Abstract

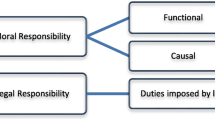

Leaders of the global prudential regulatory community hope that recent reforms will remove the need for ex post discretionary assistance to banks in the future, particularly solvency assistance. If the reforms fail to do so, restructuring of the financial system is one possible alternative, and Kane's suggestion of changing the liability of individual bankers to push them more toward conformance with something like the Kantian imperative strikes me as the germ of an idea for restructuring that is worth further exploration.

Similar content being viewed by others

Notes

The paper emphasizes the potential benefits of criminal penalties for individual bankers for taking bad-tail risks, which have largely been absent in the wake of the recent crisis. There might be practical challenges: For example, who goes to jail if a team of bankers takes imprudent risks? Just the leader? The whole team, including the administrative assistant?

Prompt Corrective Action, the solution of the early 1990s, did not work because insolvency comes on too fast for its gradual application of supervisory pressure to be effective, and market discipline did not work because markets did not see and price the bad tail risks at the times they were being taken.

Reference

Ahmed JI, Anderson C, Zarutskie RE (2015) Are the borrowing costs of large financial firms unusual? Finance and economics discussion series working paper 2015–024, Federal Reserve Board

Author information

Authors and Affiliations

Corresponding author

Additional information

Mark Carey, Board of Governors of the Federal Reserve System, mark.carey@frb.gov. This paper summarizes my remarks at the conference “The interplay between financial regulations, resilience and growth” at the Federal Reserve Bank of Philadelphia on June 16–17, 2016. This paper represents the author’s opinions and not necessarily those of the Board of Governors, the Federal Reserve System, or other members of its staff. This paper represents the author's opinions alone.

Rights and permissions

About this article

Cite this article

Carey, M. Comments on “Ethics Versus Ethos in US and UK Megabanking” by Edward J. Kane. J Financ Serv Res 53, 227–231 (2018). https://doi.org/10.1007/s10693-017-0287-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10693-017-0287-0