Abstract

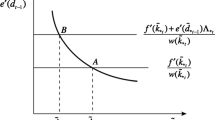

In this paper, by adopting an OLG neoclassical growth model, we show that intergenerational transfers may trigger the take off of an economy entrapped into poverty in a twofold way: (1) by eliminating the zero equilibrium, which, under technology with low factor substitutability, is always a “catching” point, so that the economy might start converging to a positive equilibrium. In this case, the appropriate instrument turns out to be a transfer from the old to the young, while there is no room for policies redistributing in the opposite direction (i.e., a pay-as-you-go pension scheme); (2) when the rich equilibrium is unstable—which can be the case under high intertemporal elasticity of substitution of individuals—the introduction of transfers may stabilize such an equilibrium, so that the economy starts converging to it. In the latter case, both policy programs such as pay-as-you-go pension schemes or subsidies to the young may help escaping from poverty. However, we point out that in either circumstance, the “size” of transfers should be sufficiently large (and, as for pensions, not even too large), in order to avoid ineffective and useless burden on the taxpayers without triggering the take off.

Similar content being viewed by others

References

Azariadis, C. (1996). The economics of poverty traps-part one: complete markets. Journal of Economic Growth, 1(4), 449–486.

Azariadis, C. (2006). The theory of poverty traps: what have we learned? In S. Bowles, S. Durlauf & K. Hoff (Eds.), Poverty traps. Princeton: Princeton University Press, chap. 1.

Bowles, S., Durlauf, S. N., & Hoff, K. (Eds.) (2006). Poverty traps. Princeton: Princeton University Press.

Cazzavillan, G., Lloyd-Braga, T., & Pintus, P. A. (1998). Multiple steady states and endogenous fluctuations with increasing return to scale in production. Journal f Economic Theory, 80, 60–107.

De La Croix, D., & Michel, P. (2002). A theory of economic growth. Cambridge: Cambridge University Press.

Diamond, P. (1965). National Debt in a neoclassical growth model. American Economic Review, 41, 1126–1150.

Easterly, W. (2001). The elusive quest for growth: economists’ adventures and misadventures in the tropics. Cambridge: MIT Press.

Eichenbaum, M. S., Hansen, L. P., & Singleton, K. J. (1986). A time series analysis of representative agent models of consumption and leisure choice under uncertainty. Working paper no. 1981. National Bureau of Economic Research.

Galor, O. (1996). Convergence? Inferences from theoretical models. The Economic Journal, 106(437), 1056–1069.

Gruber, J. (2006). A tax-based estimate of the elasticity intertemporal substitution. NBER working paper no. 11945, January.

Hall, R. (1988). Intertemporal substitution in consumption. The Journal of Political Economy, 96(2), 339–357.

Hansen, L. P., & Singleton, K. J. (1982). Generalized instrumental variables estimation of nonlinear rational expectations models. Econometrica, 50, 1269–1286.

Hansen, L. P., & Singleton, K. J. (1983). Stochastic consumption, risk aversion, and the temporal behavior of asset returns. The Journal of Political Economy, 91(2), 249–265.

Hoff, K. (2000). Beyond Rosenstein-Rodan: the modern theory of coordination problems in development. In Proceedings of the World Bank annual conference on development economics.

Hoff, K., & Sen, A. (2006). The kin system as a poverty trap. In S. Bowles, S. Durlauf & K. Hoff (Eds.), Poverty traps. Princeton: Princeton University Press, chap. 4.

Lucas, R. E. Jr. (1969). Labor capital substitution in U.S. manufacturing. In A. Harberger & M. Bailey (Eds.), Taxation of income from capital. Washington: Brookings Institution.

Manfredi, P., & Fanti, L. (2003). The demographic transition and neoclassical models of balanced growth. In N. Salvadori (Ed.), The theory of economic growth: a “classical perspective”. Cheltenham: Edward Elgar.

Matsuyama, K. (1995). Complementarities and cumulative processes in models of monopolistic competition. Journal of Economic Literature, 33, 701–729.

Matsuyama, K. (1997). Complementarity, instability and multiplicity. Japanese Economic Review, 48(3), 240–266.

Mookherjee, D., & Ray, D. (2001). Readings in the theory of economic development. New York: Blackwell Publishing.

Mulligan, C. (2003). Capital, interest, and aggregate intertemporal substitution. Working paper, University of Chicago.

Mulligan, C. (2004). What do aggregate consumption Euler equations say about the capital Income tax burden? The American economic review: papers and proceedings, May.

Prskawetz, A., Steinmann, G., & Feichtinger, G. (2000). Human capital, technological progress and the demographic transition. Mathematical Population Studies, 7(4), 343–363.

Rowthorn, R. E. (1999a). Unemployment, wage bargaining and capital-labour substitution. Cambridge Journal of Economics, July.

Rowthorn, R. E. (1999b). Unemployment, capital-labor substitution, and economic growth. IMF working paper no. 99/43, March 1.

Sachs, J. D., McArthur, J. W., Schmidt-Traub, G., Kruk, M., Bahadur, C., Faye, M., & McCord, G. (2004). Ending Africa’s Poverty Trap. Brookings Papers on Economic Activity, 1, 117–216.

Samuelson, P. A. (1958). An exact consumption-loan model of interest with or without the social contrivance of money. Journal of Political Economy, 66, 467–482.

Solow, R. (1956). A contribution to the theory of economic growth. Quarterly Journal of Economics, 70(1), 65–94.

Solow, R. (1958). A sceptical note on the constancy of relative share. American Economic Review, 48, 618–631.

Strulik, H. (1997). Learning by doing, population pressure, and the theory of demographic transition. Journal of Population Economics, 10, 285–298.

Strulik, H. (1999). Demographic transition, stagnation, and demoeconomic cycles in a model for the less developed economy. Journal of Macroeconomics, 21(2), 397–413.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Fanti, L., Spataro, L. Poverty traps and intergenerational transfers. Int Tax Public Finance 15, 693–711 (2008). https://doi.org/10.1007/s10797-008-9086-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-008-9086-8