Abstract

This paper analyzes how Egyptian manufacturing plants respond to changes in trade tariffs using firm-level data from the World Bank Enterprise Survey. Using Levinsohn and Petrin (Rev Econ Stud 70(2):317–341, 2003) methodology to calculate the total factor productivity for the Egyptian firms in the sample, the results stand in line with the heterogeneous-firm models of international trade predicting that fall in trade costs leads to a decrease in the market shares of domestic firms. The decrease of market share of the Egyptian manufacturing firms after trade reforms in 2004 reflects that the market became less concentrated after trade openness.

Source : Author elaboration using World Development Indicators

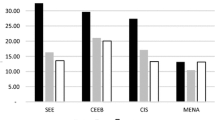

Source: author elaboration from UNIDO database

Source: author calculation using survey data

Source: author calculation using survey data

Source: author elaboration using WITS database

Similar content being viewed by others

Notes

It is a regional trade organization and free-trade area consisting of the Republic of Iceland, the Kingdom of Norway, the Swiss Confederation, and the Principality of Liechtenstein.

Manufacturing refers to industries belonging to two-digit ISIC codes (15-37) (ISIC Rev.3.1).

Multi-product firms usually represent around 40% of total firms (see Bernard et al. (2010) for the US case).

As a robustness check, Table 11 in the Appendix reports the same set of results with TFP calculated at the sector level.

For example to instrument for the tariff of the 4-digit product(1593), I use the tariff of the following product (1594) in the same classification.

Note that variation in the tariff level is negative, so lower variation reflects that the market becomes more liberalized than before.

References

Altomonte C, Barattieri A (2015) Endogenous markups, international trade, and the product mix. J Ind Compet Trade 15(3):205–221

Altomonte C, Ogliari L (2010) International trade and the competition dynamics of multi-product firms. MICRO-DYN Working Paper, 7(11)

Amiti M, Konings J (2007) Trade liberalization, intermediate inputs, and productivity: evidence from Indonesia. Am Econ Rev 97(5):1611–1638

Ashournia D, Svejstrup Hansen P, Worm Hansen J (2013) Trade liberalization and the degree of competition in international duopoly. Rev Int Econ 21(5):1048–1059

Bernard AB (2011) Multiproduct firms and trade liberalization. Q J Econ 126 (3):1271–1318

Bernard AB, Jensen JB, Lawrence RZ (1995) Exporters, jobs, and wages in US manufacturing: 1976-1987. Brookings Papers on Economic Activity, Microeconomics, 67–119

Bernard AB, Eaton J, Jensen JB, Kortum S (2003) Plants and productivity in international trade. Am Econ Rev 93(4):1268–1290

Bernard AB, Jensen JB, Schott PK (2006) Trade costs, firms and productivity. J Monet Econ 53(5):917–937

Bernard AB, Jensen JB, Redding SJ, Schott PK (2007) Firms in international trade. J Econ Perspect 21(3):105–130

Bernard AB, Redding SJ, Schott PK (2010) Multiple-product firms and product switching. Am Econ Rev 100(1):70–97

Bernard AB, Jensen JB, Redding SJ, Schott PK (2012) The empirics of firm heterogeneity and international trade. Annu Rev Econ 4:283–313

Bond EW, Syropoulos C (2008) Trade costs and multimarket collusion. RAND J Econ 39(4):1080–1104

Brander J, Krugman P (1983) A ‘reciprocal dumping’ model of international trade. J Int Econ 15:313–321

Cadot O, Iacovone L, Pierola MD, Rauch F (2013) Success and failure of African exporters. J Dev Econ 101:284–296

Chen N, Imbs J, Scott A (2009) The dynamics of trade and competition. J Int Econ 77(1):50–62

Gatti R (1999) Corruption and trade tariffs, or a case for uniform tariffs. The World Bank

Ghoneim AF, Latif LA (2008) Competition, competition policy and economic efficiency in the MENA region: the case of Egypt. In: Sekkat K (ed) Competition and efficiency in the Arab world. Palgrave Macmillan, New York

Goldberg PK, Pavcnik N (2005) Trade, wages, and the political economy of trade protection: evidence from the Colombian trade reforms. J Int Econ 66(1):75–105

Grossman GM, Helpman EI (1994) Protection for sale. Am Econ Rev 84 (4):833–850

Lawrence RZ (2000) Does a kick in the pants get you going or does it just hurt? The impact of international competition on technological change in US manufacturing. In: The Impact of international trade on wages. University of Chicago Press, pp 197–224

Levinsohn J, Petrin A (2003) Estimating production functions using inputs to control for unobservables. Rev Econ Stud 70(2):317–341

MacDonald JM (1994) Does import competition force efficient production? Rev Econ Stat 721–727

Márquez-Ramos L, Martínez-Zarzoso I, Parra MD (2012) Imports, innovation and Egyptian exports

Mayer T, Ottaviano GI (2008) The happy few: the internationalisation of european firms. Intereconomics 43(3):135–148

Mayer T, Melitz MJ, Ottaviano GI (2014) Market size, competition, and the product mix of exporters. Am Econ Rev 104(2):495–536

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71(6):1695–1725

Melitz MJ, Ottaviano GI (2008) Market size, trade, and productivity. Rev Econ Stud 75(1):295–316

Mobarak AM, Purbasari DP (2005) Corrupt trade protection in developing countries: firm level evidence on political connections and import licenses in Indonesia. University of Colorado, unpublished manuscript

Olley S, Pakes A (1996) The dynamics of productivity in the telecommunications equipment industry. Econometrica 64(6):1263–1297

Pavcnik N (2002) Trade liberalization, exit, and productivity improvements: evidence from Chilean plants. Rev Econ Stud 69(1):245–276

Pinto B (1986) Repeated games and the ‘reciprocal dumping’ model of trade. J Int Econ 20:357–366

Selwaness I, Zaki C (2015) Assessing the impact of trade reforms on informal employment in Egypt. J North African Stud 20(3):391–414

Trefler D (2004) The long and short of the Canada-US free trade agreement. Am Econ Rev 94(4):870–895

Tybout JR (2000) Manufacturing firms in developing countries: how well do they do, and why? J Econ Lit 38(1):11–44

Valdés A, Foster W (2011) A profile of border protection in Egypt: an effective rate of protection approach adjusting for energy subsidies. World Bank Policy Research Working Paper Series, Vol

Acknowledgments

I am very grateful to Jean-Philippe Tropeano, Lionel Fontagné, Marcelo Olarreaga and Angelo Secchi for many challenging interactions on this topic. I also would like to thank Philippe Gagnepain, Stéphane Gauthier and David Mirza as well as two anonymous referees for their helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This paper has received funding from Paris School of Economics.

Appendix: Robustness Check

Appendix: Robustness Check

Rights and permissions

About this article

Cite this article

Elewa, A. Trade Openness and Domestic Market Share. J Ind Compet Trade 19, 441–463 (2019). https://doi.org/10.1007/s10842-019-00295-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-019-00295-3