Abstract

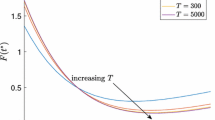

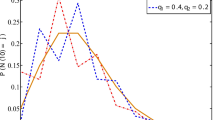

A model of rational mortgage refinancing is developed where the drift and volatility of interest rate process switch between two regimes. Because of the possibility of a regime shift, the optimal refinancing policy is characterized by the different threshold of interest differential for each regime. Numerical simulation demonstrates that the optimal refinancing threshold in each regime can be smaller or larger than the threshold under single-regime models. Finally, we evaluate the predictions of the model, based on the estimated parameters for a two-regime model to capture the evolution of the mortgage rates in the US. Our model can produce both late and early refinancing, which is consistent with the observed refinancing behavior.

Similar content being viewed by others

References

Agarwal, S., Driscoll, J. C., & Laibson, D. I. (2002). When should borrowers refinance their mortgages?. Working paper, National Bureau of Economic Research, Summer Institute.

Agarwal, S., Driscoll, J. C., & Laibson, D. I. (2004). Mortgage refinancing for distracted consumers. Mimeo, Federal Reserve Bank of Chicago, Federal Reserve Board, and Harvard University.

Agarwal, S., Driscoll, J. C., & Laibson, D. I. (2007). Optimal mortgage refinancing: A closed form solution. Working paper 13487, National Bureau of Economic Research.

Ang A., Bekaert G. (2002) Regime switches in interest rates. Journal of Business and Economic Statistics 20(2): 163–182

Archer W., Ling D. (1993) Pricing mortgage-backed securities: Integrating optimal call and empirical models of prepayment. Journal of the American Real Estate and Urban Economics Association 21(4): 373–404

Bennett P., Peach R.W., Peristiani S. (2001) Structural change in the mortgage market and the propensity to refinance. Journal of Money, Credit and Banking 33(4): 955–975

Chang, F.-R. (2004). Stochastic optimization in continuous time. Cambridge University Press.

Downing C., Stanton R., Wallace N. (2005) An empirical test of a two-factor mortgage prepayment and valuation model: How much do house prices matter?. Real Estate Economics 33(4): 681–710

Dunn K.B., McConnel J. (1981) A comparison of alternative models of pricing GNMA mortgage-backed securities. Journal of Finance 36(2): 471–484

Dunn K.B., McConnel J. (1981) Valuation of GNMA mortgage-backed securities. Journal of Finance 36(3): 599–617

Guo X., Miao J., Morellec E. (2005) Irreversible investment with regime shifts. Journal of Economic Theory 122: 37–59

Guo X., Zhang Q. (2004) Closed-form solutions for perpetual american put options with regime switching. SIAM Journal of Applied Mathematics 64(6): 2034–2049

Hamilton J. (1989) A new approach to the economic analysis of nonstationary time series and the business cycles. Econometrica 57(2): 357–384

Hurst E., Stafford F. (2004) Home is where the equity is: Mortgage refinancing and household consumption. Journal of Money, Credit and Banking 36(6): 985–1014

Stanton R. (1995) Rational prepayment and the valuation of mortgage-backed securities. Review of Financial Studies 8(3): 677–708

Author information

Authors and Affiliations

Corresponding author

Additional information

The views expressed in this paper are solely those of the authors and do not necessarily reflect official positions of the Sumitomo Trust and Banking Co., Ltd.

Rights and permissions

About this article

Cite this article

Kimura, T., Makimoto, N. Optimal Mortgage Refinancing with Regime Switches. Asia-Pac Finan Markets 15, 47–65 (2008). https://doi.org/10.1007/s10690-008-9072-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10690-008-9072-2