(\bar{w}^{*},\) \(q_{k}^{*}\) and \(q_{j}^{*}\) in the profit functions of firm U and each of the \(k\in \left\{ 1,...,K\right\} \) retail firms. Note that

Therefore, compared to a vertical separation scenario (\(\alpha =0),\) combined profits are higher for a small \(\alpha ,\) that is, regardless of the bargaining process which underlies the acquisition of a capital share in firm U, there are potential gains from trade to be realized, and therefore, backward partial integration is desirable (compared to vertical separation). The rationale is straightforward and consistent with our results from Section 4.1: a share \(\alpha \) in firm U’s capital lowers K firms’ retail-related profits.Footnote 28 However, this negative effect is more than compensated by the share they receive of firm U’s profits. Therefore, the downstream firms approached by the financial intermediary do find it beneficial to participate. This result resembles that of Okamura et al. (2011), who, in a forward integration setting (where the upstream firm may acquire a share in the capital of a downstream firm), find that the acquiring firm also chooses an aggressive strategy, trading off the profits it loses on its sales with the increased profits accruing from the capital share it acquires. Moreover, this result contrasts with Hunold and Stahl (2016), who find that not to be the case when there is an upstream monopolist.

In addition, this contributes towards justifying the role of a financial intermediary in the private placement, insofar as the increased combined profits may be used to cover the cost of the operation.Footnote 29 We explore two scenarios, both of which assume that the financial intermediary acts as a perfect agent for the upstream firm. In a first scenario, we posit that the financial intermediary maximizes gains from trade, which is equivalent to maximizing the difference between the combined profits of firm U and K retail firms under vertical separation and under partial vertical integration. This is somewhat equivalent to viewing the financial intermediary as benevolent, insofar as it maximizes the overall combined profits (post-integration) regardless of how they would be split between the upstream and downstream acquiring firms. In this scenario, the financial intermediary’s objective function is given by

In a second scenario, we assume that the financial intermediary maximizes the difference between the upstream firm’s post- and pre-integration profits. As we are interested in firm U’s profits post-integration for all shareholders, we define \(\pi _{U}^{\prime }=\pi _{U}^{*}/(1-\alpha K)\). Therefore, in this scenario, we assume that the financial intermediary maximizes (\(\pi _{U}^{\prime }/\pi _{U}^{VS}\)). This is somewhat equivalent to assuming self-interest by the upstream firm’s pre-acquisition shareholders, insofar as they are more concerned with their firm’s post-integration profits than with the acquiring firms’ profits. In other words, while in the first scenario the way the gains from trade are split between the upstream and the acquiring downstream firms are not considered, in this second scenario, we look at an extreme split of those gains from trade—one in which the upstream firm captures the largest possible share of those gains.

Recall that the share of capital firm U is willing to sell is \(\Omega ,\) and this is assumed to be an exogenous variable.Footnote 30\(^{,}\)Footnote 31 Firms \(k\in \left\{ 1,...,K\right\} \) acquire a symmetric share \(\alpha =\Omega /K\) of firm U’s capital.Footnote 32 In this context, the financial intermediary chooses K, that is, the number of firms which will acquire a symmetric share of firm U’s capital in a private placement operation. In the first scenario, the intermediary acts benevolently (denoted with superscript ‘b’) and maximizes gains from trade by choosing \(K^{b}\), while in the second scenario, the intermediary acts in the upstream firm’s self-interest (denoted with superscript ‘si’) and maximizes its post-integration profits by choosing \(K^{si}.\) We find the following:

Proposition 4

A private placement operation which maximizes gains from trade involves more retail firms than the one which maximizes the upstream firm’s post-integration profits, that is, \(K^{b}\ge K^{si}.\)

Proof

See Appendix A.\(\square \)

The rationale for this result is the following: in the self-interest scenario, the upstream firm finds it profitable to sell a share \(\Omega >0\) of its capital. However, in order to capture as large a share as possible of the associated gains from trade, it prefers to sell that share to as few retail firms as possible, as it finds it more profitable to concentrate the output expansion effect in the smallest possible number of firms, i.e., it prefers to approach a single retail firm. The intuition is straightforward: an increase in K “dilutes” the share \(\Omega \) across a larger number of firms, which will individually have a lower output expansion effect (because the stake they hold in the upstream firm is lower); in equilibrium, this leads the upstream firm to lower both wholesale prices which ultimately leads to lower profits. Therefore, the upstream firm finds it preferable to concentrate in a single retail firm the output expansion effect, as this yields higher profits.

By contrast, when the objective is to maximize gains from trade, it is preferable to “spread” the output expansion effect among more retail firms, as their profits are also considered in \(\Gamma \) (Eq. 10). Although a higher K results in profits, for the upstream firm, which are lower than when K is minimal, more retail firms are able to benefit from increased profit levels and this ultimately generate gains from trade (that is, the latter effect outweighs the former). In other words, a “concentrated” output expansion effect would increase the combined profits of too few retail firms, and this would not maximize the integration’s gains from trade.

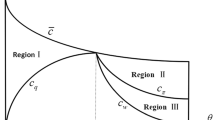

Looking more closely at the results from the gains from trade scenario, we can see in Fig. 1 (left) that \(K^{b}\) is increasing with \(\Omega \) and with N, which results in (see Fig. 1 (right)) an individual share \(\alpha ^{b}=\Omega /K^{b}\) that is decreasing with \(\Omega \) and \(K^{b}.\) Therefore, in a private placement operation motivated by gains from trade, these are maximized when only a subset of \(K^{b}<N\) retail firms acquire a symmetric share in firm U’s capital.Footnote 33 As \(\Omega \) increases, the financial intermediary finds it optimal to increase \(K^{b}\).

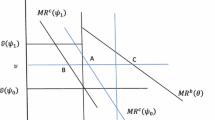

Figure 2 (left) displays the optimal “market coverage” in the private placement operation motivated by gains from trade, that is, the overall market share (prior to the operation) of the \(K^{b}\) firms which the financial intermediary will approach. This market coverage is increasing with \(\Omega \) but decreasing with N, that is, a more competitive retail segment (with more firms) will lead the financial intermediary to approach a subset of \(K^{b}\) firms which, in aggregate, have a smaller market share. Again, this is consistent with our results. With more competition in the retail segment (and thus lower retail profits), it is sufficient for a proportionally lower subset of \(K^{b}\) to benefit from the output expansion effect. Finally, Fig. 2 (right) displays the gains from trade (\(\Gamma ^{b}\)) which result from a private placement operation with \(K^{b}\) firms. Note that these gains from trade are decreasing with N and do not appear to follow a monotonic relationship with \(\Omega \) (although it is increasing with \(\Omega \) within the assumed range).

For instance, suppose \(\Omega =0.25\) and \(N=50.\) Our simulations suggest that (approximately) 2 firms should be approached to acquire a symmetric share in firm U’s capital, and this would lead to combined profits under partial vertical integration 0.4% higher than under vertical separation.

4.3 Extensions

An interesting question is whether our results hold if there is Bertrand (rather than Cournot) competition in the downstream segment.Footnote 34 With that objective in mind, we have solved the model assuming a linear demand function similar to that of Greenlee and Raskovich (2006): \(q_{j}\left( \textbf{p}\right) =d-p_{j}+\gamma \sum \limits _{i\ne j}p_{i},\) \(i=1,...,N,\) \(0<\gamma <1/\left( N-1\right) .\) In order to simplify the analysis, we have assumed \( N=2\) and \(K=1.\) Appendix C contains the underlying analysis. Our key findings are as follows: (i) given wholesale prices, the non-controlling stake \(\alpha \) also works as a rebate and induces the downstream firm holding the stake to expand production (similar to our results under Cournot competition), as does its rival because of the strategic complementarity which is typical of Bertrand competition (and this is clearly different from our results under Cournot competition); (ii) the upstream firm takes advantage of the output expansion effect of the downstream firm holding the capital stake and chooses to raise the wholesale price it faces (\(w_{K}\)); (iii) by doing so, the upstream firm is also raising the retail price chosen by its rival, so it finds it optimal to lower \(\bar{w}\) to compensate; (iv) in equilibrium, the downstream firm holding the capital stake produces less than under vertical separation and its rival produces moreFootnote 35; (v) the overall quantity produced actually increases, so that a partial vertical integration in this setup is less worrisome, from a welfare perspective, than under Cournot competition; (vi) but a partial vertical integration does not yield gains from trade (as is the case in Hunold and Stahl 2016, when there is an upstream monopolist), and so it would be unlikely to materialize.Footnote 36 In summary, although the output expansion effect also exists under Bertrand competition, strategic complementarity leads to very different results. However, although they yield benefits from a welfare perspective, partial vertical integrations would be unlikely to emerge as they fail to generate gains from trade between the interested parties.

In another extension (Appendix D), we look at (possibly discriminatory) two-part tariffs, where the upstream firm offers different contracts (a fixed fee plus a linear wholesale price) to each group of firms (K firms vs. remaining firms). Under vertical separation, two-part tariffs solve the double marginalization problem: the upstream firm, by choosing the optimal two-part tariff, induces downstream firms to produce the same quantity that they would produce under full vertical integration; in addition, as one would expect, optimal two-part tariffs allow the upstream firm to capture all industry profits. In the context of our model, where K downstream firms own a non-controlling share of the upstream firm, two-part tariffs also solve the double marginalization problem, but we find that linear wholesale pricing may, under some circumstances, actually yield higher profits than two-part tariffs. We show, in Appendix D, that this depends on the particular values of N, K and \(\Omega .\) However, we find that given \(\Omega \) and under a benevolent motivation for the private placement, the optimal number of retail firms (\(K^{b})\) to be involved in the operation renders two-part tariffs less profitable than linear and discriminatory wholesale pricing. Moreover, given N and under a self-interest motivation, it is always possible to find a share \(\Omega \) to be sold to a single downstream firm which also leads to higher upstream profits under linear and discriminatory wholesale pricing. In either case, it is then sensible to conclude that even if the upstream firm could implement two-part tariffs, it would prefer not to do so under the two motivations we look at for the private placement.Footnote 37 This result is similar to that obtained by Hunold and Stahl (2016) (Proposition 5) and lends some further robustness to the results we have obtained under linear and discriminatory wholesale prices.

5 Conclusion

In this paper, we have analyzed the possibility that a subset of retail firms acquire, through a private placement operation, a partial non-controlling interest in the capital of a key input supplier (backward partial vertical integration), where the latter is then assumed to choose its wholesale prices and, in particular, it is allowed to price discriminate between its (now) retail shareholders and their competitors. We find that it is profit-maximizing for the upstream firm to indeed price discriminate between retail firms, subtly favoring its shareholders through a lower net wholesale price which allows them to expand production. We also find that, compared to vertical separation, this partial vertical integration leads to input foreclosure and ultimately to higher retail prices and lower social welfare—a result similar to that obtained by Hunold and Stahl (2016). However, contrary to the latter, we find that backward partial integration is desirable, as it increases the combined profits of the upstream and downstream (acquiring) firms. This result also justifies the role of a financial intermediary in a private placement operation for the sale of a share in the upstream firm’s capital, and we explore two underlying motivations: a benevolent motivation which seeks to maximize gains from trade and a self-interest motivation with the objective of maximizing the upstream firm’s post-integration profits. We find that the number of firms approached to take part in the private placement under a benevolent motivation is always higher than under a self-interest motivation. We also find our results to be robust to the introduction of (possibly discriminatory) two-part tariffs by the upstream firm.Footnote 38

From a competition policy viewpoint, and in comparison to the results of Greenlee and Raskovich (2006), our analysis suggests that the possibility for price discrimination at the wholesale level is at the root of the harm to consumers through higher retail prices, and thus, in the analysis of such partial integrations, particular care should be taken to prevent discriminatory pricing. However, non-discriminatory pricing also raises competitive concerns, such as entry deterrence (Hunold 2020), which our paper does not analyze.

From a practical viewpoint, we are able to understand the drivers underlying the search for investors by financial intermediaries in private placement operations. Moreover, our results are amenable to empirical testing, in line with previous research by Allen and Phillips (2000) and Fee et al. (2006). First, in sectors similar to our model setup, backward partial integration should increase the market value of the upstream firm and of the acquiring retail firms (because of expected higher future profits) and reduce the market value of the remaining retail firms. Moreover, the number of retail firms involved in such private placements may reveal their underlying motivation.

Whether these results generalize beyond the particular setting we have analyzed is a relevant research question. We assume that contracts are fully observable. Would these results extend to a setting where contracts are secret, as in Fiocco (2016) or Hunold and Schlütter (2019)? Also, as we discuss at the end of Section 4.1 by looking at what would happen under Bertrand competition, the form of competition at the retail segment is important for our results to hold. Can the same be said for upstream competition? That is, could these results be generalized beyond the upstream monopoly assumption (as in Hunold and Stahl, 2016)? Moreover, we assume both a symmetric retail segment and a symmetric allocation of non-controlling stakes in the upstream firm’s capital; how would our results change in an asymmetric environment? These are clearly important and interesting future research questions.

Notes

Fee et al. (2006) only examine 5% blockholders. Lower stakes, presumably somewhat less uncommon, are unobserved in their dataset.

Among several other cases, BSkyB’s acquisition of a minority stake on ITV in 2006 (UK); News Corp. acquisition of a minority stake in Hughes Electronics Corporation in 2003 (US); AEG’s acquisition of minority stakes in the Hammersmith Apollo, in 2012, and Wembley Arena, in 2013 (UK); the acquisition of a minority stake in the MEO Arena in 2012 by live music event promoters (Portugal). For other relevant cases, see European Commission (2014).

The European Commission is more concerned with circumstances where such partial acquisitions yield “material influence” or “control” over the acquired firm, but it is considering whether (or not) to extend it to minority shareholdings (European Commission 2014).

Sjostrom (2013) notes that issuing companies often use investment banks as placement agents, whose role is to seek interested investors, and which play an important monitoring role of the issuing firm because of informational asymmetries between managers and potential capital acquirers (Smith 1986).

Our paper assumes perfect information and, therefore, does not consider the role of information asymmetries. The paper also does not consider alternative selling mechanisms, such as competitive offerings, where indeed accounting for information asymmetries would be essential.

We follow Salinger (1988) in defining input foreclosure as occurring when wholesale prices increase (in our case, compared with those charged under vertical separation).

In Greenlee and Raskovich (2006), the upstream firm also faces increased input demand when retail firms acquire partial stakes in its capital and, thus, raises wholesale prices. But these two effects cancel out under linear and uniform wholesale prices, and total output and final consumer prices remain unaffected.

Höffler and Kranz (2011) compare vertical separation with “legal unbundling”—a situation where a downstream firm fully owns the upstream firm, but cannot (for legal or regulatory reasons) make upstream price or non-price decisions. They find that, under legal unbundling, although the vertically integrated downstream firm has incentives to expand its output and their downstream rivals reduce their output (under quantity competition), the net effect on total quantity (“downstream expansion effect”) is positive (whereas in our case it is negative). The difference is explained by the fact that, in their model, the discrimination tool does not affect the upstream firm’s profits directly, whereas in our case, it does.

By contrast, Hunold and Stahl (2016, Proposition 2) find that backward partial integration is only desirable if upstream competition is sufficiently intense. Their result is obtained under a Bertrand duopoly in the downstream segment (which contrasts with our N-firm Cournot competition assumption). We discuss this further in Section 4.1.

The live music industry—for which, as we argue below, our model appears to be a good depiction—has several examples of (various degrees) of vertical integration (partial equity interest, lease, booking rights or ownership). For instance, AEG Live is the live-entertainment division of the Anschutz Entertainment Group (AEG), which promotes live music and entertainment events; over time, AEG has acquired or leased several venues, such as the O2 arena, Wembley Arena, and Hammersmith Apollo (London, UK) (the latter two have been assessed and cleared by the OFT and Competition Commission). Live Nation Entertainment is also a promoter of live music events and has also been active in the acquisition (full or partial) or lease of venues (139 as of 2012), especially in the USA and UK. Notably, Live Nation currently holds both a long-term lease and a shareholding of the Ziggo Dome (Amsterdam). In Portugal, the MEO Arena (Lisbon) was acquired, in 2012, by a firm whose shareholders include two live music event promoters.

Underlying this result is the balance of the output expansion effect for a subset of retail firms with the inevitable output contraction (because of input foreclosure) of their rivals.

Fiocco (2016) looks at forward (rather than backward) partial vertical integration.

Competitive bid offerings include initial public offerings (IPO) as well as share issues (depending on whether a firm is already listed or not).

Wu (2004) also observes that managers may be more capable of influencing the ownership structure through private placements, as their preferences can steer the search for investors. If that is the case, managers may be more inclined to conduct such partial integrations through private placements.

Two examples can be given of such simple processes. In the telecommunications sector, retail firms which do not possess a telecommunications network can typically purchase wholesale services from the incumbent, and this allows them to sell services directly to consumers. In the music industry, promoters organize music concerts by essentially securing deals with musicians and booking a venue for the show. For concerts which attract significant demand (e.g., well-known musicians in world tours), there is typically a relatively low number of large-capacity venues in each country, which promoters can book in order to sell tickets for a particular concert.

Hunold and Stahl (2016) also allow for price discrimination to occur at the upstream level.

Greenlee and Raskovich (2006), by contrast, assume that firm U sets a linear and uniform wholesale price.

We implicitly assume that there are no legal non-discriminatory requirements preventing the upstream firm from charging a different wholesale price to each group of retail firms.

Consider \(q_{k}^{*}\) first (Eq. 7). Note that the numerator of \(q_{k}^{*}\) is always positive, because \(a>c\) by definition. Therefore, in order for \(q_{k}^{*}>0,\) we need the denominator to be positive: \(\left( 4N-4\alpha N+4-4\alpha -\alpha ^{2}NK+\alpha ^{2}K^{2}\right) >0.\) This is equivalent to requiring that \( \alpha <\tilde{\alpha }=\frac{-2\left[ N+1-\left( N+1\right) ^{1/2}\left( K+1\right) ^{1/2}\left( 1+N-K\right) ^{1/2}\right] }{K\left( N-K\right) }.\) Now consider \(q_{j}^{*}\) (Eq. 8). In order for \( q_{j}^{*}>0,\) in addition to the previous restriction we must have that \( \left( 2-2\alpha -\alpha K\right) >0,\) which is equivalent to requiring that \(\alpha <\frac{2}{2+K}.\) This second restriction is more stringent than the first, and hence provided \(\alpha <\frac{2}{2+K}\), both \(q_{k}^{*}\) and \( q_{j}^{*}\) (\(\forall k\in \left\{ 1,...,K\right\} ,\) \(\forall j\in \left\{ K+1,...,N\right\} )\) are always positive.

A more detailed analysis of the implications of this parameter restriction would certainly be very interesting, although we do not pursue it. In general across jurisdictions, a majority shareholding (51%) is sufficient to ensure corporate control. Therefore, this parameter restriction suggests that whenever \(K\ge 2,\) the acquisition by K firms of a shareholding in firm U’s capital entails an individual shareholding of \(\alpha \le 0.5,\) consistent with it being a non-controlling shareholding and with the interior solutions we are interested in.

Note that under vertical separation, firm U’s finds it profit-maximizing not to price discriminate, that is, to charge a uniform wholesale price, \(w^{VS},\) to all retail firms.

These results yield interesting comparative statics which we discuss in detail in Appendix B. In particular, we find that (i) both wholesale prices decrease with N but \(\left| \partial w_{K}^{*}/\partial N\right| >\left| \partial \bar{w}^{*}/\partial N\right| \) (increased wholesale price asymmetry as N increases), and (ii) an increase in \(\alpha \) increases both wholesale prices, but \(\left| \partial w_{K}^{*}/\partial \alpha \right| >\left| \partial \bar{w}^{*}/\partial \alpha \right| \) (increased wholesale price asymmetry as \(\alpha \) increases).

From Eqs. 5 and 6, we find that \(\left( 1-\alpha \right) w_{K}^{*}=\frac{\left( 1-\alpha \right) \left( 2N-\alpha N+2+\alpha K\right) \left( a-c\right) }{4N-4\alpha N+4-4\alpha -\alpha ^{2}NK+\alpha ^{2}K^{2}}<\bar{w}^{*}=\frac{\left( 2N-2\alpha N+2-2\alpha +\alpha K\right) \left( a-c\right) }{4N-4\alpha N+4-4\alpha -\alpha ^{2}NK+\alpha ^{2}K^{2}}\) for \(\alpha <2/\left( 2+K\right) .\)

This is just an illustrative example to show the magnitude of the effects. We refrain from discussing whether a 40% stake by one firm or a 20% stake by two firms is (or is not) sufficient to confer influence over the upstream firm.

Looking only at retail segment profits, the output expansion effect and the retail price increase contribute towards increased revenues; however, the gross wholesale price increase leads to increased costs, and the latter effect dominates.

We do not explore in full the trade-off between increased combined profits and the private placement’s cost, but clearly, for any positive cost, one would find that not all backward partial integrations (namely those where \(\alpha \) is very close to 0) would yield net positive combined profits. This is consistent with empirical evidence by Allen and Phillips (2000), who report a mean (median) for the fraction of equity acquired of 20% (14%) (all acquisitions).

In effect, this can be seen as a restriction for the financial intermediary, decided by the shareholders of firm U, and is consistent with reality, insofar as a firm typically does not delegate in a financial intermediary the decision of the total share of capital to be relinquished by shareholders.

It would be interesting to analyze an expanded setting where the choice of \(\Omega \) is endogenous, but we did not pursue this in this paper.

It is natural to think of a symmetric share allocation given that the retail segment is also symmetric.

The rationale is straightforward: as suggested in Proposition 1 price discrimination incentives are retained even when \(K=N,\) but in this case, all retail firms would benefit from the output expansion effect (associated with a lower net wholesale price). Although this would increase firm U’s profits, increased retail competition would work in the opposite direction, thus yielding overall industry profits equal to those obtained under vertical separation. Therefore, it is preferable that only a subset \(K^{b}\) of retail firms acquire an individual share \(\alpha ^{b}\) in firm U’s capital.

That is, the increase in \(w_{K}\) is very significant and actually increases the net wholesale price faced by K firms. In other words, the upstream firm truly discriminates against its (now) non-controlling shareholders.

Note that these results are different from those obtained by Hunold and Stahl (2016), and this is explained by three features of their model: first, they assume an upstream duopoly (whereas we assume an upstream monopolist); second, they assume a downstream duopoly (whereas we assume downstream competition among N firms); third, they assume that all downstream firms acquire a non-controlling stake in the upstream firm (whereas we assume that only K firms do).

Contracts arise in equilibrium and are not selected solely by the upstream firm. However, this is outside the realm of this paper. We thank a referee for this observation.

See Appendix D.

Note that \(\pi _{kI}^{*}\) already includes the share of firm U’s profits received by each firm k. And \(\pi _{U}^{*}\) only includes the share of upstream profits that are not distributed to the K downstream firms.

The expression for \(\Gamma \) is quite cumbersome and we have chosen not to include it here.

We have conduced simulations for more values of N, but the results are similar to those presented here.

We have not restricted \(K^{b}\) or \(K^{si}\) to be integers; instead, we have focused on obtaining real (equilibrium) values for \(K^{b}\) or \(K^{si}.\) However, introducing such an integer restriction does not change our results: in that case, \(K^{si}=1\) (the lowest possible positive integer) and \(K^{b}\ge 1,\) for \(\forall N,\) \(\forall \Omega \in \left( 0,1\right] .\)

From Eqs. 5 and 6, we obtain \(\frac{\partial w_{K}^{*}}{\partial N}-\frac{\partial \bar{w}^{*}}{\partial N}=\frac{\alpha \left( 2+\alpha K\right) \left( 2\alpha -2+\alpha K\right) \left( a-c\right) }{\left( 4N-4\alpha N+4-4\alpha -\alpha ^{2}NK+\alpha ^{2}K^{2}\right) ^{2}},\) which is negative for \(\alpha <2/\left( 2+K\right) .\)

From Eqs. 5 and 6, we obtain \(\frac{\partial w_{K}^{*}}{\partial K}-\frac{\partial \bar{w}^{*}}{\partial K}=\frac{\alpha ^{3}\left( N+2\right) \left( N-2K\right) \left( a-c\right) }{\left( 4N-4\alpha N+4-4\alpha -\alpha ^{2}NK+\alpha ^{2}K^{2}\right) ^{2}},\) which is positive when \(K<N/2\) and negative otherwise.

In equilibrium, when \(K<N/2,\) the wholesale price increase effectively moderates the K firms’ output expansion and leads to \(\partial Q^{*}/\partial K<0;\) by contrast, when \(K>N/2,\) \(\partial Q^{*}/\partial K>0.\)

In Greenlee and Raskovich (2006), the demand function is firm-specific, as it includes the term \(d_{j}\) (rather than d). We have chosen to solve the model under a simpler and symmetric demand function.

In our main model, we assume that linear contracts are observable. Here, we also assume that TPT contracts are observable. The alternative—that contracts are secret and, therefore, not observed by the rival downstream firms—is analyzed by Fiocco (2016) or Hunold and Schlütter (2019). For the case of backward integration, Hunold and Schlütter (2019) find that secret contracts lead to the same (low) input prices as under vertical separation. The underlying logic is straightforward: low prices maximize the bilateral profits, which are then captured by the upstream firm through the fixed fee.

In a slightly different setup, Hunold and Schlütter (2019, Section 5.2) also discuss the outside options of partially integrated firms vis a vis non-integrated firms.

We thank a referee for making this observation.

We thank a referee for making this point.

References

Alipranti M, Petrakis E, Skartados P (2022) On the pro-competitive effects of passive partial backward ownership. Econ Lett 213:110376

Allen J, Phillips G (2000) Corporate equity ownership, strategic alliances, and product market relationships. J Finance 55:2791–2815

Baumol W, Ordover J (1994) On the perils of vertical control by a partial owner of a downstream enterprise. Revue d Économie Industrielle 69:7–20 (3rd trimester)

Brito, D, Cabral, L, Vasconcelos, H (2016). Competitive effects of partial control in an input supplier, CEPR Discussion Paper No. 11397

Chemmanur TJ, Fulghieri P (1999) A theory of the going-public decision. Rev Financ Stud 12(2):249–279

Cronqvist H, Nilsson M (2005) The choice between rights offerings and private equity placements. J Financ Econ 78(2):375–407

European Commission (2014). Towards more effective EU merger control. White Paper. COM(2014) 449

Fee C, Hadlock C, Thomas S (2006) Corporate equity ownership and the governance of product market relationships. J Financ 61:1217–1251

Finnerty JD (2013) The impact of stock transfer restrictions on the private placement discount. Financ Manag 42(3):575–609

Fiocco R (2016) The strategic value of partial vertical integration. Eur Econ Rev 89:284–302

Flath D (1989) Vertical ownership by means of shareholding interlocks. Int J Ind Organ 7(3):369–380

Greenlee P, Raskovich A (2006) Partial vertical ownership. Eur Econ Rev 50(4):1017–1041

Hertzel MG, Smith RL (1993) Market discounts and shareholder gains for placing equity privately. J Financ 48(2):459–485

Höffler F, Kranz S (2011) Legal unbundling can be a golden mean between vertical integration and ownership separation. Int J Ind Organ 29(5):576–588

Hunold M (2020) Non-discriminatory pricing, partial backward ownership, and entry deterrence. Int J Ind Organ 70:102615

Hunold, M, Schlütter, F (2019) Vertical financial interest and corporate influence. DICE Discussion Paper No. 309

Hunold M, Stahl K (2016) Passive vertical integration and strategic delegation. Rand J Econ 47(4):891–913

Inderst R, Valletti T (2011) Incentives for input foreclosure. Eur Econ Rev 55(6):820–831

Levy N, Spiegel Y, Gilo D (2018) Partial vertical integration, ownership structure and foreclosure. Am Econ J Microecon 20(1):132–180

Motta, M. (2004) Competition policy: theory and practice. Cambridge University Press

Okamura M, Nariu T, Ikeda T (2011) Direct sale or indirect sale? Effects of shareholding. Manchester School 79(3):542–549

Rey, P, Tirole, J (2007) A primer on foreclosure. In: Armstrong, M, Porter, R (Eds.), Handbook of Industrial Organization (vol. 3) (Ch. 33). Elsevier, pp 2145–2220

Riordan M (2008) Competitive effects of vertical integration. In: Buccirossi P (ed) Handbook of Antitrust Economics. MIT Press, pp 145–182

Salinger M (1988) Vertical mergers and market foreclosure. Q J Econ 103(2):345–356

Sjostrom WK (2013) Rebalancing private placement regulation. Seattle Univ Law Rev 36(2):1143–1167

Smith CW (1986) Investment banking and the capital acquisition process. J Financ Econ 15(1–2):3–29

Wu Y (2004) The choice of equity-selling mechanisms. J Financ Econ 74(1):93–119

Acknowledgements

Financial support from FCT (Foundation for Science and Technology) and POCI 2010 is gratefully acknowledged. I would like to thank three anonymous referees, Kurt Brekke, Miguel Fonseca, Tommy Staahl Gabrielsen, Matthias Hunold, Lars Sørgard, Flávio Menezes and participants in a seminar at the NHH - Norwegian School of Economics, as well as participants in the 8th Meeting of the Portuguese Economic Journal (2014, Braga, Portugal) and in the CEGE-NIPE research workshop (2014) for their helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Proofs

Proof of Proposition

1 From Eqs. 5 and 6, we obtain \(w_{K}^{*}-\bar{w}^{*}=\frac{\left( a-c\right) \left( 2+N\right) \alpha }{4N-4\alpha N+4-4\alpha -\alpha ^{2}NK+\alpha ^{2}K^{2}},\) which is positive under Assumption 1. \(\square \)

Proof of Proposition

2 In a vertical separation scenario, \(w^{VS}=\left( a-c\right) /2\) (readily obtained by substituting \(\alpha =0\) in Eqs. 5 or 6). We thus obtain \(w^{VS}-\bar{w}^{*}=-\frac{\alpha K[ 2+\alpha \left( N-K\right) ] ( a-c) }{2\left( 4N-4\alpha N+4-4\alpha -\alpha ^{2}NK+\alpha ^{2}K^{2}\right) }<0 \)under Assumption 1. Similarly, under vertical separation, \(q_{k}^{VS}=q_{j}^{VS}=q^{VS}= \frac{a-c}{2\left( N+1\right) },\) \(\forall k\in \left\{ 1,...,K\right\} , \forall j\in \left\{ K+1,...,N\right\} \) (obtained by substituting \(\alpha =0 \) in Eqs. 7 or 8). From this expression, we obtain

because the numerator is always negative and the denominator is positive. We also obtain

because the numerator is always positive and the denominator is positive provided. Under vertical separation, we obtain \(Q^{VS}=\frac{N\left( a-c\right) }{2\left( N+1\right) }\) which then yields

as the numerator is always positive and the denominator is positive. Finally, \(p^{VS}=a-Q^{VS}\) while \(p^{*}=a-Q^{*}.\) Because \(Q^{VS}>Q^{*},\) we have \(p^{VS}<p^{*}.\) \(\square \)

Proof of Proposition

3 Social welfare is given by \(SW=CS+\Pi ,\) where CS denotes consumer surplus and \(\Pi \) is the overall sum of firms’ profits, i.e., \(\Pi =\pi _{U}^{*}+\sum \limits _{k=1}^{K}\pi _{kI}^{*}+\sum \limits _{j=K+1}^{N}\pi _{j}^{*}\).Footnote 39

Consumer surplus is given by

Total industry profits are given by

Social welfare thus becomes equal to

Under Assumption 1, the derivative of social welfare with respect to \(\alpha \) is negative and given by

\(\square \)

Proof of Proposition

4 Looking first at the self-interest scenario, in equilibrium we obtain

Moreover, we find that

Therefore, any \(\Omega >0\) increases post-integration upstream profits (compared to vertical separation). We also find that

This implies that, for any given \(\Omega >0,\) \(K^{si}\) must be as low as possible to maximize \(\pi _{U}^{\prime }/\pi _{U}^{VS}\) \(\left( \forall N\right) .\)

Now turning our attention to the benevolent scenario, we find thatFootnote 40

Therefore, any small \(\Omega \) generates gains from trade. Unfortunately, maximizing \(\Gamma \) (Eq. 10) with respect to K does not yield a tractable analytical solution. Therefore, we have focused our attention in numerical simulations of that solution for 3 possible values of N: 10, 50 and 100.Footnote 41 For these three different values of N, we maximized Eq. 10 and obtained the corresponding optimal value \(K^{b}\), which is a function of \(\Omega ,\) and plotted it in Fig. 1 (left). It is now straightforward to see that \(K^{b}\ge K^{si}\).Footnote 42

Appendix B: Comparative Statics of Equilibrium Wholesale Prices

The equilibrium wholesale prices obtained in Proposition 1 depend on N, K and \(\alpha \) and yield interesting comparative statics. First, both wholesale prices decrease with N but \(\left| \partial w_{K}^{*}/\partial N\right| >\left| \partial \bar{w}^{*}/\partial N\right| \).Footnote 43 As is standard with Cournot competition, an increase in the number of firms at the retail level reduces the individual quantity each firm produces (although it increases the overall quantity produced). In turn, this induces firm U to reduce both wholesale prices, although it is profit-maximizing to reduce \(w_{K}^{*}\) more than \(\bar{w}^{*}\) (thus reducing the asymmetry between wholesale prices) because firm k’s production (\(k\in \left\{ 1,...,K\right\} \)) decreases more than that of its rivals when the number of firms increases.

Second, an increase in K increases both wholesale prices, but \(\partial w_{K}^{*}/\partial K>\partial \bar{w}^{*}/\partial K\) when \(K<N/2\) (increased asymmetry as K increases) and \(\partial w_{K}^{*}/\partial K<\partial \bar{w}^{*}/\partial K\) when \(K>N/2\) (decreased asymmetry as K increases).Footnote 44 Increased wholesale prices following an increase in K imply a real increase in K firms’ input costs, which induces them to reduce the individual quantity produced (\(q_{k}^{*}\)); however, the overall quantity produced by these K firms increases (because K increases), and this leads firm U to increase the wholesale price it charges them. Strategic substitutability explains why the wholesale price charged to other firms increases as well: the higher wholesale price charged to K firms effectively reduces their input demand and, thus, increases that of their rivals. When K is low, the aggregate output expansion of these K firms is very significant (compared to the aggregate output reduction of \(N-K\) firms) and firm U finds it profit maximizing to increase the asymmetry in wholesale prices.Footnote 45

Third, an increase in \(\alpha \) increases both wholesale prices, but \(\left| \partial w_{K}^{*}/\partial \alpha \right| >\left| \partial \bar{w}^{*}/\partial \alpha \right| \).Footnote 46 An increase in \(\alpha ,\) from firms \(k\in \left\{ 1,...,K\right\} \) perspective, increases the “rebate” they benefit from and this further induces them to expand production. In this context, firm U finds it profit-maximizing to further increase the wholesale price it charges them. Strategic substitutability explains why firm U is able to also charge a higher wholesale price to other firms, although this increase is lower than that in firms’ \(k\in \left\{ 1,...,K\right\} \) wholesale price.

Appendix C: Bertrand Competition

Suppose that instead of Cournot competition, downstream firms engage in Bertrand competition. With that objective in mind, we have solved the model assuming a linear demand function similar to that of Greenlee and Raskovich (2006): \(q_{j}\left( \textbf{p}\right) =d-p_{j}+\gamma \sum \limits _{i\ne j}p_{i},\) \(i=1,...,N,\) \(0<\gamma <1/\left( N-1\right) \).Footnote 47 The expressions obtained under a general setting with N downstream firms, where K firms hold a capital stake in U and \((N-K)\) do not, are rather cumbersome. We have therefore focused on the simpler case with \(N=2\) and \(K=1\). The results obtained in the general setting are similar to these.

Under vertical separation, the two downstream firms maximize

The first-order condition yields

In equilibrium, all prices are equal to \(p^{*}=\frac{d+w+c}{2-\gamma }\) and the total quantity sold is \(Q^{*}=\frac{d-\left[ 1-\gamma \right] \left( w+c\right) }{2-\gamma }.\) The upstream firm then maximizes:

This yields \(w^{*}=\frac{d}{2\left[ 1-\gamma \right] }-\frac{c}{2}.\) Replacing the equilibrium wholesale price in \(p^{*}\) and \(Q^{*}\), we obtain the equilibrium prices and quantities (respectively).

Under partial vertical integration, firm j (which does not hold a capital stake in U) maximizes

The first-order condition leads to

Firm k (which holds a capital stake \(\alpha \) in firm U’s capital) maximizes:

The first-order condition leads to

Upon observing wholesale prices, downstream firms set prices equal to

The upstream firm maximizes

Solving the two first-order conditions leads to the equilibrium wholesale prices:

\(d>c\) is a sufficient condition for wholesale prices to be positive. In addition, similarly to what we found under Cournot competition, we obtain price discrimination:\(\ w_{K}>\bar{w},\) \(\forall \alpha <1.\)

In order to compare the results under partial vertical integration with those of vertical separation, we assume \(d>c\) and we assume that \(\alpha <0.5 \)—which is consistent with the fact that this is a non-controlling shareholding. We find that (i) given wholesale prices, the non-controlling stake \(\alpha \) also works as a rebate and induces firm k (which holds the stake \(\alpha )\) to expand its production (similar to our results under Cournot competition), and its rival, firm j, does so as well because of strategic complementarity; (ii) the upstream firm chooses to raise the wholesale price firm k faces (\(w_{K}\)) and (iii) finds it optimal to lower \(\bar{w}\) for firm j; (iv) in equilibrium, firm k produces less than it would under vertical separation and firm j produces more; (v) the overall quantity produced increases, suggesting that a partial vertical integration in this setup is less worrisome, from a welfare perspective, than under Cournot competition; (vi) but a partial vertical integration does not yield gains from trade (as is the case in Hunold and Stahl (2016), when there is an upstream monopolist), and so it would be unlikely to materialize. In summary, although the output expansion effect also exists under Bertrand competition, strategic complementarity leads to very different results from Cournot competition. Ultimately, although they yield benefits from a welfare perspective, partial vertical integrations would be unlikely to emerge as they fail to generate gains from trade between the interested parties.

Appendix D: Two-Part Tariffs

One of our model assumptions is that, under partial vertical integration, wholesale prices may be discriminatory but are restricted to be linear. We now look at the possibility that the upstream firm charges observable but discriminatory two-part tariffs, that is, the upstream firm sells its output at a tariff \(\left\{ f_{K}^{TPT},w_{K}^{TPT}\right\} \) to K downstream firms, where \(f_{K}^{TPT}\) is a fixed fee and \(w_{K}^{TPT}\) is the marginal input price (‘TPT’ stands for two-part tariffs), and a tariff \(\left\{ \bar{f}^{TPT},\bar{w}^{TPT}\right\} \) to all other retail firms.Footnote 48

The profit function of each of the K downstream firms (that own a share in the upstream firm) under TPT is given by

For the remaining firms, the profit function of firm \(j\in \left\{ K+1,...,N\right\} \) under TPT is given by

Under TPT, the outside option of \(\left( N-K\right) \) firms is zero: rejecting the contract would not lead to positive profit levels. The same is not true for the K downstream firms: rejecting the upstream firm’s TPT contract would leave these firms with a share of the profits that the upstream firm receives by supplying the remaining \(\left( N-K\right) \) firms.Footnote 49\(^{,}\)Footnote 50 Note that we implicitly assume that all firms in the group of K firms behave symmetrically: if one rejects the contract, so do all others.

Solving the TPT problem when supplying to only \(\left( N-K\right) \) firms is similar to the TPT problem under vertical separation (albeit with a lower number of firms). We find that the optimal TPT contract successfully extracts all of \(\left( N-K\right) \) downstream firms’ profits, leaving each of the K downstream firms with profits of \(\pi _{kI}^{TPT,reject}=\frac{1}{4}\alpha \left( a-c\right) ^{2},\) that is, a share \(\alpha \) of the upstream firm’s operational profits when supplying to only \(\left( N-K\right) \) downstream firms. Note that these profits do not depend on N: as in Hunold and Schlütter (2019, Section 5.2), the upstream firm obtains the maximal industry profits and extracts all of \((N-K)\) firms’ profits.Footnote 51 Therefore, the outside option of the partially integrated K firms is a share of those maximal industry profits.

Therefore, the upstream firm must set fixed fees such that each firm is indifferent between accepting or rejecting the contract: \(\pi _{kI}^{TPT}=\pi _{kI}^{TPT,reject}\) (\(k=1,..,K)\) and \(\pi _{j}^{TPT}=0\) (\(j=K+1,..,N).\) Solving the maximization problem of Eqs. 34 and 35, we obtain the Cournot-Nash equilibrium (similar to Eqs. 3 and 4). Substituting these equilibrium quantities in the profit functions and solving for the two indifference conditions for contract acceptance, we obtain \(f_{K}^{TPT}\left( w_{K}^{TPT},\bar{w}^{TPT}\right) \) and \(\bar{f}^{TPT}\left( w_{K}^{TPT},\bar{w}^{TPT}\right) .\)

The upstream firm will then maximize (with respect to the wholesale prices)

In equilibrium under TPT, although it is free not to do so, the upstream firm chooses symmetric wholesale prices: \(w_{K}^{TPT}=\bar{w}^{TPT}=\frac{1}{2}\frac{\left( N-1\right) }{\left( N-\alpha K\right) }\left( a-c\right) .\) Importantly, \(w_{K}^{TPT}=\bar{w}^{TPT}<\bar{w}^{*}<w_{K}^{*}.\) Therefore, the output expansion effect of K firms is much more pronounced than under linear and discriminatory wholesale pricing; in addition, despite the fact that \(\bar{w}^{TPT}<\bar{w}^{*},\) the output of \(\left( N-K\right) \) firms is lower than under linear and discriminatory wholesale pricing (again, strategic substitutability explains this) but overall output is higher. These pro-competitive benefits are similar in nature to those obtained by Alipranti et al. (2022) with discriminatory two-part tariffs.

At these wholesale prices, the equilibrium fixed fees are given by

Under TPT, the upstream firm successfully extracts all profits from the \(\left( N-K\right) \) downstream firms, such that \(\pi _{j}^{TPT}=0\). By contrast, each of the K downstream firms receives profits of \(\pi _{kI}^{TPT}=\frac{1}{4}\alpha \left( a-c\right) ^{2}.\) In both cases, optimal TPT leave downstream firms with profit levels equal to their outside options. The upstream firm receives profits of \(\pi _{U}^{TPT}=\frac{1}{4}\left( 1-\alpha K\right) \left( a-c\right) ^{2}.\) Comparing this profit level with the one obtained under linear and discriminatory wholesale pricing (\(\pi _{U}^{*}\)), and taking into account that \(\alpha =\Omega /K,\) we find that

Depending on the particular values of N, K and \(\Omega ,\) TPT may or may not be more profitable than linear and discriminatory wholesale pricing. Under the two private placement scenarios we look at—either a benevolent or a self-interest motivation—it can be shown that TPT is less profitable than linear and discriminatory wholesale prices. Therefore, under those two motivations, the upstream firm would prefer not to implement TPT even if it could do so.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Gonçalves, R. Backward Partial Vertical Integration Through Private Placement. J Ind Compet Trade 23, 101–122 (2023). https://doi.org/10.1007/s10842-023-00403-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-023-00403-4