Abstract

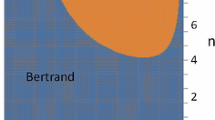

Recent theoretical research on oligopolistic competition suggests that under certain conditions prices increase with the number of competing firms. However, this counterintuitive result is based on comparative-static analyses which neglect the importance of dynamic strategies in naturally-occurring markets. When firms compete repeatedly, supra-competitive prices can become sustainable but this is arguably more difficult when more firms operate in the market. This paper reports the results of laboratory experiments investigating pricing behavior in a setting in which (static) theory predicts the counterintuitive number effect. Under a random matching protocol, which retains much of the one-shot nature of the model, the data corroborates the game-theoretic prediction. Under fixed matching duopolists post substantially higher prices, whereas prices in quadropolies remain very similar. As a result, the predicted effect is no longer observed, and towards the end the reverse effect is observed.

Similar content being viewed by others

References

Abreu, D. (1986). Extremal equilibria of oligopolistic supergames. Journal of Economic Theory, 39, 191–225.

Abreu, D. (1988). On the theory of infinitely repeated games with discounting. Econometrica, 56, 383–396.

Andreoni, J., & Croson, R. (2007, forthcoming). Partners versus strangers: random rematching in public goods experiments. In C. Plott & V. L. Smith (Eds.), Handbook of experimental economics results. Amsterdam: Elsevier.

Benjamini, Y., & Hochberg, Y. (1995). Controlling the false discovery rate: a practical and powerful approach to multiple testing. Journal of the Royal Statistical Society (B), 57(1), 289–300.

Chamberlin, E. H. (1929). Duopoly: value where sellers are few. Quarterly Journal of Economics, 44, 63–100.

Davis, D. D. (2006). Pure numbers effects and market power: new results from near continuous posted-offer markets. Working paper, Virginia Commonwealth University.

Deck, C. A., & Wilson, B. J. (2003). Automated pricing rules in electronic posted offer markets. Economic Inquiry, 41(2), 208–223.

Deck, C. A., & Wilson, B. J. (2006). Tracking customer search to price discriminate. Economic Inquiry, 44(2), 280–295.

Dufwenberg, M., & Gneezy, U. (2000). Price competition and market concentration: an experimental study. International Journal of Industrial Organization, 18, 7–22.

Friedman, J. W. (1971). A non-cooperative equilibrium for supergames. Review of Economic Studies, 38, 1–12.

Holt, C. A. (1985). An experimental test of the consistent-conjectures hypothesis. American Economic Review, 75, 314–325.

Huck, S., Normann, H.-T., & Oechssler, J. (2004). Two are few and four are many: number effects in experimental oligopolies. Journal of Economic Behavior & Organization, 53, 435–446.

Isaac, R. M., & Reynolds, S. (2002). Two or four firms: does it matter? In C. A. Holt & R. M. Isaac (Eds.), Research in experimental economics : Vol. 9. Experiments investigating market power. Amsterdam: Elsevier.

Janssen, M. C. W., & Moraga-González, J. L. (2004). Strategic pricing, consumer search and the number of firms. Review of Economic Studies, 71, 1089–1118.

Kreps, D., Milgrom, P., Roberts, J., & Wilson, R. (1982). Rational cooperation in the finitely repeated prisoners’ dilemma. Journal of Economic Theory, 27, 245–252.

Morgan, J., Orzen, H., & Sefton, M. (2006). An experimental study of price dispersion. Games and Economic Behavior, 54, 134–158.

Normann, H. T., & Wallace, B. (2006). The impact of the termination rule on cooperation in a prisoner’s dilemma experiment. Working paper, Royal Holloway and UCL.

Rosenthal, R. W. (1980). A model in which an increase in the number of sellers leads to a higher price. Econometrica, 48, 1575–1579.

Satterthwaite, M. A. (1979). Consumer information, equilibrium industry price, and the number of sellers. Bell Journal of Economics, 10, 483–502.

Selten, R., & Stoecker, R. (1986). End behavior in sequences of finite prisoner’s dilemma supergames—A learning theory approach. Journal of Economic Behavior & Organization, 7, 47–70.

Stiglitz, J. E. (1987). Competition and the number of firms in a market: are duopolies more competitive than atomistic markets? Journal of Political Economy, 95, 1041–1061.

Varian, H. R. (1980). A model of sales. American Economic Review, 70, 651–659.

Author information

Authors and Affiliations

Corresponding author

Electronic Supplementary Material

Rights and permissions

About this article

Cite this article

Orzen, H. Counterintuitive number effects in experimental oligopolies. Exper Econ 11, 390–401 (2008). https://doi.org/10.1007/s10683-007-9174-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-007-9174-0