Abstract

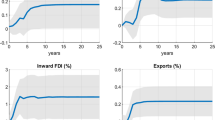

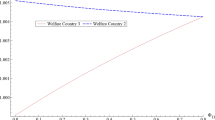

This paper develops a model of a monopolistically competitive industry with extensive and intensive investment and shows how these margins respond to changes in average and marginal corporate tax rates. Intensive investment refers to the size of a firm’s capital stock. Extensive investment refers to the firm’s production location and reflects the trade-off between exports and foreign direct investment as alternative modes of foreign market access. The paper derives comparative static effects of the corporate tax and shows how the cost of public funds depends on the measures of effective marginal and average tax rates and on the elasticities of extensive and intensive investment.

Similar content being viewed by others

References

Baldwin, R. E. (2005). Heterogeneous firms and trade: testable and untestable properties of the Melitz model (NBER DP 11471).

Baldwin, R. E., & Forslid, R. (2004). Trade liberalization with heterogeneous firms (CEPR DP 4635).

Bernard, A. B., Jensen, B. J., & Schott, P. K. (2006). Trade costs, firms and productivity. Journal of Monetary Economics, 53, 917–937.

Bond, S. R. (2000). Levelling up or levelling down? Some reflections on the ACE and CBIT proposals, and the future of the corporate tax base. In S. Cnossen (Ed.), Taxing capital income in the European union (pp. 161–179). London: Oxford University Press.

Buettner, T., & Ruf, M. (2007). Tax incentives and the location of FDI: Evidence from a panel of German multinationals. International Tax and Public Finance, 14, 151–164.

Buettner, T., & Wamser, G. (2006). The impact of non-profit taxes on foreign direct investment: evidence from German multinationals (Discussion Paper). Ifo institute and University of Munich.

Dahlby, B. (2008). Application of the MCF from taxing labor income. In The marginal cost of public funds: theory and applications. Cambridge: MIT Press.

Davies, R. B. (2004). Tax treaties and foreign direct investment: potential versus performance. International Tax and Public Finance, 11, 775–802.

De Mooij, R. A., & Ederveen, S. (2003). Taxation and foreign direct investment: a synthesis of empirical research. International Tax and Public Finance, 10, 673–693.

Devereux, M. P. (2007), The impact of taxation on the location of capital, firms and profit: a survey of empirical evidence. Oxford University Centre for Business Taxation, WP07/02.

Devereux, M. P., & Griffith, R. (1998). Taxes and the location of production: evidence from a panel of US multinational firms. Journal of Public Economics, 68, 335–367.

Devereux, M. P., & Griffith, R. (2003). Evaluating tax policy for location decisions. International Tax and Public Finance, 10, 107–126.

Devereux, M. P., Griffith, R., & Klemm, A. (2002). Corporate income tax reforms and international tax competition. Economic Policy, 17, 451–495.

Devereux, M. P., & Hubbard, G. R. (2003). Taxing multinationals. International Tax and Public Finance, 10, 469–487.

Devereux, M. P., & Lockwood, B. (2006). Taxes and the size of the foreign-owned capital stock: which tax rates matter? University of Warwick.

European Commission (2001). Company taxation in the internal market (Commission Staff Working Paper, COM(2001)582 Final).

Fuest, C. (2005). Economic integration and tax policy with endogenous foreign firm ownership. Journal of Public Economics, 89, 1823–1840.

German Council of Economic Advisors (GCEA). Max-Planck-Institute and Centre for European Economic Research (2006). Reform der Einkommens- und Unternehmensbesteuerung durch die Duale Einkommensteuer. Wiesbaden: Statistisches Bundesamt.

Gordon, R. H., & Hines, J. R. Jr. (2002). International taxation. In A. J. Auerbach, & M. Feldstein (Eds.), Handbook of public economics (Vol. 4, pp. 1935–1995). Amsterdam: Elsevier.

Gresik, T. A. (2001). The taxing task of taxing transnationals. Journal of Economic Literature, 39, 800–838.

Grossman, G., & Helpman, E. (2004). Managerial incentives and the international organization of production. Journal of International Economics, 63, 237–262.

Grossman, G., Helpman, E., & Szeid, A. (2006). Optimal integration strategies for the multinational firm. Journal of International Economics, 70, 216–238.

Haufler, A., & Schjelderup, G. (2000). Corporate tax systems and cross country profit shifting. Oxford Economic Papers, 52, 306–325.

Helpman, E. (2006). Trade, FDI, and the organization of firms. Journal of Economic Literature, 44, 589–630.

Helpman, E., Melitz, M. J., & Yeaple, S. R. (2004). Export versus FDI with heterogeneous firms. American Economic Review, 94, 300–316.

Hines, J. R. Jr. (1996). Altered states: taxes and the location of foreign direct Investment in America. American Economic Review, 86, 1076–1094.

Horstman, I. J., & Markusen, J. R. (1992). Endogenous market structures in international trade (natura facit saltum). Journal of International Economics, 32, 149–182.

Immervoll, H., Kleven, H., Kreiner, C. T., & Saez, E. (2007). Welfare reform in European countries: a microsimulation analysis. Economic Journal, 117, 1–44.

Janeba, E. (1997). International tax competition. Tübingen: Mohr Siebeck.

Keuschnigg, C. (2006). Exports, foreign direct investment and the costs of corporate taxation (CEPR DP 5769).

Keuschnigg, C. (1998). Investment externalities and a corrective subsidy. International Tax and Public Finance, 5, 449–469.

Kleven, H., & Kreiner, C. T. (2006). The marginal cost of public funds: hours of work versus labor force participation. Journal of Public Economics, 90, 1955–1973.

Krugman, P. R. (1980). Scale economies, product differentiation and the pattern of trade. American Economic Review, 70, 950–959.

Melitz, M. J. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71, 1695–1725.

President’s Advisory Panel on Federal Tax Reform (2006). Simple, fair, and pro-growth: proposals to fix America’s tax system. Washington, DC.

Razin, A., & Sadka, E. (2007a). Productivity and taxes as drivers of FDI (CEPR DP 6299).

Razin, A., & Sadka, E. (2007b). FDI, tax competition and gains from tax harmonization (Discussion Paper).

Saez, E. (2002). Optimal income transfer programs: intensive versus extensive labor supply responses. Quarterly Journal of Economics, 117, 1039–1073.

Sorensen, P. B. (Ed.) (2004). Measuring the tax burden on capital and labor. CESifo seminar series. Cambridge: MIT Press.

Technical Committee on Business Taxation (1997). Report of the technical committee on business taxation (Jack Mintz, chairman). Department of Finance, Ottawa, http://www.fin.gc.ca.

Weichenrieder, A. J. (1995). Besteuerung und Direktinvestition. Tübingen: Mohr Siebeck.

Author information

Authors and Affiliations

Corresponding author

Additional information

The paper was presented in 2006 at the German public finance meeting in Giessen; the Institute for Advanced Studies in Vienna; the ESF/CEPR Workshop on Outsourcing, Migration and the European Economy in Rome; the University of St. Gallen; the Graduate Institute for International Studies in Geneva, and in 2007 at the International Monetary Fund in Washington, DC, the CESifo Area Conference in Public Sector Economics in Munich and the 63rd IIPF Congress in Warwick. I appreciate stimulating comments by Michael Devereux and seminar participants and, in particular, by the discussants Andreas Haufler and Nadine Riedl, an anonymous referee and the editor Richard Cornes.

Rights and permissions

About this article

Cite this article

Keuschnigg, C. Exports, foreign direct investment, and the costs of corporate taxation. Int Tax Public Finance 15, 460–477 (2008). https://doi.org/10.1007/s10797-008-9077-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-008-9077-9

Keywords

- Exports

- Foreign direct investment

- Corporate taxation

- Extensive and intensive investment

- Effective tax rates

- Costs of public funds