Abstract

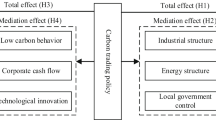

As an important environmental regulation policy, carbon emissions trading (CET) undoubtedly brings significant pressure to enterprises. However, its impact on corporate investment, particularly its financialization tendency, has been rarely studied. Based on panel data of listed companies and the difference-in-differences (DID) model, this study examines the impact of CET on corporate financialization and its mechanism. The results show that after the short-run profit pursuing motivations dominate and promote corporate financialization. Heterogeneity analysis and mechanism testing results indicate that the strengthening effect is mainly manifested in non-state-owned enterprises, small and medium-sized enterprises, polluting enterprises, and high-profit enterprises. In addition, quota auctions and government intervention can significantly suppress the corporate financialization. Therefore, the government needs to fully consider the influence of corporate heterogeneity and carry out differentiated CET policies. The trading system should be adjusted promptly and scientifically according to the actual circumstances. At the same time, the government can consider adopting measures such as subsidies to alleviate the financing problems of enterprises, thereby encouraging technological innovation and promoting sustainable development.

Similar content being viewed by others

Data availability

The data used have been extracted from publicly accessible databases, as indicated in the manuscript.

Notes

Chairman Xi Jinping, in the third point of his speech, stated, “China will adopt more robust policy measures to expand the scope of national autonomous contributions.” Furthermore, specific timelines for achieving carbon peaking and carbon neutrality were proposed.

In Chap. 10, Sect. 1 of the report, titled “Accelerating the Green Transformation of Development Patterns.”

References

Abbasi, S., & Choukolaei, H. A. (2023). A systematic review of green supply chain network design literature focusing on carbon policy. Decision Analytics Journal : 100189.

Abbasi, S., Daneshmand-Mehr, M., & Ghane Kanafi, A. (2023a). Green closed-loop supply chain network design during the coronavirus (COVID-19) pandemic: A case study in the Iranian Automotive Industry (Vol. 28, pp. 69–103). Environmental Modeling & Assessment.

Abbasi, S., Sıcakyüz, Ç., & Erdebilli, B. (2023b). Designing the home healthcare supply chain during a health crisis. Journal of Engineering Research : 100098.

Broberg, T., Marklund, P. O., Samakovlis, E., & Hammar, H. (2013). Testing the Porter hypothesis: The effects of environmental investments on efficiency in Swedish industry. Journal of Productivity Analysis, 40, 43–56.

Cai, X., Lu, Y., Wu, M., & Yu, L. (2016). Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. Journal of Development Economics, 123, 73–85.

Cao, X., & Zhang, Y. (2023). Environmental regulation, foreign investment, and green innovation: A case study from China. Environmental Science and Pollution Research, 30, 7218–7235.

Cheng, Z., & Yu, X. (2023). Can central environmental protection inspection induce corporate green technology innovation? Journal of Cleaner Production, 387, 135902.

Da Luz, A. R., Bittencourt, J. T., & Taioka, T. (2015). Wealth financialization: Operating profit as Conditioning of Financial revenue. Journal of Financial Innovation, 1, 1–5.

Dai, Y., Li, N., Gu, R., & Zhu, X. (2018). Can China’s carbon emissions trading rights mechanism transform its manufacturing industry? Based on the perspective of enterprise behavior. Sustainability, 10, 2421.

Demir, F. (2009). Financial liberalization, private investment and portfolio choice: Financialization of real sectors in emerging markets. Journal of Development Economics, 88, 314–324.

Dong, F., Dai, Y., Zhang, S., Zhang, X., & Long, R. (2019). Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Science of the Total Environment, 653, 565–577.

Fang, G., Lu, L., Tian, L., & Yin, H. (2020). Research on the influence mechanism of carbon trading on new energy—a case study of ESER system for China. Physica A: Statistical Mechanics and its Applications, 545, 123572.

Han, J., Miao, J., Du, G., Yan, D., & Miao, Z. (2021). Can market-oriented reform inhibit carbon dioxide emissions in China? A new perspective from factor market distortion. Sustainable Production and Consumption, 27, 1498–1513.

Harju, J., Kosonen, T., Laukkanen, M., & Palanne, K. (2022). The heterogeneous incidence of fuel carbon taxes: Evidence from station-level data. Journal of Environmental Economics and Management, 112, 102607.

Hussain, J., & Lee, C. C. (2022). A green path towards sustainable development: Optimal behavior of the duopoly game model with carbon neutrality instruments. Sustainable Development.

Jiang, Y., Guo, C., & Wu, Y. (2022). Does digital finance improve the green investment of Chinese listed heavily polluting companies? The perspective of corporate financialization. Environmental Science and Pollution Research, 29, 71047–71063.

Lanoie, P., Patry, M., & Lajeunesse, R. (2008). Environmental regulation and productivity: Testing the porter hypothesis. Journal of Productivity Analysis, 30, 121–128.

Leiter, A. M., Parolini, A., & Winner, H. (2011). Environmental regulation and investment: Evidence from European industry data. Ecological Economics, 70, 759–770.

Li, X., Zhang, G., & Qi, Y. Differentiated environmental regulations and enterprise innovation: The moderating role of government subsidies and executive political experience. Environment Development and Sustainability 2023: 1–31.

Liu, Y., Liu, J., & Zhang, L. (2023). Enterprise financialization and R&D innovation: A case study of listed companies in China. Electron Res Arch, 31, 2447–2471.

Lo, K., Li, H., & Wang, M. (2015). Energy conservation in China’s energy-intensive enterprises: An empirical study of the ten-Thousand enterprises Program. Energy for Sustainable Development, 27, 105–111.

Marcus, A., Geffen, D. A., & Sexton, K. (2002). Business–Government Cooperation in Environmental decision-making. Corporate Environmental Strategy, 9, 345–355.

Orhangazi, Ö. (2008). Financialisation and capital accumulation in the non-financial corporate sector: A theoretical and empirical investigation on the US economy: 1973–2003. Cambridge Journal of Economics, 32, 863–886.

Palmer, K., Oates, W. E., & Portney, P. R. (1995). Tightening environmental standards: The benefit-cost or the no-cost paradigm? Journal of Economic Perspectives, 9, 119–132.

Peng, H., Qi, S., & Cui, J. (2021a). The environmental and economic effects of the carbon emissions trading scheme in China: The role of alternative allowance allocation. Sustainable Production and Consumption, 28, 105–115.

Peng, J., Xie, R., Ma, C., & Fu, Y. (2021b). Market-based environmental regulation and total factor productivity: Evidence from Chinese enterprises. Economic Modelling, 95, 394–407.

Qi, Y., Yuan, M., & Bai, T. (2023). Where will corporate capital flow to? Revisiting the impact of China’s pilot carbon emission trading system on investment. Journal of Environmental Management, 336, 117671.

Shen, J., Tang, P., & Zeng, H. (2020). Does China’s carbon emission trading reduce carbon emissions? Evidence from listed firms. Energy for Sustainable Development, 59, 120–129.

ShiYu, L., MengDie, Z., San Ong, T., & Law, S. H. (2023). Environmental regulation, technological innovation and firm performance-empirical evidence from Yangtze River Delta Region, China. Central European Management Journal, 31, 197–217.

Sui, B., & Yao, L. (2023). The impact of digital transformation on corporate financialization: The mediating effect of green technology innovation. Innovation and Green Development, 2, 100032.

Tang, K., Qiu, Y., & Zhou, D. (2020). Does command-and-control regulation promote green innovation performance? Evidence from China’s industrial enterprises. Science of the Total Environment, 712, 136362.

Wang, Y., & Shen, N. (2016). Environmental regulation and environmental productivity: The case of China. Renewable and Sustainable Energy Reviews, 62, 758–766.

Yang, S. (2023). Carbon emission trading policy and firm’s environmental investment. Finance Research Letters : 103695.

Yao, R., Fei, Y., Wang, Z., Yao, X., & Yang, S. (2023). The impact of China’s ETS on corporate Green Governance based on the perspective of corporate ESG performance. International Journal of Environmental Research and Public Health, 20, 2292.

Zhang, Y., Wang, J., Chen, J., & Liu, W. (2023). Does environmental regulation policy help improve business performance of manufacturing enterprises? Evidence from China. Environment Development and Sustainability, 25, 4335–4364.

Zhao, Y., & Su, K. (2022). Economic policy uncertainty and corporate financialization: Evidence from China. International Review of Financial Analysis, 82, 102182.

Zhou, J., Ong, T. S., Mastellone, L., & Di Vaio, A. (2023). The effect of disciplinary inspection commission participation on the financing constraints of Chinese state-owned enterprises: A circular economy perspective. Production & Manufacturing Research, 11, 2214811.

Zhu, G., Hu, W., Peng, T., & Xue, C. (2021). The influence of corporate financialization on asymmetric cost behavior: Weakening or worsening. Journal of Business Economics and Management, 22, 21–41.

Acknowledgements

The National Natural Science Foundation of China [Grant Nos. 71991482, 42001257] and the Planning Project of Philosophy and Social Sciences in Shanxi Province [Grant No. 2021YJ021] provide funding for this research.

Author information

Authors and Affiliations

Contributions

J.S: Conceptualization, Methodology, Writing-Original Draft, Writing-Reviewing and Editing. M.X: Data curation and Investigation. X.L: Conceptualization, Methodology and Writing-Reviewing. Y.Z: Data curation and Methodology.

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Shen, J., Xu, M., Liu, X. et al. Active adaptation or short-run profit pursuing? Carbon emissions trading and corporate financialization: evidence from Chinese listed companies. Environ Dev Sustain (2024). https://doi.org/10.1007/s10668-024-04708-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10668-024-04708-0