Abstract

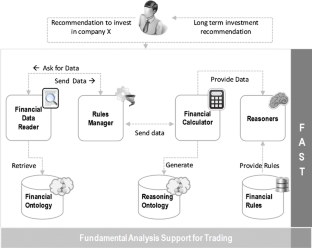

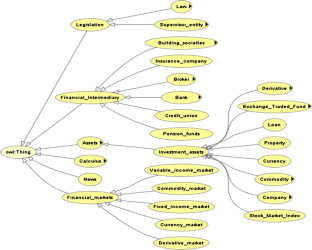

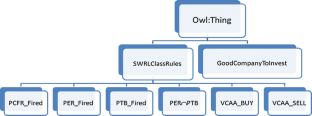

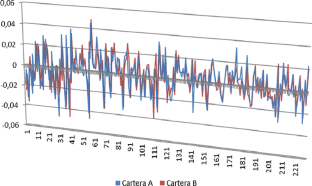

Trading systems are tools to aid financial analysts in the investment process in companies. This process is highly complex because a big number of variables take part in it. Furthermore, huge sets of data must be taken into account to perform a grounded investment, making the process even more complicated. In this paper we present a real trading system that has been developed using semantic technologies. These cutting-edge technologies are very useful in this context because they enable the definition of schemes that can be used for storing financial information, which, in turn, can be easily accessed and queried. Additionally, the inference capabilities of the existing reasoning engines enable the generation of a set of rules supporting this investment analysis process.

Similar content being viewed by others

References

Abarbanell, J. S., & Bushee, B. J. (1997). Fundamental analysis, future earnings, and stock prices. Journal of Accounting Research, 35(1), 1–24.

Anastasakis, L., & Mort, N. (2009). Exchange rate forecasting using a combined parametric and nonparametric self-organising modelling approach. Expert Systems with Applications, 36(10), 12001–12011.

Broekstra, K., Kampman, A., Van Harmelen, F. (2002). Sesame: A generic architecture for storing and querying RDF and RDF schema. The Semantic Web—ISWC 2002. 2342, 54–68

Castells, P., Foncillas, B., Lara, R., Rico, M., & Alonso, J. L. (2004). Semantic web technologies for economic and financial information management. The Semantic Web: Research and Applications, 3053, 473–487.

Chavarnakul, T., & Enke, D. (2008). Intelligent technical analysis based equivolume charting for stock trading using neural networks. Expert Systems with Applications, 34(2), 1004–1017.

Chen, J. S., & Liao, B. P. (2007). Piecewise nonlinear goal-directed CPPI strategy. Expert Systems with Applications, 33(4), 857–869.

Chen, Y., Mabu, S., Shimada, S., & Hirasawa, K. (2009). A genetic network programming with learning approach for enhanced stock trading model. Expert Systems with Applications, 36(10), 12537–12546.

Fernandez Garcia, M. E., De la Cal Marin, E. A., & Quiroga Garcia, R. (2010). Improving return using risk-return adjustment and incremental training in technical trading rules with GAPs. Applied Intelligence, 33(2), 93–106.

Fernandez, P., & Yzaguirre, J. (1995). IBEX 35: Análisis e investigaciones. In: (Eds.), Barcelona: Ediciones Internacionales Universitarias

Fox, M. S., Barbuceanu, M., Gruninger, M., & Lin, J. (1998). An organizational ontology for enterprise modeling. Simulating organizations: Computational models of institutions and groups (pp. 131–152). Cambridge: MIT Press.

Gomez, J. M., García-Sanchez, F., Valencia-Garcia, R., Toma, I., Garcia-Moreno, C. (2009). SONAR: A semantically empowered financial search engine. International work-conference on the interplay between natural and artificial computation

Haarslev, V., & Möller, R. (2003). Racer: An OWL reasoning agent for the semantic web. Proceedings of the International Workshop on Applications, Products and Services of Web-based Support Systems

Horrocks, I., Patel-Schneider, P. F., Boley H., et al. (2004). SWRL: A semantic web rule language combining OWL and RuleML. W3C Member Submission

Jang, M., & Sohn, J. C. (2004). Bossam: An extended rule engine for OWL Inferencing. Rules and Rule Markup Languages for the Semantic Web, 3323, 128–138.

Kim, K. J. (2004). Toward global optimization of case-based reasoning systems for financial forecasting. Applied Intelligence, 21, 239–249.

Kovalerchuk, B., & Vityaev, E. (2000). Data mining in finance: Advances in relational and hybrid methods. Kluwer Academic

Lee, S. J., Ahn, J. J., Oh, K. J., & Kim, T. Y. (2010). Using rough set to support investment strategies of real-time trading in futures market. Applied Intelligence, 32(3), 364–377.

Lo, A., Mamaysky, H., & Wang, J. (2000). Foundations of technical analysis: Computational algorithm, statistical inference, and empirical implementation. Journal of Finance, 55(4), 1705–1765.

Losada, A. S., Bas, J. L., Bellido, S., Contreras, J., Benjamins, R., Gomez, J. M. (2005). Data, information and process integration with semantic web services

Majhi, R., Panda, G., Majhib, B., & Sahoo, G. (2009). Efficient prediction of stock market indices using adaptive bacterial foraging optimization (ABFO) and BFO based techniques. Expert Systems with Applications, 36(6), 10097–10104.

Majhi, R., Panda, G., & Sahoo, G. (2009). Development and performance evaluation of FLANN based model for forecasting of stock markets. Expert Systems with Applications, 36(3), 6800–6808.

Markowitz, H. (1952). Portfolio selection. Journal of Finance, 7, 77–91.

Markowitz, H. (1999). The early history of portfolio theory. Financial Analysts Journal, 55(4), 1600–1960.

McGuinness, D. L., & Harmelen, F. V. (2004). OWL web ontology language overview. W3C Recommendation

Mochón, A., Quintana, D., Sáez, Y., & Isasi, P. (2008). Soft computing techniques applied to finance. Applied Intelligence, 29(2), 111–115.

Modigliani, F., & Modigliani, L. (1997). Risk-adjusted performance. Journal of Portfolio Management, 23, 45–54.

Mossin, J. (1966). Equilibrium in a capital asset market. Econometrica, 34(4), 768–783.

Motik, B., & Studer, R. (2005). KAON2—a scalable reasoning tool for the semantic web. European Semantic Web Conference

Mullins, D. W. (1982). Does the capital asset pricing model work? Harvard Business Review, 105–113

Partridge, C., & Stefanova, M. (2001). A synthesis of state of the art enterprise ontologies. Lessons Learned. The BORO Program, LADSEB CNR

Qian, B., & Rasheed, K. (2006). Stock market prediction with multiple classifiers. Applied Intelligence, 26, 25–33.

Quah, T. S. (2009). DJIA stock selection assisted by neural network. Expert Systems with Applications, 35(1/2), 50–58.

Rodríguez-González, A., García-Crespo, Á., Colomo-Palacios, R., Guildrís-Iglesias, F., & Gómez-Berbís, J. M. (2011). CAST: Using neural networks to improve trading systems based on technical analysis by means of the RSI financial indicator. Expert Systems with Applications, 38(9), 11489–11500.

Roy, A. D. (1952). Safety first and the holding of assets. Econometrica, 20(3), 431–449.

Schumaker, R. P., & Chen, S. (2009). Textual analysis of stock market prediction using breaking financial news. ACM Transactions on Information Systems, 27(2)

Sharpe, W. F. (1966). Mutual fund performance. Journal of Business, 39(1), 119–138.

Shearer, R., Motik, B., Horrocks, I. (2008). HermiT: A highly-efficient OWL reasoner. In: A. Ruttenberg, U. Sattler, C. Dolbear (Ed.), Proc. of the 5th Int. Workshop on OWL: Experiences and Directions (OWLED 2008 EU)

Sirin, E., Parsia, B., Cuenca-Grau, B., Kalyanpur, A., & Katz, Y. (2007). Pellet: A practical OWL-DL reasoner. Web Semantics: Science, Services and Agents on the World Wide Web, 5(2), 51–53.

Sitte, R., & Sitte, J. (2002). Neural networks approach to the random walk dilemma of financial time series. Applied Intelligence, 16(3), 163–171.

Standfield, K. (2005). Intangible finance standards: Advances in fundamental analysis & technical analysis. Elsevier Academic Press

Vanstone, B., & Finnie, G. (2009). An empirical methodology for developing stockmarket trading systems using artificial neural networks. Expert Systems with Applications, 36(3), 6668–6680.

Vanstone, B., & Tan, C. N. W. (2005). Artificial neural networks in financial trading. In: M. Khosrow-Pour (Ed.), Encyclopedia of information science and technology. Idea Group

Wang, Y. F. (2003). Mining stock prices using fuzzy rough set system. Expert Systems with Applications, 24(1), 13–23.

Wen, Q., Yang, Z., Song, Y., & Jia, P. (2010). Automatic stock decision support system based on box theory and SVM algorithm. Expert Systems with Applications, 37(2), 1015–1022.

XBRL International. (2009). XBRL: eXtensible business reporting language. Retrieved June 19, 2009, from XBRL International Web site: http://www.xbrl.org

Yoda, M. (1994). Predicting the Tokyo stock market. In: G. J. Deboeck (Ed.), Trading on the edge (pp. 66–79). Wiley (1994)

Acknowledgements

This work is supported by the Spanish Ministry of Science and Innovation under the project TRAZAMED (IPT-090000-2010-007).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Rodríguez-González, A., Colomo-Palacios, R., Guldris-Iglesias, F. et al. FAST: Fundamental Analysis Support for Financial Statements. Using semantics for trading recommendations. Inf Syst Front 14, 999–1017 (2012). https://doi.org/10.1007/s10796-011-9321-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10796-011-9321-1