Abstract

The purpose of this paper was to examine children’s education financing alternatives among households in rural China. Data on education financing was from a household survey conducted in three poverty villages in Guizhou, China. The difference in financing education by households was verified through non-parametric testing. Findings show that private savings is dominant in financing education of children in school. Formal loans are almost absent even in the highest wealth group examined. The findings implied that the extension of financial services to children’s education could motivate parents to send their children for more education, increase disposable income of rural households by reducing precautionary savings, and provide better-educated labors in rural China.

Similar content being viewed by others

The role of financing in rural households is to smooth consumption by capital input or by insurance. Financial services support rural households in consumption or insure them against risks for well-being. These mechanisms of finance have been discussed in literature concerned with achieving consumption smoothing against shocks (Cochrane 1991; Morduch 1995). But in poor rural areas of developing countries, people generally lack access to formal financial services in the constraint of the credit market and the absence of an insurance market (Zeller and Meyer 2002). When the shocks from consumption occur, rural households are restricted to internal or informal mechanisms, such as private savings (Paxson 1992), liquidation of durable or productive assets (Rosenzweig and Wolpin 1993), or borrowings from neighbors and relatives (informal loans), or transfers and charities (Morduch 1994). Adjustment of inclusive asset-based policy programs such as Individual Development Accounts (IDAs) in USA thus enables low-income households to accumulate assets for consumption and development of families by encouraging them to save more effectively (Han and Sherraden 2009). The consensus of empirical literatures also assumed that gaps in consumption smoothing exist in effective insurance and credit markets (Moscardi and de Janvry 1977), but such gaps are much smaller for better-off households than for the poorest (Morduch 1995) because the better-off households have better access to formal financial institutions due to the fragmentation in the financial market, given the limited capacity of informal financial institutions and the differential risk-aversion of formal financial institutions (Hulme and Mosley 1996; Moll 1989).

Household-based and rural-community-based financing mechanisms are important, but they have limitations in storing wealth safely and dealing with co-variant shocks to irregular income streams during the year (Wang et al. 2008). Financial institutions like rural banks may therefore expand financing possibilities in rural areas, especially when they operate on an above-regional scale and thus intermediate between savers and borrowers living in different areas with different financing requirements and risks. Access to reliable savings and credit products from a rural bank thus forms a welcome addition to the capability of households to smooth consumption requirements over the year, to deal with financial shocks and to invest in new enterprises. Monetization through increased financial savings and through intermediation by financial institutions which makes investment easier for an economy is described as “financial deepening,” and forms the core of the theory of financial development (McKinnon 1973; Shaw 1973).

The apparent limited role of financial institutions in the rural financial markets of China is not exceptional. In many rural areas of the world, a large proportion of the population does not have access to regular banking services (Zeller and Meyer 2002). The situation, on the one hand, and the acknowledgement of the importance of access to financial services in economic development, on the other hand, has resulted in long-term attention to microfinance by the world’s policy makers, financial institutions and development agencies. As a result, there is presently a wealth of experience available in providing small-scale financial services to low-income households in all parts of the world. Additionally, impact studies provide a sharper insight into the possibilities and limitations of microfinance in the development context (Hulme and Mosley 1996). Experience and increased insight enable the avoidance of common pitfalls in the first place and provide guidelines for interventions in the second. However, financing is situation-specific and world-wide experiences must be combined with insight into the local situation to test whether the common experiences are valid and to give specific directions to the formulation of interventions.

Facing the substantial challenges that remain in the supply side of providing affordable, useful, and sustainable financial services in rural areas, both policy makers and the researchers need to appreciate and pay attention to the effects of credit and insurance mechanisms as complex weaves of consumption smoothing, which have proved to be fundamental determinants in relevant policy making. As China enters world markets, the need for a more skilled workforce increases as long as the nation accesses newer forms of technology and organizational arrangements. Numerous studies in China and around the world reveal that education promotes productivity on the farm, and also helps the agricultural sector adapt to changing markets and technologies (Heckman 2005). Comparatively speaking, education expectations of parents have been raised in China (Sun 2003). Parents who are better at future prospects are expected to find it easier to convey the concern to their children (Gouskova et al. 2010), and spend more on the education of their children in school. It leads to severe financial burden on households, particularly on poor households in the rural areas. What are the characteristics of financial sources in education expenditures of households in rural China? Do all rural households finance education expenditures in the same way?

The methods of education financing of rural households in China are analyzed and compared in this paper, given the situation of limited access to institutional financial services in China. Education expenditures are predictable and in principle households are able to include the expected expenditures in their financial planning and budget. By verifying the characteristics of the rural financing of education, it’s possible to determine the capability of rural households to plan and invest predictable consumption. The remainder of the paper is organized as follows. In Sect. 2, the methodology is presented with a description of the data sources. Income, finance and education expenditures of rural households in China are discussed in Sect. 3. In Sect. 4, a comparison of the methods of education financing is made among the groups classified by household wealth as well as education level of school children. Findings are interpreted and conclusions are drawn in the last section.

Data and Methodology

The household is one of the important units in macro decision-making, affecting production, consumption and finance in the economy. The financial decision of households on consumption is expressed in both the permanent income hypothesis (PIH) dealing with income and saving behaviour, and the life-cycle model depicting the relation of age to borrowing and saving, income and consumption. The life-cycle theory (Modigliani and Brumberg 1954) assumed that financial decisions of households on consumption smoothing are related in the first place to the income or wealth of household. Wang et al. (2008) discussed how rural households smooth medical expenditures by asset management, linking past, current and future economic activities, and internal and external financing methods. Internal financing method deals with the assets under direct command by a household. The two most common methods of internal financing are spending savings and liquidating non-financial assets. External financing operates on the credit side of rural financial market. In the form of loans from formal and informal sources, incurring debt is the major external financing method, while reserving credit is treated as a remaining potential to borrow in the future (Baker and Bhargava 1974).

The household budget for consumption expenditure is partly predictable and partly unexpected. Based on Schultz’s Human Capital Theory (Schultz 1961, 1963), we assume that education expenditures as the key investment of human capital are predictable, and can be planned or scheduled in advance. The expected returns will materialise in the long-term through increased market and non-market productivity. Considering the increased pressure from the economic development of China, and the resulting increased demands on the educational system (Kang 2003), financing education expenditures is a major household concern that is approached through a great variety of mechanisms, such as diversifying production, maintaining stocks, and building a network of social relationships. A common issue is the role of wealth: wealthier households have in general more possibilities of internal financing as their asset portfolio is ample and more diversified. In addition, they have better access to external financing from formal and informal sources than do poorer households. Wealth is therefore incorporated in our analysis through dividing rural households into five wealth categories. In China, there are three major education levels of the children in school: primary, secondary and higher education. Different levels of schooling contribute to economic growth differently, and lead to different expenditures and financial methods which will be considered in the analysis.

The empirical part of the paper is carried out according to household wealth levels, children’s education levels, and financing alternatives outlined above, which is summarised in Table 1. Households are divided evenly into five wealth groups from lowest to highest wealth households. Four education levels of schooling are used. The higher the education level of the children in school, the more costly the education. Financing alternatives for education expenditures are explored by comparing internal and external methods, and the differences among the five wealth groups are tested, in order to identify the characteristics of households in financing education as well as the predictability of education expenditures.

The data for the analysis are drawn from two sets of sources on the level of households. The general perspective data are from two sources: the data on rural household incomes are from national surveys carried out by National Bureau of Statistics of China (NBS) involving 68,000 households in 857 counties from 1980 to 2007; the data of rural household savings and credit are from a national survey by Agriculture Department of China (ADC) involving 20,000 households in 300 permanent observation sites in rural China from 1986 to 2003 (Agriculture Department of China 2001, 2006). The data on financing education is from the household survey by the International Centre for Agricultural and Rural Development (ICARD) of the Chinese Academy of Agricultural Science (CAAS) and the International Food Policy Research Institute (IFPRI) in 2005. All households in three villages of Guizhou Province, South West China, were interviewed. Two of them are national poverty villages in which the annual per capita net income was below 683 yuan in the survey year. There were a total 793 valid respondents. Authors are grateful to ICARD of CAAS and IFPRI for the permission to use the data.

Financial Situation and Education Expenditures in Rural China

In China, cash component of rural household income jumped from 52% in 1980 to 86% in 2007 (Table 2). This increase demonstrates the tendency toward monetization in rural China since the economic reform in 1980 (National Bureau of Statistics of China 2008). Cash income from self-run enterprises, trade, all kinds of odd jobs and work outside the villages has improved access of rural households to the consumer market, and has strengthened the capability of rural households to adjust during crises.

Savings in financial assets also increased substantially, by 14% annually from 1986 to 2003. Loan increased correspondingly but by a much slower rate of less than 5% annually, due to the stagnated intermediation and limited outreach of financial services, particularly formal financial services in rural areas. The major purpose of loans to rural households has changed from investment in production to smoothing consumption since 1996 (Table 3). However, the existence of financial constraints in smoothing consumption is more serious than that in production investment (Huang et al. 2007). The effect of financial services in smoothing consumption of rural households protruded into financial market as the constraints of rural financial institutes need to be relieved.

In the study of human capital from the perspective of formal education, Schultz sought to clarify the investment process and the incentives to invest in human capital, and pointed out that education is the key investment in human capital (Schultz 1961, 1963). With the rapid economic development and upgrading of the economic structure and pattern, the Chinese government has emphasized universal primary and widespread secondary schooling, and more recently has expanded the emphasis on higher education (Schultz 2004). Education expenditures have become an important part of household living expenditures, from less than 5% in 1980 to nearly 10% in 2007(Table 4). The increase in education expenditures reflects the sharp rise of tuitions and fees to some extent, particularly in higher education. In the meantime, the students are motivated by greater expectation from their parents to pursue higher education. The financing of education expenditures poses a dilemma for both rural households and government; the issue of dealing with increased education costs is both individual and national.

The condition of Guizhou Province, where the survey was carried out, is described and compared with the national level of China. In Guizhou Province, one of the poorest provinces in China, both income and education expenditures of rural households are substantially lower than the national level. Total income and cash income of rural households is 44 and 52% lower than the national level, respectively. Education expenditures were 52% lower than the national level in 2007 (Tables 2, 4). A backward economy and unfavorable living conditions in rural Guizhou Province call for the attention of the government, organizations and academic circles to experiment on new projects and test the marginal effect of policy attempt.

Average wealth, income and the presence of education expenditures of the surveyed households in each group classified by wealth level are presented in Table 5. Because the surveyed villages are located in the poorest area of Guizhou Province, the income per capita of the households was only 1,641 yuan, 62% lower than the provincial average of 2,661 yuan in 2005. Negative correlation between wealth and the presence of education expenditures reveals the fact that education in the rural area is a considerable burden on the poor households.

Education expenditures are the major component in consumption of households with children in school. Since schooling is mostly funded at the local level in China, resource constraints in the poor rural area affect access to schooling (Heckman 2005). The proportion of education expenditures to income of the surveyed households was 9%, lower than the 11.6% in China and the 10.4% in Guizhou Province in 2005.

Expenditures for primary, secondary and higher education of children in surveyed households show a distinct increase which is understandable as locations of schools are further away and access costs increase. Lavy (1992) has argued that direct costs such as user fees and travel costs are an important component in household educational decisions. Household expenditure for primary education is quite similar for all wealth groups. Secondary and higher education expenditures tend to increase with increasing wealth (Table 6). The standard deviation of education expenditures per group shows the existence of a wide divergence of expenditures within the wealth groups.

Alternatives for Financing Education among Rural Households

Alternative methods for financing education expenditures by household wealth group are illustrated in Table 7. Internal methods for financing education are predominant with financial savings as the main source for all wealth groups. External financing covers around 15% of the expenditures with loans from relatives and friends as the major source. Transfers and formal loans are small, only 2 and 1% in the expenditures respectively. Rural households predominantly choose the internal method to finance education expenditures. It shows the predictability of education in rural households, as well as the capability of households to meet education expenditures largely by savings in financial assets among all wealth categories. Additionally, the findings support the assumption of the existence of financial constraints in the rural financial market by the fact that neither loans from formal financial institutions nor informal mechanisms play an important role in any group.

The finding reveals that there is a substantial disparity in education expenditures among different education levels. Table 8 demonstrates shares of financing methods by different education levels of schooling. The share of internal financing of expenditures drops by nearly 0.40, from 0.80 of primary education expenditures to 0.40 of higher education expenditures, while the share of external financing jumps up by 0.52, from 0.08 of primary to 0.60 of higher education expenditures. Savings and formal loans play a major role in internal and external financing methods, which apply to all education levels. Primary education is financed predominantly by private savings because of the lowest outlay. Loans become more important with the increase of education level of school children. Underinvestment in higher education by students from poor families would remain a prevalent and significant problem if there were credit constraints on investment in higher education, which is also a matter of concern in developed countries (Cao 2008). Mitigation from the government and some Non-government Organizations (NGOs) plays a role in primary school and increasingly in secondary school, and is absent in financing higher education expenditures.

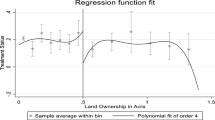

There are wide standard deviations of education expenditures and financing methods among five wealth groups (Tables 5, 6, 7). To determine whether there are differences in financing methods of education expenditures among the five wealth groups, generally a t test would be used, assuming the data meet the requirement of normal distribution. However, distribution analysis of education expenditures and financing methods shows that neither data field is normally distributed, and the data show different directions in skewness. Education expenditures are skewed towards the low end of the expenditure scale, the result of the fact that the low outlay of primary education expenditures is predominant in surveyed households. External finance in education expenditures, which is represented by the share of formal and informal loans in total education finance, are skewed towards the high end of the external finance scale (Fig. 1). Comparison of financing methods among different education levels shows that, in spite of predictability of education, rural households cannot self-support higher education expenditures. The large proportion of external financing in higher education expenditures and its near absence in primary education expenditures are the major reasons for the high end skewness of external finance in education expenditures.

To further identify the possible relationship between household wealth and the methods for financing education, the Kruskal–Wallis Test was used to examine whether the difference in financing methods for education expenditures among different wealth groups is statistically significant. As a non-parametric test, the Kruskal–Wallis Test does not require specifications as to the distribution of data, and the test result is considered consistent and reliable. The test result is indicated in Table 9.

According to the test result, surveyed households show the difference in shares of total internal and external financing for education expenditures at 5% significant level. The difference in total internal financing is developed from the divergence of household wealth and asset portfolio. The difference in external financial decision on education is significant on informal loan, but not on formal loans. It suggests that: first, the credit reserve is different among rural households; second, formal financial education service is still absent from the rural financial market in general, but shows great potential in serving children’s higher education.

Conclusion and Remarks

Financing children’s education is a major concern of rural households. According to the empirical study presented in this paper, the education is primarily financed by private savings of rural households, which applies to all wealth groups. Loans from relatives and friends and liquidation of non-financial assets are also important financing methods. Amounts of transfers and formal financing are small, but the role is important for lower wealth groups. Formal loans are negligible so far but have great potential in the future for serving higher education of children in rural households. The financing of higher education would be realized by well-designed financial services, particularly those easy and convenient financial practices and tools (Muske and Winter 2001), which also improve the rural household’s long-term financial position. The mitigations from government or other organizations only focus on primary and secondary education, which does not relieve rural households from fundamental financial stress. Methods for financing education expenditures of rural households correlate to household wealth and education levels of children in school. The significant difference exists in total internal and external financing. Wealthier households tend to pay education expenditures largely by internal method. Although education is predictable, higher education expenditures cannot be self supported, and are primarily financed by external methods, which leads households into financial stress and deteriorates livelihoods if farmers have to liquidate their non-financial assets instead of turning the assets into collateral securing formal loans. In conclusion, there is great potential to develop financial services for children’s education, particularly at levels of secondary and higher education. The availability of financial services could motivate parents to send their children for more education and increase disposable income by reducing the precautionary savings of households, in addition to providing better-educated labors in rural China.

References

Agriculture Department of China. (2001). National rural social-economic survey data collection from 1986 to 1999. Beijing: Agriculture Press of China (in Chinese).

Agriculture Department of China. (2006). Database of research centre for rural economy. Retrieved May 5, 2006, from http://www.rcre.org.cn (in Chinese).

Baker, C. B., & Bhargava, V. K. (1974). Financing small-farm development in India. Australian Journal of Agricultural Economics, 18(2), 102–118.

Cao, H. (2008). Credit constraints and human capital investment in college education. Journal of Family and Economic Issues, 29(1), 41–54.

Cochrane, J. H. (1991). A sample test of consumption insurance. The Journal of Political Economy, 99(5), 957–976.

Gouskova, E., Chiteji, N., & Stafford, F. (2010). Pension participation: Do parents transmit time preference? Journal of Family and Economic Issues, 31, 138–150.

Han, C. K., & Sherraden, M. (2009). Attitudes and saving in individual development accounts: Latent class analysis. Journal of Family and Economic Issues, 30, 226–236.

Heckman, J. (2005). China’s human capital investment. China Economic Review, 16, 50–70.

Huang, Z., Liu, X., & Cheng, E. (2007). The credit demand of China farmers: Production or consumption? Management World, 2, 73–80 (in Chinese).

Hulme, D., & Mosley, P. (1996). Finance against poverty: Volume 1. London: Routledge.

Kang, L. (2003). Chinese children’s changing family and school environments. Journal of Family and Economic Issues, 24(4), 381–395.

Lavy, V. (1992). Investment in human capital: Schooling supply constraints in rural Ghana. Living Standards Measurement Study Working Paper, No. 93. Washington, D.C.: World Bank.

McKinnon, R. I. (1973). Money and capital in economic development. Washington, DC: Brookings Institution.

Modigliani, F., & Brumberg, R. (1954). Utility analysis and the consumption function: An interpretation of cross-Section data. In K. K. Kurihara (Ed.), Post-Keynesian economics. New Jersey: Rutgers University Press.

Moll, H. A. J. (1989). Farmers and finance: Experience with institutional savings and credit in West Java. Wageningen: Wageningen Agricultural University.

Morduch, J. (1994). Poverty and vulnerability. American Economic Review, 84(2), 221–225.

Morduch, J. (1995). Income smoothing and consumption smoothing. Journal of Economic Perspectives, 9(3), 103–114.

Moscardi, E., & de Janvry, A. (1977). Attitudes toward risk among peasants: An econometric approach. American Journal of Agricultural Economics, 59(4), 710–716.

Muske, G., & Winter, M. (2001). In-depth look at family cash-flow management practices. Journal of Family and Economic Issues, 22(4), 353–372.

National Bureau of Statistics of China. (2008). China yearbook of rural household survey. Beijing: China Statistics Press (in Chinese).

Paxson, C. H. (1992). Using weather variability to estimate the response of savings to transitory income in Thailand. American Economic Review, 82(1), 15–33.

Research Centre for Rural Economy, Ministry of Agriculture of China. (2001). National rural social-economic survey data collection, 1986–1999. Beijing: China Agriculture Press (in Chinese).

Rosenzweig, R. M., & Wolpin, K. I. (1993). Credit market constraints, consumption smoothing, and the accumulation of durable production assets in low-income countries: Investments in bullocks in India. Journal of Political Economy, 101(2), 223–244.

Schultz, T. W. (1961). Investment in human capital. American Economic Review, 51(1), 1–17.

Schultz, T. W. (1963). The economic value of education. New York: Columbia University Press.

Schultz, P. T. (2004). Human resources in China: The birth quota, returns to schooling, and migration. Pacific Economic Review, 9(3), 245–267.

Shaw, E. (1973). Financial deepening in economic development. New York: Oxford University Press.

Sun, Y. (2003). Overview of children in China. Journal of Family and Economic Issues, 24(4), 331–335.

Wang, H., Moll, H., & Fan, S. (2008). Comparative analysis of farm households on financing medical care in rural China. The Chinese Economy, 41(6), 56–74.

Zeller, M., & Meyer, R. (2002). Improving the performance of microfinance: Financial sustainability, outreach and impact. In M. Zeller & R. L. Meyer (Eds.), The triangle of microfinance (pp. 1–18). Baltimore, MD: Johns Hopkins University Press.

Acknowledgments

The paper was sponsored by the Scientific Research Foundation for the Returned Overseas Chinese Scholars, Ministry of Eduction of The People’s Republic of China.

Open Access

This article is distributed under the terms of the Creative Commons Attribution Noncommercial License which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This is an open access article distributed under the terms of the Creative Commons Attribution Noncommercial License (https://creativecommons.org/licenses/by-nc/2.0), which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

About this article

Cite this article

Wang, Hs., Moll, H. Education Financing of Rural Households in China. J Fam Econ Iss 31, 353–360 (2010). https://doi.org/10.1007/s10834-010-9210-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-010-9210-7