Abstract

In the framework of uncertainty theory, this paper investigates the pricing problem of American swaption. By assuming that the floating interest rate obeys an uncertain differential equation, the pricing formula of American swaption is derived. Furthermore, parameter estimation of the uncertain interest rate model is given, and the uncertain hypothesis test shows that the uncertain interest rate model fits the Shanghai interbank offered rate well. Finally, as a byproduct, this paper also indicates that stochastic differential equations cannot model real-world interest rates.

Similar content being viewed by others

References

Choi, J., & Shin, S. (2016). Fast swaption pricing in gaussian term structure models. Mathematical Finance, 26(4), 962–982.

Filipović, D., & Kitapbayev, Y. (2018). On the American swaption in the linear-rational framework. Quantitative Finance, 18(11), 1865–1876.

Jagannathan, R., Kaplin, A., & Sun, S. (2003). An evaluation of multi-factor CIR models using LIBOR, swap rates, and cap and swaption prices. Journal of Econometrics, 116(1–2), 113–146.

Lio, W., & Liu, B. (2021). Initial value estimation of uncertain differential equations and zero-day of COVID-19 spread in China. Fuzzy Optimization and Decision Making, 20(2), 177–188.

Liu, B. (2007). Uncertainty theory (2nd ed.). Springer-Verlag.

Liu, B. (2008). Fuzzy process, hybrid process and uncertain process. Journal of Uncertain Systems, 2(1), 3–16.

Liu, B. (2009). Some research problems in uncertainy theory. Journal of Uncertain Systems, 3(1), 3–10.

Liu, B. (2013). Toward uncertain finance theory. Journal of Uncertainty Analysis and Applications, 1, 1.

Liu, Y., & Liu, B. (2022a). Estimating unknown parameters in uncertain differential equation by maximum likelihood estimation. Soft Computing, 26(6), 2773–2780.

Liu, Y., & Liu, B. (2022b). Residual analysis and parameter estimation of uncertain differential equations. Fuzzy Optimization and Decision Making. https://doi.org/10.1007/s10700-021-09379-4.

Liu, Z., & Yang, Y. (2021). Barrier swaption pricing problem in uncertain financial market. Mathematical Methods in the Applied Sciences, 44(1), 568–582.

Liu, Z., & Yang, Y. (2022). Swaption pricing problem in uncertain financial market. Soft Computing, 26(4), 1703–1710.

Lu, J., Yang, X., & Tian, M. (2022). Barrier swaption pricing formulae of mean-reverting model in uncertain environment. Chaos, Solitons & Fractals, 160, 112203.

Snedecor, G.W., & Cochran, W.G. (1989). Statistical methods, 8th edn. Iowa State University Press.

Xiao, C., Zhang, Y., & Fu, Z. (2016). Valuing interest rate swap contracts in uncertain financial market. Sustainability, 8(11), 1186.

Yao, K. (2016). Uncertain differential equation. Springer-Verlag.

Yao, K., & Chen, X. (2013). A numerical method for solving uncertain differential equations. Journal of Intelligent & Fuzzy Systems, 25(3), 825–832.

Yao, K., & Liu, B. (2020). Parameter estimation in uncertain differential equations. Fuzzy Optimization and Decision Making, 19(1), 1–12.

Ye, T., & Liu, B. (2022a). Uncertain hypothesis test for uncertain differential equations. Fuzzy Optimization and Decision Making. https://doi.org/10.1007/s10700-022-09389-w.

Ye, T., & Liu, B. (2022b). Uncertain hypothesis test with application to uncertain regression analysis. Fuzzy Optimization and Decision Making, 21(2), 157–174.

Yu, Y., Yang, X., & Lei, Q. (2022). Pricing of equity swaps in uncertain financial market. Chaos, Solitons & Fractals, 154, 111673.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A Stochastic interest rate model

Appendix A Stochastic interest rate model

Let us reconsider overnight SHIBOR from April 1, 2021 to March 15, 2022 (see Table 1). Assume the interest rate obeys a stochastic differential equation

where m, a and \(\sigma \) are unknown parameters, and \(W_t\) is a Wiener process. For any fixed parameters \(m,\ a,\ \sigma \) and \(i\ (2\le i\le 238)\), we solve the updated stochastic differential equation with an initial value \( r_{i-1}\)

and get the probability distribution of normal random variable \(r_{i}\)

where \(\mu _i\) is the expected value, i.e.,

and \(\nu ^2\) is the variance, i.e.,

Define the i-th residual

Then, \(\varepsilon _i(m,a,\sigma )\in (0,1)\) can be regarded as a sample of uniform probability distribution \({{\mathcal {U}}}(0,1)\).

Since the number of unknown parameters is three and the first three moments of the uniform probability distribution \({{\mathcal {U}}}(0,1)\) are 1/2, 1/3, and 1/4, we have the following equation

whose root is

Thus we obtain a stochastic interest rate model,

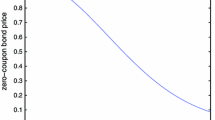

Let us test whether the stochastic interest rate model (14) fits SHIBOR interest rates. That is, we should test whether the uniform probability distribution \({{\mathcal {U}}}(0,1)\) fits the 237 residuals

See Fig. 5. To check if the residuals are from the same population \({{\mathcal {U}}}(0,1)\), we apply the “Chi-square goodness-of-fit test” (Snedecor & Cochran, 1989) with a significance level 0.05. Then using the function ‘chi2gof’ in Matlab, we obtain the p-value as 0.0011, indicating that the residuals do not come from the same population \({{\mathcal {U}}}(0,1)\). Therefore, the stochastic interest rate model (14) does not fit overnight SHIBOR.

Residual plot of stochastic interest rate model (14)

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Yang, X., Ke, H. Uncertain interest rate model for Shanghai interbank offered rate and pricing of American swaption. Fuzzy Optim Decis Making 22, 447–462 (2023). https://doi.org/10.1007/s10700-022-09399-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10700-022-09399-8