Abstract

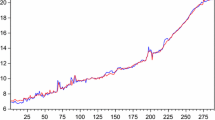

This paper attempts to re-evaluate the long-run macroeconomic relationship between government revenues and expenditures of the Greek economy over the period 1999–2010. The empirical analysis applies the newly developed asymmetric ARDL cointegration methodology of Shin et al. (2011) which permits more flexibility in the dynamic adjustment process towards equilibrium, than in the classical case of a linear model. Our findings point towards the fiscal synchronization hypothesis, supporting evidence of asymmetric interactions between the two fiscal components in both the long- and the short-run time horizon. More particularly, in the long-run, the negative changes of expenditures dominate the response of revenues, while the opposite applies in the response of expenditures.

Similar content being viewed by others

Notes

Investigating the relationship between government revenues and expenditures also provides the framework to address the issue of budget sustainability. Most relevant studies either focus on testing the discounted public deficit or the debt for stationarity (Hamilton and Flavin 1986; Holmes et al. 2010; and others), or on the detection of a long-run relationship between government revenues and spending, adopting the cointegration framework (Trehan and Walsh 1988, 1991; Haug 1991; and others).

For an international survey of the empirical literature regarding the revenue-expenditure nexus up to 2003, see Payne (2003).

For an extensive derivation of the model see Shin et al. (2011).

Following Shin et al. (2011), we adopted a conservative approach to the choice of critical values and employed k = 1.

References

Afonso A, Rault C (2009) Spend-and-tax: a panel data investigation for the EU. Econ Bull 29:2542–2548

Baghestani H, McNown R (1994) Do revenues or expenditure respond to budgetary disequilibria? South Econ J 60:311–322

Barro RJ (1979) On the determination of the public debt. J Polit Econ 87:940–971

Bohn H (1991) Budget balance through revenue or spending adjustments. J Monet Econ 27:333–359

Buchanan JM, Wagner RE (1978) Dialogues concerning fiscal religion. J Monet Econ 4:627–636

Chang T, Liu WR, Caudill SB (2002) Tax-and-spend, spend-and-tax, or fiscal synchronization: new evidence for ten countries. Appl Econ 34:1553–1561

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Engle RF, Granger CWJ (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 55:251–276

Friedman M (1978) The limitations of tax limitation. Policy Rev, Summer 7–14

Garcia S, Henin P-Y (1999) Balancing budget through tax increases or expenditure cuts: is it neutral? Econ Model 16:591–612

Hamilton JD, Flavin MA (1986) On the limitations of government borrowing: a framework for empirical testing. Am Econ Rev 76:808–819

Hasan SY, Sukar AH (1995) Short and long-run dynamics of expenditures and revenues and the government budget constraint: further evidence. J Econ 22:35–42

Hatemi-J A, Skukur G (1999) The causal nexus of government spending and revenue in Finland: a bootstrap approach. Appl Econ Lett 6:641–644

Haug AA (1991) Cointegration and government borrowing constraints: evidence for the United States. J Bus Econ Stat 9:97–101

Holmes M, Otero J, Panagiotidis T (2010) Are EU budget deficits stationary? Empir Econ 38(3):767–778

Hondroyiannis G, Papapetrou E (1996) An examination of the causal relationship between government spending and revenue: a cointegration analysis. Public Choice 89:363–374

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxf Bull Econ Stat 52:169–210

Joulfaian D, Mookerjee R (1991) Dynamics of Government revenues and expenditures in industrial economies. Appl Econ 23:1839–1844

Katrakilidis CP (1997) Spending and revenues in Greece: new evidence from error correction modelling. Appl Econ Lett 4:387–391

Kollias C, Makrydakis S (1995) The causal relationship between tax revenues and government spending in Greece: 1950–1990. Cyprus J Econ 8:3–11

Kollias C, Makrydakis S (2000) Tax and spend or spend and tax? Empirical evidence from Greece, Spain, Portugal and Ireland. Appl Econ 32:533–546

Kollias C, Paleologou S-M (2006) Fiscal policy in the European Union: tax and spend, spend and tax, fiscal synchronisation or institutional separation? J Econ Stud 33:108–120

Koren S, Stiassny A (1995) Tax and spend or spend and tax? An empirical investigation for Austria. Empirica 22:127–149

Kwiatkowski D, Phillips PCB, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationarity against the alternative of a unit root: how sure are we that economic time series have a unit root? J Econom 54:159–178

Li X (2001) Government revenue, government expenditure, and temporal causality: evidence from China. Appl Econ 33:485–497

Meltzer AH, Richard SF (1981) A rational theory of the size of government. J Polit Econ 89:914–927

Miller SM, Russek FS (1989) Co-integration and error-correction models: the temporal causality between government taxes and spending. South Econ J 57:221–229

Mounts SW, Sowell C (1997) Taxing, spending and the budget process: the role of the budget regime in the intertemporal budget constraint. Swiss J Econ Stat 133:421–439

Musgrave R (1966) Principles of budget determination. In: Cameron H, Henderson W (eds) Public finance: selected readings. Random House, New York, pp 15–27

Narayan P, Narayan S (2006) Government revenue and government expenditure nexus: evidence from developing countries. Appl Econ 38:285–291

Ouattara B (2004) Foreign aid and fiscal policy in senegal. Mimeo

Paleologou S-M (2013) Asymmetries in the revenue-expenditure nexus: a tale of three countries. Econ Model 30:52–60

Park WK (1998) Granger causality between government revenues and expenditures in Korea. J Econ Dev 23:145–155

Payne JE (2003) A survey of the international empirical evidence on the tax-spend debate. Public Financ Rev 31:302–324

Payne JE, Mohammadi H, Cak M (2008) Turkish budget deficit sustainability and the revenue-expenditure nexus. Appl Econ 40:823–830

Peacock AT, Wiseman J (1979) Approaches to the analysis of government expenditure growth. Public Financ Rev 7:3–23

Pesaran B, Pesaran MH (2009) Time series econometrics using Microfit 5.0. Oxford University Press, Oxford

Pesaran MH, Shin Y (1999) An autoregressive distributed lag modeling approach to cointegration analysis. In: Strøm S (ed) Econometrics and economic theory in the 20th century: the Ragnar Frisch centennial symposium. Cambridge University Press, Cambridge

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16:289–326

Provopoulos G, Zambaras A (1991) Testing for causality between government spending and taxation. Public Choice 68:277–282

Ross KL, Payne JE (1998) A reexamination of budgetary disequilibria. Public Financ Rev 26:67–79

Saunoris JW, Payne JE (2010) Tax more or spend less? Asymmetries in the UK revenue–expenditure nexus. J Policy Model 32:478–487

Schorderet Y (2003) Asymmetric cointegration. Department of Economics, University of Geneva

Shin Y, Yu B, Greenwood-Nimmo M (2011) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. Mimeo

Trehan B, Walsh CE (1988) The sustainability of government deficits: implications of the present-value borrowing constraint. J Econ Dyn Control 12:425–444

Trehan B, Walsh CE (1991) Testing intertemporal budget constraints: theory and applications to U. S. federal budget and current account deficits. J Money Credit Bank 23:206–223

Vamvoukas G (1997) Budget expenditures and revenues: an application of error-correction modelling. Public Financ 52:125–138

Von Fustenberg G, Green R, Jeong J (1985) Have taxes led government expenditures? The United States as a test case. J Public Policy 5:321–348

Von Fustenberg G, Green R, Jeong J (1986) Tax and spend, or spend and tax? Rev Econ Stat 68:179–188

Wildavsky A (1988) The new politics of the budgetary process. Scott Foresman, Glenview

Zivot E, Andrews DWK (1992) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 20:25–44

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Athanasenas, A., Katrakilidis, C. & Trachanas, E. Government spending and revenues in the Greek economy: evidence from nonlinear cointegration. Empirica 41, 365–376 (2014). https://doi.org/10.1007/s10663-013-9221-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-013-9221-3