Abstract

Climate change research with the economic methodology of cost–benefit analysis is challenging because of valuation and ethical issues associated with the long delays between CO2 emissions and much of their potential damages, typically of several centuries. The large uncertainties with which climate change impacts are known today and the possibly temporary nature of some envisaged CO2 abatement options exacerbate this challenge. For example, potential leakage of CO2 from geological reservoirs, after this greenhouse gas has been stored artificially underground for climate control reasons, requires an analysis in which the uncertain climatic consequences of leakage are valued over many centuries. We here present a discussion of some of the relevant questions in this context and provide calculations with the top–down energy-environment-economy model DEMETER. Given the long-term features of the climate change conundrum as well as of technologies that can contribute to its solution, we considered it necessary extending DEMETER to cover a period from today until the year 3000, a time span so far hardly investigated with integrated assessment models of climate change.

Similar content being viewed by others

1 Introduction

Though much is left to be understood about the technical, economic, political, and public acceptance dimensions of CO2 capture and storage (CCS), it may become a major mechanism to curb global CO2 emissions. According to the Special Report on CCS (SR-CCS) of the Intergovernmental Panel on Climate Change (IPCC), it is expected that CO2 artificially injected underground can remain securely stored during at least centuries [13]. Even while the probability of long-term CO2 storage integrity is deemed very high, it cannot be excluded that, e.g. because of unforeseen effects, CO2 may once leak from geological reservoirs to the atmosphere. In that case, CCS would constitute a delay of CO2 emissions rather than a genuine reduction option (see e.g. [35, 37]). This problem is serious, as the use of CCS itself requires energy—applied to standard electricity generation, for example, it involves a substantial part of the energy content of the fossil fuels used. In other words, more fossil fuels are required to run a fossil-based power plant equipped with CCS in order to produce the same net output of electricity as a conventional non-CCS plant. Hence, with CCS application, more CO2 is captured and stored underground than the amount of avoided emissions. The climatic consequences of slow CCS-associated CO2 leakage may thus be grave, as are possibly the economic implications.

Studying the long term through the discipline of economics is challenging. The question addressed in this paper is therefore: if stored CO2 would gradually leak over a time frame of 100 to 1,000 years, how would we need to evaluate this leakage in an economic framework? In an earlier publication, we analyzed the economics of CCS with a focus on non-trivial seepage patterns, by contrasting an exponential with a hump-shaped leakage model over a relatively short time frame of about 100 years [34]. In the present article, we analyze more in depth the underlying methodology and discuss the issues that arise with cost–benefit analysis of CCS characterized by CO2 leakage in a setting that considers both the very long term and aspects of uncertainty. In this section, we first make a number of preliminary observations, whereas in Section 2, we describe the model we used for our analysis and the way in which we adapted it for this paper’s purposes. In Section 3, we report our main findings in terms of a series of model run outcomes, while in Section 4, we summarize our main conclusions.

The presence of oil, natural gas, and CO2 trapped in geological formations demonstrates that reservoir seals exist that are able to contain fossil fuels and CO2 underground over time scales of millions of years. Still, it is not unimaginable that CO2 artificially stored underground slowly leaks from its geological medium and gradually migrates to the aboveground environment. Especially for storage options other than depleted oil and gas fields, such as aquifers and coal seams, aspects of long-term storage effectiveness remain for the moment uncertain. A large number of sites exist where one expected to find oil or natural gas, but where no such resources proved available, potentially as a result of an insufficient quality of geological cap-rock material. At many places on Earth, large quantities of oil and natural gas may once have been stored underground, but that, in the absence of appropriate containment layers, eventually seeped away to be absorbed in the aboveground biosphere or atmosphere [2]. Hence, it may not be guaranteed that the formations employed for artificial CO2 storage retain integrity forever, possibly for depleted oil and natural gas fields, but especially for other types of geological reservoirs (see e.g. also [16]). Plenty of natural examples exist, as well as instances related to human activity including exploration, mining, production, and storage of natural resources, which involved either low-speed modest seepage or sudden large-scale leakage of liquid or gaseous substances [17–19].Footnote 1

Indicative figures for possible CO2 leakage from the SR-CCS of the IPCC [13] suggest that for carefully selected CO2 storage sites annual leakage rates are very likely to remain below 0.1%/year. It could prove difficult, however, to select CO2 storage sites for which one can guarantee such low leakage rates, let alone a 100% storage efficiency, e.g. due to the high heterogeneity between different types of geological storage formations. Also, if more stringent limitations appear to exist than expected with respect to CO2 storage site selection capabilities, or management proves more intricate or insufficient during storage operation, leakage rates of 0.1%/year or even 1%/year may not be totally excludable. It has been argued that 1%/year CO2 leakage is unacceptable from a global climate point of view, while a 0.1%/year leakage rate may perhaps be permissible (see e.g. [35] and references therein). At a 1%/year CO2 leakage rate a given quantity of geologically stored CO2 will have reduced to 37% of that amount after 100 years, whereas 90% of that quantity is still stored underground after a century for a storage medium characterized by a 0.1%/year leakage rate. Given that climate change is a problem stretching over at least the forthcoming centuries, one concludes that in the 1%/year leakage case CCS clearly becomes an ineffective emissions abatement option. If a 0.1%/year leakage rate applies; however, a large share of the geologically stored CO2 remains sequestered even after the time frame of a couple of centuries, so that CCS retains much of its value as climate management technology. This simple observation is confirmed by more refined economic analyses of climate change and CCS with CO2 leakage (see [10, 29]).

In our previous paper [34], we made a concise analytical inspection of the economic problem of CO2 leakage as associated with CCS deployment, as well as a more detailed integrated assessment analysis of this issue with the top–down model DEMETER. In particular, we derived an expression for the CCS effectiveness η t :

The first part of Eq. 1 defines the CCS effectiveness as the share η t of the carbon emission price τ t that CCS operators receive for storing CO2. In other words, we define the CCS effectiveness as the marginal social value of CO2 storage, relative to the case in which the integrity of storage is perfect. The marginal value of CO2 storage is reduced by the shadow price μ t for stored CO2, and the effectiveness measure relates this to the current shadow price of emissions τ t . The second equality expresses the shadow price μ t as the net present value of the future social costs associated with the future stream of leaking CO2, corrected for the energy penalty, since a share 1 − c of the energy content of the primary fuel is required to operate the CCS process. Hence, in order to avoid one unit of CO2 through CCS implementation, one needs to capture and store 1/c units of CO2 (0 < c < 1). The third equality assumes a constant leakage rate λ, so that an amount equal to \( \left( {{{\lambda } \left/ {c} \right.}} \right){e^{{--\lambda s}}} \) will leak back to the atmosphere at every future point in time. Furthermore, the second equality assumes that carbon taxes increase exponentially at rate g, so that τ t+s = e gs τ t , and a constant interest rate r. The third equality can easily be obtained through basic mathematics. This equation helps to understand how the CCS effectiveness depends on the energy penalty (−), the leakage rate (−), the carbon price growth path (−), and the interest rate (+).Values for the effectiveness of CCS obtained by applying Eq. 1, however, do not necessarily directly translate into outcomes of our numerical simulations. We explain this in more detail in Section 2.

For our present work, we updated the model DEMETER and extended it to cover a much longer time horizon in order to connect to new insights in particularly the geoscientific arena (see also [27]). With regard to the main economics features of DEMETER, we introduced an extension until the year 2300, while for the model’s subroutines representing a reduced-form climate system, respectively, a CO2-leaking geological reservoir, we implemented an horizon that stretches as far as our modeling end-point in the year 3000. To our knowledge, it is the first time that a top–down energy-economy-environment model has been developed that covers such a long time frame—which we consider essential for studying this subject matter appropriately.Footnote 2 The length of this time span is, in addition to the modeling of uncertainty with respect to CO2 seepage phenomena, the main novelty that we proffer to the environmental modeling, assessment, and economics literature.

2 Model and Methodology

DEMETER simulates the global use of fossil fuels, non-fossil energy, and an energy technology that decarbonizes fossil fuels through the application of CCS [8]. This model, including a basic climate module and generic production and consumption behavior, is an extension of DEMETER that previously has been instrumental in the study of several other climate-related policy questions (see [5–8, 32]). Recently, DEMETER was also extended and used specifically for the purpose of studying CCS-related issues [34].

DEMETER describes a representative agent who maximizes the net present value of utility under a set of equilibrium conditions and a range of (inter alia climate-related) constraints. Solving the program involves the quantification of a combination of policy instruments and the calculation of dynamic time paths for a series of economic and energy-specific variables that together lead to an optimal aggregated and discounted overall welfare. The simulated climate change dynamics are as in the seminal DICE model, characterized by a multi-layered system that consists of an atmosphere, an upper-ocean and a lower-ocean stratum (see for the details [24]). Since DEMETER has been used in several papers already, that include extensive accounts of the adopted simulation characteristics, we restrict ourselves here to a concise presentation of its main features, mostly as related to CCS. We refer in particular to Gerlagh et al. [7] for a broad general description of the model and to Gerlagh and van der Zwaan [8] for more details on the specifications with regard to CCS.

To summarize briefly, there are four representative producers and corresponding sectors, denoted by superscripts j = C, F, N, and CCS, for the producer of the final good, the producer of energy based on fossil-fuel technology, respectively, carbon-free technology, and the producer of CCS technology. Output of the final good sector is denoted by Y C. This good is used for consumption C, investments I in all four sectors, operation and maintenance M in both energy sectors and the application of CCS technology to the fossil-fuel energy sector (see Eq. 2). Our distinction between investment costs and operation and maintenance costs is in line with the simulation of these two distinct cost components in most bottom–up energy systems models. For the latter, see e.g. Keppo and van der Zwaan [15], who present an analysis regarding CCS deployment under uncertain CO2 storage capacity with the energy systems model TIAM-ECN.

In order to describe production, DEMETER accounts for technology embodied in capital that is installed in all previous periods. It distinguishes between production that uses the vintages of previous (minus the most recent) periods on the one hand, and production that uses the newest vintage for which the capital stock has been installed in the directly preceding period on the other hand. The input and output variables (as well as prices) associated with the most recent vintage are denoted by tildes (~). Vintages are scrapped at rate δ¸ so that current activity levels are for a fraction (1 − δ) determined by previous activity, and for the complementary part (δ) by new activity; see also the dynamics described by Eqs. 6–7 below. In this way, DEMETER captures economic inertia that are important for designing and evaluating optimal climate policy (see [9]).

For every vintage, the production of the final good is based on a nested CES-function, using a capital–labor composite, \( {\tilde{Z}_t} \), and a composite measure for energy services, \( {\tilde{E}_t} \), as intermediates:

in which \( A_t^1 \) and \( A_t^2 \) are technology coefficients, and γ is the substitution elasticity between \( {\tilde{Z}_t} \) and \( {\tilde{E}_t} \). The capital–labor composite \( {\tilde{Z}_t} \) is defined as:

which expresses that the capital–labor composite has a fixed value share α for capital. New capital is by definition equal to investments made one period ahead: \( \tilde{K}_t^j = I_{{t - 1}}^j \).

We model energy production \( {\tilde{E}_t} \) through a CES-aggregate of the two energy types, generated respectively by the sectors F and N:

in which σ is the elasticity of substitution between F and N.

Energy services derived from fossil fuels can be confronted with a carbon tax levied on CO2 emissions, to which energy producers can respond by choosing to decarbonize energy supply through CCS implementation. Energy-related CO2 emissions, EnEm t , are proportional to the carbon content of fossil fuels, denoted by \( \varepsilon_t^F \). Part of energy-related CO2 emissions, CCSR, is captured through CCS technology (6). Equation 7 calculates the total flow of CO2 capture and storage activity, CCS t , for both old and new CCS technology vintages. For every ton of CO2 captured and not emitted, the amount of CO2 stored exceeds the amount of CO2 captured by a factor 1/c CCS, due to the decrease in energy efficiency by a factor c CCS as a result of CCS application. We calculate CO2 leakage trough a two-box system (as in [34]), since it is the simplest way to simulate the likely phenomenon that there will be close to zero leakage directly after injection, but that leakage occurs with an increasing rate after some specified time (typically gaining momentum decades after closure of the storage site) and that ultimately this rate gradually declines back to zero as a result of natural trapping mechanisms. In every period the stock of stored CO2, \( S_t^{\text{CCS}} \), consists of two compartments: \( S1_t^{\text{CCS}} \) and \( S2_t^{\text{CCS}} \). The first compartment increases with the flow of CCS t , while a fixed share \( \delta_1^{\text{CCS}} \) of the stored stock of CO2 leaks into the second box (8). The second box leaks to the atmosphere (9)—this secondary seepage adds to future emissions of anthropogenic CO2 (10). For the present paper, we use this leakage module with an expected average delay between storage and leakage of 100 years (high leakage) and 500 years (low leakage), respectively.

The public agent sets not only taxes to CO2 emissions but also decides on the exemption that fossil fuel users receive from paying the CO2 tax after they have complemented their fossil energy consumption with CCS. When this central agent imposes a CO2 tax, one of the possible reactions of the entire economy is a decrease in overall energy consumption. Producers can also shift from fossil fuels to carbon-free energy, or, alternatively, decarbonize fossil-based energy production through the application of CCS. The level of CO2 emissions is proportional to the consumption of fossil fuels not complemented with CCS. Like in van der Zwaan and Gerlagh [33], CO2 emissions from current fossil fuel use are complemented by additional emissions generated from geological leakage of previously stored CO2. Unlike in van der Zwaan and Gerlagh [33], however, where we assumed a constant leakage rate, we here adopt a two-layer storage model as specified above (and in [34]). Since the leakage rate is non-constant and carbon taxes do not increase at a constant rate, Eq. 1 for the effectiveness of CCS does not carry over immediately. Yet, the carbon tax and CCS exemption from this tax can, ex-post, be treated as proxies for the shadow price of CO2 and CCS effectiveness. In comparison to van der Zwaan and Gerlagh [34], for the purposes of this paper, we have made a series of modifications in order to account for the possibly very long-term effects of CO2 leakage associated with CCS.

The first modification concerns the time window over which we perform our analysis. To fully account for CO2 leakage, we extended the seepage subroutine and climate module to the year 3000. Prolonging the economic part of DEMETER equally far into the future we deem unnecessary, so that we chose to calculate the full economic equilibrium with increasing population and productivity for the years 2010–2200 (the first simulation period) only. For the next 100 years, from 2200 to 2300 (the second simulation period), we assume constant population and productivity and calculate efficient investment levels omitting the equilibrium conditions that link CO2 taxes to the use of fossil fuels, non-fossil fuels, energy savings, and CCS deployment. The main difference between the first and second period is that the latter abstracts from learning externalities. In the third (i.e. final) period, from 2300 to 3000, we only employ the climate module. An important feature, however, is that temperature changes in the last period are converted into a measure of damages included in the overall welfare function which thus affect the optimization program in the first period.

We assume that there is one representative agent, who chooses optimal taxes and partial carbon tax exemption for CCS-complemented fossil fuels in the first period, and all abatement options in the second period, to maximize public welfare:

in which W is total welfare, ρ the pure rate of time preference, C t /L t consumption per capita, and D t the induced climate change damage in units of utility. In other words, the latter constitutes a damage that does not affect the overall production level. This welfare structure can be understood as an assumption that climate damages grow proportionally with income, even when they cannot be expressed in losses of economic output.Footnote 3 To see this, notice that when D t = 0.01, welfare decreases with the same level, 0.01(1 + ρ)1–t L t , as if consumption C t decreased by 1%. We use 2% and 20% of GDP (or, more precisely, GWP, i.e. gross world product) as the low and high estimates, respectively, for the damages resulting from global climate change, both as associated with a 3°C average temperature increase. The economic horizon, T 1 (2,300), is shorter than the geo-scientific (that is, climate change) horizon, T 2 (3,000).

Our second major modification in comparison to previous versions of DEMETER is that we separate the welfare perspective of the representative public agent from the savings decision of the representative private consumer. In other words, we do not assume a constant pure time preference parameter that governs the savings decisions of the representative consumer, nor do we employ such a parameter that is subsequently simultaneously used for intergenerational welfare aggregation (as we did in previous versions of DEMETER). Instead, we suppose that consumers save a constant fraction of output, s, and that savings are efficiently distributed between the various investment opportunities. Savings determine the real interest rate, captured in the model through the variable β t that defines the corresponding price of the consumer good in period t + 1, relative to the price in period t, through the relation β t = 1/(1 + i t ). In this equation, i t is the real interest rate and 1 + i t are the costs of new capital in the next period, again relative to the price of the consumer good.

This adjustment implies that we decouple investments in capital from the social rate of time preference used for optimal climate policy calculations. Rather than assuming that capital markets reflect social preferences for spreading consumption over time, we adopt a constant savings rate of 25%. The central planner who maximizes aggregated welfare is assumed not to be able to change this savings behavior: savings decisions are made by individuals as part of their life cycle consumption decisions, rather than as part of an intergenerational tradeoff for which a public agent is needed.Footnote 4

Our assumption of an exogenous savings rate implies that a gap may exist between the rate of return on capital and the rate of return on public investments in climate policy.Footnote 5 The existence of such a gap, as modeled in our new version of DEMETER, is not necessarily unreasonable. Citizens may develop different time preferences during their life, which affects their savings behavior. On a larger time scale, this compares to varying intergenerational time preferences, which influences public decisions on climate change. Governments cannot commit future governments to transfer public savings to future generations; thus, even if a strict Pareto improvement were possible by decreasing abatement and increasing savings, it might not be feasible for a government to implement such a strategy [20]. DEMETER can thus be interpreted as using a utilitarian framework,Footnote 6 with a logarithmic utility function, and a 1%/year or 3%/year pure rate of time preference for aggregation over time, denoted as low or high discounting, respectively.

The third major adaptation of DEMETER with respect to previous model versions concerns the inclusion of uncertainty that resolves over time. Uncertainty is modeled through the simulation of multiple possible states-of-the-world, each with pre-specified probabilities, but with control variables (such as prices and taxes) that are equal over the various states up to period T*. At T*, uncertainty is resolved. After T*, the model solves all equations in parallel for all states-of-the-world, but with different values for policy variables for each of them. For our purposes, crucial policy variables include the carbon tax, needed to materialize set climate control goals. Before T*, the model solves all equations but with the additional requirement that all policy variables are the same over all states-of-the-world. The two main periods (i.e., the time frames before respectively after T *) are linked to each other in a way common to this type of uncertainty modeling, that is, via expected values of policy variables that together specify the optimal policy during the first period. Running DEMETER and solving the model’s optimization algorithm now yields hedging strategies that take stock of all possible state-of-the-world outcomes after the resolution of uncertainty at time T *.

A final group of smaller modifications concerns a collection of several relatively minor adjustments of the model. These relate to mostly calibration parameter value assumptions, which can have a significant effect on the modeling outcomes. We list here the most important of our new parameter choices:

-

1.

We re-calibrated our demographic assumptions through a fit of recent medium-range UN scenario data with a logistic curve plus a constant, in which the global population converges to a maximum of 10.25 billion in 2100 [31].

-

2.

We adjusted the climate-forcing target corresponding to a doubling of the CO2 concentration from 4.1 down to 3.7 W/m2, while maintaining our central assumption of a 3°C climate sensitivity.

-

3.

We converted the currency with which we run our model from US dollars to Euros, at 2000 price levels, in order to emphasize the attention CO2 leakage currently receives from the research community in Europe, and to establish comparability with the results presented in other papers recently written on this subject.

-

4.

We added an oil price shock (“peak oil”) at the start of our simulation in 2010, such that marginal costs of fossil fuels instantaneously increase in 2010 from 4.1€/MJ by 50%. This adjustment causes a temporary break in emissions and spurs non-carbon fuel use during the first decade of the simulation period.

-

5.

We added decreasing-returns-to-scale for the non-fossil fuel sector to reflect concerns over e.g. land availability and resource optimality, such that its marginal costs double when output increases from 0 to 320 EJ/year (i.e. total energy demand in 1997).

-

6.

As a result of the latter, non-fossil fuel learning-by-doing is complemented by an opposing force, such that marginal costs of non-fossil fuels decrease less compared to previous model versions.

3 Simulations and Interpretations

3.1 Leakage Versus Discount Rate

While in earlier work based on DEMETER, we calculated cost-effective strategies for a range of different climate control targets, with the adjusted version of this model as described above, we here carry out a full cost–benefit analysis using either a high or low discount rate. Our basic assumption is that this pure rate of time preference reflects social preferences for long-term welfare, while capital markets may have a higher rate of return. We thus assume that capital markets are driven by forces not directly related to long-term social preferences and are not in direct control of governments. Note that Lind [20] discusses these matters extensively and particularly assesses the impossibility of Hicks compensation, a central assumption underlying the use of market prices for cost–benefit analysis in an intergenerational context.Footnote 7 For the present study, in addition to a benchmark scenario (not described here), we define four policy scenarios with assumptions that put increasingly higher costs on climate change damages:

- S1::

-

high discounting (ρ = 3%/year), low damages (2% GDP for 3°C), low leakage (average delay = 500 years)

- S2::

-

high discounting (ρ = 3%/year), high damages (20% GDP for 3°C), low leakage (average delay = 500 years)

- S3::

-

low discounting (ρ = 1%/year), high damages (20% GDP for 3°C), low leakage (average delay = 500 years)

- S4::

-

low discounting (ρ = 1%/year), high damages (20% GDP for 3°C), high leakage (average delay = 100 years)

Scenario S1 represents more or less the optimistic perspective and descriptive view expressed by many mainstream economists such as reported in Nordhaus [23]. Scenario S2 reflects a more pessimistic view on climate change damages, as suggested for instance by Stern [28], but maintains the descriptive welfare perspective with high discounting. Scenario S3, on the other hand, adds to the pessimistic climate damage standpoint a prescriptive or ethical perspective as defended, for example, in Stern [28] and Heal [12]. The fourth scenario, S4, assumes low discounting, high damages, and also relatively ineffective CCS (that is, characterized by high leakage of CO2).

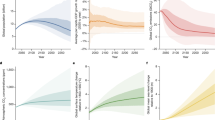

A comparison of the carbon tax and CO2 emission reductions across scenarios S1, S2, S3 and S4 (see Figs. 1 and 2) shows that not only discounting matters but also expected climate damage estimates play as much a role for the design of optimal climate policy. Figures 1 and 2 point out that scenario S1 achieves only modest emission reductions with respect to the baseline and, hence, requires only low carbon taxing even by the end of the century. Scenario S2 implies much more drastic climate mitigation efforts (and hence much higher carbon taxes), with emissions reduced well below 1990 levels by 2050, because of high damages as a result of global climate change. The required carbon tax proves to remain below 100 €/tCO2 for the first 50 years. We emphasize that in order to correctly interpret such a number, it is important to understand that in our model carbon taxes apply globally, and emission reduction efforts are shared worldwide. Otherwise, if only the currently industrialized part of the world reduces CO2 emissions, much higher carbon taxes would be required in the participating countries in order to achieve similar global emission abatement levels. With low values of the discounting rate (as in scenarios S3 and S4), CO2 emission levels are cut back sharply to almost zero by the end of the century. Required carbon taxes exceed the 100 €/tCO2 level from today onwards. The difference between low and high leakage (S4 versus S3) is hard to discern in Figs. 1 and 2 but becomes much more pronounced in Figs. 3 and 4.

Figures 3 and 4 show that (1) higher climate damages necessitate more CCS deployment (S2 versus S1), (2) lower discounting reduces the effectiveness of CCS (S3 versus S2), and (3) a higher CO2 leakage rate substantially reduces the effectiveness of CCS and thus induces lower CCS diffusion (S4 versus S3). Figure 4 also shows that (4) the effectiveness of CCS is substantially less during early decades in comparison to later in the century. Clearly, the results depicted in Figs. 3 and 4 do not support the idea that CCS constitutes only an intermediate technology that has as main function to smoothen the transition from fossil fuels towards non-carbon energy sources: CCS has an ever increasing role during at least the twenty-first century. Our results confirm some of the main results we reported in van der Zwaan and Gerlagh [34]. They can be understood through an inspection of Eq. 1—for doing so, it is important to realize that while the overall tax levels increase from S1 to S4, the tax growth rates (g) decrease in this order (as demonstrated in Fig. 1). When we assume high discounting and low climate damages (as in S1), carbon taxes remain low so that CCS will only gradually be deployed while not becoming a widely diffused technology before the second half of the century (see Fig. 3). Higher climate damage assumptions (S2 versus S1) lead to a higher tax level, and as CO2 emissions consequently drop, the atmospheric CO2 concentration increases less quickly: the marginal damage incurred to the economy (which is increasing in the CO2 concentration) thus increases less. Higher climate damage assumptions, however, lead to a lower g and thus to a higher CCS effectiveness: this explains why the S2 line in Fig. 4 lies above the one for S1. This observation also explains the pattern behind result (iv): the shadow price (or carbon tax) of CO2 emissions increases more strongly during the first decades than in later ones, so that g decreases over time: hence, the CCS effectiveness increases during the century. Lower discounting increases the net present value of future leakages and thus reduces the CCS effectiveness (see again Eq. 1). This explains result (2), while (3) is obvious.

3.2 Uncertainty in Leakage and Damages

What could be the effect of uncertainty in our knowledge about the value of climate change damages and CO2 leakage rates? These types of questions have been addressed in a theoretical setting by e.g. Ulph and Ulph [30] and Webster [36], in applied integrated assessment models by Manne and Richels [21], Nordhaus and Popp [22], Yohe et al. [38], and Bosetti et al. [1], and in a simple cost–benefit analysis by Rabl and van der Zwaan [25]. We define a new set of scenarios with different possible values for the uncertain parameters we want to study. We assume for all these scenarios a low (and unique) value for the pure rate of time preference (ρ = 1%/year), since we find this value ethically best defendable. Hence, our uncertainty analysis only concerns scientific parameters and does not involve normative parameters such as the discount rate for welfare analysis. We replace the previously assumed scenarios S1 and S2 with scenarios SA and SB as defined below, while keeping S3 and S4. Scenarios SA and SB differ from S3 and S4 only with respect to the level of the global climate damages assumed. We then have four possible climate change scenarios, SA, SB, S3, S4: two based on low climate damage estimates and two others on high damage estimates and, similarly, two based on a high CO2 leakage rate and two others on a low leakage rate. A fifth case, the policy scenario SH, introduces uncertainty. This scenario generates hedging behavior, as we assume that climate change damages and CO2 leakage phenomena remain uncertain until 2050. After 2050, this uncertainty resolves. The probabilities for low and high climate damages are assumed equal, while a low leakage rate is assumed four times more likely than a high speed of seepage. Hence, in scenario SH the respective overall realization probabilities for scenarios SA, SB, S3, and S4 are 40%, 10%, 40%, and 10%, respectively.

- SA::

-

Low damages (2% GDP for 3 K), low leakage (average delay = 500 years)

- SB::

-

Low damages (2% GDP for 3 K), high leakage (average delay = 100 years)

- S3::

-

High damages (20% GDP for 3 K), low leakage (average delay = 500 years)

- S4::

-

High damages (20% GDP for 3 K), high leakage (average delay = 100 years)

- SH::

-

Uncertainty with regard to damages and leakage until 2050, when uncertainty resolves

As one can see from Figs. 5 and 6, uncertainty regarding climate change damages is (as expected) important for both the shadow price and level of CO2 emissions. Under uncertainty, the optimal carbon tax takes about the (weighted) average level of that in the four potential scenarios, i.e. around 100 €/tCO2 up to 2050. When climate change damages turn out to be not too large, the CO2 price can be lowered after 2050, while it needs a substantial ramping up after 2050 if the more pessimistic estimates of climate change damages turn out to be correct. It proves that with high climate damages and high CO2 leakage the optimal taxation level in 2100 is close to 900 €/tCO2, while it reaches a value slightly exceeding 800 €/tCO2 in the high climate damages with low seepage case. This finding confirms our observations in the previous subsection. With a high seepage rate, CCS can contribute less to overall emission reductions; thus, more non-fossil fuel energy needs to be employed, for which higher taxes are required. Hence, total abatement costs (expressed as consumption foregone) are also higher. Indeed, carbon taxes incur higher immediate social costs in the high seepage scenario. In the long term, however, the more intensive use of CCS in the low seepage scenario proves to lead to a higher temperature in the second half of the millennium.

Figures 6 shows the optimal level of CO2 emissions in scenario SH. A first important observation is that even a moderate carbon tax (of around 100 €/tCO2), when applied consistently and globally until at least 2050, is capable of significantly reducing the global level of CO2 emissions until in any case the middle of the century. Clearly and unsurprisingly, with higher carbon taxation, the emission profile shown in Fig. 6 would become even lower. One also clearly sees the model’s vintage structure, in the sense that emissions are continuous (Fig. 6) even though policy instruments switch in an abrupt fashion (Fig. 5). In the SH sub-scenarios in which low climate damages are revealed in 2050, carbon taxes are suddenly cut by about a factor 4. Consequently, fossil fuels become abruptly very competitive again, which explains the surge in CO2 emissions depicted in Fig. 6. Large new energy investments will go into fossil fuel based technologies, not complemented with CCS, which leads to a massive return in CO2 emissions, which by the end of the century exceed current levels. That surge is comparable to the increase in use of carbon-free energy sources during the first half of the century. Also well visible from Fig. 6 is that when CCS proves characterized by high CO2 leakage in 2050, the deployed CCS activity to date will generate higher CO2 emissions. If in 2050, high climate damages are revealed, then abatement of CO2 emissions needs to be further enhanced, for which tax levels are required that are eventually several times higher than those calculated optimal for 2050.

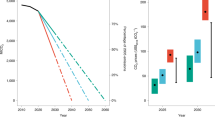

Figures 7 and 8 show the atmospheric concentration of CO2 and the global average temperature path, respectively, during the entire millennium for each of the four scenarios SA, SB, S3, and S4. As can be seen, in the low climate damage scenarios (SA and SB), optimal calculated CO2 emission levels allow the atmospheric CO2 concentration to rise above 1,000 ppmv, while the high damage cases (S3 and S4) keep the atmospheric CO2 concentration well below 550 ppmv. From the CO2 emissions profile shown in Fig. 6, we saw that the hedging scenario SH is strongly skewed towards precautionary high abatement levels, that is, the emission levels are well below the weighted average of the four individual policy scenarios. Indeed, as can be observed, in 2050, there is hardly any break in the emissions (reduction) trend line if high climate damages prove to be revealed in that year. The reason for this outcome is that CO2 emission reductions become progressively very hard to realize, in such a way that they are less than proportional to carbon prices. In other words, during the forthcoming several decades, the average CO2 price (evolution) of the low damage and high damage scenarios implies that emission cuts are close to the optimal levels of the latter. Precaution is applied that accounts for the worst possible outcome in 2050: if a steep emission reduction path was not followed until the middle of the century, it would become exceedingly costly—or even infeasible—after 2050 to reach the few tCO2 emission level required in scenarios S3 and S4 by the end of the century. Similar precautionary results were obtained by Keppo and van der Zwaan [15].

Figures 7 and 8 also show another remarkable feature: low leakage rates do not prevent stored CO2 from leaking back but merely delay the process. The consequence is that with low leakage rates, the atmospheric CO2 concentration is lower during the first few centuries, but when stored CO2 starts to seep, the atmospheric CO2 concentration eventually reaches a peak nearly as high as in the high leakage case. Figure 7 shows that this delayed peaking occurs close after the middle of the millennium. As can be seen from Fig. 8, in the low leakage case the global average surface temperature even increases beyond a level seen in the high leakage scenario. The employment of CCS may thus imply dangerous interference with the climate system to be delayed by a century, or a couple of hundreds of years. Note that the height of each of the peaks in Fig. 7 (scenarios SA and SB) is to a large extent due to the sheer volume of CCS activity deployed over the first couple of centuries. The decline in CO2 concentrations after these respective peaks can be explained by the fact that natural phenomena exist (such as ocean uptake) that remove CO2 from the atmosphere, in combination with the fact that fossil fuels (also when equipped with CCS) are no longer used given the competitiveness of renewables. Even though we apply a low discount rate of 1%/year—which in principle should position us to attach importance to distant concerns—counted over a millennium this amounts to a discount factor as reductive as about 1:20,000. This points to a fundamental problem with discounting: when current activities cause damages in the very long term (say, as in our case, over some thousand years), then any discounting seems inappropriate if future consequences are considered relevant. We leave this issue for further research, but here preliminarily argue that this finding supports the reasoning of Stern [28] and Heal [12] in support of (almost) zero discounting.

In different scenarios, CCS delivers varying contributions to achieve overall CO2 emission reductions. In the short term, i.e. during the forthcoming few decades, CCS activity proves driven by high carbon taxation and low CO2 leakage, as is shown by the graphs depicted in Fig. 9. Indeed, the SH scenario graph is perfectly on course to meet the high damage, low leakage scenario S3—the latter is essentially the extrapolation of the former. In the longer term, as it becomes more sensitive for DEMETER that CCS does not constitute an entirely carbon-free technology and that its deployment in the low leakage case involves only a delay of CO2 emissions, not a pure emission reduction strategy, CCS in relative terms turns not so favorable anymore. This is especially true when climate-induced damages to the global economy are revealed to be high. In other words, CCS is not a sustainable activity when the stored CO2 leaks to the atmosphere, even if this happens in the distant future. The corresponding additional source of CO2 emissions causes damages in the far future, which are internalized in the decision making process of this century. It can be observed that the low leakage case dominates the policy in the stochastic scenario. The fact that a 20% probability exists that high CO2 leakage materializes from 2050 onwards does not reduce the extent of CCS activity until 2050 very much. After 2050 the four state-of-the-worlds yield diverging CCS diffusion paths that are compatible with the same logics as applicable to the explanation of the dynamics behind Figs. 7 and 8.

The effectiveness of CCS—the measure for the efficiency of CCS as introduced in the previous section—expresses the share of CO2 emission permits or carbon taxes that can be waived for CO2 stored underground through CCS application. In Fig. 10, we see that, when climate change damages and possible CO2 leakage phenomena remain for the moment incompletely characterized quantities, the CCS effectiveness until the middle of the century amounts to about 50% today and increases to some 70% by 2050. Hence, CCS should not be given full exemption from payments for CO2 emission permits or, alternatively, from carbon taxation, but be subject to about half of the CO2 price today and about a third in 2050. Figure 10 shows also that when a high CO2 leakage rate is revealed in 2050, the CCS effectiveness dramatically drops to 20–30%, at which level, it stays until the end of the century. With a low leakage rate, on the other hand, the CCS effectiveness further increases, to reach a value close to 90% in 2100. In each of these two leakage cases, it proves that the intensity of the damages incurred as a result of global climate change have little effect on the effectiveness of CCS. Figure 10 demonstrates that the CCS effectiveness never reaches its potential maximum of 100%. These findings imply that energy producers relying on CCS-complemented fossil fuel combustion will have to pay, in all four policy scenarios, some carbon taxes on the mere basis of the fact that the CO2 they stored underground involves a certain level of leakage. Whereas they would not be fully penalized by the prevailing CO2 price, their actions will definitely be influenced by CO2 price variations: when carbon taxes go up, the competitiveness of CCS with respect to non-carbon sources such as solar and wind energy depreciates.

4 Conclusions

The findings reported in this article confirm many of the conclusions made in our earlier work on the economics of CCS and leakage of CO2 [34]. In that publication, we derived an expression for the effectiveness of CCS, which we employed again here. The simulated time paths for the CCS effectiveness presented in the present paper show more or less the same overall tendency as the ones calculated for our prior article. It is also clear, however, that some marked differences can be observed in the numerical values of the evolution of our CCS effectiveness expression between these two articles. This discrepancy can largely be ascribed to two important modifications that we introduced in DEMETER: (1) the introduction of uncertainty in knowledge regarding two essential determinants of energy policy, related to respectively climate damages and CO2 leakage, and (2) the simulation of a much longer time frame over which we analyze the economics of optimal climate policy design, CCS implementation and its potentially harmful feature in the form of CO2 seepage from geological storage formations.

Among our more specific main results described in the present study are, first, that CO2 leakage does eventually (by the end of the century) not reduce the effectiveness of CCS very much when one assumes a descriptive (high) value for the discount rate, especially in combination with high climate change damage assumptions. We demonstrated that in the latter case with a 3%/year pure rate of time preference, CO2 leakage with an average delay of 500 years proves to be acceptable in our modeling framework, since the CCS effectiveness amounts to about 70% today and increases to over 95% by the end of the twenty-first century. While the results reported in this paper cannot be directly compared with those published in van der Zwaan and Gerlagh [34]—where we showed that a leakage rate as high as 1%/year could be acceptable—our descriptive discounting findings are pretty much in agreement with our prior ones. With a prescriptive (low) value for the discount rate, however, leakage can become problematic: leakage with a mean residence time of 100 years reduces the attractiveness of CCS substantially, down to close to 0% today and at most only just above 20% during the current century. With this finding, we clearly depart from the more preliminary recommendations formulated in our earlier article. In order to correctly draw our new conclusion, it is imperative that calculations account for the very long term, that is, as far in the future as the entire present millennium. Almost all previous studies have so far failed to do so, including our own simulations with DEMETER. We here also found that even if affected by a long average leakage delay (hence, a low leakage rate), CCS is capable of generating climate change in the very long term. Furthermore, even a pure discount rate as low as 1%/year may give an exceedingly low weight to very long-term consequences of current decisions. We thus believe that an important topic for future work is a rigorous study of the main arguments in a fundamental discussion about discounting in the very long run versus cost–benefit analysis of global climate change.

Another major outcome of our present analysis is that uncertainty regarding the value of the leakage rate and the extent of climate-induced damages to the global economy should not prevent us from deploying CCS on a large scale (e.g., [14]). The deployment of CCS technology, however, ought not to be fully exempt from carbon taxes. Or, in an alternative policy scenario, emission permits should be bought by electricity producers in order for them to be allowed to run fossil-based power plants equipped with imperfect (leakage-affected) CCS. With the arguments made in this article, we do not necessarily provide support for obliging, e.g., coal-based power plants to be only operated if equipped with CCS technology. Rather, we show that if an effective global climate treaty can be agreed upon, the ensuing carbon price will stimulate the use of coal with CCS and disfavor its use without CCS. Furthermore, market forces will determine the extent to which fossil fuel usage complemented with CCS technology will compete with non-carbon alternatives such as renewables and nuclear energy. Possible CO2 leakage phenomena can affect this competitiveness.

Notes

The recent Gulf of Mexico oil spill showed, for example, that neither oil production activities nor manmade closures of oil fields are infallible.

The analysis by Hasselmann et al. [11] also involves a very long time frame but uses reduced-form abatement costs without specification of the mechanisms of energy savings, non-carbon energy use and CCS deployment.

See Gerlagh and van der Zwaan [4] for a discussion on the modeling of intangible climate change damages.

Note that in an Overlapping Generations (OLG) model savings also do not depend on an intergenerational weighing of welfare, cf. Gerlagh and van der Zwaan [4].

For an extensive theory discussion on public time preferences and rates of returns on public investments, see Gerlagh and Liski [3].

See Schneider et al. [26] for a discussion on representative agents versus the utilitarian framework.

We here do not go into detailed discussion of high versus low discounting, but only report on the consequences of our discounting choices. We refer to Schneider et al. [26], and Gerlagh and Liski [3] for new recent perspectives on this subject—these do not connect the discussion to risk and uncertainty, but to private versus public preferences.

References

Bosetti, V., Carraro, C., Sgobbi, A., & Tavoni, M. (2009). Delayed Action and Uncertain Stabilisation Targets: How Much Will the Delay Cost? Climatic Change, 96, 299–312.

Deffeyes, K. S. (2005). Beyond Oil: the view from Hubbert’s peak. Farrar: Straus & Giroux.

Gerlagh, R. & M. Liski (2011). Public Investment as Commitment. CESifo working paper, 3330.

Gerlagh, R., & van der Zwaan, B. C. C. (2001). The effects of ageing and an environmental trust fund in an overlapping generations model on carbon emission reductions. Ecological Economics, 36, 311–326.

Gerlagh, R., & van der Zwaan, B. C. C. (2003). Gross world product and consumption in a global warming model with endogenous technological change. Resource and Energy Economics, 25, 35–57.

Gerlagh, R., & van der Zwaan, B. C. C. (2004). A sensitivity analysis of timing and costs of greenhouse gas emission reductions under learning effects and niche markets. Climatic Change, 65, 39–71.

Gerlagh, R., van der Zwaan, B. C. C., Hofkes, M. W., & Klaassen, G. (2004). Impacts of CO2-taxes in an economy with niche markets and learning-by-doing. Environmental and Resource Economics, 28, 367–394.

Gerlagh, R., & van der Zwaan, B. C. C. (2006). Options and Instruments for a Deep Cut in CO2 Emissions: Carbon Capture or Renewables, Taxes or Subsidies? The Energy Journal, 27(3), 25–48.

Ha-Duong, M., Grubb, M. J., & Hourcade, J.-C. (1997). Influence of socioeconomic inertia and uncertainty on optimal CO2 emission abatement. Nature, 30, 270–273.

Ha-Duong, M., & Keith, D. W. (2003). Carbon storage: the economic efficiency of storing CO2 in leaky reservoirs. Clean Techn Environ Policy, 5, 181–189.

Hasselmann, K., Hasselmann, S., Giering, R., Ocana, V., & Von Storch, H. (1997). Sensitivity study of optimal CO2 emission paths using a simplified structural integrated assessment model (SIAM). Climatic Change, 37(2), 345–386.

Heal, G. (2009). The Economics of Climate Change: a Post-Stern Perspective. Climatic Change, 96(3), 275–297.

IPCC. (2005). Special Report on Carbon Dioxide Capture and Storage, Intergovernmental Panel on Climate Change, Working Group III. Cambridge: Cambridge University Press.

Keller, K., McInerney, D., & Bradford, D. F. (2008). Carbon dioxide sequestration: how much and when? Climatic Change, 88(3–4), 267–291.

Keppo, I., & van der Zwaan B. C. C. (2011). The impact of uncertainty in forcing targets and CO2 storage availability on long-term climate change mitigation. Environmental Modelling and Assessment, this special issue.

Kharaka, Y. K., Cole, D. R., Hovorka, S. D., Gunter, W. D., Knauss, K. G., & Freifeld, B. M. (2006). Gas-water-rock interactions in Frio Formation following CO2 injection: implications for the storage of greenhouse gases in sedimentary basins. Geology, 34, 7.

King, D. M. (2004). Trade-based carbon sequestration accounting. Environmental Management, 33(4), 559–571.

Klusman, R. W. (2003). Evaluation of leakage potential from a carbon dioxide EOR/sequestration project. Energy Conversion and Management, 44(12), 1921–1940.

Lackner, K. S., & Brennan, S. (2009). Envisioning carbon capture and storage: expanded possibilities due to air capture, leakage insurance, and C-14 monitoring. Climatic Change, 96(3), 357–378.

Lind, R. C. (1995). Intergenerational equity, discounting, and the role of cost–benefit analysis in evaluating global climate policy. Energy Policy, 23, 379–389.

Manne, A., & Richels, R. (1995). The Greenhouse Debate: Economic Efficiency, Burden Sharing and Hedging Strategies. Palo Alto: EPRI.

Nordhaus, W., & Popp, D. (1997). What is the value of scientific knowledge? An application to global warming using the PRICE model. The Energy Journal, 18, 1–47.

Nordhaus, W. (1994). Managing the Global Commons: the Economics of Climate Change. Cambridge: MIT.

Nordhaus, W., & Boyer, J. (2000). Warming the World, Economic Models of Global Warming. Cambridge: MIT.

Rabl, A., & van der Zwaan, B. C. C. (2009). Cost-Benefit Analysis of Climate Change Dynamics: Uncertainties and the Value of Information”, Special Issue “The Economics of Climate Change: Targets and Technologies. Climatic Change, 96(3), 313–333.

Schneider M. T., Traeger, C., Winkler, R. (2010). Trading off generations: infinitely-lived agent versus OLG. mimeo, available through the authors’ websites.

Shaffer, G. (2010). Long-term effectiveness and consequences of carbon dioxide sequestration. Nature Geoscience, 3(7), 464–467.

Stern, N. (Ed.). (2006). The Economics of Climate Change: The Stern Review. Cambridge: Cambridge University Press.

Teng, F., & Tondeur, D. (2007). Efficiency of Carbon storage with leakage: Physical and economical approaches. Energy, 32(4), 540–548.

Ulph, A., & Ulph, D. (1997). Global warming, irreversibility and learning. The Economic Journal, 107, 636–650.

UN. (2009). Population Division of the Department of Economic and Social Affairs of the United Nations Secretariat, World Population Prospects: The 2008 Revision. New York: United Nations.

van der Zwaan, B. C. C., Gerlagh, R., Klaassen, G., & Schrattenholzer, L. (2002). Endogenous technological change in climate change modelling. Energy Economics, 24, 1–19.

van der Zwaan, B. C. C., & Gerlagh, R. (2008). The Economics of Geological CO2 Storage and Leakage. FEEM, Nota di Lavoro, no. 10, Milano, Italy.

van der Zwaan, B. C. C., & Gerlagh, R. (2009). Economics of Geological CO2 Storage and Leakage. Climate Change, 93(3/4), 285–309.

van der Zwaan, B. C. C., & Smekens, K. (2009). CO2 Capture and Storage with Leakage in an Energy-Climate Model. Environmental Modeling and Assessment, 14, 135–148.

Webster, M. (2000). The Curious Role of "Learning" in Climate Policy: Should We Wait for More Data? Cambridge: MIT.

Wilson, E. J., Johnson, T. L., & Keith, D. W. (2003). Regulating the Ultimate Sink: Managing the Risks of Geologic CO2 Storage. Environmental Science and Technology, 37, 16.

Yohe, G., Andronova, N., & Schlesinger, M. (2004). To hedge or not against an uncertain climate future. Science, 306, 416–417.

Acknowledgements

The research leading to these results has received funding from the European Community's Seventh Framework Programme through the PLANETS project (FP7/2007–2011, grant agreement no. 211859) and ECO2 project. Feedback on this subject matter is acknowledged from several colleagues, amongst whom in particular Klaus Lackner, as well as the elaborate comments to this paper from two anonymous referees.

Open Access

This article is distributed under the terms of the Creative Commons Attribution Noncommercial License which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This is an open access article distributed under the terms of the Creative Commons Attribution Noncommercial License (https://creativecommons.org/licenses/by-nc/2.0), which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

About this article

Cite this article

Gerlagh, R., van der Zwaan, B. Evaluating Uncertain CO2 Abatement over the Very Long Term. Environ Model Assess 17, 137–148 (2012). https://doi.org/10.1007/s10666-011-9280-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10666-011-9280-4

Keywords

- Climate change

- Carbon dioxide emissions

- Climate control

- CO2 capture and storage (CCS)

- Geological leakage