Abstract

A well-known result from the theory of finitely repeated games states that if the stage game has a unique equilibrium, then there is a unique subgame perfect equilibrium in the finitely repeated game in which the equilibrium of the stage game is being played in every period. Here I show that this result does in general not hold anymore if players have social preferences of the form frequently assumed in the recent literature, for example in the inequity aversion models of Fehr and Schmidt (Quartely Journal of Economics 114:817–868, 1999) or Bolton and Ockenfels (American Economic Review 100:166–193, 2000). In fact, repeating the unique stage game equilibrium may not be a subgame perfect equilibrium at all. This finding should have relevance for all experiments with repeated interaction, whether with fixed, random or perfect stranger matching.

Similar content being viewed by others

Notes

See also Engelmann and Strobel (2004) for an extensive discussion.

In other words, the game is now a stochastic game and not a repeated game. This insight seems to be some kind of folk wisdom in the literature. It has also been pointed out recently in Hu (2010). Nevertheless, for brevity I will use the term “T-period repeated game” to mean a game form of a repeated game even if the preferences do not satisfy separability (cf. Osborne and Rubinstein, 1994, Definition 137.1).

With slight modifications the analysis can also be applied to extensive form stage games with a unique SPE. See the remark below.

In experiments, sometimes a third way of paying subjects is used, namely paying one randomly chosen period. In this case, one has to make assumptions about how social preferences interact with risk (see Trautmann, 2009 and Fudenberg and Levine, 2012). The current discussion applies only if social preferences are assumed to depend on the expected value of the resulting lottery (as in Trautmann’s “process Fehr-Schmidt” model).

As Osborne and Rubinstein (1994, Definition 137.1) point out, the crucial assumption for the standard result is “weak separability” of preferences.

There is nothing unusual about repeated games with an extensive form game as the stage game (see e.g. Rubinstein and Wolinsky, 1995).

This model is a simplified version of the one used in Huck et al. (2001).

Absolute (or perfect) stranger matching uses the restriction that a subject will never be matched with another subject more than once.

If players are not informed about others’ decisions, they have to form beliefs about them which makes the analysis more complicated.

References

Balafoutas, L. Kocher, M., Putterman, L., & Sutter, M. (2010). Equality, equity and incentives: an experiment (IZA Discussion Paper No. 5204).

Brown, M., Falk, A., & Fehr, E. (2004). Relational contracts and the nature of market interactions. Econometrica, 72(3), 747–780.

Bolton, G. E., & Ockenfels, A. (2000). A theory of equity, reciprocity and competition. American Economic Review, 100, 166–193.

Cabrales, A., Nagel, R., & Rodriguez Mora, J. V. (2012). It is Hobbes, not Rousseau: an experiment on voting and redistribution. Experimental Economics, 15(2), 278–308.

Charness, G., & Rabin, M. (2002). Understanding social preferences with simple tests. Quarterly Journal of Economics, 117, 817–869.

Cohn, A., Fehr, E., Herrmann, B., Schneider, F. (2011). Social comparison in the workplace: evidence from a field experiment (IZA Discussion Paper No. 5550).

Duffy, J., & Muñoz-García, F. (2012). Patience or fairness? Analyzing social preferences in repeated games. Games, 3(1), 56–77.

Engelmann, D., & Strobel, M. (2004). Inequality aversion, efficiency, and maximin preferences in simple distribution experiments. American Economic Review, 94(4), 857–869.

Fehr, E., & Schmidt, K. M. (1999). A theory of fairness, competition and cooperation. Quarterly Journal of Economics, 114, 817–868.

Fudenberg, D., & Levine, D. K. (2012). Fairness, risk preferences and independence: impossibility theorems. Journal of Economic Behavior & Organization, 81, 606–612.

Hu, W. (2010). Inequity aversion preference in the dynamic public good game (Mimeo), University of Toulouse.

Huck, S., Müller, W., & Normann, H. T. (2001). Stackelberg beats Cournot: on collusion and efficiency in experimental markets. Economic Journal, 111, 749–765.

Masclet, D., & Villeval, M.-C. (2008). Punishment, inequality, and welfare: a public good experiment. Social Choice and Welfare, 31, 475–502.

Osborne, M., & Rubinstein, A. (1994). A course in game theory. Cambridge: MIT Press.

Rabin, M., & Weizsäcker, G. (2009). Narrow bracketing and dominated choices. American Economic Review, 99(4), 1508–1543.

Rubinstein, A., & Wolinsky, A. (1995). Remarks on infinitely repeated extensive-form games. Games and Economic Behavior, 9, 110–115.

Sousa, S. (2010). Cooperation and punishment under uncertain enforcement (CeDex Discussion Paper No. 2010-06), University of Nottingham.

Sutter, M., Haigner, S., & Kocher, M. (2010). Choosing the stick or the carrot? Endogenous institutional choice in social dilemma situations. Review of Economic Studies, 77(4), 1540–1566.

Teyssier, S. (2008). Experimental evidence on inequity aversion and self-selection between incentive contracts (GATE working paper W.P. 08-21).

Trautmann, S. T. (2009). A tractable model of process fairness under risk. Journal of Economic Psychology, 30(5), 803–813.

Tversky, A., & Kahneman, D. (1981). The framing of decisions and the psychology of choice. Science, 211, 453–458.

Author information

Authors and Affiliations

Corresponding author

Additional information

I thank Christoph Brunner, David Cooper, John Duffy, Dirk Engelmann, Nikos Nikiforakis, Axel Ockenfels, Klaus Schmidt, and participants of the ESA conference in Chicago for discussions. Three referees and the editor provided very useful comments.

Appendix

Appendix

Proof of the Claim

We can analyze the game as a game between P1 and P2 since these are the only active players (although the payoffs of R1 and R2 do matter when P1 and P2 have social preferences).

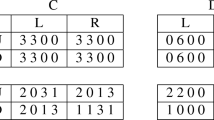

After the first period, the following 9 subgames can originate, \((a_{1}^{1},a_{2}^{1})\in \{(100,0),(100,100), (0,100),(0,0),(100,40),(40,100),(0,40),(40,0),(40,40)\}\), where \(a_{i}^{t}\) denote the amounts that proposer i keeps for himself in period t.

To prove that a SPE exists in which P1 and P2 keep 100 in the first period and 0 in the second, we consider first the subgame (100,100). The (overall) Fehr–Schmidt utilities for the actions \(a_{i}^{2}\in \{0,40,100\}\) in this subgame are given by the following matrix (since the payoff matrix is symmetric, only the utilities of P1 are shown).

P2 | ||||

|---|---|---|---|---|

0 | 40 | 100 | ||

P1 | 0 | 100 | \(100-20\beta -\frac{40}{3}\alpha\) | \(100-\frac{100}{3}\beta -\frac{100}{3}\alpha\) |

40 | 140−60β | \(140-\frac{200}{3}\beta\) | 140−80β−20α | |

100 | \(200-\frac{400}{3}\beta\) | 200−140β | \(200-\frac{400}{3}\beta\) | |

Thus, (0, 0) is a Nash equilibrium in this subgame for β≥3/4. It can be checked that P1 can obtain no higher utility in any other subgame. Thus for P1 and P2 to keep 100 in the first period and 0 in the second is a SPE.

To show that the repetition of (40,40) is not SPE for some parameters, consider the subgame (40,40) which results in the following Fehr-Schmidt utility matrix.

P2 | ||||

|---|---|---|---|---|

0 | 40 | 100 | ||

P1 | 0 | \(40-\frac{200}{3}\alpha\) | 40−60α | \(40-\frac{200}{3}\alpha\) |

40 | \(80-\frac{40}{3}\beta -20\alpha\) | 80 | \(80-\frac{40}{3}\beta -20\alpha\) | |

100 | \(140-\frac{200}{3}\beta\) | \(140-\frac{220}{3}\beta\) | \(140-\frac{200}{3}\beta\) | |

While (100, 100) is always a Nash equilibrium of this subgame, (40, 40) is a Nash equilibrium only for \(80\geq 140-\frac{220}{3}\beta\), or β≥9/11. Hence, for β<9/11, the repetition of the stage game Nash equilibrium is not a SPE.

Together these facts imply that the repetition of (40,40) is never the unique SPE. □

Rights and permissions

About this article

Cite this article

Oechssler, J. Finitely repeated games with social preferences. Exp Econ 16, 222–231 (2013). https://doi.org/10.1007/s10683-012-9336-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-012-9336-6