Abstract

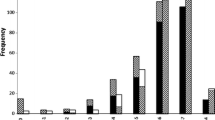

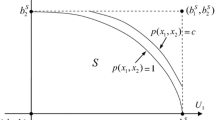

We consider a sequential two-party bargaining game with uncertain information transmission. When the first mover states her demand she does only know the probability with which the second mover will be informed about it. The informed second mover can either accept or reject the offer and payoffs are determined as in the ultimatum game. Otherwise the uninformed second mover states his own demand and payoffs are determined as in the Nash demand game. In the experiment we vary the commonly known probability of information transmission. Our main finding is that first movers’ and uninformed second movers’ demands adjust to this probability as qualitatively predicted, that is, first movers’ (uninformed second movers’) demands are lower (higher) the lower the probability of information transmission.

Similar content being viewed by others

References

Bagwell, K. (1995). Commitment and observability in games. Games and Economic Behavior, 8, 271–280.

Cabrales, A., García-Fontes, W., & Motta, M. (2000). Risk dominance selects the leader: An experimental analysis. International Journal of Industrial Organization, 18, 137–162.

Chakravorti, B., & Spiegel, Y. (1993). Commitment under imperfect observability: Why it is Better to Have Followers Who Know That They Don’t Know Rather Than Those Who Don’t Know That They Don’t Know. Bellcore Economics Discussion Paper No. 103.

Charness, G. (2000). Self-serving cheap talk and credibility: a test of aumann’s conjecture. Games and Economic Behavior, 33, 177–194.

Fershtman, C., Judd, K. L., & Kalai, E. (1991). Observable contracts : Strategic delegation and cooperation. International Economic Review, 32, 551–559.

Fischbacher, U. (1999). z-Tree: Zurich toolbox for readymade economic experiments–-experimenter’s manual. Working Paper, University of Zurich.

Güth, W. (1995). On ultimatum bargaining experiments: A personal review. Journal of Economic Behavior & Organization, 37, 329–344.

Güth, W., Müller, W., & Spiegel, Y. (2001). Noisy leadership: An experimental approach. Working Paper, Tel Aviv University.

Harsanyi, J. (1995). A new theory of equilibrium selection for games with complete information. Games and Economic Behavior, 8, 91–122.

Harsanyi, J. C., & Selten, R. (1988). A general theory of equilibrium selection in games. Cambridge, Mass. and London: MIT Press.

Huck, S., & Müller, W. (2000). Perfect versus imperfect observability: An experimental test of Bagwell’s result. Games and Economic Behavior, 31, 174–190.

Kandori, M., Mailath, G. J., & Rob, R. (1993). Learning, mutation, and long run equilibria in games. Econometrica, 61, 29–56.

Laffont, J. J., & Tirole, J. (1993). A theory of incentives in procurement and regulation. Cambridge, MA: The MIT Press.

Morgan, J., & Vardy, F. (2004). An experimental study of commitment and observability in stackelberg games. Games and Economic Behavior, 49, 401–423.

Nash, J. (1950). The bargaining problem. Econometrica, 18, 155–162.

Rapoport, A. (1997). Order of play in strategically equivalent games in extensive form. International Journal of Game Theory, 26, 113–136.

Roth, A. E. (1995). Bargaining experiments. In John H. Kagel and Alvin E. Roth (Eds.), The handbook of experimental economics. Princeton University Press.

Rubinstein A. (1989). The electronic mail game: Strategic behavior under ‘almost common knowledge’. American Economic Review, 79, 385–391.

Straub, P. (1995). Risk dominance and coordination failures in static games. Quarterly Review of Economics and Finance, 35, 339–363.

Van Damme, E., & Hurkens, S. (1997). Games with imperfectly observable commitment. Games and Economic Behavior, 21, 282–308.

Van Huyck, J. B., Battalio, R. C., & Beil, R. O. (1990). Tacit coordination games, strategic uncertainty, and coordination failure. American Economic Review, 80, 234–248.

Van Huyck, J. B., Battalio, R. C., & Beil, R. O. (1991). Strategic uncertainty, equilibrium selection, and coordination failure in average opinion games. Quarterly Journal of Economics, 106, 885–911.

Young, H. P. (1993). The evolution of conventions. Econometrica, 61, 57–84.

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL Classification C72 · C78 · C92

Rights and permissions

About this article

Cite this article

Fischer, S., Güth, W., Müller, W. et al. From ultimatum to Nash bargaining: Theory and experimental evidence. Exp Econ 9, 17–33 (2006). https://doi.org/10.1007/s10683-006-1468-0

Received:

Revised:

Accepted:

Issue Date:

DOI: https://doi.org/10.1007/s10683-006-1468-0