Abstract

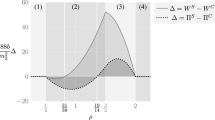

We reconsider Rosen’s economics of superstars model establishing, in the case of single-type consumers, a constant price-to-quality ratio. Rosen also conjectured that, in the case of multiple-type consumers, the normal course of consumer behavior forces the price-to-quality relationship to be convex and prevents it from being concave. We show that this conjecture is false and explain why there is no a priori reason to rule out concavity in the price-to-quality relationship. In this model, the market matches consumers to artists on the basis of quality: consumers of each type select only one level of quality, supplied by artists endowed with a specific level of talent. The concavity or convexity of the price-to-quality relationship is non-trivially related to the way both populations are matched. Consumers with poor knowledge have greater fixed costs above and beyond the price they have to pay on the market. They are therefore less reluctant when prices rise sharply and they specialize in levels of quality that entail a high marginal appreciation of quality: this can mean either a high or a low level of quality, depending on price curvature. With convexity, as Rosen pointed out, they turn toward superstars. Symmetrically, convexity encourages connoisseurs to turn toward low quality. But concavity too is fully possible: consumer–artist matching, for the same reasons, simply has the reverse effect. Connoisseurs go for great talents, whose price of quality flattens out. The global shape of the price-to-quality relationship (concave or convex) is determined by market clearing conditions and, more crucially, by the distribution of agents on both sides.

Similar content being viewed by others

Notes

However, the convexity can still come from contingent contextual factors on markets, for example, when the market for pop music is divided into singles and albums:“While most of the established singers could have attained that level of success by demonstrating their above average ability (quality) in the entry-level market, others might have attained it through what we might call the “back door” approach, i.e., by having non-quality attributes or factors. Once having gained successes in the singles market, it was possible to attain further success in the album market. This is what Adler calls a “snowballing effect” in Adler (1985)” from Hamlen (1994, p. 404). These kinds of effects are reproduced on artificial cultural markets by Salganik et al. (2006) and Salganik and Watts (2008).

Courty (2011) rightly notes that the pricing of quality depends on the matching rule between quality levels and consumer types, which is also one of our main conclusions.

Rosen admits that his model is not perfectly general and takes little account of the preference for variety. A more general model would assume a utility function \(u(x,\int _zn(i)i{\rm d}i)\).

“fixed” means “not depending on quality \(z\)”.

Highest knowledge levels need less time per unit \(n\) embodied in \(y\). Connoisseurs are closer to \(\underline{t}\) and non-connoisseurs closer to \(\overline{t}\).

In a more general model of choice, the monetary constraint would be \(px+\int _zp(i)n(i){\rm d}i\le wt_w\) and consumers would have to choose \(n(i)\) at each level \(i\). A special form of indivisibility could explain why consumers are restrained to choose only one level of quality. Technically, this indivisibility is equivalent to a constraint that forces the quantity consumed to be the same \(n_i=n\), for all \(i\). This indivisibility could be induced in a short-term context. When a person needs a lawyer for a divorce, for instance, (s)he does not select multiple qualities from the market, but merely purchases one quantity from a single type of supplier. In a more general long-term context, (s)he could buy the complete set of quality in the best quantity \(n_i\) of each level \(i\).

Lévy-Garboua and Montmarquette (1996) hypothesize that consumers build expectations on the quality of their future theatrical experiences based on the good or bad experiences, they have had attending plays in the past. In other fields, this could be the probability of success in some endeavor: a successful outcome to an operation for a surgeon, winning a trial for a lawyer, and so on.

Rosen (1981 p. 846).

Doing so, we depart from Rosen’s assumptions and assume perfect competition, unlike Borghans and Groot (1998), but as Filer (1986) that asserts that in the case of the arts, “there is no evidence that markets for most art forms are particularly concentrated.” Obviously the “superstar concentration” effect is alleviated in the multiple-type case.

This is the equation \(p(z)=\upsilon z-\tilde{s}\) in the paper from Rosen p. 848.

See notes (3) and (6).

Because of the indifference property in the single-type case, both sets coincide and matching is randomized. This is no longer the case in the multiple-type case.

Were it true, \(C'_1\) would thus be the minimum, not the maximum, utility \(s_1\) would reach in the catalog, because any straight line on the left would describe another indifference locus with higher quality for the same prices. Within a concave relationship, consumers, regardless of their connoisseurship \(-s\), would ask only for the highest level of quality available, which is not consistent with multiple levels of talent.

References

Adler, M. (1985). Stardom and talent. American Economic Review, 75(1), 208–212.

Alper, N. O., & Wassall, G. H. (2006). Artists’ careers and their labor markets, Chapter 23. In V. Ginsburgh & D. Throsby (Eds.), Handbook of the economics of art and culture (Vol. 1, pp. 813–864). Amsterdam: Elsevier.

Borghans, L., & Groot, L. (1998). Superstardom and monopolistic power: Why media stars earn more than their marginal contribution to welfare. Journal of Institutional and Theoretical Economics, 54, 546–557.

Chung, K. H., & Cox, R. A. K. (1994). A stochastic model of superstar–dom: An application of the yule distribution. Review of Economics and Statistics, 76(4), 771–775.

Connolly, M., & Krueger, A. B. (2006). Rockonomics: The economics of popular music, Chapter 20. In V. Ginsburgh & D. Throsby (Eds.), Handbook of the economics of art and culture (Vol. 1, pp. 667–719). Amsterdam: Elsevier.

Courty, P. (2011). Unpriced quality. Economics Letters, 111, 13–15.

Courty, P. & Pagliero, M. (forthcoming). The pricing of art and the art of pricing: Pricing styles in the concert industry. In Ginsburgh, V., & Throsby, D. (eds.) The handbook of the economics of art and culture (Vol. 2). Amsterdam: Elsevier.

DeVany, A. S., & Walls, W. D. (2004). Motion picture profit, the stable paretian hypothesis, and the curse of the superstar. Journal of Economic Dynamics and Control, 28, 1035–1057.

Filer, R. K. (1986). The starving artist: Myth or reality? Earning of artists in the united states. Journal of Political Economy, 94, 56–75.

Giles, D. E. (2006). Superstardom in the us popular music industry revisited. Economics Letters, 92, 68–74.

Hamlen, W. A. (1991). Superstardom in popular music: Empirical evidence. Review of Economics and Statistics, 32(3), 395–406.

Hamlen, W. A. (1994). Variety and superstardom in popular music. Economic Inquiry, 32(3), 395–406.

Krueger, A. B. (2005). The economics of real superstars: The market for rock concerts in the material world. Journal of Labor Economics, 23(1), 1–30.

Lévy-Garboua, L., & Montmarquette, C. (1996). A microeconometric study of theatre demand. Journal of cultural economics, 20, 25–50.

Rosen, S. (1981). The economics of superstars. American Economic Review, 71(5), 845–858.

Salganik, M. J., Dodds, P. S., & Watts, D. J. (2006). Experimental study of inequality and unpredictability in an artificial cultural market. Science, 311(5672), 854–856.

Salganik, M. J., & Watts, D. J. (2008). Leading the herd astray: An experimental study of self-fulfilling prophecies in an artificial cultural market. Social Psychology Quarterly, 71(4), 338–355.

Acknowledgments

I thank the MESHS, Maison Européenne des Sciences de l’Homme et de la Société Lille Nord-de-France, the MESR Ministère de l’Enseignement Supérieur et de la Recherche and the Nord-Pas-de-Calais Regional Council (CPER funds) for financial support. I am indebted to Frédéric Jouneau-Sion, Nicolas Schwed and Marjorie Sweetko for helpful comments and suggestions. I am very much indebted to Moez Kilani, whose extreme modesty explains why he did not co-author this paper. I would like to thank the anonymous referees for their valuable comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Champarnaud, L. Prices for superstars can flatten out. J Cult Econ 38, 369–384 (2014). https://doi.org/10.1007/s10824-014-9219-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10824-014-9219-0