Abstract

We explore the relation between redistribution choices, source of income, and pre-redistribution inequality. Previous studies find that when income is earned through work there is less support for redistribution than when income is determined by luck. Using a lab experiment, we vary both the income-generating process (luck vs. performance) and the level of inequality (low vs. high). We find that an increase in inequality has less impact on redistribution choices when income is earned through performance than when income results from luck. This result is likely explained by individuals using income differences as a heuristic to infer relative deservingness. If people believe income inequality increases as a result of performance rather than luck, then they are likely to believe the poor deserve to stay poor and the rich deserve to stay rich.

Similar content being viewed by others

Notes

Building upon the framework of Hotelling (1929) and Downs (1957), Meltzer and Richard (1981) predict that the tax rate implemented in equilibrium should be the tax rate favored by median-income individuals and that equilibrium taxes should increase as income inequality increases. Note that much of the theoretical political economy and public choice research on taxation and redistribution assumes that individuals are concerned with only their material self-interest when they vote or make other decisions with an impact on redistribution.

In the instructions, rounds were referred to as “periods”. Participants were told that “Once the 4th Period is completed, we will randomly select one of the Periods as the “Period-that-counts” and “Note that since all Periods are equally likely to be chosen, you should act in each Period as if it will be the “Period-that-counts.”

See http://laurakgee.weebly.com/index.html for the Online Appendix, which contains the instructions for the Performance-High treatment. The instructions for the other treatments are similar and are available upon request.

In the instructions (see Online Appendix), we do not use the term “median voter”. Instead, we explained the voting in the following way: "The “actual level” of the reallocation will be the highest reallocation, which a majority of the group members support, that is if at least two of the three group members vote “yes.” The process is best explained by some examples: Stage B Reallocation Voting Example: Suppose in Stage B the group member’s voting looks like ... Participant 1 voted for 15% reallocation. Participant 2 voted for 30%. Participant 3 voted for 5%. The reallocation would be 15% because that is the highest value that at least two of the three group members (Participants 1 and 2) supported.” Note that in the instructions we referred to the redistribution rate as a “reallocation” rate and stage 2 as stage B. In our post-test questionnaire, we also asked participants if they felt the instructions were clear and 95% answered in the affirmative. In addition, we asked for improvements in the post- questionnaire, and 75% of the participants did not make any suggestions.

Since payoffs are randomly assigned, we do not have participants in the luck treatments perform a task, as this may generate feelings of unfairness. A participant may feel unfairly treated if she performs the task well but is randomly assigned a low payoff.

Average payoffs are the same pre- and post-redistribution.

The summary statistics for the sessions with beliefs elicitation separated from the sessions without beliefs elicitation are presented in Table 10. Note that in the Performance sessions with belief elicitation, participants finish more tasks and vote for lower redistribution rates than in the original performance sessions. This difference occurs despite round 1 of each of these sessions being identical up to the belief elicitation stage. The computer lab was upgraded between the original sessions in 2014 and the sessions with beliefs elicitation in 2016, which could drive the difference in the number of tasks completed. In order to account for this difference in our regression analysis, we include a dummy variable for belief elicitation and present the pooled and the no-beliefs results side by side.

All t-tests discussed in this section and the next are two-sided.

In the Performance-High sessions without beliefs 14.69 tasks are completed on average, while in the Performance-Low sessions without beliefs only 13.49 tasks are completed on average. Similarly, in the Performance-High sessions with beliefs 22.69 tasks are completed on average, while in the Performance-Low sessions with beliefs only 19.29 tasks are completed on average. But, in both cases, the difference is not statistically significant (\(t=1.35\) for the no-beliefs sessions and \(t=1.71\) for the beliefs sessions). The lack of statistical significance in these cases is likely explained by the smaller sample sizes of the beliefs and no-beliefs sub-groups.

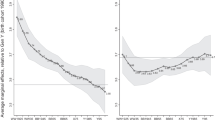

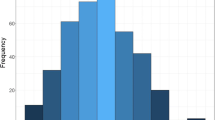

If \(r_{it}^* \le 0\) then \(r_{it}=0\) and if \(r_{it}^* \ge 100\) then \(r_{it}=100\). There are many observations at 0 and 100 as shown in Fig. 3.

Summing \(\beta\) and \(\alpha _{H}\), the combined coefficient is not significantly different from zero when using clustered standard errors in column 1 \((t=-0.91)\) or without clustering \((t=-1.44)\) and, for column 2, with clustered standard errors \((t=-1.07)\) or without clustering \((t=-1.82)\).

\(\alpha _{p} = 16.16\) in column 1 and \(\alpha _{p}= 17.96\) in column 2. See Table 6 for the standard errors.

In column 1, \(\alpha _{p}\) + \(\beta = -3.99\), with \(t=0.69\) using clustered standard errors. In column 2, \(\alpha _{p}\) + \(\beta = -6.37\), with \(t=0.98\) using clustered standard errors.

When including all sessions (column 1), mean redistribution is 41.11 in the performance treatments and 35.72 in the luck treatments (t-statistic of the difference is 1.66). When including all sessions except for the Beliefs sessions (column 2), the mean redistribution in the performance treatments goes up to 51.40 and it remains at 35.72 in the luck treatments, thus their difference reaches statistical significance with \(t=4.57\).

See Table 10 for summary statistics by beliefs versus no-beliefs sessions.

For \(\alpha _{p}\), the p-value of the difference between column 1 and column 2 estimates is 0.68 using unclustered standard errors and 0.41 using clustered standard errors; while for the difference between column 3 and column 4 estimates, the p-value is 0.65 using unclustered standard errors and 0.33 using clustered standard errors. For \(\beta\), the p-value of the difference between column 1 and column 2 estimates is 0.48 using unclustered standard errors and 0.20 using clustered standard errors; while for the difference between column 3 and column 4 estimates, the p-value is 0.44 using unclustered standard errors and 0.15 using clustered standard errors. Finally, for \(\alpha _{H}\), the p-value of the difference between column 1 and column 2 estimates is 0.58 using unclustered standard errors and 0.32 using clustered standard errors; while for the difference between column 3 and column 4 estimates, the p-value is equal to 0.54 using unclustered standard errors and 0.27 using clustered standard errors.

In Panel A, to show that redistribution decreases as inequality increases in the performance treatments, we sum \(\beta +\alpha _H= -19.25\) (\(t=1.70\) using clustered standard errors and \(t=1.99\) using unclustered standard errors). For Panel B, we find \(\beta +\alpha _H= -25.79\) (\(t=1.99\) using clustered standard errors and \(t=2.29\) using unclustered standard errors).

For example, assume a participant aims to equalize payoffs. If she was in a group with one bottom-, middle-, and top-type earning ($0, $9 and $18), then she would like the redistribution rate to be 50% (post-redistribution payoffs would then be $9, $9, $9). However, if instead she was in a group with one bottom- and two top-types, then she would like the redistribution rate to be 25%. Recall that when there are two top-types, then both top-types pay their redistribution amount to the single bottom-type. In this case, the 25% redistribution rate would imply that both top-types pay $4.50 to the bottom-type, and the post-redistribution payoffs would then be $9, $9, $9.

See Table 10 for beliefs by round. Participants in Performance-High-Beliefs and Performance-Low-Beliefs had similar beliefs about the proportion of bottom-types (19.8 vs. 24.2, with a t-statistic for the difference equal to \(-1.22\)). Yet beliefs about the proportion of middle- or top-types differ by whether inequality is low or high. Beliefs about the proportion of middle-types are 47.7 for high inequality and 36.8 for low inequality (t-statistic of the difference equal to 3.22), while beliefs about the proportion of top-types are 32.5 for high inequality and 39 for low inequality (t-statistic of the difference equal to \(-1.58\)). See Fig. 4 for the full distribution of beliefs by treatment.

We report the results of the models controlling for beliefs in Table 9. In our main model, in Table 6 column 1, the difference-in-differences estimator is \(-20.15\), while it is \(-14.92\) when we control for beliefs; yet these coefficients are not statistically different from each other (p-value of the chi test using clustered standard errors equal to 0.57 using clustered standard errors and 0.44 using unclustered standard errors).

References

Agranov, M., & Palfrey, T. R. (2015). Equilibrium tax rates and income redistribution: A laboratory study. Journal of Public Economics, 130, 45–58.

Alesina, A., & Angeletos, G.-M. (2005). Fairness and redistribution: US versus Europe. American Economic Review 95.

Alesina, A., & Glaeser, E. L. (2004). Fighting poverty in the US and Europe: A world of difference (Vol. 26). Oxford: Oxford University Press.

Arrow, K. J. (1998). What has economics to say about racial discrimination? The Journal of Economic Perspectives, 12(2), 91–100.

Balafoutas, L., Kocher, M. G., Putterman, L., & Sutter, M. (2013). Equality, equity and incentives: An experiment. European Economic Review, 60, 32–51.

Bertola, G., & Ichino, A. (1995). Wage inequality and unemployment: United States versus Europe. In NBER Macroeconomics Annual 1995, Volume 10, pp. 13–66. MIT Press.

Bertrand, M., & Mullainathan, S. (2004). Are Emily and Greg more employable than Lakisha and Jamal? A field experiment on labor market discrimination. The American Economic Review, 94(4), 991–1013.

Cabrales, A., Nagel, R., & Mora, J. V. R. (2012). It is Hobbes, not Rousseau: An experiment on voting and redistribution. Experimental Economics, 15(2), 278–308.

Cappelen, A. W., Hole, A. D., Sørensen, E. Ø., & Tungodden, B. (2007). The pluralism of fairness ideals: An experimental approach. The American Economic Review, 97(3), 818–827.

Cherry, T. L., Frykblom, P., & Shogren, J. F. (2002). Hardnose the dictator. The American Economic Review, 92, 1218–1221.

Cox, J. C., Friedman, D., & Gjerstad, S. (2007). A tractable model of reciprocity and fairness. Games and Economic Behavior, 59(1), 17–45.

Dasgupta, U. (2011). Do procedures matter in fairness allocations? Experimental evidence in mixed gender pairings. Economics Bulletin, 31(1), 820–829.

De Araujo, F. A., Carbone, E., Conell-Price, L., Dunietz, M. W., Jaroszewicz, A., Landsman, R., Lamé, D., Vesterlund, L., Wang, S., & Wilson, A. J. (2015). The effect of incentives of real effort: Evidence from the slider task.

de Oliveira, A. C. M., Eckel, C., & Croson, R. T. A. (2012). The stability of social preferences in a low-income neighborhood. Southern Economic Journal, 79(1), 15–45.

Downs, A. (1957). An economic theory of democracy. Journal of Political Economy, 65, 135–150.

Durante, R., Putterman, L., & Weele, J. (2014). Preferences for redistribution and perception of fairness: An experimental study. Journal of the European Economic Association, 12(4), 1059–1086.

Erkal, N., Gangadharan, L., & Nikiforakis, N. (2011). Relative earnings and giving in a real-effort experiment. The American Economic Review, 101, 3330–3348.

Esarey, J., Salmon, T. C., & Barrilleaux, C. (2012). What motivates political preferences? Self-interest, ideology, and fairness in a laboratory democracy. Economic Inquiry, 50(3), 604–624.

Fahr, R., & Irlenbusch, B. (2000). Fairness as a constraint on trust in reciprocity: Earned property rights in a reciprocal exchange experiment. Economics Letters, 66(3), 275–282.

Gill, D., & Prowse, V. L. (2011). A novel computerized real effort task based on sliders. Available at SSRN 1732324.

Guvenen, F., Kuruscu, B., & Ozkan, S. (2013). Taxation of human capital and wage inequality: A cross-country analysis*. The Review of Economic Studies.

Hoffman, E., McCabe, K., Shachat, K., & Smith, V. (1994). Preferences, property rights, and anonymity in bargaining games. Games and Economic Behavior, 7(3), 346–380.

Hotelling, H. (1929). Stability in competition. The Economic Journal, 39(153), 41–57.

Iversen, T., & Soskice, D. (2006). Electoral institutions and the politics of coalitions: Why some democracies redistribute more than others. American Political Science Review, 100(02), 165–181.

Krawczyk, M. (2010). A glimpse through the veil of ignorance: Equality of opportunity and support for redistribution. Journal of Public Economics, 94(1), 131–141.

Ku, H., & Salmon, T. C. (2013). Procedural fairness and the tolerance for income inequality. European Economic Review, 64, 111–128.

Lefgren, L. J., Sims, D. P., & Stoddard, O. B. (2016). Effort, luck, and voting for redistribution. Journal of Public Economics, 143, 89–97.

McCoy, S. K., & Major, B. (2007). Priming meritocracy and the psychological justification of inequality. Journal of Experimental Social Psychology, 43(3), 341–351.

Meltzer, A. H., & Richard, S. F. (1981). A rational theory of the size of government. The Journal of Political Economy, 89, 914–927.

Milanovic, B. (2000). The median-voter hypothesis, income inequality, and income redistribution: An empirical test with the required data. European Journal of Political Economy, 16(3), 367–410.

Oxoby, R. J., & Spraggon, J. (2008). Mine and yours: Property rights in dictator games. Journal of Economic Behavior & Organization, 65(3), 703–713.

Phelps, E. S. (1972). The statistical theory of racism and sexism. The American Economic Review, 62(4), 659–661.

Rey-Biel, P., Sheremeta, R. M., & Uler, N. (2015). When income depends on performance and luck: The effects of culture and information on giving. Available at SSRN 2617382.

Ruffle, B. J. (1998). More is better, but fair is fair: Tipping in dictator and ultimatum games. Games and Economic Behavior, 23(2), 247–265.

Rutström, E. E., & Williams, M. B. (2000). Entitlements and fairness: An experimental study of distributive preferences. Journal of Economic Behavior & Organization, 43(1), 75–89.

Sandmo, A. (1983). Progressive taxation, redistribution, and labor supply. The Scandinavian Journal of Economics, 311–323.

Steven Beckman, R., Gregory DeAngelo, W. J. S., & Wang, N. (2014). Is the veil of ignorance gender-neutral? Reference dependence and sexual selection in decisions toward risk and inequality. Working paper.

Tirole, J., & Bénabou, R. (2006). Belief in just world and redistributive politics. The Quarterly Journal of Economics, 121(2), 699–746.

Tyran, J.-R., & Sausgruber, R. (2006). A little fairness may induce a lot of redistribution in democracy. European Economic Review, 50(2), 469–485.

Author information

Authors and Affiliations

Corresponding author

Additional information

The opinions expressed in this manuscript belong to the authors and do not represent official positions of the Federal Reserve Board or the Federal Reserve System. We would like to thank Mariana Blanco for her kind assistance with this paper. In addition, we thank Christopher Anderson, Darcy Covert, Xinxin Lyu, Mike Manzi, Maria Morales-Loaiza, Eitan Scheinthal, Tom Tagliaferro, Isabelle Vrod, Kenneth Weitzman, and Qinyue Yu for excellent research assistance. Finally, we thank the editors, two anonymous referees, Kelsey Jack, Pablo Querubin, Debraj Ray, and Gregory DeAngelo for their helpful comments and suggestions. This research was supported in part by funds from the Tufts University Faculty Research Awards Committee.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Gee, L.K., Migueis, M. & Parsa, S. Redistributive choices and increasing income inequality: experimental evidence for income as a signal of deservingness. Exp Econ 20, 894–923 (2017). https://doi.org/10.1007/s10683-017-9516-5

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-017-9516-5