Abstract

Using a capacity-then-production choice model, we consider whether excess capacity results hold, when there is one provider, i.e., a monopoly or a public firm, in a network product and service market. In the case of a monopoly, if consumers form expectations of network sizes after (before) a capacity-scale decision, the capacity scale is larger than (equal to) the production quantity. Thus, excess capacity results hold (do not hold). Furthermore, in the case of a public firm, excess capacity results do not hold, irrespective of the timing of consumer expectations. However, this result depends on the specification of the utility function.

Similar content being viewed by others

Availability of data and material

Not applicable.

Code availability

Not applicable.

Notes

In the Appendix. 1, we examine the third case, in which, at the first stage, the monopoly decides the capacity scale; at the second stage, the monopoly decides the production quantity; and finally, at the third stage, consumers form expectations of network sizes, based on the production decision.

Given Eq.. (1), it holds that \( \frac{\mathrm{\partial \Pi}\left(q,x,y;n\right)}{\partial y}=\frac{\partial^2U\left(q,y;n\right)}{\partial q\partial y}q= nq>0. \)

For example, removing the adjustment term in Eq. (1), i.e., \( -\frac{1}{2}{y}^2, \) we have \( \frac{\partial U\left(q,x,y;n\right)}{\partial y}= nq>0. \)

In view of Eqs. (7), (8), and (10), and Appendix. 2, the levels of capacity scale and production quantity in the case of a monopoly are socially lower than that those of the first-best policy in the cases of passive and responsive expectations.

References

Boivin C, Vencatachellum D (2002) RD in markets with network externalities. Econ Bull 12(9):1–8

Buccella D, Fanti L (2016) Entry in a network industry with a “capacity-then-production” choice. Seoul J Econ 29:411–429

Haruna S (1996) A note on holding excess capacity to deter entry in a labor-managed industry. Can J Econ 29:493–499

Hoernig S (2012) Strategic delegation under price competition and network effects. Econ Lett 117(2):487–489

Horiba Y, Tsutsui S (2000) International duopoly, tariff policies and the case of free trade. Jap Econ Rev 51:207–220

Hurkens S, López AL (2014) Mobile termination, network externalities and consumer expectations. Econ J 124:1005–1039

Naskar M, Pal R (2020) Network externalities and process R&D: a Cournot–Bertrand comparison. Math Soc Sci 103:51–58

Nishimori A, Ogawa H (2004) Do firms always choose excess capacity? Econ Bull 12(2):1–7

Ogawa H (2006) Capacity choice in the mixed duopoly with product differentiation. Econ Bull 12(8):1–8

Toshimitsu T (2017) On consumer expectations in a network goods market: the monopoly case. Econ Bull 37(1):488–493

Vives X (1986) Commitment, flexibility, and market outcomes. Int J Ind Organ 4:217–229

Zhang J (1993) Holding excess capacity to deter entry in a labor-managed industry. Can J Econ 26:222–234

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

The Case of Responsive Expectations

In the case of responsive expectations, in which consumers believe the announced production quantity of the monopoly (active beliefs, i.e., y = q), the monopoly can commit to the production quantity before consumers form expectations of network size. Accordingly, the inverse demand function, i.e., Eq. (2), is revised as \( p\left(q,y=q;n\right)=A-\left(1-n\right)q=\overset{\frown }{p}\left(q;n\right). \) Thus, the profit function, i.e., Eq. (4), is expressed as:

In this case, we obtain the same results as those in a pure monopoly market where excess capacity results do not hold, i.e., \( {q}^{\ast \ast \ast }={x}^{\ast \ast \ast }=\frac{A}{2\left(1-n\right)}. \)

Furthermore, we can demonstrate that excess capacity results do not hold in the first-best policy.

Appendix 2

The First-best Policy

1.1 Appendix 2.1

The Case of Ex Post Expectations

Given x and y, the government decides the production quantity to maximize social welfare. Based on Eq. (12), because the FOC is given by \( \frac{\partial W\left(q,x,y;n\right)}{\partial q}=A-q+ ny+c\left(x-q\right)=0, \) it holds that \( {q}^F={q}^F\left(x,y;n\right)=\frac{A+ cx+ ny}{1+c}. \) Under the fulfilled expectations, i.e., y = q, we obtain \( {\tilde{q}}^F={\tilde{q}}^F\left(x;n\right)=\frac{A+ cx}{1+c-n}. \) Thus, Eq. (12), is rewritten as:

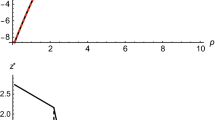

Using the above equation, the FOC of maximization of social welfare with respect to the capacity scale is given by \( \frac{\partial W\left({\tilde{q}}^F\left(x;n\right),x;n\right)}{\partial x}=\frac{c}{1+c-n}\left\{A-\left(1-n\right)x\right\}. \) Thus, we obtain the following capacity scale and production quantity: \( {x}^{F\ast }=\frac{A}{1-n} \) and \( {q}^{F\ast }=\frac{A+{cx}^{F\ast }}{1+c-n}=\frac{A}{1-n}={y}^{F\ast }. \)

1.2 Appendix 2.2

The Case of Ex Ante Expectations

In this case, the game of the sequential decisions of production quantity and then capacity scale is identical to the game of simultaneous decisions of these levels, given the expected network sizes. In particular, because of Eq. (12), we derive the following FOCs: \( \frac{\partial W\left(q,x;y,n\right)}{\partial q}=A-q+ ny+c\left(x-q\right)=0 \) and \( \frac{\partial W\left(q,x;y,n\right)}{\partial x}=-c\left(x-q\right)=0. \) At the first stage, the fulfilled expectations, i.e., y = q, hold, and we obtain the following capacity scale and production quantity in the equilibrium: \( {y}^{F\ast \ast }={q}^{F\ast \ast }={x}^{F\ast \ast }=\frac{A}{1-n}. \)

Based on Appendixes 2.1 and 2.2, excess capacity results do not hold in the first-best policy.

Appendix 3

The Case of Ex Ante Expectations Based on a General Formulation

1.1 Appendix 3.1

Monopoly

The profit function of a monopoly is generally expressed as:

In the case of ex ante expectations, given the expected network sizes, the FOCs of profit maximization with respect to production quantity and then capacity scale are given by:

Furthermore, in the first stage, the fulfilled expectations hold, i.e., y = q. Because it holds in the equilibrium that y∗∗ = q∗∗ = x∗∗, excess capacity results do not arise.

1.2 Appendix 3.2

The First-best Policy

The social welfare function is generally expressed as:

Following Appendix 3.1, we have the following equations:

Thus, because it holds in the equilibrium that yF ∗ ∗ = qF ∗ ∗ = xF ∗ ∗, the excess capacity results do not hold.

Rights and permissions

About this article

Cite this article

Toshimitsu, T. Note on Excess Capacity in a Monopoly Market with Network Externalities. J Ind Compet Trade 21, 411–422 (2021). https://doi.org/10.1007/s10842-021-00363-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-021-00363-7