Abstract

In this paper, we analyze the collaboration between an environmental group (EG) and polluting firms when they are asymmetric in their abatement costs. We find that, as firms become more asymmetric, the EG collaborates more with the firm suffering from an abatement cost disadvantage, but this additional collaboration does not overcome firms’ cost asymmetry, producing an overall decrease in total abatement and an increase in total emissions. We also evaluate the welfare effects of introducing an EG and/or a regulator, finding that the latter generally yields larger welfare gains than the former when neither are present. Unlike previous studies, we show that the welfare benefit from a second agent is, under most settings, largest when firms are more asymmetric in their abatement costs.

Similar content being viewed by others

Notes

For more details visit http://www.edf.org/partnerships/mcdonalds and see Hartman and Stafford (1997) and Livesey (1999).

This collaboration helped replace ozone-destroying chlorofluorocarbons withhydrocarbon in refrigeration technology, visit http://www.greenpeace.org/international/story/15323/how-greenpeace-changed-an-industry-25-years-of-greenfreeze-to-cool-the-planet/.

In 2013, Revlon and the Breast Cancer Fund, for instance, did not collaborate in reducing chemicals deemed to be cancerous, such as DMDM Hydantoin and Quaternium-15. In this period, Revlon was not subject to environmental policy regarding these chemicals in the US, although Quaternium-15 is to be regulated in California in 2025. While other reasons could explain the lack of partnerships, our model identifies an additional source when firms do not face environmental regulation. See February 9, 2015 Guardian article “Under pressure: campaigns that persuaded companies to change the world,” www.theguardian.com/sustainable-business/2015/feb/09/corporate-ngo-campaign-environment-climate-change (accessed Sept. 27, 2021).

Alternatively, \(\lambda =0\) can apply for an upstream firm whereas \(\lambda >0\) is more relevant for a downstream firm that directly deals with end-consumer markets.

For comparison purposes, we assume that the EG’s collaboration produces the same cost-reducing effect as in Espinola-Arredondo et al. (2021), helping us isolate the effect of firm heterogeneity in equilibrium results.

We only present firm i in this and the following Lemmas, Corollaries, and Propositions, however firm j faces symmetric problems with symmetric results and is omitted for brevity.

The denominator term B for every firm i depends on both its cost of investing and that of its rival’s, \(\gamma _i\) and \(\gamma _j\).

As shown in Lemma 3, best response function \(z_j(z_i)\) is unaffected by \(\gamma _i\), thus not changing equilibrium abatement \(z_j(b_i,b_j)\).

For example, elasticities at \(\gamma _i=1.1\) are calculated as \(\varepsilon _x=\dfrac{[x(1.1)-x(1)]/x(1)}{(1.1-1)/1}\).

Firms continue to invest in abatement without the regulator or EG present because of the increase in demand abatement provides through parameter \(\lambda\). Appendices 1-1 examine how our equilibrium results are affected if only the EG is present, only the regulator is present, or if neither of them is present.

Tables analogous to Tables 4-9 which evaluates the elasticity of the welfare gains or losses with respect to marginal increases in firm asymmetry are available upon request. In the baseline case, percentage changes in the welfare gains from introducing environmental regulation or EGs diminish as firms become more asymmetric in their cost of investing in abatement, and the welfare losses become more severe.

This is the case for each of the parameters that only impact the EG’s decision (\(\theta\), \(\beta\), and \(c_{EG}\)).

References

Baron DP (2012) The industrial organization of private politics. Quart J Political Sci 7(2):135–174

Baron DP, Diermeier D (2007) Strategic activism and nonmarket strategy. J Econ Manag Strat 16(3):599–634

Espinola-Arredondo A, Stathopoulou E, Munoz-Garcia F (2021) Regulators and environmental groups: Better together or apart? forthcoming. Environ Dev Econ

Fischer C, Lyon TP (2014) Competing environmental labels. J Econ Manag Strat 23(3):692–716

Harbaugh R, Maxwell JW, Roussillon B (2011) Label confusion: The Groucho effect of uncertain standards. Manag Sci 57(9):1512–1527

Hartman C, Stafford E (1997) Green alliances: Building new business with environmental groups. Long Range Plan 30(2):184–196

Heijnen P (2013) Information advertising by an environmental group. J Econ 108(3):249–272

Heijnen P, Schoonbeek L (2008) Environmental groups in monopolistic markets. Environ Res Econ 39(4):379–396

Heyes AG, Maxwell JW (2004) Private vs. public regulation: Political economy of the international environment. J Environ Econ Manag 48(2), 978–996

Innes R (2006) A theory of consumer boycotts under symmetric information and imperfect competition. Econ J 116(511):355–381

Liston-Heyes C (2001) Setting the stakes in environmental contests. J Environ Econ Manag 41(1):1–12

Livesey SM (1999) McDonald’s and the Environmental Defense Fund: a case study of a green alliance. J Bus Commun 36(1):5–39

Riddel M (2003) Candidate eco-labeling and senate campaign contributions. J Environ Econ Manag 45(2):177–194

Rondinelli DA, London T (2003) How corporations and environmental groups cooperate: Assessing cross-sector alliances and collaborations. Acad Manag Exec 17(1):61–76

Seitanidi MM, Crane A (2013) Social partnerships and responsible business: A research handbook. Routledge Publishers

Stafford ER, Polonsky MJ, Hartman CL (2000) Environmental NGO-business collaboration and strategic bridging: A case analysis of the greenpeace-foron alliance. Bus Strat Environ 9(2):122–135

Stathopoulou E, Gautier L (2019) Green alliances and the role of taxation. Environ Res Econ 74(3):1189–1206

Strandholm JC, Espinola-Arredondo A, Munoz-Garcia F (2021) Pollution abatement with disruptive R&D investment. Res Energy Econ 66:1–29

van der Made A, Schoonbeek L (2009) Information provision by interest groups. Environ Res Econ 43(4):457–472

Yaziji M, Doh J (2009) NGOs and corporations: Conflict and collaboration. Cambridge University Press, Cambridge

Funding

Strandholm received partial funding from the University of South Carolina Upstate Office of Sponsored Awards and Research Support’s Scholarly Course Reallocation Program.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethical Approval

Not applicable

Informed consent

Not applicable.

Conflicts of interest

The authors declare that they have no conict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Strandholm thanks the University of South Carolina Upstate Office of Sponsored Awards and Research Support for partial funding of the project.

A Appendix

A Appendix

1.1 A.1 Proof of Lemma 1

The first-order condition from the firm’s problem is

Solving for \(q_i\) we obtain firm i’s best response function,

Firm j has a symmetric best response function. Simultaneously solving the best response functions for \(q_i\) and \(q_j\), we obtain equilibrium output in the fourth stage of,

We find that output is positive if and only if,

Inserting equilibrium output in the firm’s fourth-stage profits, we find,

1.2 A.2 Proof of Corollary 1

Taking a derivative of firm i’s profit with respect to \(z_i\), \(\lambda\), \(z_j\), and t we obtain:

The final comparative static is positive, \(\frac{\partial \pi _i(t)}{\partial t}>0\), if \(z_i<\frac{2(a-t-\lambda z_j)}{9-4\lambda }\).

1.3 Proof of Lemma 2

In the third stage, the regulator’s problem is,

The first-order condition is,

Solving for t, we obtain the emission fee,

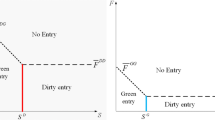

in which \(t(Z)>0\) if and only if \(Z<\frac{2a(4d-1)}{\lambda +4d(3-\lambda )}\equiv \tilde{Z}\). The emission fee is unambiguously decreasing in aggregate abatement Z, and increasing in public image \(\lambda\):

The comparative static on the emission fee with respect to environmental damage d is,

which is positive if and only if \(Z<\frac{2a}{2-\lambda }\equiv \bar{Z}\). Comparing \(\bar{Z}\) and \(\tilde{Z}\), we find that \(\bar{Z}>\tilde{Z}\) under all parameter conditions:

which simplifies to \(d>-\frac{1}{2}\), which always holds as \(d>\frac{1}{2}\).

1.4 A.4 Proof of Lemma 3

In the second stage, we first evaluate realized equilibrium profits in the fourth stage \(\pi _k(z_i,z_j)=\pi _k(t(Z))\), where t(Z) is from Lemma 2. Inserting this into each firm i’s problem in the second stage, we have that

and differentiating with respect to \(z_i\) we find

Solving for \(z_i\), we obtain firm i’s best response function

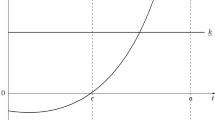

where \(A\equiv 16 d (5 d+3+2(d+1)(\gamma _i-b_i \theta ))+8( \gamma _i-b_i \theta )-(4 d+3)^2 \lambda ^2-32 d (2 d+1) \lambda +4 \lambda\), and \(A>0\) if \(\gamma _i>\frac{16 d^2 (\lambda -1) (\lambda +5)+8 d (\lambda (3 \lambda +4)-6)+\lambda (9 \lambda -4)}{8 (2 d+1)^2}\). Taking derivatives of A with respect to \(\gamma _i\) and \(\gamma _j\) yields

Firm j has a symmetric best response function. This best response function has the following properties:

-

1.

when \(b_i=0\) and \(\lambda =0\), the best response function is

$$\begin{aligned} z_i(z_{j})=\frac{a \left( 8 d^2+4 d-1\right) -2 d (4 d+3) z_j}{2 \gamma _i+4 d (2 \gamma _i (d+1)+5 d+3)}, \end{aligned}$$which is unambiguously decreasing in \(z_j\);

-

2.

when \(b_i=0\) and \(\lambda >0\), the best response function is

$$\begin{aligned} z_i(z_j)=\frac{8 a d (4 d+\lambda +2)+a(6 \lambda -4)-z_j\left[ (4 d+3) \left( 4 d ((\lambda -1) \lambda +2)+\lambda ^2\right) -2 \lambda \right] }{8 \gamma _i+16 d (2 \gamma _i (d+1)+5 d+3)-(4 d+3)^2 \lambda ^2-32 d (2 d+1) \lambda +4 \lambda }, \end{aligned}$$and is decreasing in \(z_j\) if and only if \(\gamma _i>\bar{\gamma }\);

-

3.

when \(b_i\), \(\lambda >0\), \(z_i(z_j)\) is decreasing in \(z_j\) if and only if \(\gamma _i>\bar{\gamma }+\theta b_i\),

where \(\bar{\gamma }\equiv \frac{\lambda (9 \lambda -4)+8 d [\lambda (3 \lambda +4)-6]-16 d^2 (1-\lambda ) (5+\lambda )}{8 (1+2 d)^2}\). This cutoff decreases in d, and increases in \(\lambda\) as follows:

1.5 A.5 Proof of Proposition 1

Simultaneously solving for \(z_i\) and \(z_j\) in the best response function \(z_i(z_j)\), and \(z_j(z_i)\) yields the equilibrium abatement

for each firm i, where the term B is defined as

When the EG is absent, \(b_i=b_j=0\), each firm i’s equilibrium abatement is

where the term C is defined as

1.6 A.6 Proof of Proposition 2

The EG’s marginal benefit is

We can simplify this further since \(\frac{\partial e_i^{NoEG}}{\partial b_i}=\frac{\partial e_j^{NoEG}}{\partial b_i}=0\) and \(\frac{\partial e_i^{EG}}{\partial b_i}=\frac{\partial q}{\partial b_i}-\frac{\partial z_i}{\partial b_i}\), where \(q(t(z_i(b_i,b_j),z_j(b_i,b_j)))\). Therefore,

which simplifies further to \(\frac{\partial q}{\partial b_i}=\frac{\partial q}{\partial t}\frac{\partial t}{\partial z_i}\left( \frac{\partial z_i}{\partial b_i}+\frac{\partial z_j}{\partial b_i} \right)\). We also know that since \(t(Z)=t(z_i+z_j)\), then \(\frac{\partial t}{\partial z_i}=\frac{\partial t}{\partial z_j}\). Substituting this into \(MB_i\), we obtain

1.7 A.7 Robustness Checks

1.7.1 A.7.1Higher \(\theta =0.45\)

Since \(\theta\) only shows up in the EG’s problem, the equilibrium values in the absence of the EG coincide with those in Tables 1b, 15 and 16.

1.7.2 A.7.2 Higher \(\beta =0.2\).

Since \(\beta\) only affects the EG’s problem, the equilibrium values in the absence of the EG coincide with those in Tables 1b, 17, 18, 19, 20 and 20.

1.7.3 A.7.4 Higher \(c_{EG}=0.1\)

Since \(c_{EG}\) only affects the EG’s problem, the equilibrium values in the absence of the EG coincide with those in Tables 1b and 21. The equilibrium values in this case are shown in Table 21.

1.7.4 A.7.5 Higher \(\lambda =0.2\)

Table 22. Table 22 shows the equilibrium values when λ=0.2.e 22.

1.7.5 A.7.6 Higher \(a=2\)

Table 23. Table 23 shows the equilibrium values when a=2.e 23.

1.8 A.8 No EG, Regulation Present

In this case, there is no actor in the first stage and the results from the fourth stage (Lemma 1) and the third stage (Lemma 2) are unchanged:

Second Stage We can use the result from Proposition 1 where \(z_i(b_i,b_j)\) is evaluated at \(b_i=b_j=0\) to obtain each firm i’s equilibrium investment in abatement in the absence of the EG,

which entails equilibrium profits of

Social welfare in this case is

where the NoEG superscripts are removed for readability.

1.9 A.9 No Regulation, EG Present

Fourth stage In this case, the fourth stage remains unchanged except now we treat \(t=0\), and the results from Lemma 1 become,

Second Stage In the absence of the regulator, there is no player in the third stage, so we proceed to the second stage of the game where each firm i solves

The first-order condition is

and firm i’s best response function is

Firm j has a symmetric best response function. Simultaneously solving for \(z_i\) and \(z_j\), we find

First stage The EG’s problem remains

In the absence of the regulator, the firm’s abatement is not impacted by an emissions fee (as \(t=0\)) and solely incentivized by how abatement impacts demand, \(\lambda\). The EG anticipates this when choosing its collaboration efforts \(b_i\) and \(b_j\).

Social welfare in this case is

1.10 A.10 No Regulation, no EG

In the absence of both the EG and the regulator, the game only includes stages two and four.

Fourth stage We again use our result from Lemma A1 where \(t=0\), which yields

Second Stage Each firm i’s problem in the second stage is

with first-order condition

and best response function

Firm j has a symmetric best response function. Simultaneously solving for \(z_i\) and \(z_j\), we obtain

which coincides with \(z_i^{NoReg}\) when evaluated at \(b_i=b_j=0\) (see Appendix 1). Inserting this equilibrium abatement level into firm i’s equilibrium output, we obtain that

which entails equilibrium profits of

Social welfare in this case is

which, when evaluated at the equilibrium is

1.11 A.11 Proof of Proposition 3

The EG’s marginal benefit is

We can simplify this further since \(\frac{\partial e_i^{NoEG}}{\partial b_i}=\frac{\partial e_j^{NoEG}}{\partial b_i}=0\) and \(\frac{\partial e_i^{EG}}{\partial b_i}=\frac{\partial q}{\partial b_i}-\frac{\partial z_i}{\partial b_i}\), where \(q(t(z_i(b_i,b_j),z_j(b_i,b_j)))\). Therefore,

which simplifies further to \(\frac{\partial q}{\partial b_i}=\frac{\partial q}{\partial t}\frac{\partial t}{\partial z_i}\left( \frac{\partial z_i}{\partial b_i}+\frac{\partial z_j}{\partial b_i} \right)\). We also know that since \(t(Z)=t(z_i+z_j)\), then \(\frac{\partial t}{\partial z_i}=\frac{\partial t}{\partial z_j}\). Substituting this into \(MB_i\), we obtain

Rights and permissions

About this article

Cite this article

Strandholm, J.C., Espinola-Arredondo, A. & Munoz-Garcia, F. Green Alliances: Are They Beneficial when Regulated Firms are Asymmetric?. J Ind Compet Trade 22, 145–178 (2022). https://doi.org/10.1007/s10842-022-00384-w

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-022-00384-w