Abstract

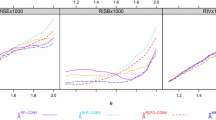

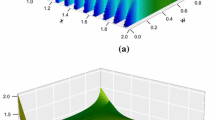

We investigate extreme dependence in a multivariate setting with special emphasis on financial applications. We introduce a new dependence function which allows us to capture the complete extreme dependence structure and present a nonparametric estimation procedure. The new dependence function is compared with existing measures including the spectral measure and other devices measuring extreme dependence. We also apply our method to a financial data set of zero coupon swap rates and estimate the extreme dependence in the data.

Similar content being viewed by others

References

Coles, S.G., An Introduction to Statistical Modeling of Extreme Values, Springer, (2001).

Coles, S.G. and Tawn, J.A., “Modelling extreme multivariate events,” J. R. Stat. Soc. B. 53, 377–392, (1991).

Einmahl, J., de Haan, L. and Sinha, A.K., “Estimating the spectral measure of an extreme value distribution”, Stoch. Proc. Appl. 70, 143–171, (1997).

Einmahl, J., de Haan, L. and Piterbarg, V.I., “Nonparametric estimation of the spectral measure of an extreme value distribution,” Ann. Stat. 29, 1401–1423, (2001).

Embrechts, P., Klüppelberg, C. and Mikosch, T., Modelling Extremal Events for Insurance and Finance, Springer, Berlin, 1997.

Embrechts, P., de Haan, L. and de Huang, X., “Modelling multivariate extremes,” in Extremes and Integrated Risk Management (P. Embrechts, ed), RISK Books, pp. 59–67, 2000.

De Haan, L. and Resnick, S., “Limit theory for multidimensional sample extremes.” Z. Wahrscheinlichkeitstheorie. verw. Gebiete. 40, 317–337, (1977).

De Haan, L. and De Ronde, J., Sea and wind: multivariate extremes at work. Extremes 1, 7–45, (1998).

Hauksson, H. A., Dacorogna, M., Domenig, T., Müller, U. and Samorodnitsky, G., Multivariate extremes, aggregation and risk estimation. Quantitative Finance 1, 79–95, (2001). Available at http://papers.ssrn.com/sol3/papers.cfm?abstract\_id=254392.

Huang, X., Statistics of Bivariate Extremes. Ph.D. Thesis, Erasmus University Rotterdam, Tinbergen Research Institute, no. 22. (1992).

Joe, H., Multivariate Models and Dependence Concepts. Chapman & Hall, London, 1997.

Kuhn, G., Multivariate Value at Risk Schätzung von Zins Swap Sätzen. Diploma Thesis. Munich University of Technology. Available at www.ma.tum.de/stat/. (2002).

Leadbetter, M.R., Lindgren, G. and Rootzën, H., Extremes and Related Properties of Random Sequences and Processes. Springer, New York, 1983.

Ledford, A. and Tawn, J., “Statistics for near independence in multivariate extreme values,” Biometrika 83, 169–187, (1996).

Nelsen, R., An Introduction to Copulas. Lecture Note in Statistics, no. 139. Springer, New York, 1999.

Qi, Y., Almost sure convergence of the stable tail empirical dependence function in multivariate extremes statistics. Acta. Math. Appl. Sin. 13, 167–175, (1997).

Resnick, S.I., Extreme Values, Regular Variations and Point Processes, Springer, New York, 1987.

Schlather, M. and Tawn, J., Properties of extremal coefficients. Technical report ST 00–01, Department of Mathematics and Statistics, Lancaster University, 2000.

Schlather, M. and Tawn, J., “A dependence measure for multivariate and spatial extreme values: Properties and inference,” Biometrika 90, 139–156, (2003).

Smith, R.L., “Statistics of extremes, with applications in environment, insurance and finance,” Chapter 1 of Extreme Values in Finance, Telecommunications and the Environment (B. Finkenstadt and H. Rootzén, eds) Chapman and Hall/CRC Press, 2003.

Tawn, J.A., “Bivariate extreme value theory: Models and estimation,” Biometrika 75, 397–415, (1988).

Author information

Authors and Affiliations

Corresponding author

Additional information

AMS 2000 Subject Classification. Primary—62G32, 62H12 Secondary—62E20

Rights and permissions

About this article

Cite this article

Hsing, T., Klüppelberg, C. & Kuhn, G. Dependence Estimation and Visualization in Multivariate Extremes with Applications to Financial Data. Extremes 7, 99–121 (2004). https://doi.org/10.1007/s10687-005-6194-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10687-005-6194-z