Abstract

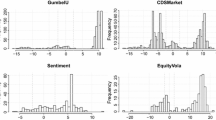

We represent credit spreads across ratings as a function of common unobservable factors of the Vasicek form. Using a state-space approach we estimate the factors, their process parameters, and the exposure of each observed credit spread series to each factor. We find that most of the systematic variation across credit spreads is captured by three factors. The factors are closely related to the implied volatility index (VIX), the long bond rate, and S&P500 returns, supporting the predictions of structural models of default at an aggregate level. By making no prior assumption about the determinants of yield spread dynamics, our study provides an original and independent test of theory. The results also contribute to the current debate about the role of liquidity in corporate yield spreads. While recent empirical literature shows that the level and time-variation in corporate yield spreads is driven primarily by a systematic liquidity risk factor, we find that the three most important drivers of yield spread levels relate to macroeconomic variables. This suggests that if credit spread levels do contain a large liquidity premium, the time variation of this premium is likely driven by the same factors as default risk.

Similar content being viewed by others

References

Amato J. D., Remolona E. M. (2003) The credit spread puzzle. BIS Quarterly Review 5: 51–63

Amato, J. D., & Luisi, M. (2006). Macro factors in the term structure of credit spreads, BIS Working Paper No. 203.

Amihud Y., Mendelson H. (1986) Asset pricing and the bid-ask spread. Journal of Financial Economics 17: 223–249

Ang A., Piazzesi M. (2003) A no-arbitrage vector autoregression of term structure dynamics with macroeconomic and latent variables. Journal of Monetary Economics 50: 745–787

Babbs S. H., Nowman K. B. (1999) Kalman filtering of generalized Vasicek models. Journal of Financial and Quantitative Analysis 34: 118–130

Campbell M., Lettau B. G., Malkiel J., Xu Y. (2001) Have individual stocks become more volatile?. Journal of Finance 56: 1–43

Campbell Y., Taksler G. B. (2003) Equity volatility and corporate bond yields. Journal of Finance 58: 2321–2349

Chakravarti I., Laha R. G., Roy J. (1967) Handbook of methods of applied statistics, Vol. I.. Wiley and Sons, New York, pp 392–394

Chen, H. (2008). Macroeconomic conditions and the puzzles of credit spreads and capital structure. Working paper, Massachusetts Institute of Technology.

Chen L., Collin-Dufresne P., Goldstein R. S. (2009) On the relation between the credit spread puzzle and the equity premium puzzle. Review of Financial Studies 22: 3367–3409

Chen R. R., Scott L. (1993) Multi-factor cox-ingersoll-ross models of the term structure: Estimates and tests from a Kalman Filter model. Journal of Fixed Income 3: 14–31

Collin-Dufresne, R., Goldstein, P., & Helwege, J. (2010). Is credit event risk priced? Modeling contagion via the updating of beliefs. NBER Working paper No. 15733.

Collin-Dufresne R., Goldstein P., Martin S. J. (2001) The determinants of credit spread changes. Journal of Finance 56: 2177–2207

Cox J., Ingersoll J., Ross S. (1985) A theory of the term structure of interest rates. Econometrica 53: 385–407

De Jong, F., & Driessen J., (2006). Liquidity risk premia in corporate bond markets. Working paper, University of Amsterdam.

Delianedis, G., & Geske, R. (2002). The components of corporate credit spreads: Default, recovery, tax, jumps, liquidity, and market factors. Working paper 22–01, Anderson School, UCLA.

Driessen J. (2005) Is default event risk priced in corporate bonds?. Review of Financial Studies 18: 165–195

Duffee G. R. (1998) The relation between treasury yields and corporate bond yield spreads. Journal of Finance 53: 225–2241

Duffie D., Singleton K. (1997) An econometric model of the term structure of interest rate swap yields. Journal of Finance 52: 1287–1321

Duffie D., Singleton K. (1999) Modelling the term structure of defaultable bonds. Review of Financial Studies 12: 687–720

Elton E. J., Agrawal D., Gruber M. J., Mann C. (2001) Explaining the rate spread on corporate bonds. Journal of Finance 56: 247–277

Eom Y. H., Helwege J., Huang J. (2004) Structural models of corporate bond pricing: An empirical analysis. Review of Financial Studies 17: 499–544

Ericsson J., Jacobs K., Oviedo R. (2009) The determinants of credit default swap premia. Journal of Financial and Quantitative Analysis 44: 109–132

Ericsson J., Renault O. (2006) Liquidity and credit risk. Journal of Finance 61: 2219–2250

Estrella A., Hardouvelis G. A. (1991) The term structure as a predictor of real economic activity. Journal of Finance 46: 555–576

Fama E. F., French K. R. (1996) Multifactor explanations of asset pricing anomalies. Journal of Finance 51: 55–84

Feldhutter P., Lando D. (2008) Decomposing swap spreads. Journal of Financial Economics 88: 375–405

Fisher L. (1959) Determinants of risk premiums on corporate bonds. Journal of Political Economy 67: 217–237

Fridson M., Jonsson J. (1995) Spread versus treasuries and the riskiness of high-yield bonds. Journal of Fixed Income 5: 79–88

Gemmill, G., & Keswani, A. (2008). Idiosyncratic downside risk and the credit spread puzzle. Working paper, available at SSRN.

Geyer A., Pichler S. (1999) A state-space approach to estimate and test multifactor Cox-Ingersoll-Ross models of the term structure. The Journal of Financial Research 22: 107–130

Hamilton J. D. (1994) Time series analysis. Princeton University Press, Cambridge

Huang, J., & Huang, M. (2003). How much of the corporate-treasury yield spread is due to credit risk? Working paper, Pennsylvania State University.

Huang J., Kong W. (2003) Explaining credit spread changes: New evidence from option-adjusted bond indexes. Journal of Derivatives 11: 30–44

Jacobs K., Li X. (2008) Modeling the dynamics of credit spreads with stochastic volatility. Management Science 54: 1176–1188

Jarrow R. A., Lando D., Yu F. (2005) Default risk and diversification: Theory and empirical implications. Mathematical Finance 15: 1–26

Jarrow R. A., Turnbull S. M. (1995) Pricing derivatives on financial securities subject to credit risk. Journal of Finance 50: 53–85

Joutz, F., Mansi, S. A., & Maxwell, W. F. (2001). The dynamics of corporate credit spreads. Working paper, George Washington University and Texas Tech University.

Kwan S. H. (1996) Firm-specific information and the correlation between individual stocks and bonds. Journal of Financial Economics 40: 63–80

Liu J., Longstaff F. A., Mandell R. E. (2006) The market price of risk in interest rate swaps: The roles of default and liquidity risks. Journal of Business 79: 2337–2360

Longstaff F. A. (2004) The flight-to-liquidity premium in U.S. Treasury bond prices. Journal of Business 77: 511–526

Longstaff F. A., Schwartz E. S. (1995) A simple approach to valuing risky fixed and floating rate debt. Journal of Finance 50: 789–819

Longstaff F. A., Mittal S., Neis E. (2005) Corporate yield spreads: Default risk or liquidity? New evidence from the credit default swap market. Journal of Finance 60: 2213–2253

Massey F. J. (1951) The Kolmogorov–Smirnov test for goodness-of-fit. Journal of the American Statistical Association 46: 68–78

Merton R. C. (1974) On the pricing of corporate debt: The risk structure of interest rates. Journal of Finance 29: 449–470

Papageorgiou N., Skinner F. S. (2006) Credit spreads and the zero-coupon treasury spot curve. Journal of Financial Research 29: 421–439

Pedrosa M., Roll R. (1998) An equilibrium characterization of the term structure. Journal of Fixed Income 8: 7–26

Perraudin, W., & Taylor, A. (2003). Liquidity and bond market Spreads. Working paper, Bank of England.

Vasicek O. A. (1977) An equilibrium characterization of the term structure. Journal of Financial Economics 5: 177–188

Wu L., Zhang F. X. (2008) A no-arbitrage analysis of macroeconomic determinants of the credit spread term structure. Management Science 54: 1160–1175

Zhou, C. (1997). A jump-diffusion approach to modelling credit risk and valuing defaultable securities. Working paper, Federal Reserve Board.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bhar, R., Handzic, N. A Multifactor Model of Credit Spreads. Asia-Pac Financ Markets 18, 105–127 (2011). https://doi.org/10.1007/s10690-010-9123-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10690-010-9123-3