Abstract

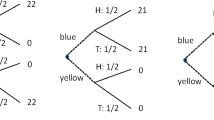

We present an experimental design where uncertainty is generated from the advice of experts with conflicts of interest. In this experiment clients are faced with a variant of a multi-armed bandit problem with a random end-time. On the known arm (the “task screen”), clients can earn a certain payment per completion of a decoding task. However, clients may also opt for the unknown arm where they earn an uncertain amount if they end the experiment on this “expert screen”. The amount is uncertain to the clients because the value is being communicated through an “expert” with conflicted incentives. A control session provides for direct transmission of the value to the clients. Our results show that ambiguity aversion is alive-and-well in this environment. Also, when we vary the wage rate on the known arm we find that higher opportunity cost clients are less likely to heed the advice of conflicted experts.

Similar content being viewed by others

References

Ahn, D., Choi, S., Gale, D., & Kariv, S. (2009). Estimating ambiguity aversion in a portfolio choice experiment (Working Paper). University of California, Berkeley.

Anderson, C. M. (2001). Behavioral models of strategies in multi-armed bandit problems. PhD Dissertation, California Institute of Technology.

Camerer, C. (1995). Individual decision making. In J. H. Kagel & A. E. Roth (Eds.), The handbook of experimental economics. Princeton: Princeton University Press.

Chow, C. C., & Sarin, R. (2001). Comparative ignorance and the Ellsberg paradox. The Journal of Risk and Uncertainty, 22, 129–139.

Chow, C. C., & Sarin, R. (2002). Known, unknown, and unknowable uncertainties. Theory and Decision, 52, 127–138.

DeGroot, M. (1970). Optimal statistical decisisons. New York: McGraw-Hill.

Dulleck, U., & Kerschbamer, R. (2006). On doctors, mechanics, and computer specialists: the economics of credence goods. Journal of Economic Literature, 44, 5–42.

Dulleck, U., Kerschbamer, R., & Sutter, M. (2008). The experimental economics of credence goods (Working Paper). Queensland University.

Ellsberg, D. (1961). Risk, ambiguity, and the savage axioms. The Quarterly Journal of Economics, 75, 643–669.

Engel, R. P. (2007). Essay on risk and incentives. PhD Dissertation, Florida State University, Department of Economics.

Falk, A., & Fehr, E. (2003). Why labour market experiments? Labour Economics, 10, 399–406.

Fischbacher, U. (2007). z-tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10, 171–178.

Fox, C. R., & Tversky, A. (1995). Ambiguity aversion and comparative ignorance. The Quarterly Journal of Economics, 110, 585–603.

Greiner, B. (2003). An online recruitment system for economic experiments. In K. Kremer & V. Macho (Eds.), Forschung und Wissenschaftliches Rechnen. Gottingen: Ges. für Wiss., Datenverabeitung.

Gilboa, I., & Schmeidler, D. (1989). Maxmin expected utility with non-unique prior. Journal of Mathematical Economics, 18, 141–153.

Hu, Y., Kayaba, Y., & Shum, M. (2010). Non-parametric learning rules from bandit experiments: the eyes have it (Caltech Social Sciences Working Paper #1326). Pasadena: California Institute of Technology.

Klibanoff, P., Marinacci, M., & Mukerji, S. (2005). A smooth model of decision making under ambiguity. Econometrica, 73, 1849–1892.

Luce, R. D., & Raiffa, H. (1957). Games and decisions. New York: Wiley.

Maccheroni, F., Marinacci, M., & Rustichini, A. (2006). Ambiguity aversion, robustness, and the variational representation of preferences. Econometrica, 74, 1447–1498.

Moore, D A., Cain, D. M., Loewenstein, G., & Bazerman, M. H. (2005). Conflicts of interest: challenges and solutions in business, law, medicine, and public policy. New York: Cambridge University Press.

Moore, E., & Eckel, C. (2006). Measuring ambiguity aversion (Working Paper). University of Texas at Dallas.

Nelson, M. W. (2005). A review of experimental and archival conflicts-of-interest research in accounting. In Moore et al. (Eds.), Conflicts of interest: challenges and solutions in business, law, medicine, and public policy. New York: Cambridge University Press.

Plott, C. R., & Wilde, L. L. (1982). Professional diagnosis vs. self-diagnosis: an experimental examination of some features of markets with uncertainty. In V. L. Smith (Ed.) Research in experimental economics (Vol. 2). Greenwich: JAI Press.

Sarin, R. K., & Weber, M. (1993). Effects of ambiguity in market experiments. Management Science, 39, 602–615.

Thompson, D. (1993). Understanding financial conflict of interest. The New England Journal of Medicine, 329, 573–576.

Traeger, C. P. (2010). Subjective risk, confidence, and ambiguity (CUDAIRE Working Paper, No. 1103). Department of Agricultural and Resource Economics, University of California, Berkeley.

Author information

Authors and Affiliations

Corresponding author

Electronic Supplementary Material

Below are the links to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Norton, D.A., Isaac, R.M. Experts with a conflict of interest: a source of ambiguity?. Exp Econ 15, 260–277 (2012). https://doi.org/10.1007/s10683-011-9299-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-011-9299-z