Abstract

Much of the literature on household finance tends to focus on relatively objective measures of financial security (e.g., savings, income, financial knowledge), and there has been less research on measures of subjective financial well-being. This gap is due in part to the absence of a common understanding on defining and measuring subjective financial well-being. The Consumer Financial Protection Bureau has recently developed a new Financial Well-Being Scale that provides a comprehensive way to measure this construct. The research on this scale is still scarce and little is known about how subjective financial well-being evolves over time. This paper uses a two-wave survey of low- and moderate-income tax filers to present among the first longitudinal analyses of this scale. Through descriptive analysis and lagged dependent variable regressions, we assess (1) the stability of financial well-being over a six-month period; (2) the extent to which relatively stable household characteristics predict volatility in subjective financial well-being; and (3) the relationship between adverse financial events, including financial shocks and material hardships, and subjective financial well-being. We find that financial well-being scores are extremely stable over the short-term, and that relatively stable household characteristics are not strong predictors of subjective financial well-being changes. We also find that, while adverse financial events like job loss are significantly associated with lower subjective financial well-being scores, the magnitude of these relationships is not large. These results have implications for the use of the financial well-being scale in evaluations of financial security interventions.

Similar content being viewed by others

Notes

The goal of developing the CFPB’s Financial Well-Being Scale was to provide a more accurate measure of subjective financial well-being. The scale was developed using large samples of survey respondents and applying rigorous statistical methods such as item response theory techniques. In addition, the CFPB validated the scale against other similar concepts (e.g., financial satisfaction). For more details on scale development and validation, see https://files.consumerfinance.gov/f/documents/201705_cfpb_financial-well-being-scale-technical-report.pdf

The response rate between the waves was 31%. In the Appendix, Table 7 compares characteristics of respondents who dropped out after Wave 1 with respondents who completed both survey waves (i.e., those who constitute our analytical sample). The comparison of weighted samples suggests attrited and non-attrited individuals were similar on observable characteristics.

We restricted the 2017 ACS sample to adults with incomes at 200% of the federal poverty line (FPL) or lower, and developed inverse probability weights based on the respondents’ age, age squared, education, student status, gender, race/ethnicity, and the presence of children in the household. For more details on this weighting process, see Solon et al. (2015). Table 8 (see Appendix) compares the observable characteristics of our sample with those of adult respondents to the 2017 ACS whose incomes did not exceed 200% of the FPL. The comparison shows our weighted sample was quite similar to the population of U.S. adults who are at or below 200% of the FPL.

The one exception to this is the question on eviction, which we ask over the prior 12 months at Wave 1 and over the prior 6 months at Wave 2.

We also estimated these models including controls for state of residence and the date of survey completion. These state and date controls did not appreciably change our estimates.

In the models with financial characteristics, we include the tax-related variables highlighted in Table 1, including whether a household received a refund, the amount of the refund received, and the amount of taxes owed. Because these variables were not central to our analysis, they are not included in the results presented here; however, estimates for these variables are available upon request.

Regressing the Wave 1 financial well-being quartile on the change in financial well-being scores confirms these results. The change in financial well-being scores for the first and fourth quartiles, respectively, was significantly different from the change in all other quartiles, whereas change in financial well-being scores for those in the second quartile did not differ significantly from the change for those in the third quartile (and vice versa).

To appropriately estimate the relationships between shocks and hardships and financial well-being, our models require sufficient intraperson variation in the experience of these shocks and hardships across the two survey waves. Our analysis shows that the proportion of households that either experienced a shock in Wave 2 but not in Wave 1 or experienced a shock in Wave 1 but not in Wave 2 ranged from a low of 3.5% for evictions (n = 115) to a high of 27.5% for auto repairs (n = 924). The proportion of households that either experience a hardship in Wave 2 but not in Wave 1 or vice versa ranges from a low of 8.8% for skipped rent payments (n = 293) to a high of 19.2% for skipping any medical care (n = 638). These results indicate that the amount of intraperson variation in the experience of shocks and hardships in our sample is sufficient to estimate the relationships between these adverse events and financial well-being scores.

Each of the regression models in the main analysis control for the baseline level of subjective financial well-being. This approach enables us to estimate the average subjective financial well-being at Wave 2 across a variety of household characteristics, independent of initial subjective financial well-being levels. As a robustness check, we re-estimated the full OLS models in our main analysis using first differences regression models that did not control for baseline subjective financial well-being. In these models, the dependent variable was the difference between Wave 2 and Wave 1 financial well-being scores, and all household characteristics, shocks, and hardships were measured as in the main analysis. Generally, this estimation strategy did not notably change the results from the main analysis. The vast majority of household characteristics remained unassociated with significant changes in subjective financial well-being, and the relationships between adverse financial events and financial well-being scores exhibited similar coefficient patterns, though the relationships were slightly more attenuated than those in the main analysis. This finding speaks to the validity of using models that control for baseline subjective financial well-being, as in the main analysis, to estimate the relationship between household and individual characteristics and downstream subjective financial well-being. The results from the first differences estimation are available upon request.

References

Abbi, S. (2012). A need for product innovations to help LMI consumers manage financial emergencies. Doorway to Dreams Fund. Retrieved February 28, 2021, from https://buildcommonwealth.org/assets/downloads/ANeedforProductionInnovation_Jan12.pdf

Aboagye, J., & Jung, J. Y. (2018). Debt holding, financial behavior, and financial satisfaction. Journal of Financial Counseling and Planning, 29(2), 208–218. https://doi.org/10.1891/1052-3073.29.2.208.

Ahn, N., García, J. R., & Jimeno, J. F. (2004). The impact of unemployment on individual well-being in the EU (European Network of Economic Policy Research Insitutes, Working Paper 29). Retrieved March 3, 2021, from https://www.ceps.eu/ceps-publications/impact-unemployment-individual-well-being-eu/

Bardo, A. R. (2017). A life course model for a domains-of-life approach to happiness: Evidence from the United States. Advances in Life Course Research, 33, 11–22. https://doi.org/10.1016/j.alcr.2017.06.002.

Bartfeld, J., & Collins, J. M. (2017). Food insecurity, financial shocks, and financial coping strategies among households with elementary school children in Wisconsin. Journal of Consumer Affairs, 51(3), 519–548. https://doi.org/10.1111/joca.12162.

Bell, D. N. F., & Blanchflower, D. G. (2010). UK unemployment in the Great Recession. National Institute Economic Review, 214(1), R3–R25. https://doi.org/10.1177/0027950110389755.

Beverly, S. G., Schneider, D., & Tufano, P. (2006). Splitting tax refunds and building savings : An empirical test. Tax Policy and the Economy, 20(September), 111–162. https://doi.org/10.1016/S0008-8846(01)00455-0.

Białowolski, P. (2018). Hard times! How do households cope with financial difficulties? Evidence from the Swiss Household Panel. Social Indicators Research, 139(1), 147–161. https://doi.org/10.1007/s11205-017-1711-4.

Board of Governors of the Federal Reserve System. (2016). Report on the economic well-being of U.S. households in 2015. Retrieved February 28, 2021,from https://www.federalreserve.gov/2015-report-economic-well-being-us-households-201605.pdf

Board of Governors of the Federal Reserve System. (2018). Report on the Economic Well-Being of U.S. Households in 2017. Retrieved from https://www.federalreserve.gov/publications/files/2017-report-economic-well-being-us-households-201805.pdf

Bufe, S., Sun, S., Roll, S., Kondratjeva, O., & Grinstein‐Weiss, M. (2019). How do changing financial circumstances relate to financial well-being? Evidence from a national survey. Washington University in St. Louis, Social Policy Institute. Retrieved from https://openscholarship.wustl.edu/cgi/viewcontent.cgi?article=1007&context=spi_research

Burke, J., & Perez-Arce, F. (2019). Longitudinal changes in financial well-being, financial behaviors, and life events research brief final. University of Southern California, Center for Economic and Social Research. Retrieved from https://files.consumerfinance.gov/f/documents/cfpb_financial-well-being_burke-perez-arce_brief.pdf

Chamberlain, K., & Zika, S. (1992). Stability and change in subjective well-being over short time periods. Social Indicators Research, 26(2), 101–117. https://doi.org/10.1007/BF00304394.

Chang, Y., Chatterjee, S., & Kim, J. (2014). Household finance and food insecurity. Journal of Family and Economic Issues, 35(4), 499–515. https://doi.org/10.1007/s10834-013-9382-z.

Collins, J. M., & Gjertson, L. (2013). Emergency savings for low-income consumers. Focus, 30(1), 12–17. Retrieved from https://www.irp.wisc.edu/publications/focus/pdfs/foc301c.pdf

Collins, J. M., & Urban, C. (2018). Understanding financial well-being over the lifecourse: An exploration of measures. Montana State University. Retrieved from https://www.montana.edu/urban/Draft_FWB_2018%20Anonymous.pdf

Comerton-Forde, C., de New, J., Salamanca, N., Ribar, D. C., Nicastro, A., & Ross, J. (2020). Measuring financial wellbeing with self-reported and bank-record data. Institute of Labor Economics. Retrieved from http://ftp.iza.org/dp13884.pdf

Consumer Financial Protection Bureau. (2015). Measuring financial well-being. Retrieved from https://files.consumerfinance.gov/f/201512_cfpb_financial-well-being-user-guide-scale.pdf

Consumer Financial Protection Bureau. (2017a). CFPB Financial Well-Being Scale. Retrieved from https://files.consumerfinance.gov/f/documents/201705_cfpb_financial-well-being-scale-technical-report.pdf

Consumer Financial Protection Bureau. (2017b). Financial well-being in America. Retrieved from https://files.consumerfinance.gov/f/documents/201709_cfpb_financial-well-being-in-America.pdf

Deaton, A. (2008). Income, health, and well-being around the world: Evidence from the Gallup World Poll. Journal of Economic Perspectives, 22(2), 53–72. https://doi.org/10.1257/jep.22.2.53.

Dedmond, M., Lakshmanan, V., & Cabusora, H. (2019). Financial security in low- to moderate-income communities: The Consumer Financial Protection Bureau’s Well-Being Scale in a direct services setting. Consumer Financial Protection Bureau. Retrieved from https://files.consumerfinance.gov/f/documents/cfpb_financial-well-being_dedmon_brief.pdf

DeNeve, K. M., & Cooper, H. (1998). The happy personality: A meta-analysis of 137 personality traits and subjective well-being. Psychological Bulletin, 124(2), 197–229. https://doi.org/10.1037/0033-2909.124.2.197.

Despard, M. R., Grinstein-Weiss, M., Guo, S., Taylor, S., & Russell, B. (2018). Financial shocks, liquid assets, and material hardship in low- and moderate-income households: Differences by race. Journal of Economics, Race, and Policy, 1(4), 205–216. https://doi.org/10.1007/s41996-018-0011-y.

Despard, M. R., Guo, S., Grinstein-Weiss, M., Russell, B., Oliphant, J. E., & Deruyter, A. (2018). The mediating role of assets in explaining hardship risk among households experiencing financial shocks. Social Work Research, 42(3), 147–158. https://doi.org/10.1093/swr/svy012.

Despard, M. R., Taylor, S., Ren, C., Russell, B., Grinstein-Weiss, M., & Raghavan, R. (2018). Effects of a tax-time savings experiment on material and health care hardship among low-income filers. Journal of Poverty, 22(2), 156–178. https://doi.org/10.1080/10875549.2017.1348431.

Diener, E. (1994). Assessing subjective well-being: Progress and opportunities. Social Indicators Research, 31(2), 103–157. https://doi.org/10.1007/BF01207052.

Diener, E., & Biswas-Diener, R. (2002). Will money increase subjective well-being? A literature review and guide to needed research. Social Indicators Research, 57(2), 119–169. https://doi.org/10.1023/A:1014411319119.

Diener, E., Emmons, R. A., Larsem, R. J., & Griffin, S. (1985). The Satisfaction With Life Scale. Journal of Personality Assessment, 49(1), 71–75. https://doi.org/10.1207/s15327752jpa4901_13.

Diener, E., Lucas, R. E., & Scollon, C. N. (2006). Beyond the hedonic treadmill: Revising the adaptation theory of well-being. American Psychologist, 61(4), 305–314. https://doi.org/10.1037/0003-066X.61.4.305.

Diener, E., Oishi, S., & Lucas, R. E. (2003). Personality, culture, and subjective well-being: emotional and cognitive evaluations of life. Annual Review of Psychology, 54(1), 403–425. https://doi.org/10.1146/annurev.psych.54.101601.145056.

Duflo, E., & Saez, E. (2003). The role of information and social interactions in retirement plan decisions: Evidence from a randomized experiment. Quarterly Journal of Economics, 118(3), 815–842. https://doi.org/10.1162/00335530360698432.

Easterlin, R. A. (2001). Income and happiness: Towards a unified theory. Economic Journal, 111(473), 465–484. https://doi.org/10.1111/1468-0297.00646.

Eid, M., & Diener, E. (2004). Global judgments of subjective well-being: Situational variability and long-term stability. Social Indicators Research, 65(3), 245–277. https://doi.org/10.1023/B:SOCI.0000003801.89195.bc.

Fernandes, D., Lynch, J. G., & Netemeyer, R. G. (2014). Financial literacy, financial education, and downstream financial behaviors. Management Science, 60(8), 1861–1883. https://doi.org/10.1287/mnsc.2013.1849.

Friedline, T., & West, S. (2016). Financial education is not enough: Millennials may need financial capability to demonstrate healthier financial behaviors. Journal of Family and Economic Issues, 37(4), 649–671. https://doi.org/10.1007/s10834-015-9475-y.

Fujita, F., & Diener, E. (2005). Life satisfaction set point: Stability and change. Journal of Personality and Social Psychology, 88(1), 158–164. https://doi.org/10.1037/0022-3514.88.1.158.

Gallagher, E. A., Gopalan, R., & Grinstein-Weiss, M. (2019). The effect of health insurance on home payment delinquency: Evidence from ACA Marketplace subsidies. Journal of Public Economics, 172, 67–83. https://doi.org/10.1016/j.jpubeco.2018.12.007.

Gomez, V., Krings, F., Bangerter, A., & Grob, A. (2009). The influence of personality and life events on subjective well-being from a life span perspective. Journal of Research in Personality, 43(3), 345–354. https://doi.org/10.1016/j.jrp.2008.12.014.

Gonza, G., & Burger, A. (2017). Subjective well-being during the 2008 economic crisis: Identification of mediating and moderating factors. Journal of Happiness Studies, 18(6), 1763–1797. https://doi.org/10.1007/s10902-016-9797-y.

Graham, C. (2009). Happiness around the world: The paradox of happy peasants and miserable millionaires. Oxford University Press. https://doi.org/10.1093/acprof:osobl/9780199549054.001.0001.

Graham, C., Grinstein‐Weiss, M., Chun, Y., & Roll, S. (2020). Well-being and mental health amid COVID-19: Differences in resilience across minorities and whites. Brookings Institution. Retrieved from https://www.brookings.edu/research/well-being-and-mental-health-amid-covid-19-differences-in-resilience-across-minorities-and-whites/

Grinstein-Weiss, M., & Bufe, S. (2019). Financial shocks and financial well-being: Which factors help build financial resiliency in lower-income households? Consumer Financial Protection Bureau. Retrieved from https://files.consumerfinance.gov/f/documents/cfpb_financial-well-being_mgw-bufe_brief.pdf

Grinstein-Weiss, M., Pinto, O., Kondratjeva, O., Roll, S., Bufe, S., Barkali, N., & Gottlieb, D. (2019). Enrollment and participation in a universal child savings program: Evidence from the rollout of Israel’s national program. Children and Youth Services Review, 101, 225–238. https://doi.org/10.1016/j.childyouth.2019.03.048.

Hansen, T., Slagsvold, B., & Moum, T. (2008). Financial satisfaction in old age: A satisfaction paradox or a result of accumulated wealth? Social Indicators Research, 89(2), 323–347. https://doi.org/10.1007/s11205-007-9234-z.

Hardy, B. L., Hill, H. D., & Romich, J. (2019). Strengthening social programs to promote economic stability during childhood. Social Policy Report, 32(2), 1–36. https://doi.org/10.1002/sop2.4.

Hardy, B. L., & Ziliak, J. P. (2014). Decomposing trends in income volatility: The “wild ride” at the top and bottom. Economic Inquiry, 52(1), 459–476. https://doi.org/10.1111/ecin.12044.

Heflin, C. (2016). Family Instability and material hardship: Results from the 2008 Survey of Income and Program Participation. Journal of Family and Economic Issues, 37(3), 359–372. https://doi.org/10.1007/s10834-016-9503-6.

Heflin, C., Sandberg, J., & Rafail, P. (2009). The structure of material hardship in U.S. households: An examination of the coherence behind common measures of well-being. Social Problems, 56(4), 746–764. https://doi.org/10.1525/sp.2009.56.4.746.

Hsieh, C. M. (2004). Income and financial satisfaction among older adults in the United States. Social Indicators Research, 66(3), 249–266. https://doi.org/10.1023/B:SOCI.0000003585.94742.aa.

Jivraj, S., & Nazroo, J. (2014). Determinants of socioeconomic inequalities in subjective well-being in later life: A cross-country comparison in England and the USA. Quality of Life Research, 23(9), 2545–2558. https://doi.org/10.1007/s11136-014-0694-8.

Joo, S. H., & Grable, J. E. (2004). An exploratory framework of the determinants of financial satisfaction. Journal of Family and Economic Issues, 25(1), 25–50. https://doi.org/10.1023/B:JEEI.0000016722.37994.9f.

Kim, J., & Garman, E. T. (2004). Financial stress, pay satisfaction and workplace performance. Compensation & Benefits Review, 36(1), 69–76. https://doi.org/10.1177/0886368703261215.

Kim, J., Garman, E. T., & Sorhaindo, B. (2003). Relationships among credit counseling clients’ financial wellbeing, financial behaviors, financial stressor events, and health. Journal of Financial Counseling and Planning, 14(2). Retrieved from https://www.afcpe.org/news-and-publications/journal-of-financial-counseling-and-planning/volume-14-2/relationships-among-credit-counseling-clients-financial-well-being-financial-behaviors-financial-stressor-events-and-health/

Kim, J., Sorhaindo, B., & Garman, E. T. (2006). Relationship between financial stress and workplace absenteeism of credit counseling clients. Journal of Family and Economic Issues, 27(3), 458–478. https://doi.org/10.1007/s10834-006-9024-9.

Lee, J. M., Lee, J., & Kim, K. T. (2020). Consumer financial well-being: Knowledge is not enough. Journal of Family and Economic Issues, 41(2), 218–228. https://doi.org/10.1007/s10834-019-09649-9.

Leete, L., & Bania, N. (2010). The effect of income shocks on food insufficiency. Review of Economics of the Household, 8(4), 505–526. https://doi.org/10.1007/s11150-009-9075-4.

Lever, J. P. (2004). Poverty and subjective well-being in Mexico. Social Indicators Research, 68(1), 1–33. https://doi.org/10.1023/B:SOCI.0000025567.04153.46.

Lucas, R. E. (2007). Adaptation and the set-point model of subjective well-being. Current Directions in Psychological Science, 16(2), 75–79. https://doi.org/10.1111/j.1467-8721.2007.00479.x.

Luhmann, M., Hofmann, W., Eid, M., & Lucas, R. E. (2012). Subjective well-being and adaptation to life events: A meta-analysis. Journal of Personality and Social Psychology, 102(3), 592–615. https://doi.org/10.1037/a0025948.

McKernan, S-M., Ratcliffe, C., & Vinopal, K. (2009). Do assets help families cope with adverse events? (Brief 10). Urban Institute. Retrieved from https://www.urban.org/sites/default/files/publication/33001/411994-Do-Assets-Help-Families-Cope-with-Adverse-Events-.PDF

Mullainathan, S., & Shafir, E. (2013). Scarcity: Why having too little means so much. . Times Books.

Nagypál, É., & Tobacman, J. (2019). Credit characteristics , credit engagement tools , and financial well-being. Consumer Financial Protection Bureau. Retrieved from https://files.consumerfinance.gov/f/documents/cfpb_credit-karma_report_2019-08.pdf

Netemeyer, R. G., Warmath, D., Fernandes, D., & Lynch, J. G. (2018). How am i doing? Perceived financial well-being, its potential antecedents, and its relation to overall well-being. Journal of Consumer Research, 45(1), 68–89. https://doi.org/10.1093/jcr/ucx109.

Pew Charitable Trusts. (2015). The role of emergency savings in family financial security: How do families cope with financial shocks? Retrieved from https://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2015/10/the-role-of-emergency-savings-in-family-financial-security-how-do-families

Plagnol, A. C. (2011). Financial satisfaction over the life course: The influence of assets and liabilities. Journal of Economic Psychology, 32(1), 45–64. https://doi.org/10.1016/j.joep.2010.10.006.

Plagnol, A. C., & Easterlin, R. A. (2008). Aspirations, attainments, and satisfaction: Life cycle differences between American women and men. Journal of Happiness Studies, 9(4), 601–619. https://doi.org/10.1007/s10902-008-9106-5.

Rautio, N., Kautiainen, H., Koponen, H., Mäntyselkä, P., Timonen, M., Niskanen, L., Saaristo, T., Oksa, H., Peltonen, M., Puolijoki, H., Vanhala, M., & Keinänen-Kiukaanniemi, S. (2013). Financial satisfaction and its relationship to depressive symptoms in middle-aged and older adults: Results from the FIN-D2D survey. International Journal of Social Psychiatry, 59(3), 239–246. https://doi.org/10.1177/0020764011433635.

Roberts, J. A., & Clement, A. (2007). Materialism and satisfaction with over-all quality of life and eight life domains. Social Indicators Research, 82(1), 79–92. https://doi.org/10.1007/s11205-006-9015-0.

Rojas, M. (2006). Life satisfaction and satisfaction in domains of life: Is it a simple relationship? Journal of Happiness Studies, 7(4), 467–497. https://doi.org/10.1007/s10902-006-9009-2.

Roll, S., Mitchell, D. S., Bufe, S. A. M., Lynne, G., & Grinstein-Weiss, M. (2017). The experience of volatility in low- and moderate-income households : Results from a national survey. Aspen Institute. Retrieved from https://www.aspeninstitute.org/publications/experience-volatility-low-moderate-income-households-results-national-survey/

Roll, S., & Moulton, S. (2019). Credit counseling and consumer credit trajectories. Economic Inquiry, 57(4), 1981–1996. https://doi.org/10.1111/ecin.12802.

Roll, S., Taylor, S. H., & Grinstein-Weiss, M. (2016). Financial anxiety in low- and moderate-income households: Findings from the Household Financial Survey (CSD Research Brief 16–42).Washington University in St. Louis, Center for Social Development. Retrieved from https://csd.wustl.edu/Publications/Documents/RB16-42.pdf

Ryan, C. (2012). Responses to financial stress at life transition points (Occassional Papers No. 41). Australian Government Department of Families, Housing, Community Services, and Indigenious Affairs. Retrieved from https://www.dss.gov.au/sites/default/files/documents/09_2012/op41.pdf

Schanzenbach, D., Nunn, R., Bauer, L., & Mumford, M. (2016). Where does all the money go: Shifts in household spending over the past 30 years. The Hamilton Project. Retrieved from https://www.hamiltonproject.org/papers/where_does_all_the_money_go_shifts_in_household_spending_over_the_past_30_y

Searle, B. A., & Köppe, S. (2014). Assets, savings and wealth, and poverty: A review of evidence. Final report to the Joseph Rowntree Foundation. Personal Finance Research Centre. Retrieved from https://www.bristol.ac.uk/media-library/sites/geography/pfrc/pfrc1405-assets-savings-wealth-poverty.pdf

Seghieri, C., Desantis, G., & Tanturri, M. L. (2006). The richer, the happier? An empirical investigation in selected European countries. Social Indicators Research, 79(3), 455–476. https://doi.org/10.1007/s11205-005-5394-x.

Shapiro, G. K., & Burchell, B. J. (2012). Measuring financial anxiety. Journal of Neuroscience, Psychology, and Economics, 5(2), 92–103. https://doi.org/10.1037/a0027647.

Sirgy, M. J., Michalos, A. C., Ferriss, A. L., Easterlin, R. A., Patrick, D., & Pavot, W. (2006). The quality-of-life (QOL) research movement: Past, present, and future. Social Indicators Research, 76, 343–466. https://doi.org/10.1007/s11205-005-2877-8.

Solon, G., Haider, S. J., & Wooldridge, J. M. (2015). What are we weighting for? Journal of Human Resources, 50(2), 301–316. https://doi.org/10.3368/jhr.50.2.301.

Sun, S., Kondratjeva, O., Roll, S., Despard, M. R., & Grinstein‐Weiss, M. (2018). Financial well-being in low- and moderate-income households: How does it compare to the general population?(Research Brief 18–03). Washington University in St.Louis, Social Policy Institute. Retrieved from https://openscholarship.wustl.edu/cgi/viewcontent.cgi?article=1008&context=spi_research

Sun, S., Roll, S., Kondratjeva, O., Bufe, S., & Grinstein-Weiss, M. (2019). Assessing the short-term stability of financial well-being in low- and moderate-income households. . Washington University in St. https://doi.org/10.7936/cvrt-ss16.

Theodos, B., Stacy, C. P., & Daniels, R. (2018). Client led coaching: A random assignment evaluation of the impacts of financial coaching programs. Journal of Economic Behavior and Organization, 155(November), 140–158. https://doi.org/10.1016/j.jebo.2018.08.019.

USDA Economic Research Service. (2012). Six-item short form of the Food Security Survey Module. U.S. Department of Agriculture. Retrieved from https://www.ers.usda.gov/topics/food-nutrition-assistance/food-security-in-the-us/survey-tools/#six

Vera-Toscano, E., Ateca-Amestoy, V., & Serrano-del-Rosal, R. (2006). Building financial satisfaction. Social Indicators Research, 77(2), 211–243. https://doi.org/10.1007/s11205-005-2614-3.

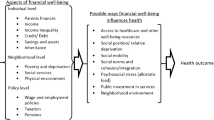

Walker, J. T., Bocian, D. G., DeMarco, D., Freeman, B., & Warmath, D. (2018). Understanding the pathways to financial well-being. Abt Associates. Retrieved from https://www.abtassociates.com/sites/default/files/2018-09/FWB Report 2_Final_180709.pdf

Welsch, H., & Kühling, J. (2016). How has the crisis of 2008–09 affected subjective well-being? Evidence from 25 OECD countries. Bulletin of Economic Research, 68(1), 34–54. https://doi.org/10.1111/boer.12042.

Wilkinson, L. R. (2016). Financial strain and mental health among older adults during the Great Recession. Journal of Gerontology. Series B, Psychological Sciences and Social Sciences, 71(4), 745–754. https://doi.org/10.1093/geronb/gbw001.

Winkelmann, L., & Winkelmann, R. (1998). Why are the unemployed so unhappy? Evidence from panel data. Economica, 65(257), 1–15. https://doi.org/10.1111/1468-0335.00111.

Winkelmann, R. (2014). Unemployment and happiness. IZA World of Labor. https://doi.org/10.15185/izawol.94.

Xiao, J. J., Chen, C., & Chen, F. (2014). Consumer financial capability and financial satisfaction. Social Indicators Research, 118(1), 415–432. https://doi.org/10.1007/s11205-013-0414-8.

Xiao, J. J., & Li, H. (2011). Sustainable consumption and life satisfaction. Social Indicators Research, 104(2), 323–329. https://doi.org/10.1007/s11205-010-9746-9.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare they have no conflicts of interest.

Ethical Approval

All procedures performed in studies involving human participants were in accordance with the ethical standards of the institutional review board of Washington University in St. Louis (IRB ID: 201801040) and with the 1964 Helsinki declaration and its later amendments or comparable ethical standards.

Informed Consent

Informed consent was obtained from all individual participants included in the study.

Disclaimer

Statistical compilations disclosed in this document relate directly to the bona fide research of, and public policy discussions concerning, financial security of individuals and households as it relates to the tax filing process and more generally. Compilations follow Intuit's protocols to help ensure the privacy and confidentiality of customer tax data.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Roll, S., Kondratjeva, O., Bufe, S. et al. Assessing the Short-Term Stability of Financial Well-Being in Low- and Moderate-Income Households. J Fam Econ Iss 43, 100–127 (2022). https://doi.org/10.1007/s10834-021-09760-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-021-09760-w