Abstract

Can a society suffering contests between rich and poor achieve good governance in the face of endemic corruption? We examine a stylized poor state with weak institutions in which a “culture of evasion” damages state authority. Many evade tax payments, limiting the state’s economic development capability. In the face of extensive corruption, it is challenging for the state to establish and implement policies reflecting good governance: for example, a government that is accountable and transparent, efficient and effective, and follows the rule of law. The rich and poor possess different views on what is the appropriate level of enforcing proper payments of taxes due. The government needs to design an effective tax administration policy that minimizes corruption and is sensitive to the present and future needs of society. To do this, it must understand what drives such widespread corruption.

Similar content being viewed by others

1 Introduction

Extensive tax evasion (illegal activity) and tax avoidance (legal ways to reduce taxes), while known worldwide, is especially acute where enforcement is lax. Typically, this is accompanied by complicit tax enforcement officials. Moreover, constituencies with different interests may compete in attempting to influence the setting of the tax rate. Tax collection enforcement itself may be the outcome of negotiations, lobbying, and other elements of a political process among competing constituencies, bureaucrats, and politicians. The result is that the various economic actors live in an environment where rules and their enforcement appear fluid, where corrupt transactions are part of everyday life.

Against this background, we study the choices made by competing constituencies and the taxing authority, and the consequences (in equilibrium) for each of them and for the society. We focus on tax enforcement, a critical issue in which there have been major contributions but which is generally omitted from or glossed over in the discussion of tax policy (Bird 2004; Das-Gupta and Bird 2012; Keen and Slemrod 2017; Addison et al. 2018).

Weak tax administration and the consequential pervasive lack of compliance by potential taxpayers is characteristic of weak governance.Footnote 1 Countries with high inequality and weak governance often share other characteristics, making the financing of public policy difficult.Footnote 2 We model a stylized state having high inequality, weak institutions, low tax morale, and a subsequent “culture of evasion.” Many people avoid paying taxes, limiting the state’s revenue-raising capability and the role it plays in economic development (Andreoni et al. 1998). The rich and poor comprise constituencies with different economic and political interests, here captured by each group having different desired levels of tax rule administration and enforcement. In the face of such extensive corruption, it is challenging to establish and implement policies reflecting good governance.

Using game-theoretical political-economic modeling, we study the explicit interactions among the poor, the rich, and a tax administrator (TA) in order to understand the choice of the tax enforcement level and the consequent social outcome. The poor and the rich represent two constituent (or interest) groups who act strategically to drive policy for their own benefit.Footnote 3 They are rent-seekers/rent-avoiders who spend resources and enter a contest (as in a lobbying game), to influence the level of tax enforcement chosen by the administration. The rich prefer lower (zero) enforcement while the poor prefer a relatively higher enforcement level. The TA is not a neutral arms-length actor; rather, the TA has both the public and own self-interest in mind when proposing an enforcement level. The TA also chooses a tax enforcement level in order to maximize a weighted average of the resulting utility levels of two competing groups, as well as the lobbying expenditures of the two contestants (which perhaps accrue as rent to the administrator, the TA’s own narrow self-interest). The TA’s objective function turns on a single parameter (α) that represents the prevailing political culture, tax morale, or degree of politicization of the government.

Our TA is not necessarily an extreme rent-seeker. Depending on political culture and tax morale, the welfare of constituent groups may be of concern. The TA’s objective function reflects commitments to the public and to the TA’s own narrow self-interest. Indirectly, we also account for the politician’s policy preferences although this actor’s behavior is not explicitly modeled. As in Epstein and Nitzan (2006, 2007), a single parameter captures the political culture in which the TA exists: the weight assigned to social welfare relative to the total rent-seeking outlays.

We obtain striking results from a relatively simple model. In general, the tax enforcement level proposed by the TA may be higher or lower than the poor’s utility-maximizing tax enforcement level. It is shown how the enforcement level affects the lobbying efforts of the groups and who it affects more. Also, we show that the optimal tax enforcement level from the poor’s viewpoint is always lower than its utility-maximizing tax enforcement. There exists a political culture that gives rise to the situation where the optimal enforcement level of the TA equals the enforcement that one of the groups (rich or poor) would prefer.

Much of the literature on tax and revenue mobilization in developing countries has focused on the constraints on the state’s revenue-raising capability and, hence, the role the state plays in economic development (Andreoni et al. 1998). The public economics literature has examined the impacts of a given tax policy, studying the trade-offs between efficiency and equity in a general equilibrium framework (Addison et al. 2018). Lurking in the background for some time, but increasingly receiving attention, has been the administrative dimension of revenue collection (Das-Gupta and Bird 2012). Indeed, it is still common in papers discussing tax administration to call for more work—both theoretical and empirical—on the topic (Bird 2004; Slemrod 2007; Das-Gupta and Bird 2012; Alm 2014; Keen and Slemrod 2017; Addison et al. 2018).Footnote 4

We model the analysis of revenue mobilization as a contest between rich and poor constituencies. There is a vast political economy literature on policy formation providing insights on tax policy, corruption, evasion, among many other political processes (Persson and Tabellini 2002; Grossman and Helpman 2001; Epstein and Nitzan 2006). We examine public policy toward tax enforcement as determined by rent-seeking bureaucrats and politicians and the lobbying efforts of rich and poor constituencies (Myles and Naylor 1996; Schneider and Bose 2017). Policy maximizes an objective function that takes into consideration, in some measure, both social welfare and the policy-maker's own interests (Epstein and Nitzan 2006). Constituent groups rent-seeking, lobbying or influence investment is captured by the contest success function (CSF). As in Grossman and Helpman (2001) and Persson and Tabellini (2002), we let the tax administrator’s objective function be a weighted average of the expected social welfare and lobbying efforts.Footnote 5

The next section of the paper sets out the core of our rent-seeking model, in which we examine the workings of a contest in which the rich and poor vie for a tax enforcement plan that serves their own interests. Both act to maximize their expected net benefit by lobbying the government for their respective optimal levels of tax payment enforcement. In Sect. 3, we consider social welfare, explicitly accounting for the actions of the tax administrator (TA), their consequences, and the responses of the rich and the poor. The tax administrator is characterized as capturing the interests of society as a whole, the government, and own self-interest. We explicitly introduce the overlay of TA decision making into our modeling and examine the model’s comparative statics. In Sect. 4, we discuss several useful, if somewhat speculative implications of our modeling, including how hard the rich and poor fight for their desired tax enforcement levels, the possibility of a poverty trap, change in the TA’s/society’s sensitivity to corruption, and the existence and elimination of endemic corruption through the formation of anti-corruption herds. Sensitivity to corruption and related herding behavior reflect society’s “tax morale” (Alm and Torgler 2006; Luttmer and Singhal 2014). Section 5 concludes.

2 Tax payments enforcement

We model tax payment enforcement in an economy with inequality. To capture parsimoniously inequality, we posit two agents—one with relatively high income, the other with relatively low income—who take part in a rent-seeking/avoidance contest (Epstein and Nitzan 1999, 2007). The high/low divide is one among many ways of characterizing the income distribution. Further simplifying the discussion, we refer to high-income agents as rich, and those with low income as poor.

The core of our model is the contest between the rich and poor, which we model in this section. Both act to maximize their expected net benefit by lobbying the government for their respective optimal levels of tax payment enforcement (Das-Gupta 2005; Das-Gupta et al. 2004). The tax administrator (TA) who proposes and sets the tax enforcement level E represents the government in our model. The TA is imperfectly honest, both wanting to receive rents from the efforts of the rich and poor to influence her/his decisions and wanting to act in the best interests of the country by reflecting society’s prevalent sentiment with respect to tax avoidance and enforcement (Flatters and MacLeod 1995). Thus, rent-seeking/avoidance is an important part of the corruption story.

Sections 2.1 and 2.2 formally establish what the contest between the rich and poor looks like, given that both of these actors are trying to influence TA actions. The government redistributes income and spends its resources on items from which the citizens benefit such as education, health care, roads, parks, and security. In order to better focus our discussion, we consider the case where the tax level is fixed (we will talk about other options later). Under this tax level, the rich are net payers and the poor are net receivers. Thus, the rich pay more taxes than they get back from the government and the poor gain from the government more than they pay.

One might argue that the poor would not try to influence the TA as they are extremely resource constrained. However, it is useful to think about the rich and poor in our modeling as extreme cases. More than two groups are possible, each having stakes in the enforcement level. For example, assume that there are three groups: rich, middle class, and poor. The rich and the middle class can invest, and would want to invest, in bringing enforcement level to a certain optimal level, but not too high; the poorest are so resource constrained that they do not invest. In this paper, we model the relatively rich and the relatively poor middle class who can and want to invest, referring to them for simplicity as the rich and poor. The true poor who cannot invest do not take part in this contest. They are omitted from the rest of the discussion.

In order to focus our story, we think of the issue at hand as setting the level of enforcement. The rich find it is easier to avoid paying taxes while for the poor it is harder. In this situation, the poor prefer that the government enforces tax collection since the better is the tax collection (assuming tax enforcement is identical for all the population), the better off are the poor even if they would pay more taxes. Accordingly, the rich prefer a more reluctant enforcement rule, since they are better off paying less (up until a certain level of tax paid).Footnote 6

Alternatively, we could think about struggles between poor and rich over the tax level, or over the combination of tax level and enforcement. That is, we might talk about a joint policy combining both tax rates and enforcement levels. In general, the results of our analysis will not change.

Our story is that the tax administrator wishes to change the status quo enforcement level. The poor would prefer a harsher enforcement level while the rich would prefer a less binding one that enables them to tax evade. Below, we describe the contest between rich and poor over the determination of the enforcement level.

2.1 The contest between rich and poor

A tax administrator (TA) establishes the contest (but not the contest success function, discussed later in this paragraph) by proposing tax enforcement level E at a level that is higher than the status quo. For simplicity, we assume that the status quo enforcement level is zero. Thus, the poor would benefit and the rich would be harmed from this change. The proposal will be presented before the parliament or the ruling politician who will determine whether to approve or reject the proposal.Footnote 7 Approval or rejection is a function of the contest success function (CSF). The CSF converts rent-seeking/avoidance efforts by the rich and poor to influence the TA’s proposed enforcement level E into probabilities of approval and rejection. The TA takes as given the CSF when determining the level of enforcement. With this information, the rich and the poor decide on their lobbying expenditures (that is, their strategies), allowing us to obtain the enforcement level assuming the contest has a Nash equilibrium and complete information on the parameters is available. The equilibrium outcome from the rent-seeking/avoidance contest is the TA’s political constraint. The policy the TA follows reflects its various commitments and its political constraint.

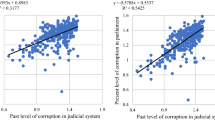

These steps are illustrated in this figure which is described in more detail below:

Before proceeding further, we should spend a minute discussing our conceptualization of the key policy element in this paper, the enforcement level E. Clearly, many elements of tax administration policy need consideration in actual practice and using the single policy E is overly simple. However, it does focus our story. Das-Gupta et al. (2016) have recently offered the empirical analogue of this. They propose and construct a Tax Administration Measure of Effectiveness (TAME), an index that captures the tax administration environment including its effectiveness and enforcement.Footnote 8 We rely on this conceptualization.Footnote 9

The risk-neutral agents, the poor (p) and the rich (r) spend xp and xr on rent-seeking/avoidance to affect chances of approving or rejecting the proposed enforcement level. Expenditure by the rich and poor in this lobbying contest correlates closely with their chances of winning. Expenditures xp and xr establish the approval probability of the TA’s proposed policy E; e.g., with probability Prp the parliament accepts the proposed enforcement level E (that benefits the poor). As stated before, for convenience, we set the status quo enforcement level to zero and this is the desired level by the rich so that the rich are not the subjects of tax enforcement. In general, we can think of this as setting their E at some minimum level enabling the rich to obtain their desired level of public goods.

Enforcement level E* maximizes the payoff to the poor. Whereas the rich prefer minimal enforcement, the poor’s preferred enforcement level is positive and high enough to ensure the availability of a sufficient level of public goods, but not too high, as this may hurt them. The poor understand the benefit of paying taxes as aiding public goods provision while recognizing that the cost of paying too much also needs consideration.

The rich and the poor have expected net payoffs (surpluses) ofFootnote 10

and,

\( \varvec{E}(u_{\text{r}} ) \) and \( \varvec{E}(u_{\text{p}} ) \) are expected net payoffs to the rich and poor, respectively. Ar and Ap are the respective payoffs to the rich and poor if the policy that benefits them is not approved. Namely, Ap is the payoff for the poor when the proposed enforcement level E is not approved; Ar is the payoff for the rich when the new enforcement level is approved (i.e., E rises above its status quo level of 0). nr and np are the real benefits each group receives from their rent-seeking/avoidance activities if the enforcement policy is approved or rejected depending on if it is the poor or the rich.Footnote 11 The sizes of the benefits going to each group are a function of the enforcement level. Prr and Prp are the contestants’ probabilities of winning the contest (note, Prr + Prp = 1). xr and xp are their contest expenditures. The stakes, the n, are a function of the enforcement level and in equilibrium, so are the probabilities.

Victory belongs to the poor if the parliament or the ruling politician approves the proposed enforcement level, as this is their preferred outcome, and they receive np. The poor’s payoff is Ap when the parliament or the ruling politician does not accept their favored policy; np is the winning benefit received by the poor. Therefore, if the poor win the contest, they get Ap + np, otherwise they get Ap. If parliament or the ruling politician rejects the proposed enforcement level, the rich receive real benefit nr; in fact, a win for the rich provides them with an avoided loss. The rich receive payoff (profits) Ar when the parliament or the ruling politician does not adopt their favored enforcement level: nr is the winning benefit received by the rich in the contest. Note again that the enforcement level is set at zero when the rich win the contest.

From the CSF, we obtain probabilities Prr and Prp; i.e., the CSF converts expenditures by the rich and poor into the probabilities they can obtain their favored policy outcome. Note that the CSF is given and is Tullock’s (1980) non-discriminating rule that player i’s success probability when competing against player j is

The interior Nash equilibria of our two-player contest (subgame) are characterized by

The second-order sufficient conditions of such equilibria are satisfied.

Rich and poor equilibrium expenditures and winning probabilities are

From (5), we see that whoever has the higher benefit also has the higher probability of winning the contest.

2.2 Relative efforts, winning probabilities, and the proposed enforcement level

We now consider some of the consequences of the model setup in Sect. 2.1; we examine here the comparative statics of the contest. When the proposed enforcement level E changes, the effects on equilibrium expenditures by the rich and poor are

and

where \( \eta_{j} = \frac{{\partial n_{j} }}{\partial E}\frac{E}{{n_{j} }} = n_{j}^{{\prime }} \frac{E}{{n_{j} }} \) is contestant j’s benefit elasticity with respect to changing the proposed enforcement level E. As discussed earlier in Sect. 2, we are talking about the relatively rich and poor who want to invest in the contest, and for simplicity ignoring the possibility of more groups having stakes in the enforcement level.

E* is the enforcement level that maximizes the poor’s expected net payoff. This assumes that there is a maximum enforcement level that is good for the poor and even they have a limit on the enforcement level. Of course, the rich prefer as low a level as possible. For E* > E > 0, notice that \( \frac{{\partial n_{j} }}{\partial E} = n_{j}^{{\prime }} > 0,\quad \forall \;j = p,r \) and for E > E*, \( \frac{{\partial n_{p} }}{\partial E} < 0\;{\text{and}}\;\frac{{\partial n_{r} }}{\partial E} > 0 \). Also notice that there exists \( \bar{E} \), such that the poor prefer an enforcement level E exceeding the optimal level E* (E* < E < \( \bar{E} \)) rather than a zero enforcement level. Then again, a very high enforcement level E, \( (E > \bar{E}) \), is worse than a zero enforcement level.

Therefore, the effect of changes in enforcement on outlays made by the rich and poor is ambiguous. The critical elements here are the contestants’ benefit elasticities with respect to changes in the enforcement level.By (5),

Since

we obtain

Proposition 1

-

(a)

a. If\( E^{*} > E > 0 \), the effect of a proposed enforcement level E change on the odds the rich will win the contest and their relative contest expenditure is ambiguous. Elasticities\( \eta_{r} \)and\( \eta_{p} \)drive this effect. Specifically,

$$ \frac{{\partial \left( {\Pr_{\text{r}}^{*} /\Pr_{\text{p}}^{*} } \right)}}{\partial E} = \frac{{\partial \left( {x_{\text{r}}^{*} /x_{\text{p}}^{*} } \right)}}{\partial E}\begin{array}{*{20}c} > \\ < \\ \end{array} 0\quad {\text{if}}\quad \eta_{\text{r}} - \eta_{\text{p}} \;\begin{array}{*{20}c} > \\ < \\ \end{array} \;0. $$ -

(b)

If\( \bar{E} > E > E^{*} \), a proposed enforcement level E change affects directly the odds the rich will win the contest and their relative contest expenditure. Namely,

$$ \frac{{\partial \left( {\Pr_{\text{r}}^{*} /\Pr_{\text{p}}^{*} } \right)}}{\partial E} = \frac{{\partial \left( {x_{\text{r}}^{*} /x_{\text{p}}^{*} } \right)}}{\partial E} > 0. $$

This proposition directly characterizes the chances each player has of winning the contest when there is a change in the proposed enforcement level, where winning the contest means obtaining its’ desired enforcement level from the TA. The relationship between elasticities \( \eta_{r} \) and \( \eta_{p} \) plays a key role in case (1.a). That is, it tells us with respect to changing the proposed enforcement level E, how elastic is the rich’s benefit compared to the poor’s benefit. When \( \eta_{r} \) exceeds \( \eta_{p} \), the poor have a better chance of winning and their relative rent-seeking efforts increase. However, in case (1.b) the poor’s benefit decreases while that of the rich increases with proposed enforcement level increases. Therefore, the poor are more likely to lose and they decrease their relative rent-seeking efforts.

Let us now examine what happens to the sum of expenditures by the rich and poor on achieving their enforcement goals. Where X is total rent-seeking/avoidance expenditures (or effort, also referred to as rent dissipation), by (5), in equilibrium we have

We are interested in how the sum of expenditures by the rich and poor as they try to influence the contest is related to the proposed enforcement level E,

That is, generally, it is ambiguous. More specifically, we can characterize when overall rent dissipation is increasing byFootnote 12

Lemma 1

-

(a)

If\( E^{*} > E > 0 \), then\( \frac{{\partial X^{*} }}{\partial E} > 0 \).

-

(b)

If\( \bar{E} > E > E^{*} \), then\( \frac{{\partial X^{*} }}{\partial E}\begin{array}{*{20}c} < \\ > \\ \end{array} 0 \)i f\( \frac{{ - \eta_{\text{r}} }}{{\eta_{\text{p}} }}\begin{array}{*{20}c} < \\ > \\ \end{array} \frac{{n_{\text{r}} }}{{n_{\text{p}} }} \).

Interestingly, under the sufficient condition, \( - \eta_{r} \,\, < \,\,\,\eta_{p} \), the sum of rent-seeking expenditures by the rich and poor is inversely related to the proposed enforcement level, E. This lemma characterizes rent dissipation.

What happens to each player’s expenditures when the proposed enforcement level changes? (1.a) tells us when total expenditure (that is, total effort or rent dissipation) increases as proposed enforcement increases if E is below the poor’s optimal enforcement level, E*. The contest between rich and the poor becomes more intense as the respective benefits are high. Even when an increase persuades the poor to reduce their rent-seeking activities, the rich counterbalance this reduction by disproportionately increasing their rent-avoidance efforts. (1.b) stipulates the circumstances that tell us how equilibrium total rent-seeking/avoidance expenditures react to proposed enforcement level changes, when E is above the poor’s optimal enforcement level, E*.

3 Tax administration

We characterized in Sect. 2 the contest between the rich and the poor. Here, we consider social welfare, explicitly accounting for the actions of the tax administrator (TA), their consequences, and the responses of the rich and the poor. The TA takes the rent-seeking/avoidance contest discussed in Sect. 2 as a political constraint. Commitment to the populace and self-interest motivate the TA.

3.1 The politically constrained tax administrator

The tax administrator (TA) establishes the enforcement level E taking into account the contest between the rich and the poor, its desire to acquire rents, and its commitment to enhancing social welfare. The TA’s specific objective function captures these commitments. The TA gains from lobbying expenditures with regard to the proposed enforcement level and from the four possible payoffs to the rich and the poor, because part or all of these expenditures are a resource transfer to the TA. Hence, the objective function is \( G\left( {\varvec{E}(u_{\text{r}} );\;\varvec{E}(u_{\text{p}} );\;(x_{\text{r}} + x_{\text{p}} )} \right) \) for the TA. The expected net payoffs to the rich and poor are \( \varvec{E}\left( {u_{\text{r}} } \right) \) and \( \varvec{E}\left( {u_{\text{p}} } \right) \) as per Eqs. (1) and (2). The contestants’ expenditures (xr + xp) either are wasted lobbying resources or represent transfers to the government (of which the TA is the agent). The TA gains the greater the fraction of the expenditures it captures and the sum of rich and poor expected payoffs to others.

Player l’s equilibrium expected payoff, l = rich or l = poor, is \( \bar{\varvec{E}}\left( {u_{l}^{*} } \right) \); i.e., \( \bar{\varvec{E}}\left( {u_{l}^{*} } \right) \) is player l’s equilibrium expected payoff disregarding rent-seeking/avoidance costs, \( \varvec{E}\left( {u_{l}^{*} } \right) = \bar{\varvec{E}}\left( {u_{l}^{*} } \right) - x_{l}^{*} \). Assume an additive TA objective function,

The TA has mixed commitments. The weight (1–2α) determines whether \( \,\left( {x_{p}^{*} \, + \,x_{r}^{*} } \right) \) adds to or subtracts from welfare. If the total rent-seeking/avoidance expenditures are wasted, the weight is negative. Weights α and (1–2α) apportion the welfare components, with α capturing the TA’s mixed commitments to the public and self. This parameter reflects the prevailing sentiment in the society with respect to tax avoidance and enforcement, echoing contestants’ expenditure allocations between wasteful and non-wasteful resources received by the TA. Here, we see the TA’s public commitment and narrow self-interest in collecting contestants’ expenditures.

Given (11), when \( \alpha = 1 \), the TA is totally committed to the public interest and society views expenditures on rent-seeking/avoidance as completely wasteful. When \( \alpha = 1/2 \) and we again observe a fully committed TA, expenditures made by the rich and the poor are in fact a transfer from the rich and poor to the government that reallocates it back to them. In the extreme case, \( \alpha = 0 \). Here, the TA’s objective is maximizing rich and poor expenditures on the contest while ignoring the public’s welfare. The TA cares only about getting contest rent! Other intermediate cases are obtained for \( 0 < \alpha < 1,\quad \alpha \ne {1 \mathord{\left/ {\vphantom {1 {3,\quad \alpha \ne {1 \mathord{\left/ {\vphantom {1 2}} \right. \kern-0pt} 2}}}} \right. \kern-0pt} {3,\quad \alpha \ne {1 \mathord{\left/ {\vphantom {1 2}} \right. \kern-0pt} 2}}} \). When \( 0 < \alpha < 0.5 \), efforts at rent-seeking/avoidance positively affect the TA; when \( 0.5 < \alpha < 1 \), the effect on the TA’s objective function is negative.

3.2 The equilibrium enforcement level

To determine the optimal level of E maximizing the TA’s objective function (11), we look at the interior solution to the TA’s problem, characterized by the first-order condition

or,

E** satisfies (13) which maximizes the objective function of the TA (11). Assuming the second-order condition holds, \( \frac{{\partial^{2} G(.)}}{{\partial E^{2} }} = \alpha \frac{{\partial^{2} \left( {\bar{\varvec{E}}\left( {u_{\text{r}}^{*} } \right) + \bar{\varvec{E}}\left( {u_{\text{p}}^{*} } \right)} \right)}}{{\partial E^{2} }} + \left( {1 - 2\alpha } \right)\frac{{\partial^{2} X^{*} }}{{\partial E^{2} }} < 0 \), Eqs. (4) and (13) characterize an interior Stackelberg–Nash equilibrium \( \left( {x_{r}^{*} ,x_{p}^{*} ,E^{**} } \right) \).

Turning to examine how changes in α, the parameter summarizing the sensitivity of the society and the TA to corruption and evasion, affect the equilibrium enforcement level E**, it can be shown that \( \frac{{\partial E^{**} }}{\partial \alpha } = \frac{{ - \partial^{\,\,2} G(.)/\partial \,E\,\partial \,\alpha }}{{\partial^{\,\,2} G(.)/\partial \,E^{2} }} \). By the second-order condition, \( \frac{{\partial^{2} G(.)}}{{\partial E^{2} }} < 0 \). By means of the first-order conditions, we can see that \( \frac{{\partial E^{**} }}{\partial \alpha } \) and \( \frac{{\partial X^{*} }}{\partial E} \) have opposite signs. Hence,

Proposition 2

Via Lemma 1, we immediately see the conditions determining the sign of \( \left( {\frac{{\partial E^{**} }}{\partial \alpha }} \right) \).

E** is the equilibrium enforcement level in our extended tax enforcement game. However, the poor prefer the level maximizing their expected net payoff, E*. We can compare E* and E** by examining the relationship between the TA’s/society’s sensitivity to corruption (\( \alpha \)) and this comparison’s outcome. We want to know: (i) Is there an \( \alpha \) which gives rise to an enforcement level E** equal to E*? (ii) Is there an \( \alpha \) which gives rise to an enforcement level E** equal to the level the rich prefer (which we denote by zero)?

When α = 0, the TA’s objective is maximizing rent-seeking/avoidance expenditures while ignoring public welfare. Such an assumption implies a TA who is totally committed to her/his own narrow interest in governing the expenditures made by the rich and poor who are each trying to win the contest. The equilibrium enforcement level E** maximizes \( G(E) = X^{*} (E) \) and satisfies the first-order condition

By Lemma 1, it is clear that if \( \frac{{ - \eta_{\text{r}} }}{{\eta_{\text{p}} }} < \frac{{n_{\text{r}} (E)}}{{n_{\text{p}} (E)}} \), then E** = E*, otherwise E** > E*. We thus obtain,

Proposition 3

-

(a)

There exists α1, such that E**(α1) = E*.

-

(b)

If\( \frac{{ - \eta_{r} }}{{\eta_{p} }}\,\, < \,\,\frac{{n_{r} (E)}}{{n_{p} (E)}} \), there exists\( \alpha_{2} \)such that E**(\( \alpha_{2} \)) > E*.

As presented above, there exists a level of enforcement E** that maximizes the TA objective function (11). The optimal enforcement level is a function of α capturing the TA’s commitments to the public well-being.

Proposition 3 tells us that this society possesses a sensitivity to corruption that brings about the enforcement level E* that is preferred by the poor. The proposition also informs us about conditions ensuring the proposed enforcement level exceeds E*. The introduction of the enforcement level E* in our setting may require positive α, i.e., that the TA assigns a positive weight to the public’s aggregate expected benefit.

Proposition 3a tells us that there exists a level of commitment of the TA to the public well-being that provides the same enforcement level that is optimal for the poor. Proposition 3b tells us that if it holds that \( \frac{{ - \eta_{\text{r}} }}{{\eta_{\text{p}} }} < \frac{{n_{\text{r}} (E)}}{{n_{\text{p}} (E)}} \), then there exists a level of commitment of the TA to the public well-being that will give a higher level of enforcement than the poor would prefer. This would only happen if the level of commitment of the TA to the public well-being is sufficiently low and thus the TA is increasing the level of enforcement to increase her/his own well-being by increasing the total amount of expenditure spent by the two groups. It is clear from the above that under these conditions, \( \alpha_{2} \) < \( \alpha_{1} \).

In a similar way to Epstein and Nitzan (2003, 2004), we argued above that if the poor win the contest with certainty, they prefer the TA to set the enforcement level at E*, maximizing the poor’s benefit \( n_{p} \), and satisfying: \( \left. {\frac{{\partial n_{\text{p}} \left( E \right)}}{\partial E}} \right|_{{E = E^{**} }} = 0 \). E* is the optimal level of enforcement maximizing the poor’s benefit. It does not maximize the poor’s expected benefit. Thus, it only looks at the benefits and does not take into consideration the probability of winning or losing the contest or the level of expenditure invested in the contest. However, the poor do not win the contest with certainty in our extended strategic setting, so they need to take into consideration the possibility that increasing their net benefit (by increasing E) may reduce their probability of winning the contest by increasing opposition by the rich. The poor in our setting prefer the TA to set the enforcement level at \( E_{0} \)—the enforcement level maximizing their equilibrium expected net payoff. From (2) and (6), the poor’s expected payoff is

The positive enforcement level \( E = E_{0} \) maximizing \( E\left( {u_{p}^{*} } \right) \) is characterized by the first-order condition:

At E** = E*, \( \frac{{\partial n_{\text{p}} (E)}}{\partial E} = 0 \). Since, \( \frac{{\partial n_{\text{r}} (E)}}{\partial E} > 0 \) at \( E^{*} \), \( \left. {\frac{{\partial \varvec{E}\left( {u_{\text{p}}^{*} } \right)}}{\partial E}} \right|_{{E = E^{*} }} < 0 \). This implies that the enforcement level maximizing the poor’s expected net payoff is smaller than \( E^{*} \). Summing up:

Proposition 4

-

a)

\( E_{0} < E^{*} \).

-

b)

α3 exists, such that E*(α3) = E0.

The level of enforcement that maximizes the poor’s payoff is \( E^{*} \). However, if they also take into consideration the probability of winning and the level of expenditure needed to try to win approval (in equilibrium the probabilities, the benefits, and the expenditure are all functions of the level of enforcement), we will obtain that the optimal enforcement level maximizing the expected payoff is lower than what maximizes the payoff: \( E_{0} < E^{*} \). The reason is that if they ask for a lower level, the resistance of the rich will be lower and the poor may have a higher probability of winning.

Given the expected payoff of both groups, the TA maximizes her/his expected payoff as stated in (11). For each given \( \alpha \) (the weight the TA assigns to welfare), the level of enforcement that the TA proposes will be different. Thus, the proposition states that there exists an \( \alpha \) such that the enforcement level that the TA proposes will be identical to the level that the poor prefer. If the TA operates at a level where corruption sensitivity is embodied by \( \alpha_{3} \) > 0, we are describing a TA who is more committed to enhancing social welfare than a TA whose equilibrium policy equals \( E^{*} \). We wish to note that what we have presented above is with regard to the level of commitment of the TA to the public well-being and how this connects to what the poor would have wanted with regard to the TA’s proposed enforcement level.

4 Some implications of the poor’s constraint

In this section, we offer several useful, if somewhat speculative, implications of our modeling: (1) how hard the rich and poor fight for their desired tax enforcement levels; (2) the possibility of herding by taxpayers; (3) change in the TA’s/society’s sensitivity to corruption; and (4) a poverty trap. Up to here, we have observed that the proposed optimal enforcement level may well be even higher than what the poor would like; however, it may also be lower than the poor’s desires (since they receive benefits from collected taxes) and closer to the wishes of the rich (which is zero enforcement). This depends on the sensitivity of the political culture to corruption and reduced tax enforcement.

Recall we showed the optimal level of enforcement maximizing the benefit to the poor is E*, while the level maximizing the expected net payoff of the poor is \( E_{0} \) and it holds that \( E_{0} < E^{*} \). Assume that the proposed enforcement level is set at \( E_{0} \). From (5), the expenditure of the poor attempting to influence the proposed policy equals \( x_{\text{p}}^{*} (E_{0} ) = \frac{{n_{\text{p}}^{2} \left( {E_{0} } \right)n_{\text{r}} \left( {E_{0} } \right)}}{{\left( {n_{\text{p}} \left( {E_{0} } \right) + n_{\text{r}} \left( {E_{0} } \right)} \right)^{2} }} \). As the desired enforcement level the rich prefer is lower than that of the poor, the level of expenditure under \( E_{0} \) is more than what is optimal for the rich.

The expected net payoff to the poor would be: \( \varvec{E}\left( {u_{\text{p}}^{*} } \right) = A_{\text{p}} + \frac{{\left( {n_{\text{p}} (E_{0} )} \right)^{3} }}{{\left( {n_{\text{r}} (E_{0} ) + n_{\text{p}} (E_{0} )} \right)^{2} }} \), which is higher than if the enforcement level was equal to zero (the desired level for the rich). However, we have to remember that the benefit is in expected terms while the expenditure is absolute. This means that the revealed payoff may be negative since expenditure may be too high. The outcome may be either

if they lose the competition, or if they win

If it holds that \( u_{\text{p}} = A_{\text{p}} - x_{\text{p}} (E) < 0 \), then the poor may decide not to invest resources or will invest fewer resources than needed to attain the optimal E as (18) is negative and they will invest such that (18) will be positive—they will invest less than is necessary to maximize their expected net payoff. This gives the rich more influence on determining (together with the TA) the enforcement level. In other words, even though the poor should fight to increase enforcement, they may well not do so.Footnote 13

In the case just presented, the rich will have a greater influence on determining the country’s enforcement measures. Hence, lower enforcement is generally the rule. The poor can obtain more from the government then they pay in taxes. The reason is simply that their income is low and the benefits they get from government are higher than what they pay in. On the other hand, they do not have many resources and it is not clear that they can afford to invest resources in attempting to affect the enforcement level. Notice that poor, low-income individuals wish tax enforcement to be stricter than desired by the rich. As the poor pay less to the government than they receive in benefits from the government, their net tax payment is negative—they want taxes to be properly collected.

What can change this? Consider herding by taxpayers and the TA’s/society’s sensitivity to corruption. Both concepts are related to the idea of tax morale (Luttmer and Singhal 2014; Torgler et al. 2008; Alm and Torgler 2006). Both are implementations reflecting how an individual’s compliance may be affected by others. Incorporating these motivations for tax compliance, we gain some insight into how they affect behavior.

First, think about possible herding and assume it follows a process as modeled in Epstein and Gang (2010). Here, it starts with people exogenously insisting on paying their appropriate taxes. Slowly, very slowly, people will stop evading taxes, as they will see others not evading. With heterogeneous people, first those who are most affected—most sensitive, those with a lower threshold—will stop evading (Epstein and Gang 2010). This will increase the actual level of enforcement observed by others and will increase the benefits the poor obtain, enabling (18) to be positive. What this means is that the poor will be able to increase their efforts to have increased enforcement, eventually drawing in those with a higher threshold level and slowly further increasing the number not evading. Finally, it will affect the rich. What we are observing here is essentially “backwards herding”; i.e., instead of evasion leading to increased evasion as described in Epstein and Gang (2010), enforcement acts to generate increased honesty which further increases honesty potentially until there is no longer any tax evasion.

Second, consider a change in the TA’s/society’s sensitivity to corruption: Here too, we might observe “backwards herding.” If the TA/society becomes more sensitive to corruption—that is, \( \alpha \) in our model increases—this would reduce the influence of the rich on the chosen level of tax enforcement. It seems that the higher possibility would be the first possibility; thus, a herd will start paying taxes that will start affecting all others. Like the herd that started not paying taxes, in the same way, a herd can start to pay taxes that will affect the rest of the population.

Finally, consider the possibility of a poverty trap. Instead of a less than zero outcome holding as we have just discussed for Eq. (18), think of the outcome as less than some threshold. The poor will now not invest in trying to change the level of payment enforcement—that is they will not make these types of expenditures. Thus, the enforcement level decreases. In a heterogeneous population, first those with low payoffs A stop investing possibly affecting those with higher payoffs such as Ar which will then cause others to not invest, making the poor poorer and poorer. Thus, we have a trap!

5 Conclusion

Tax administration policy is the set of instruments by which the government influences voluntary and involuntary compliance in trying to achieve its goals. Our goal is to understand some of the forces involved in determining tax administration policy by examining the contest over it. Many papers on tax administration and compliance address their tax revenue impact in an accounting sense and under assumptions of the standard economic models of tax evasion (Das-Gupta and Gang 2000). We discuss and compare choices facing the government over tax administration and behavioral instruments, where the government faces large-scale endemic corruption and wants to achieve the highest aggregate level of good governance.

Frequently, economic policy results from a contest among concerned parties who argue for their desired policy and against the suggestions of others. In our story, the relatively rich and poor are engaged in a struggle determining the degree of tax enforcement. The struggle can take different forms including bribery, lobbying, rent-seeking, and protests. The outcome depends on the payoffs the contestants receive if the tax administrator chooses their desired enforcement level, or not.

Efforts of Transparency International, the World Bank, and others who evaluate institutions have raised awareness of the costs of doing business and living in different environments. We build a story here of how awareness of corruption affects tax enforcement. The story is not always straightforward. We characterize an economy in which there are inequality and tax evasion and avoidance by both rich and poor, but these two groups have different interests and therefore use their resources trying to influence the efforts made to enforce tax payments at the level that benefits them the most. The government’s multiple objectives are captured here in the character of the tax administrator, who we picture as a multifaceted individual facing personal conflicts captured in a welfare function.

The government needs to design an effective tax administration policy that minimizes corruption and is sensitive to society’s present and future needs. The tax administrator (TA) acting as the government’s agent faces choices in searching for the mechanism that will achieve the highest aggregate level of good governance over the set of tax administration instruments and efforts.

We examine a stylized poor state with weak institutions in which a “culture of evasion” damages state authority. Many people evade tax payments, limiting the role the state can play in economic development. In the face of such extensive corruption, it is challenging to establish and implement policies reflecting good governance, i.e., maximizing social welfare.

We lay out the lobbying contest between the relatively rich and poor, in which the tax authority acts on behalf of social welfare and her/his own self-interest to determine the tax enforcement level, while understanding the contest that is going on. The effect of the enforcement level on the outlays of the rich and poor hinges on the elasticities of their benefits with respect to changes in the enforcement level. Understanding this along with the size of each group’s stakes in the contest, we see that enforcement may move in the opposite directions of lobbying efforts, in part reflecting sensitivity to and tolerance of corruption. Under certain conditions, sensitivity to corruption gives rise to enforcement levels that benefit the poor. With this, we discuss the possibility of a poverty trap.

Notes

Singh (1997) states: “…it is useful to think about governance along three dimensions: (1) the degree of commitment or durability of laws and rules; (2) the degree of enforcement of these laws; and (3) the degree of decentralization of jurisdictions with respect to providing public goods.” This paper falls under dimensions (1) and (2).

Recent work by Addison et al. (2018) nicely surveys the literature on the relationship between tax policy and development concerns.

We discuss the interpretation of the simplifying assumption of two constituent income groups below, in the first part of Sect. 2.

In the seminal work by Yitzhaki (1974), lobbying groups are not taken into consideration.

Note that the rich also benefit from tax payments as they cannot provide everything for themselves. In our analyses here, we are only considering the levels of tax enforcement that the rich perceive more as subsidizing the poor.

Instead of a parliament or ruling politician as the final decision-maker, the TA could also be making this final decision after a waiting period, holding public hearings on the proposed policy, and so on.

Das-Gupta et al. (2016) suggest that TAME is composed of numerous factors. Summarizing, these include: TA ability to audit, inspect, penalize, prosecute; number and quality of tax inspectors, information, balance sheets, TA budget; efficient resource allocation such as taxpayer identification, and registration, processing of returns, audits, post-audit appeals, sanctions, tax collection, taxpayer assistance, internal audits; output per inspector; duration, arrears, revenue loss duration of assessments completion, appeals, etc., and quality.

Indices of tax administration have been a focus of some recent research. Aside from TAME, Keen and Slemrod (2017) develop another “summary measure of the impact of administrative interventions—the enforcement elasticity of tax revenue.”

Note that we do not include relative group size as the size of the stakes already considers this. A larger group will have a larger stake. Of course, a larger stake does not necessarily mean a bigger group, though a bigger group generally indicates a larger stake. We do not assume that the groups are identical. As above, one could think about a game among three groups: poor, middle class, and rich. The poor do not invest in the contest, while the rich and middle class do invest. Thus, the contest collapses to two contestants: rich and middle class. The effect of group size is one of the components that affect the stake sizes. A larger group may be influenced more by the enforcement level; thus, this group would have a larger stake and thus in equilibrium this will have an effect on its investment. Therefore, the effect of the relative size of the different groups has an effect on the outcome via the size of the stakes.

Given the defined contest, the CSF for approval is a positive function of the poor’s investment and negative with regard to the rich. In the case that the level of enforcement is too high for the poor and they would prefer zero enforcement to the proposal, the poor will not invest xp = 0 and xr = \( \varepsilon > 0 \) so that Prp = 0 and Prr = 1.

Instead of the payment being less than zero as in Eq. (18), we could write it as less than some positive threshold. See the discussion on the poverty trap below.

References

Addison, T., Niño-Zarazúa, M., & Pirttilä, J. (2018). Introduction: Fiscal policy, state building and economic development. Journal of International Development, 30(2), 161–172.

Alm, J. (2014). Tax evasion, labor market effects, and income distribution. IZA World of Labor, 2014, 91. https://doi.org/10.15185/izawol.91.

Alm, J., & Torgler, B. (2006). Culture differences and tax morale in the United States and in Europe. Journal of Economic Psychology, 27(2), 224–246.

Andreoni, J. B., Erard, B., & Feinstein, J. (1998). Tax compliance. Journal of Economic Literature, 36(2), 818–860.

Bird, R. M. (2004). Administrative dimensions of tax reform. Asia-Pacific Tax Bulletin, 10(3), 134–150.

Das-Gupta, A. (2005). Economic theory of tax compliance with special reference to tax compliance costs. In A. Bagchi (Ed.), Readings in public finance. New Delhi: Oxford University Press.

Das-Gupta, A. & Bird, R. M. (2012). Public finance in developing countries. Rotman School of Management. Working paper no. 2111065. http://dx.doi.org/10.2139/ssrn.2111065.

Das-Gupta, A., Estrada, G. B. & Park, D. (2016). Measuring tax administration effectiveness and its impact on tax revenue. Nanyang Technological University, School of Humanities and Social Sciences, Economic Growth Centre No. 1601.

Das-Gupta, A., & Gang, I. N. (2000). Decomposing revenue effects of tax evasion and tax structure changes. International Tax and Public Finance, 7(2), 177–194.

Das-Gupta, A., Ghosh, S., & Mookherjee, D. (2004). Tax administration reform and taxpayer compliance in India. International Tax and Public Finance, 11(5), 575–600.

Dreher, A., Kotsogiannis, C., & McCorriston, S. (2009). How do institutions affect corruption and the shadow economy? International Tax and Public Finance, 16(6), 773.

Epstein, G. S., & Gang, I. N. (2010). Why pay taxes when no one else does? Review of Development Economics, 14(2), 374–385.

Epstein, G. S. & Nitzan, S. (1999). Endogenous determination of minimum wage. IZA Working Paper No. 73.

Epstein, G. S., & Nitzan, S. (2003). Political culture and monopoly price determination. Social Choice and Welfare, 21(1), 1–19.

Epstein, G. S., & Nitzan, S. (2004). Strategic restraint in contests. European Economic Review, 48(1), 201–210.

Epstein, G. S., & Nitzan, S. (2006). The politics of randomness. Social Choice and Welfare, 27(2), 423–433.

Epstein, G. S., & Nitzan, S. (2007). Endogenous public policy and contests. Berlin: Springer.

Flatters, F., & Macleod, W. B. (1995). Administrative corruption and taxation. International Tax and Public Finance, 2(3), 397–417.

Grossman, G. M., & Helpman, E. (2001). Special interest politics. Cambridge: MIT Press.

Keen, M., & Slemrod, J. (2017). Optimal tax administration. Journal of Public Economics, 152, 133–142.

Luttmer, E. F., & Singhal, M. (2014). Tax morale. Journal of Economic Perspectives, 28(4), 149–168.

Myles, G. D., & Naylor, R. A. (1996). A model of tax evasion with group conformity and social customs. European Journal of Political Economy, 12(1), 49–66.

Persson, T., & Tabellini, G. (2002). Political economics and public finance. In Handbook of public economics (Vol. 3, pp. 1549–1659). Amsterdam: Elsevier.

Schneider, P., & Bose, G. (2017). Organizational cultures of corruption. Journal of Public Economic Theory, 19(1), 59–80.

Singh, N. (1997). Governance and reform in India. Journal of International Trade & Economic Development, 6(2), 179–208. https://doi.org/10.1080/09638199700000013.

Slemrod, J. (2007). Cheating ourselves: The economics of tax evasion. Journal of Economic Perspectives, 21(1), 25–48.

Torgler, B., Demir, I. C., Macintyre, A., & Schaffner, M. (2008). Causes and consequences of tax morale: An empirical investigation. Economic Analysis & Policy, 38(2), 313–339.

Tullock, G. (1980). Efficient rent-seeking. In J. M. Buchanan, R.D. Tollison & G. Tullock (Eds.), Toward a theory of the rent-seeking society (pp. 97–112). Texas: University Press.

Yitzhaki, S. (1974). A note on income tax evasion: A theoretical analysis. Journal of Public Economics, 3, 201–202.

Acknowledgements

We are grateful for their comments and insights to the editors and referees and to conference participants at the July 2017 UNU-WIDER Conference on Public Economics for Development Conference, Maputo, Mozambique.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations

Rights and permissions

The opinions expressed in this article are those of the authors and do not necessarily reflect the views of the UNU-WIDER, its Board of Directors, or the countries they represent.

Open Access This article is licensed under the terms of the Creative Commons Attribution-NonCommercial-ShareAlike 3.0 IGO License, which permits any non-commercial use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the UNU-WIDER, provide a link to the Creative Commons licence, and indicate if changes were made. If you remix, transform, or build upon this article or a part thereof, you must distribute your contributions under the same licence as the original.

The use of the UNU-WIDER’s name, and the use of the UNU-WIDER’s logo, shall be subject to a separate written licence agreement between the UNU-WIDER and the user and is not authorized as part of this CC-IGO licence. Note that the link provided above includes additional terms and conditions of the licence.

The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-sa/3.0/igo/.

About this article

Cite this article

Epstein, G.S., Gang, I.N. Inequality, good governance, and endemic corruption. Int Tax Public Finance 26, 999–1017 (2019). https://doi.org/10.1007/s10797-019-09542-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-019-09542-z