Abstract

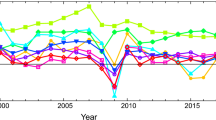

We study the dynamic relation between sovereign yield curve and external shocks driven by global uncertainty and capital inflows. A Nelson–Siegel model is estimated to capture the three latent factors of the yield curve corresponding to level, slope and curvature. The state-space representation of the model is used to document the dynamic relation between the factors of the yield curve, the domestic macroeconomic variables (capacity utilization ratio, inflation, and monetary policy rate) and the external factors (global risk perception and capital flows). We find that although domestic macroeconomic variables have some impact on the future shape of the yield curve, the impact is becoming weaker after the 2008 global financial crisis. The results suggest that external factors emerge to have sizeable and significant impact on both macroeconomic variables and the latent factors. These results have important policy implications for policymakers especially for central bankers and debt managers when capital flows have been a major concern after the 2008 global financial crisis.

Similar content being viewed by others

Notes

Please see Telatar et al. (2003) how political instability distorts the relationship between the term structure of interest rates and macroeconomic aggregates.

The macroeconomic factors are selected in the spirit of Diebold et al. (2006) to represent the state of economy. There can be other factors representing the state of economy in an emerging economy, just like foreign exchange rates. This can be especially valid for Turkey since exchange rate pass-through to inflation has been prominent during the sample period. However, the literature on the yield curve models that incorporate foreign exchange variables is so slim. Important exceptions are those of Chen and Tsang (2013) and Stavrakeva and Tang (2016) who study the yield curve in predicting foreign exchange levels in advanced economies and the contemporaneous relation between yields and currency appreciation, respectively. Yet, there is not a consensus on extracting the information from foreign exchange rates. Stavrakeva and Tang (2016), for instance, decompose exchange rates into five terms including, uncovered interest rate parity, excess returns, expectations about future excess returns, change in expectations about future excess returns and changes in expectations over the long-run nominal exchange rate. This sort of conflict in a newly flourishing literature motivates us to ignore the possible impacts of movements in foreign exchange rates on yield curve. We are however confident that the information in foreign exchange rates is to some extent captured by the monetary policy rate (ir), given that central banks in emerging economies often consider foreign exchange movements for financial stability concerns and take action accordingly. So that the information loss arising from the absence of foreign exchange rate in the model is more or less compensated.

The number of different maturities used in this paper is slightly less than the maturities used in many other papers (see e.g. Diebold et al. 2005; Diebold and Li 2006) which study the yield curve in advanced bond markets. This is because the long end of the Turkish yield curve is still around 10 years maturity and is shorter than many yield curves in advanced bond markets.

We will also elaborate on this phenomenon when we discuss the VAR results in the upcoming section.

The own-lag coefficient of L(t) rounds to 1.08 but stationarity is assured since the largest eigenvalue of the A matrix is smaller than 1.

We estimate several other orderings to observe possible changes, but the main dynamic relations do not change.

The phrase short-termism refers to investment behaviour of agents in the financial intermediation chain weighing near-term outcomes too heavily at the expense of longer-term opportunities and thus forgoing valuable investment projects and potential output (Davies et al. 2014). The phrase also contains the meaning of herding behaviour during turbulent times.

To keep the average return on assets constant, investors have incentives to shift into riskier credit market segments which is a highly visited phenomenon after 2008 under the name of “search for yield”.

References

Afonso A, Martins MM (2012) Level, slope, curvature of the sovereign yield curve, and fiscal behaviour. J Bank Finance 36(6):1789–1807

Akyuz Y, Cornford A (1999) Capital flows to developing countries and the reform of the international financial system. Technical report

Ang A, Piazzesi M, Wei M (2006) What does the yield curve tell us about GDP growth? J Econom 131(1–2):359–403

Balkan E, Yeldan E (1996) Financial liberalization in developing countries: the Turkish experience. Working papers, Department of Economics, Bilkent University

Bauer MD, Rudebusch GD (2014) The signaling channel for Federal Reserve bond purchases. Int J Cent Bank 10(3):233–289

Blanchard O (2004) Fiscal dominance and inflation targeting: lessons from Brazil. NBER working papers 10389, National Bureau of Economic Research, Inc

Blanchard O, Dell’ariccia G, Mauro P (2013) Rethinking macro policy II: getting granular. IMF staff discussion notes 13/003, International Monetary Fund

Boratav K, Turel O, Yeldan E (1996) Dilemmas of structural adjustment and environmental policies under instability: post-1980 Turkey. World Dev 24(2):373–393

Borensztein E, Gelos RG (2003) A panic-prone pack? The behavior of emerging market mutual funds. IMF Staff Pap 50(1):3

Celasun O, Denizer C, He D (1999) Capital flows, macroeconomic management, and the financial system—Turkey, 1989–97. Policy research working paper series 2141, The World Bank

Chen Y, Tsang KP (2013) What does the yield curve tell us about exchange rate predictability? Rev Econ Stat 95(1):185–205

Choe H, Kho B-C, Stulz RM (1999) Do foreign investors destabilize stock markets? The Korean experience in 1997. J Financ Econ 54(2):227–264

Davies R, Haldane AG, Nielsen M, Pezzini S (2014) Measuring the costs of short-termism. J Financ Stab 12:16–25

Dewachter H, Lyrio M (2006) Macro factors and the term structure of interest rates. J Money Credit Bank 38(1):119–140

Didier T, Hevia C, Schmukler SL (2012) How resilient and countercyclical were emerging economies during the global financial crisis? J Int Money Finance 31(8):2052–2077

Diebold FX, Li C (2006) Forecasting the term structure of government bond yields. J Econom 130(2):337–364

Diebold FX, Piazzesi M, Rudebusch GD (2005) Modeling bond yields in finance and macroeconomics. Am Econ Rev 95(2):415–420

Diebold FX, Rudebusch GD, Aruoba S (2006) The macroeconomy and the yield curve: a dynamic latent factor approach. J Econom 131(1–2):309–338

Engen EM, Laubach T, Reifschneider DL (2015) The macroeconomic effects of the Federal Reserve’s unconventional monetary policies. Finance and economics discussion series 2015-5, Board of Governors of the Federal Reserve System (U.S.)

Estrella A, Hardouvelis GA (1991) The term structure as a predictor of real economic activity. J Finance 46(2):555–76

Estrella A, Mishkin FS (1996) The yield curve as a predictor of U.S. recessions. Curr Issues Econ Finance 2(Jun)

Fabozzi F, Fabozzi T (2006) Bond markets, analysis and strategies. Prentice Hall, Upper Saddle River

Fratzscher M (2012) Capital flows, push versus pull factors and the global financial crisis. J Int Econ 88(2):341–356

Gabriele A, Baratav K, Parikh A (2000) Instability and volatility of capital flows to developing countries. World Econ 23(8):1031–1056

Gauvin L, McLoughlin C, Reinhardt D (2014) Policy uncertainty spillovers to emerging markets evidence from capital flows. Bank of England working papers 512, Bank of England

Gurkaynak RS, Wright JH (2012) Macroeconomics and the term structure. J Econ Lit 50(2):331–67

Ihrig JE, Klee EC, Li C, Schulte B, Wei M (2012) Expectations about the Federal Reserve’s balance sheet and the term structure of interest rates. Technical report

IMF (2012) Turkey; 2012 article IV consultation. IMF staff country reports 12/338, International Monetary Fund

IMF (2013) World economic outlook, April 2013: hopes. realities, risks

Joslin S, Priebsch M, Singleton KJ (2014) Risk premiums in dynamic term structure models with unspanned macro risks. J Finance 69(3):1197–1233

Kara AH (2008) Turkish experience with implicit inflation targeting. Cent Bank Rev 8(1):1–16

Kesriyeli M, Ozmen E, Yiit S (2011) Corporate sector liability dollarization and exchange rate balance sheet effect in Turkey. Appl Econ 43(30):4741–4747

Kim W, Wei S-J (2002) Foreign portfolio investors before and during a crisis. J Int Econ 56(1):77–96

Lakonishok J, Shleifer A, Vishny RW (1992) The impact of institutional trading on stock prices. J Financ Econ 32(1):23–43

Lange RH (2014) The small open macroeconomy and the yield curve: a state-space representation. N Am J Econ Finance 29(C):1–21

Li C, Wei M (2013) Term structure modeling with supply factors and the Federal Reserve’s large-scale asset purchase progarms. Int J Cent Bank 9(1):3–39

Metin-Ozcan K, Voyvoda E, Yeldan AE (2001) Dynamics of macroeconomic adjustment in a globalized developing economy: Growth, accumulation and distribution, Turkey 1969–1999. Can J Dev Stud 22(1):219–253

Milesi-Ferretti G, Tille C (2011) The great retrenchment: international capital flows during the global financial crisis. Econ Policy 26(66):285–342

Nelson CR, Siegel AF (1987) Parsimonious modeling of yield curves. J Bus 60(4):473–89

OECD (2012) OECD economic surveys: Turkey 2012. Technical report. OECD Publishing

Onis Z, Aysan AF (2000) Neoliberal globalisation, the nation-state and financial crises in the semi-periphery: a comparative analysis. Third World Q 21(1):119–139

Ozatay F (2016) Turkey’s distressing dance with capital flows. Emerg Mark Finance Trade 52(2):336–350

Ozkan FG, Unsal DF (2012) Global financial crisis, financial contagion and emerging markets. Discussion papers 12/35, Department of Economics, University of York

Powell MJD (1964) An efficient method for finding the minimum of a function of several variables without calculating derivatives. Comput J 7(2):155–162

Rohn O, Gonen R, Koen V, Karasahin R (2012) Tackling Turkey’s external and domestic macroeconomic imbalances. OECD economics department working papers 986. OECD Publishing

Stavrakeva V, Tang J (2016) Exchange rates and the yield curve. Working papers 16-21, Federal Reserve Bank of Boston

Telatar E, Telatar F, Ratti RA (2003) On the predictive power of the term structure of interest rates for future inflation changes in the presence of political instability: the Turkish economy. J Policy Model 25(9):931–946

Yenturk N (1999) Short-term capital inflows and their impact on macroeconomic structure: Turkey in the 1990s. Dev Econ 37(1):89–113

Acknowledgements

We are grateful to Fritz Breuss (the Editor) and an anonymous referee for helpful comments. We also thank Ali Bircan for his assistance in computations. The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of the Central Bank of the Republic of Turkey. All errors and omissions are our own.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ozturk, H. The shape of sovereign yield curve in an emerging economy: Do macroeconomic or external factors matter?. Empirica 47, 83–112 (2020). https://doi.org/10.1007/s10663-018-9405-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-018-9405-y