Abstract

Using 1994–2009 data, we find that All-American (AA) analysts’ buy and sell portfolio alphas significantly exceed those of non-AAs by up to 0.6 % per month after risk-adjustments for investors with advance access to analyst recommendations. For investors without such access, top-rank AAs still earn significantly higher (by 0.3 %) monthly alphas in buy recommendations than others. AAs’ superior performance exists before (as well as after) they are elected, is not explained by market overreactions to stars, and is not significantly eroded after Reg-FD. Election to top-AA ranks predicts future performance in buy recommendations above and beyond other previously observable analyst characteristics. Institutional investors actively evaluate analysts and update the AA roster accordingly. Collectively, these results suggest that skill differences among analysts exist and AA election reflects institutional investors’ ability to evaluate and benefit from elected analysts’ superior skills. Other investors’ opportunity to profit from the stars’ opinions exists, but is limited due to their timing disadvantage.

Similar content being viewed by others

Notes

See October issues of the Institutional Investor magazine for various years, which announce AA election results and discuss the election criteria.

Cohen et al. (2010) also use Reg-FD as a natural experiment in their study of the value of analysts’ social network.

Trading ahead of research reports is governed by Nasdaq Rule 2110–4 (http://www.sec.gov/pdf/nasd1/2000ser.pdf), which prohibits trading for a broker firm’s own account in anticipation of a research report, but does not prohibit selective disclosure to clients. See Juergens and Lindsey (2009) for a detailed discussion of the rule and its interpretation.

For example, the 2009 AA ranking was based on polls from more than 890 buy-side firms, including 87 of the 100 biggest U.S. equity managers (Kramer 2009). The 2001 AA ranking was sent to, among others, the II300, the magazine’s ranking of the largest institutions in the U.S.. The II magazine weights various respondents based on the size of the voting institution (Dini 2001).

In late 2002, NASD Rule 2711 came into effect which required brokerage firms to disclose the distribution of their buys, holds, and sells in all their research reports; In early 2003, the Global Settlement was reached between regulators and 12 large brokerage firms where combined $1.4 billion in fines were charged for publishing overly optimistic research. The median pay of sell-side analysts fell from $230,000 in 2001 to $155,000 in 2003, according to the CFA Institute (Schack 2004).

Anecdotally, these high-performing former AA analysts often accepted high-paying positions at hedge funds or moved to proprietary trading within brokerage firms. For example, Samuel Buttrick, who ranked first in the Airlines category for 9 years, moved from UBS’s research department to its proprietary trading team in 2003 (Schack 2004).

A number of papers examine other analyst characteristics that may be related to skill, but not the star status. Mikhail et al. (2004) and Li (2005) focus on analysts with superior past performance. Cooper et al. (2001) identify “lead analysts” by the timeliness of their forecasts. Bonner et al. (2007) use media coverage of analysts to proxy for analyst “celebrity”. Both past performance and celebrity status may be correlated with, but are distinct from, star status. We report below that while measures of past performance are statistically significant in predicting star election, much of actual election outcome is unexplained by such variables. Bonner et al. (2007) report that their measure of celebrity is distinct from the AA status.

Papers studying analyst forecasts (e.g., Stickel (1992), Cowen et al. (2006), Hong et al. (2000), Hong and Kubik (2003), Gleason and Lee (2003), Jackson (2005), and Fang and Yasuda (2009) among others) find a positive relation between analyst reputation and earnings forecast quality (measured by forecast accuracy and/or bias). But a positive reputation-performance relation in forecasts need not translate to a positive reputation-performance relation in recommendations. Forecasts are precise numbers whose accuracy can be easily observed by investors, whereas recommendations are softer targets. An analyst may have a strong incentive to provide accurate forecasts in order to be seen as “smart”, but may use recommendations opportunistically (e.g., by showing an optimistic bias) to “curry favor” with company management, which is key for information access. Empirical evidence on the consistency between forecasts and recommendations is mixed. Malmendier and Shanthikumar (2007) document differences between forecasts and recommendations; Hall and Tacon (2010) find that analysts with accurate past forecasts do not make more profitable recommendations in the future. In contrast, Loh and Mian (2006) and Ertimur et al. (2007) find that analysts who make more accurate forecasts also make more profitable recommendations. Also see Lin and McNichols (1998), Clarke et al. (2007), Brown and Huang (2010), and Kecskes et al. (2010).

Balakrishnan et al. (2011) go further and provide evidence that analyst recommendations (rather than forecasts) play a role in bubbles and post-news price drift by influencing traders’ higher-order beliefs (beliefs about other traders’ beliefs about a stock’s valuation).

Ljungqvist et al. (2009) report that records in the I/B/E/S recommendations data were altered for downloads between 2002 and 2004. They also report that I/B/E/S corrected these problems after Feb 12, 2007. Our data sample is downloaded on March 8, 2010 and is thus free from potential biases documented by Ljungqvist et al. (2009).

Each spring, typically in April or May, Institutional Investor conducts a large survey among buy-side managers, asking them to evaluate sell-side analysts along the following four dimensions: stock picking, earnings forecasts, written reports, and overall service. The survey results lead to the annual election of the AA analysts, which is published in the magazine’s October issues.

According to Institutional Investor’s 2007 analyst compensation survey (Oct 2007), the average cash compensation of senior analysts in 2006 was more than half a million dollars, whereas AA analysts commanded more than $1.4 million. Sessa (1999) and Hong et al. (2000) also discuss financial and professional rewards associated with AA titles. Banks reward AA analysts because they bring in business flows. See, for example, Krigman et al. (2001), Dunbar (2000), Ljungqvist et al. (2006), Clarke et al. (2007), Cliff and Denis (2004), and Liu and Ritter (2010).

Banks have distinct systems for coding their analyst recommendations, but typically had five levels corresponding to strong buy, buy, hold, sell, and strong sell. Prior to 2002, I/B/E/S translates the different systems used by banks to a numeric coding system on a scale of 1–5, where 1 refers to the strongest positive recommendation and 5 to the strongest negative recommendation. Around 2002, many banks switched from a 5-grade system to a 3-grade system, corresponding to overweight, market-weight, and under-weight (Kadan et al. (2009)). I/B/E/S translates the three levels as 2, 3, and 4; thus our classification is still valid.

This construction means that we focus on revisions between the buy/sell categories. We conduct robustness checks where we examine revisions between the finer recommendation levels and find quantitatively very similar results. We also examine re-iterations under both construction methods separately, and find that re-iterations generate much lower levels of alpha (although still statistically significant). Alpha differentials among analyst groups are generally not significant on re-iterations. These results (unreported and available upon request) confirm that new recommendations are more informative than re-iterations.

In unreported robustness check analyses, we use 3-day, 7-day, 14-day, and 60-day holding periods and find that our main results are qualitatively unchanged, though the levels of alphas are (not surprisingly) higher the shorter the holding periods.

We use the list provided in Loughran and Ritter (2004) to identify tech stocks. We reported the results using the whole sample (both tech and non-tech stocks) in a previous version of this paper; the results (unreported and available upon request) are qualitatively identical to those of non-tech stocks reported in this paper, as the majority of analysts cover non-tech stocks. As for tech-stock portfolios (also unreported but available upon request), the raw returns and alphas are on average much higher, especially in the pre-2000 years. We find that tech AA analysts strongly and significantly outperform tech non-AA analysts, and the results are robust to controlling for the tech sector return (the 5-factor model).

The tech index return used is ArcaEx Tech 100 Index (^PSE).

In unreported analyses, we confirm robustness of the baseline results. First, we compute alternative portfolio returns using daily Daniel et al. (1997) benchmark-adjusted returns. Qualitative results regarding performance differentials between AAs and non-AAs are unchanged. Second, we use firm characteristics to estimate portfolio-specific trading commissions based on the method in Keim and Madhavan (1997) and compare the net-of-commission alphas. While the alphas for all groups are substantially lower net of trading cost, the AA–non-AA alpha differentials are wider after trading-cost adjustments. This is because AAs tend to cover stocks that are cheaper to trade (i.e., larger and NYSE-listed), while annual turnovers are similar between AAs and non-AAs.

Quarterly earnings announcement dates are obtained from Compustat. We find about 10 % of revisions in our sample are made within the 3-day window around the earnings announcement dates, similar to the 12 % reported by Loh and Stulz (2011).

For brevity, we report in this section only portfolio results that include recommendation-date returns and thus reflect potential profits to investors with advance access to analyst information. In an earlier draft of the paper, we also report all corresponding results that exclude recommendation-date returns. These results are available upon request.

Since AA election results are announced in October, we use as “pre-election” the 12-month period before this announcement, i.e., the 12-month period ending in September each year. We choose this cutoff period because, though voting by institutional investors takes place around April, would-be AAs cannot start eliciting greater market responses or gaining superior access to the management until their status as AAs becomes public, which does not take place until October. We also conducted additional unreported analysis where we used an alternative definition of the pre-election period as the 12-month period starting in April of the year prior to the election year and ending in March of the election year (7 months before the announcement of AA election results in October). Our qualitative results are robust to this alternative specification — i.e., future AAs significantly outperform non-AAs, and the result is mainly due to strong performances by future top-rank AAs.

In unreported robustness checks, we confirm that there are no reversals after a 3-day, 7-day, or 14-day holding period through the end of the first month, no reversals between the first and the second month, and between the end of the second month through the end of the first year. In addition, we analyzed portfolios that bought and held stocks with outstanding “buy” or “sell” recommendations in consecutive 2-month periods within the first year (e.g., portfolios from day 61–120, day 121–180, etc.). We find that the levels of as well as the differences between the alphas are small and statistically insignificant, confirming no reversal in these periods. Another concern is whether trading costs erode the performance differentials between AAs and non-AAs. An earlier version of our paper included detailed estimations of transactions costs. Taking transaction costs into account generally widens the performance differential between AAs and non-AAs because AAs tend to recommend larger, more liquid stocks. Our estimation suggests that the annual turnovers of the AA and non-AA portfolios are similar: 186 % for the AA buy portfolio and 189 % for the non-AA buy portfolio. The round-trip buy (sell) trading costs, however, are larger for the non-AA portfolios: 1.7 % (1.6 %) versus 1.1 % (1.2 %) for AAs. As an example, taking turnover and trading costs into account reduces the AAs’ five-factor, 3-day buy portfolio alpha (unreported) from 2.92–2.9 % and reduces the non-AAs’ (similarly estimated, 3-day portfolio) alpha from 2.11–2.07 %, thus widening the alpha differential. Effects on other portfolios are similar and confirm that transaction costs do not erode the performance differentials between AAs and non-AAs.

Stickel (1995) finds that the stronger market impact of 1st-ranked AAs reverses to zero by the end of 30 days. However, he cautions that the small sample makes the inference tenuous (there were only 425 buy and 400 sell recommendations for 1st-ranked AAs in his sample). We have about 8,000 buys and 8,000 sells for top-rank AAs. In unreported robustness checks using event-study methodology (which Stickel (1995) uses), we do not find reversal by the end of the month as he documented.

The 12 banks involved in the Settlement are: Bear Stearns, Credit Suisse First Boston, Deutsche Bank, Goldman Sachs, J.P. Morgan Chase, Lehman Brothers, Merrill Lynch, Morgan Stanley, Salomon Smith Barney, UBS Warburg, Piper Jaffray, and Thomas Weisel. (Thomas Weisel was added to the list in 2004). See http://www.sec.gov/news/press/2002-179.htm

See, for example, Barber et al. (2006) and (2007) and Loh and Stulz (2011). Many banks also switched from a 5-grade system to a 3-grade system, which caused a spike in the number of new and re-stated recommendations issued in 2002 (Kadan et al. (2009)). In our own analysis, we found that not only 2002 contains a disproportionately large number of sell recommendations, but also that returns associated with these sell recommendations (presumably triggered by the need for regulatory compliance) were often positive.

We also repeated these tests (unreported) separately for the banks sanctioned by the Global Settlement (primarily large banks) and other non-sanctioned banks. We find that the three main findings—namely (i) persistence of AA outperformance post Reg-FD, (ii) increase in the sell outperformance during the Interim Period and subsequent deterioration in the Post-Settlement Period, and (iii) weakening of top-rank AAs’ outperformance in the Post-Settlement Period—all hold similarly for sanctioned and non-sanctioned bank analysts.

We thank Brad Barber for suggesting this analysis.

We focus on high-\( \widehat{p} \) analysts because few low-\( \widehat{p} \) analysts actually get elected, resulting in insufficient sample size to examine low-\( \widehat{p} \)AAs.

Illustrating the regulatory pressures at the time, the cover article for the 2003 AA election in Institutional Investor quotes an anonymous 13-year veteran analyst as saying “people are scared… that everyone’s watching and ready to pounce on every little thing you say or do, whether it’s the regulators, the plaintiff’s lawyers, the press or even our compliance people”. The article also reports investors’ complaints that analysts were reluctant to take controversial stances—especially bullish ones—for fear of running afoul of regulators.

Consistent with this, Kadan et al. (2009) document an overall decline in recommendation informativeness after 2003.

In a static setting, Chen et al. (2005) provide evidence that investors form perceptions about an analyst’s ability from his track record. We go further and study the effectiveness of changes institutional investors made to the AA roster.

Guan et al. (2010) show that AA analysts who depart the profession after the conflict-of-interest reforms performed better than other analysts (e.g., non-AAs) who cover the same firms prior to their departures; they do not compare the performance within the AA ranks, as we do here.

In unreported analysis, we find different changes in the non-AA pool. Non-AAs leaving the profession in this period are less experienced than the remaining non-AAs, opposite to the pattern among top-rank AAs. Thus, the conflicts-of-interest reforms seem to have asymmetric impacts on the analysts’ labor market: On the one hand, the most experienced, top-rank AAs left the profession, perhaps seeking better career options outside sell-side research; on the other hand, the least experienced non-AAs also left, possibly due to budget cuts and an overall less lucrative career prospect. Both trends are consistent with a narrowing of the performance gap between the AA and non-AA pool post Settlement. An alternative (and non-mutually exclusive) explanation for the narrowing of the performance gap is that the conflict-of-interest reforms had a sharper effect on the behavior of non-AAs than on AAs. This could be the case if the AA status mitigates conflicts-of-interest even before the reforms. Fang and Yasuda (2009) find that AA status plays a disciplining role, leading to high research quality of AAs relative to others even when the degree of conflicts was high. Thus the incremental disciplinary role of the reforms could be larger for non-AAs than for AAs. Consistent with this view, Ertimur et al. (2007) find that the positive relation between forecast accuracy and recommendation profitability strengthens after the conflict-of-interest reforms for conflicted analysts.

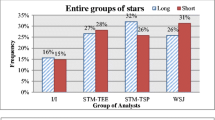

In constructing Fig. 1, we take the level of each recommendation and classify it as a “buy” if its level is either “strong buy” or “buy” (ratings 1 and 2 in the 5-point scale; 1 in the 3-point scale), and “sell” if it is “hold”, “sell”, or “strong sell” (ratings 3, 4, and 5 in the 5-point scale; 2 and 3 in the 3-point scale). Thus by this construction, the “buys” and “sells” in Fig. 1a add up to 100 % of all recommendations. This is different from the “buy” and “sell” portfolios that we construct for the alpha estimation, where we focus only on new recommendations and revisions that result in switches between the “buy” category and the “sell” category.

We define turnover as the analyst disappearing from the AA list. This includes either being demoted to non-AA status or leaving the profession entirely. In a related study, Bagnoli et al. (2008) calculates retirement rates and report that AA retirements rose in 2000 around the passage of Reg-FD, and returned to the Pre-Reg-FD level in 2001 and 2002.

We also examined promotions/demotions between top-rank AA positions and bottom-rank AA positions. Results for these comparisons are qualitatively similar but weaker than the reported results and generally insignificant.

Both demotions from top-rank AA to non-AA and promotions from non-AA to top-rank AA involve fewer than 50 analysts.

References

Altinkiliç O, Hansen R (2009) On the information role of stock recommendation revisions. J Account Econ 48:17–36

Altinkiliç O, Balashov V, Hansen R (2010) Evidence that analysts are not important information-intermediaries, working paper, Freeman School of Business, Tulane University

Bagnoli M, Watts S, Zhang Y (2008) Reg-FD and the competitiveness of all-star analysts. J Account Public Policy 27:295–316

Bailey W, Li H, Mao C, Zhong R (2003) Regulation fair disclosure and earnings information: market, analyst, and corporate responses. J Financ 58:2487–2514

Balakrishnan K, Schrand C, Vashishtha R (2011) Analyst recommendations and higher order beliefs: explaining bubbles and price drift, working paper. University of Pennsylvania

Barber B, Lehavy R, McNichols M, Trueman B (2001) Can investors profit from the prophets? Security analyst recommendations and stock returns. J Financ 56:531–563

Barber B, Lehavy R, McNichols M, Trueman B (2006) Buys, holds, and sells: the distribution of investment banks' stock ratings and the implications for the profitability of analysts' recommendations. J Account Econ 41:87–117

Barber B, Lehavy R, Trueman B (2007) Comparing the stock recommendation performance of investment banks and independent research firms. J Financ Econ 85:490–517

Benabou R, Laroque G (1992) Using privileged information to manipulate markets: insiders, gurus, and credibility. Q J Econ 107:921–958

Boni L, Womack K (2006) Analysts, industries, and price momentum. J Financ Quant Anal 41:85–109

Bonner S, Hugon A, Walther B (2007) Investor reaction to celebrity analysts: the case of earnings forecast revisions. J Account Res 45:481–513

Bradley D, Jordan B, Ritter JR (2003) The quiet period goes out with a bang. J Financ 58:1–36

Bradley D, Jordan B, Ritter JR (2008) Analyst behavior following IPOs: the bubble period evidence. Rev Financ Stud 21:101–133

Brown L and Huang K (2010) Forecast-recommendation consistency and earnings forecast quality, working paper

Carhart M (1997) On persistence in mutual fund performance. J Financ 52:57–82

Clarke J, Khorana A, Patel A, Rau R (2007) The impact of all-star analyst Job changes on their coverage choices and investment banking deal flow. J Account Econ 84:713–737

Cliff M, Denis D (2004) Do initial public offering firms purchase analyst coverage with underpricing? J Financ 59:2871–2901

Cohen L, Frazzini A, Malloy C (2010) Sell-side school ties. J Financ 65:1409–1947

Cooper R, Day T, Lewis C (2001) Following the leader: a study of individual analysts’ earnings forecasts. J Financ Econ 61:383–416

Cowen A, Groysberg B, Healy P (2006) What types of analyst firms make more optimistic forecasts? J Account Econ 41:119–146

Daniel K, Grinblatt M, Titman S, Wermers R (1997) Measuring mutual fund performance with characteristic-based benchmarks. J Financ 52:875–899

Diamond DW (1989) Reputation acquisition in debt markets. J Polit Econ 97:828–862

Dini J (2001) “The all-America research team. (status of equity research’s future explored)”. The Institutional Investors Magazine (October 2001)

Dunbar C (2000) Factors affecting investment bank initial public offering market share. J Financ Econ 55:3–41

Elton E, Gruber M, Grossman S (1986) Discrete expectational data and portfolio performance. J Financ 41:699–713

Emery D, Li X (2009) Are Wall Street analyst rankings popularity contest? J Financ Quant Anal 44:411–437

Ertimur Y, Sunder J, Sunder S (2007) Measure for measure: the relation between forecast accuracy and recommendation profitability of analysts. JAccount Res 45:567–606

Fama E, French K (1993) Common risk factors in the return on bonds and stocks. J Financ Econ 33:3–53

Fang L, Yasuda A (2009) The effectiveness of reputation as a disciplinary mechanism in sell-side research. Rev Financ Stud 22:3735–3777

Gintschel A, Markov S (2004) The effectiveness of regulation FD. J Account Econ 37:293–314

Gleason C, Lee C (2003) Analyst forecast revisions and market price discovery. Account Rev 78:193–225

Gomes A, Gorton G, Madureira L (2007) SEC regulation fair disclosure, information, and the cost of capital. J Corp Finan 13:300–334

Green TC (2006) The value of client access to analyst recommendation. J Financ Quant Anal 41:1–24

Grossman S, Stiglitz J (1980) On the impossibility of informationally efficient markets. Am Econ Rev 70:393–408

Guan Y, Lu H, Wong F (2010) Conflict-of-interest reforms and brain drain in investment banks, working paper

Hall J, Tacon P (2010) Forecast accuracy and stock recommendations. J Contemp Account Econ 6:18–33

Hong H, Kubik JD (2003) Analyzing the analysts: career concerns and biased earnings forecasts. J Financ 58:313–351

Hong H, Kubik J, Solomon A (2000) Security analysts’ career concerns and herding of earnings forecasts. Rand J Econ 31:121–144

Irvine P (2003) The incremental impact of analyst initiation of coverage. J Corp Finan 9:431–451

Irvine P, Lipson M, Puckett A (2007) Tipping. Rev Financ Stud 20:741–768

Jackson A (2005) Trade generation, reputation, and sell-side analysts. J Financ 60:673–717

Jegadeesh N, Kim W (2006) Value of analyst recommendations: international evidence. J Financ Mark 9:274–309

Jegadeesh N, Kim J, Krische S, Lee C (2004) Analyzing the analysts: when do recommendations add value? J Financ 59:1083–1124

Juergens J, Lindsey L (2009) Getting out early: an analysis of market making activity at the recommending analyst’s firm. J Financ 64:2327–2359

Kadan O, Madureira L, Wang R, Zach T (2009) Conflicts of interest and stock recommendations: the effect of global settlement and related regulations. Rev Financ Stud 22:4189–4217

Kecskes A, Womack K (2010) Adds and drops of analyst coverage: does the stock market overreact? Working paper

Kecskes, A., R. Michaely, K. Womack (2010) What drives the value of analysts’ recommendations: earnings estimates or discount rate estimates? Working paper

Keim D, Madhavan A (1997) Transaction costs and investment style: an inter-exchange analysis of institutional equity trades. J Financ Econ 46:265–292

Kramer L (2009) “The 2009 All-America Research Team: a time to rebuild”. The Institutional Investor Magazine (October 2009)

Krigman L, Shaw WH, Womack K (2001) Why do firms switch underwriters? J Financ Econ 60:245–284

Leone A, Wu J (2007) What does it take to become a superstar? Evidence from Institutional investor rankings of financial analysts, working paper. Simon School of Business, University of Rochester

Li X (2005) The persistence of relative performance in stock recommendations of sell-side financial analysts. J Account Econ 40:129–152

Lin H, McNichols MF (1998) Underwriting relationships, analysts earnings forecasts and investment recommendations. J Account Econ 25:101–127

Liu X, Ritter J (2010) Local underwriter oligopolies and IPO underpricing. Working paper, University of Florida

Ljungqvist A, Marston F, Wilhelm WJ (2006) Competing for securities underwriting mandates: banking relationships and analyst recommendations. J Financ 61:301–340

Ljungqvist A, Malloy C, Marston F (2009) Rewriting history. J Financ 64:1935–1960

Loh R, Mian M (2006) Do accurate earnings forecasts facilitate superior investment recommendations? J Financ Econ 80:455–483

Loh R, Stulz R (2011) When are analyst recommendation changes influential. Rev Financ Stud 24:593–627

Loughran T, Ritter J (2004) Why has IPO underpricing changed over time? Financ Manag 2004:5–37

Malmendier U, Shanthikumar D (2007) Do security analysts speak in two tongues? NBER working paper

Mikhail M, Walther B, Willis R (2004) Do security analysts exhibit persistent differences in stock picking ability? J Financ Econ 74:67–91

Mohanram P, Sunder S (2006) How has regulation FD affected the operations of financial analysts? Contemp Account Res 23:491–525

Schack J (2004) “The 2004 All-America Research Team”. The Institutional Investor Magazine (October 2004)

Sessa D (1999) All star analysts 1999 survey: Early mornings, late nights mark an analyst’s day. Wall Str J, June 29, R13

Stickel S (1992) Reputation and performance among security analysts. J Financ 47:1811–1836

Stickel S (1995) The anatomy of the performance of buy and sell recommendations. Fin Anal J 51:25–39

Womack K (1996) Do brokerage analysts’ recommendations have investment value? J Financ 51:137–167

Author information

Authors and Affiliations

Corresponding authors

Additional information

We thank Yakov Amihud, Brad Barber, Mark Chen, David Musto (the editor), Edwin Elton, Steve Figlewski, Gary Gorton, Martin Gruber, Pierre Hillion, Chris James, Kose John, Xi Li, Alexander Ljungqvist, Chris Malloy, Felicia Marston, Andrew Metrick, Jay Ritter, Michael Roberts, Michael Schill, Rob Stambaugh, Laura Starks, James Vickery, Bill Wilhelm, Kent Womack, Jeff Wurgler, an anonymous referee, and the seminar and conference participants at Florida, INSEAD, NYU, Virginia, Wharton, the 1st Saw Centre for Financial Studies Conference on Quantitative Finance, the AFA meetings (Boston), the EFA meetings (Zurich), and 9th Conference of the Swiss Society for Financial Market Research (Zurich) for helpful discussions, and I/B/E/S for making their data available for academic use. Financial support from the Wharton Rodney L. White Center for Financial Research, the INSEAD R&D Committee, and the INSEAD/Wharton Alliance is gratefully appreciated. Shichang Cao, Ben Lin, and Dong Yi provided excellent research assistance. All errors and omissions are our own.

Rights and permissions

About this article

Cite this article

Fang, L.H., Yasuda, A. Are Stars’ Opinions Worth More? The Relation Between Analyst Reputation and Recommendation Values. J Financ Serv Res 46, 235–269 (2014). https://doi.org/10.1007/s10693-013-0178-y

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10693-013-0178-y